India uPVC Door and Window Market Size, Share, By Product Type (uPVC Doors, uPVC Windows), By Application (Residential, Commercial, Industrial), By End-Use (New Construction, Renovation & Replacement), By Distribution Channel (Direct Sales, Dealers & Distributors, Online Channels), India uPVC Door and Window Market Size Insights, Industry Trends, Forecasts to 2035.

Industry: Construction & ManufacturingIndia uPVC Door and Window Market Size Insights Forecasts to 2035

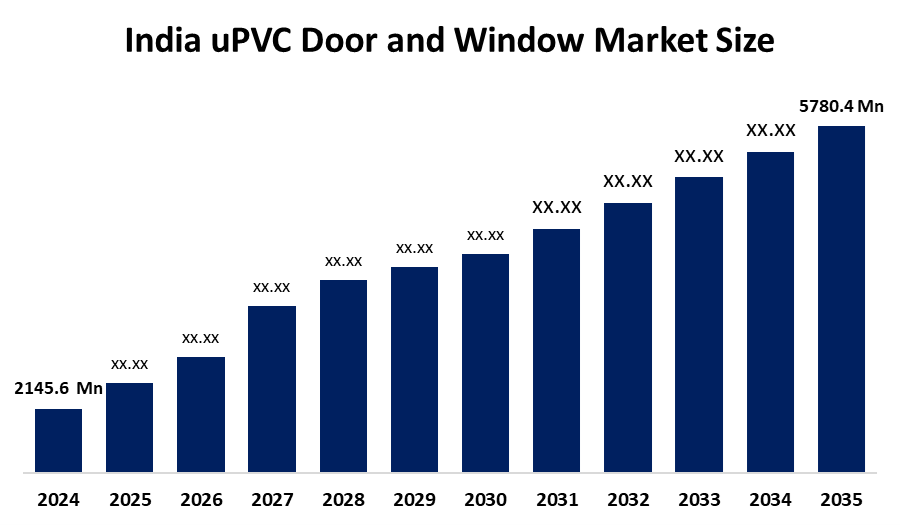

- India uPVC Door and Window Market Size 2024: USD 2,145.6 Mn

- India uPVC Door and Window Market Size 2035: USD 5,780.4 Mn

- India uPVC Door and Window Market Size CAGR: 9.43%

- India uPVC Door and Window Market Size Segments: Product Type, Application, End-Use, Distribution Channel

Get more details on this report -

The uPVC Door and Window Market Size refers to uPVC doors and windows made of unplasticized polyvinyl chloride. These are designed to be durable, thermally insulating, soundproofing, and of low maintenance compared to traditional wooden and aluminium materials. These products are utilized in residential housing, commercial buildings, offices, hospitals, and industrial facilities. The uPVC door and window market expansion is fueled by rapid urbanization, increasing housing demand, and the growing preference for energy, efficient and weather, resistant construction materials.

The central and state government initiatives like Housing for All, Smart Cities Mission, and large, scale infrastructure development are leading to quicker adoption of uPVC doors and windows all over India. Greater awareness of green buildings, long product life, and resistance to moisture, termites, and corrosion are also factors that are driving demand. Frequent innovations in extrusion technology, multi, chamber profiles, double glazing, and UV, resistant coatings are performance and appearance and thus, the uPVC systems become more attractive builders and consumers.

India uPVC Door and Window Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 2,145.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.43% |

| 2035 Value Projection: | 5,780.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Fenesta Building Systems, Encraft India Pvt Ltd, VEKA India, Rehau India Pvt Ltd, Deceuninck India, Prominance Window Systems, Aparna Venster, Window Magic India, Koemmerling India, NCL VEKA Ltd, LG Hausys India, Lingel Windows & Doors Technologies, AIS Windows, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India uPVC Door and Window Market:

The India uPVC Door and Window Market Size is mainly driven by residential and commercial construction sectors that are on the rise, the substitution of traditional wooden systems with the modern ones, the need for energy, efficient buildings and infrastructure projects that are being supported by the government. The brisk real estate activities and the increasing urban populations are the main factors that have ensured the market keeps on growing at a steady pace.

The India uPVC Door and Window Market Size is restrained by the fluctuating prices of the raw materials, high initial costs for the installation, low penetration in the rural areas, and reliance on imported uPVC compounds, which can influence the prices and the availability of the products.

The next housing projects, the renovation and replacement demand, the growth in tier, 2 and tier, 3 cities, the use of smart and insulated window systems, and the strengthening of the organized dealer and distribution networks are some of the places where the market can find future opportunities.

