India Vinyl Acetate Monomer Market Size, Share, By Type (Polyvinyl Alcohol, Polyvinyl Acetate, Ethylene Acetate, Ethylene Vinyl Acetate, And Others), By End Use (Packaging, Construction, Textile, Adhesive, And Others), And India Vinyl Acetate Monomer Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Vinyl Acetate Monomer Market Insights Forecasts to 2035

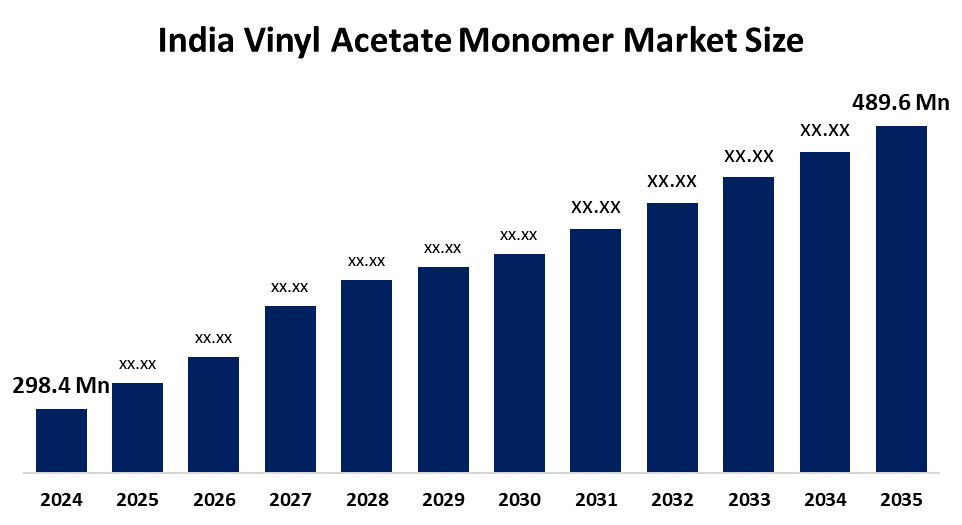

- India Vinyl Acetate Monomer Market Size 2024: USD 298.4 Million

- India Vinyl Acetate Monomer Market Size 2035: USD 489.6 Million

- India Vinyl Acetate Monomer Market CAGR 2024: 4.6%

- India Vinyl Acetate Monomer Market Segments: Type and End Use

Get more details on this report -

The India vinyl acetate monomer market refers to the production, distribution and usage of vinyl acetate monomer (VAM), a compound polymerise to create products such as poly vinyl acetate, ethylene vinyl acetate and poly vinyl alcohol. VAM is a colourless, combustible liquid that creates emulsions with excellent adhesion properties and high strength when used in combination with other materials, which is why it has become one of the most important components in construction materials, the production of automotive parts and the manufacturing of consumer products due to its extreme versatility and wide-ranging industrial use.

The vinyl acetate monomer in India are backed by government support, including the Bureau of Indian Standards (BIS) has amended the Vinyl Acetate Monomer Quality Control Order, mandating compulsory compliance with Indian Standard IS 12345:1988 and Standard Mark certification for all VAM goods except those for export, strengthening product quality and safety standards in the domestic market. In the automotive sector, one of VAM’s key end users accounts for around 6% of India’s GDP and exported 4.5 million vehicles in 2023-24, underscoring the sector’s scale and its role in propelling demand for VAM-based adhesives and coatings in vehicle assembly and finishing.

As technology advances, India’s vinyl acetate monomer providers are now using new technologies such as refinement and advanced distillation processes along with separation methods that minimize the environmental impact and use of resources are being employed to produce bio-based vinyl acetate monomers. This has prompted the introduction of biocatalyst technologies, green chemistry and biomaterials. These technologies not only allow manufacturers to produce inexpensive adhesives but also increase their use of environmentally safe water and provide manufacturers with the tools to make their products compliant with evolving regulations and provide environmentally conscious consumers with a greener option in their purchasing decisions.

India Vinyl Acetate Monomer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 298.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.6% |

| 2035 Value Projection: | USD 489.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | Visen Industries Ltd., Vinyl Chemicals Ltd., Nikhil Adhesives Limited, Celanese India Private Limited, Jubilant Agri and Consumer Product Ltd., Wacker Metroark Chemicals Private Limited, Pon Pure Chemicals Private Limited, Pidilite Industries Limited, Asian Paints Limited, Reliance Industries Limited, Triveni Chemicals, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Vinyl Acetate Monomer Market:

The India vinyl acetate monomer market is driven by the robust demand from adhesives, paints, and coatings sectors, rapid industrialization, urban infrastructure development, expansion of key end-use industries such as construction, automotive manufacturing, and packaging, greater residential and commercial building activity, consumer demand for high-performance and aesthetic materials grows, the requirement for VAM-derived products that deliver strong adhesion, durability, and finish quality, and increasing utilisation of water-based and environmentally friendly formulations in both industrial and consumer applications.

