India Tofu Products Market Size, Share, By Product Type (Firm Tofu, Soft Tofu, Silken Tofu), By Packaging Type (Blocks, Trays, Vacuum-Sealed Packs), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Health Stores, Online Platforms, Restaurants), Market Insights, Industry Trends, and Forecasts to 2035.

Industry: Food & BeveragesIndia Tofu Product Market Insights Forecasts to 2035

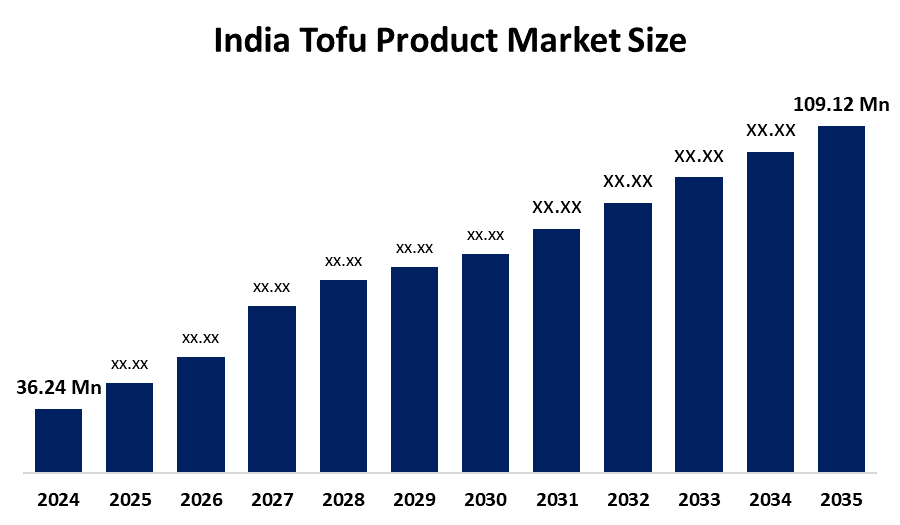

- India Tofu Product Market Size 2024: USD 36.24 Mn

- India Tofu Product Market Size 2035: USD 109.12 Mn

- India Tofu Product Market CAGR 2024: 10.54%

- India Tofu Product Market Segments: Product Type, Packaging Size, Distribution Channel

Get more details on this report -

Tofu products are plant, based foods derived by coagulating soy milk and are available in various forms such as firm, soft, or silken. These products are excellent sources of protein without any cholesterol and can be considered as alternatives to meat and dairy. They have become very popular due to their wide applicability in household cooking, food service, ready, to, eat meals, salads, and snacks. The gradual shift towards health, conscious lifestyles, the increase in the number of vegetarians and vegans, and the preference for sustainable protein sources are some of the main reasons that tofu consumption is on the rise, especially in urban and semi, urban areas of India.

At present, India is heavily reliant on imports for soy protein isolates that are used for making tofu, which means there is an opportunity for the domestic soy industry to grow. The retail sector consisting of organized retail, online platforms, and foodservice outlets is working towards making tofu more accessible to consumers in response to the demand. Various technological innovations like vacuum and modified atmospheric packaging, cold chain logistics, and the launch of flavored and ready, to, cook tofu variants are resulting in longer shelf life, better quality, and consumer convenience. Besides this, government support is paving the way for the industry to grow further. Industry bodies like SOPA are encouraging the use of tofu in nutrition programs, and initiatives such as the Year of Soy 2026 being proposed are some examples of this support. APEDAs export facilitation for processed soy products is helping India to take up a bigger role in the global plant, based protein markets creating long, term opportunities for domestic expansion as well as exports.

India Tofu Product Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 36.24 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 10.54% |

| 2023 Value Projection: | 36.24 Million In 2024 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 181 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Distribution, By Packaging Type |

| Companies covered:: | Soyakrit (Veganova Foods), Nature’s Soy, Soyarich Foods, Murli Greens, SOYFU, Soyamrut, Venus Food & Beverages, Madhav and Foods key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Tofu Products Market:

The Indian tofu products market size is largely driven by consumer health consciousness trends. Customers want foods that are rich in protein, low in fat, and free from cholesterol for weight and heart health purposes. Some of the reasons that add to the demand for tofu are the increase in vegan and vegetarian lifestyles, the environment as a trend that supports sustainable protein, and the culinary versatility of tofu as a substitute for Indian and global dishes. The increasing availability through supermarkets, online platforms, and restaurants is also enabling the market to grow.The India tofu products market size is limited by the cultural preference of dairy and lentils, low consumer awareness in semi, urban/rural areas, strong competition from paneer and pulses, inconsistency in quality, short shelf life, high prices, and fragmented production and distribution networks.