Market Segmentation

The India uPVC Door and Window Market Size share is classified into product type, application, end-use, and distribution channel.

By Product Type:

The India uPVC Door and Window Market Size is divided by product type into uPVC doors and uPVC windows. Among these, the uPVC windows segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Their supremacy is largely due to the fact that more units are being installed in new and replacement projects in both categories, better thermal and acoustic insulation, longer service life as compared to traditional materials, growing awareness of the energy, saving benefits, and the strong preference of homeowners and builders for durable and low, maintenance window solutions.

By Application:

TheIndia uPVC Door and Window Market Size is divided by application into residential, commercial, and industrial. Among these, the residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Residential expansion is fueled by the continuous construction of new houses, the growth of apartment complexes and villas, the urban redevelopment projects, the increase in disposable incomes, and the consumer preference for energy, efficient, aesthetically pleasing, and low, maintenance door and window solutions in homes.

By End-Use:

The India uPVC Door and Window Market Size is divided by end-use into new construction and renovation & replacement. Among these, the new construction segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The rise is attributed to the fast infrastructure development, housing projects led by the government, the growth of commercial and residential projects, the increased use of modern construction practices, and the demand for durable, maintenance, free uPVC products in developing urban areas.

By Distribution Channel:

The India uPVC Door and Window Market Size is divided by distribution channel into direct sales, dealers & distributors, and online channels. Among these, the dealers & distributors segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Their dominance results from long, standing regional networks, dependable on, site measurement and installation services, after, sales support, good relationships with builders and contractors, and tier, 2 and tier, 3 city customers who have better accessibility than those from other channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India uPVC door and window market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India uPVC Door and Window Market:

- Fenesta Building Systems

- Encraft India Pvt Ltd

- VEKA India

- Rehau India Pvt Ltd

- Deceuninck India

- Prominance Window Systems

- Aparna Venster

- Window Magic India

- Koemmerling India

- NCL VEKA Ltd

- LG Hausys India

- Lingel Windows & Doors Technologies

- AIS Windows

Recent Developments in Japan Clinical Trials Support Services Market:

In July 2025, SBM Gold has made its foray into finished fenestration solutions with the announcement of its expansion in uPVC doors and windows. The company presented uPVC door and window systems that are suitable for both residential and commercial buildings. With this diversification, SBM Gold is not only deepening its building, material portfolio but also is in sync with the increasing demand for sturdy and easy, to, clean construction products in India.

In April 2024, Epigral Ltd commissioned an additional 45,000 TPA CPVC resin line at its Dahej, Gujarat facility, increasing total CPVC capacity to 75,000 TPA. The expansion improves domestic availability of CPVC raw materials, supports downstream manufacturers of pipes, doors, and window profiles, and reduces India’s dependence on imported specialty polymers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India uPVC door and window market based on the below-mentioned segments:

India uPVC Door and Window Market, By Product Type

- uPVC Doors

- uPVC Windows

India uPVC Door and Window Market, By Application

- Residential

- Commercial

- Industrial

India uPVC Door and Window Market, By End-Use

- New Construction

- Renovation & Replacement

India uPVC Door and Window Market, By Distribution Channel

- Direct Sales

- Dealers & Distributors

- Online Channels

Frequently Asked Questions (FAQ)

-

What is the India uPVC door and window market size?India uPVC Door and Window Market is expected to grow from USD 2,145.6 million in 2024 to USD 5,780.4 million by 2035, growing at a CAGR of 9.43% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by rapid urbanization, rising residential and commercial construction, preference for energy-efficient, low-maintenance, and durable materials, government initiatives like Housing for All and Smart Cities Mission, growing awareness of green buildings, and technological innovations in uPVC extrusion and multi-chamber profiles.

-

What factors restrain the India uPVC door and window market?Constraints include fluctuating raw material prices, high initial installation costs, low penetration in rural areas, and dependence on imported uPVC compounds which may affect prices and availability.

-

How is the market segmented by product type?The market is segmented into uPVC Doors and uPVC Windows.

-

How is the market segmented by application?The market is segmented into Residential, Commercial, and Industrial.

-

How is the market segmented by distribution channel?The market is segmented into Direct Sales, Dealers & Distributors, and Online Channels.

-

Who are the key players in the India uPVC door and window market?Key companies include Fenesta Building Systems, Encraft India Pvt Ltd, VEKA India, Rehau India Pvt Ltd, Deceuninck India, Prominance Window Systems, Aparna Venster, Window Magic India, Koemmerling India, NCL VEKA Ltd, LG Hausys India, Lingel Windows & Doors Technologies, AIS Windows.

Need help to buy this report?