The India vinyl acetate monomer market is restrained by the high production cost associated with manufacturing, cost pressures are exacerbated by intense competition from imported VAM, stringent environmental and regulatory compliance requirements, and challenging profitability and scalability in a price-sensitive industrial environment.

The future of India vinyl acetate monomer market is bright and promising, with versatile opportunities emerging from the potential for import substitution through domestic production facilities, as well as backward integration by the major industries to reduce supply chain vulnerability and provide greater competitiveness through lower cost. There is also growing opportunities within the end-use applications of high-purity VAM within the pharmaceutical and electronic coatings, solar panel encapsulates, and advanced polymer films that are both backed by government initiatives such as the Make in India initiative and production linked incentive schemes. The increased acceptance of bio-based and low VOC VAM formulations within the sustainability-oriented sectors creates additional opportunities for differentiation, as well as value creation within a growing market.

Market Segmentation

The India Vinyl Acetate Monomer Market share is classified into type and end use.

By Type:

The India vinyl acetate monomer market is divided by type into polyvinyl alcohol, polyvinyl acetate, ethylene vinyl acetate, and others. Among these, the polyvinyl acetate segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Extensive use in manufacturing adhesives for construction, cost effective, versatile, easy to apply, and rising demand for packaging materials in India all contribute to the polyvinyl acetate segment's largest share and higher spending on vinyl acetate monomer when compared to other type.

By End Use:

The India vinyl acetate monomer market is divided by end use into packaging, construction, textile, adhesive, and others. Among these, the construction segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The construction segment dominates because of massive demand for polyvinyl acetate and EVA-based emulsions used in adhesives, paints, and sealants, rapid urbanization, infrastructure development, and increased spending on residential and commercial projects in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India vinyl acetate monomer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Vinyl Acetate Monomer Market:

- Visen Industries Ltd.

- Vinyl Chemicals Ltd.

- Nikhil Adhesives Limited

- Celanese India Private Limited

- Jubilant Agri and Consumer Product Ltd.

- Wacker Metroark Chemicals Private Limited

- Pon Pure Chemicals Private Limited

- Pidilite Industries Limited

- Asian Paints Limited

- Reliance Industries Limited

- Triveni Chemicals

- Others

Recent Developments in India Vinyl Acetate Monomer Market:

In January 2025, a leading manufacturer, Asian Paints resumed production of VAE-based paints, becoming the first domestic producer of this market and reducing import dependency for these specific applications.

In February 2024, India’s Ministry of Chemicals and Fertilisers approved a new Quality Control Order for VAM, making it mandatory for all VAM sold in India to be IS 12345:1988 certified, aimed at improving product quality and compliance in manufacturing and imports.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India vinyl acetate monomer market based on the below-mentioned segments:

India Vinyl Acetate Monomer Market, By Type

- Polyvinyl Alcohol

- Polyvinyl Acetate

- Ethylene Vinyl Acetate

- Others

India Vinyl Acetate Monomer Market, By End Use

- Packaging

- Construction

- Textile

- Adhesive

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India vinyl acetate monomer market size?A: India vinyl acetate monomer market is expected to grow from USD 298.4 million in 2024 to USD 489.6 million by 2035, growing at a CAGR of 4.6% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the robust demand from adhesives, paints, and coatings sectors, rapid industrialization, urban infrastructure development, expansion of key end-use industries such as construction, automotive manufacturing, and packaging, greater residential and commercial building activity, consumer demand for high-performance and aesthetic materials grows, the requirement for VAM-derived products that deliver strong adhesion, durability, and finish quality, and increasing utilisation of water-based and environmentally friendly formulations in both industrial and consumer applications.

-

Q: What factors restrain the India vinyl acetate monomer market?A: Constraints include the high production cost associated with manufacturing, cost pressures are exacerbated by intense competition from imported VAM, stringent environmental and regulatory compliance requirements, and challenging profitability and scalability in a price-sensitive industrial environment.

-

Q: How is the market segmented by end use?A: The market is segmented into packaging, construction, textile, adhesive, and others.

-

Q: Who are the key players in the India vinyl acetate monomer market?A: Key companies include Visen Industries Ltd., Vinyl Chemicals Ltd., Nikhil Adhesives Limited, Celanese India Private Limited, Jubilant Agri and Consumer Product Ltd., Wacker Metroark Chemicals Private Limited, Pon Pure Chemicals Private Limited, Pidilite Industries Limited, Asian Paints Limited, Reliance Industries Limited, Triveni Chemicals, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?