India's tofu market size has promising potential to grow with protein, rich and fortified tofu, the introduction of tofu in schools, corporate meals, and catering, and promoting domestic soy processing to reduce imports. Adoption can be accelerated through awareness programs, influencer collaborations, and Indianized products such as tofu paneer, tofu tikka, and ready, to, cook meals.

Market Segmentation

The Japan Clinical Trials Support Services Market share is classified into phase type and service.

By Product Type:

The India tofu products market size is divided by product type into firm tofu, soft tofu, and silken tofu. Among these, the firm tofu segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Its dominance is mainly a result of its versatility in cooking, being very suitable for grilling, frying, or stir, fry dishes, and a strong consumer preference for its use as a paneer substitute in Indian recipes. On top of that, more and more people are getting to know its protein, rich, low, fat, and cholesterol, free nature, which is why both retail and foodservice channels are experiencing higher consumption.

By Packaging Type:

The India tofu products market size is divided by packaging type into blocks, trays, and vacuum-sealed packs. Among these, the vacuum-sealed pack segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The main reason for its dominance is the extended shelf life, better hygiene, and convenience for urban consumers. The packaging makes it very easy to distribute through supermarkets, e, commerce, and home delivery, thus spoilage is reduced and trust in product quality is increased.

By Distribution Channel:

The India tofu products market size is divided by distribution channel into super markets/hypermarkets, specialty health stores, online platforms, and restaurants. Among these, the supermarkets/hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth of the urban market, consumer trust in the organized retail, the visibility of branded tofu products, and accessibility in metro and tier, 2 cities are the main reasons behind this growth. Supermarkets, on their part, also offer promotions and variety, thus attracting health, conscious and vegetarian consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India tofu products market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Clinical Trials Support Services Market:

- Soyakrit (Veganova Foods)

- Nature’s Soy

- Soyarich Foods

- Murli Greens

- SOYFU

- Soyamrut

- Venus Food & Beverages

- Madhav Foods

Recent Developments in Japan Clinical Trials Support Services Market:

In October 2025, the Soyabean Processors Association of India (SOPA) requested the Indian government to incorporate soy-based foods such as tofu into major nutrition schemes, including the Mid-Day Meal Programme, Public Distribution System (PDS), and national nutrition campaigns. The objective of this initiative is to increase protein intake across the country while creating a market for tofu as an affordable and healthy protein source.

In March 2025, the Agricultural and Processed Food Products Export Development Authority (APEDA) showcased India’s agriculture and processed food sector, along with plant-based soy products, at the 39th AAHAR Exhibition held in New Delhi. This participation strengthened export preparedness and enhanced global market visibility for value-added products such as tofu, thereby supporting the growth of their demand at the international level.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India tofu products market based on the below-mentioned segments:

India Tofu Products Market, By Product Type

- Firm Tofu

- Soft Tofu

- Silken Tofu

India Tofu Products Market, By Packaging Type

- Blocks

- Trays

- Vacuum-Sealed Packs

India Tofu Products Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Health Stores

- Online Platforms

- Restaurants

Frequently Asked Questions (FAQ)

-

Q: What is the India tofu product market size?The market is expected to grow from USD 36.24 million in 2024 to USD 109.12 million by 2035, at a CAGR of 10.54% during 2025–2035.

-

Q: What are the key growth drivers of the market?Rising health consciousness, growing vegetarian and vegan populations, demand for sustainable protein, tofu’s use as a paneer substitute, and expanding organized retail and online availability.

-

Q: What factors restrain the India tofu product market?Cultural preference for dairy and lentils, low awareness outside urban areas, competition from paneer and pulses, short shelf life, higher costs, and fragmented supply chains.

-

Q: How is the market segmented?The market is segmented by product type (firm, soft, silken tofu), packaging type (blocks, trays, vacuum-sealed packs), and distribution channel (supermarkets/hypermarkets, specialty health stores, online platforms, restaurants).

-

Q: Who are the key players in the India tofu product market?Key players include Soyakrit (Veganova Foods), Nature’s Soy, Soyarich Foods, Murli Greens, SOYFU, Soyamrut, Venus Food & Beverages, and Madhav Foods.

-

Q: Who are the target audiences for this report?Market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?