India Titanium Dioxide Market Size, Share, and COVID-19 Impact Analysis, By Application (Paints and Coatings, Plastics, Paper and Pulp, Cosmetics and Other), By End-User Industry (Construction, Automotive and Transportation, Packaging, and Other), and India Titanium Dioxide Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Titanium Dioxide Market Insights Forecasts to 2035

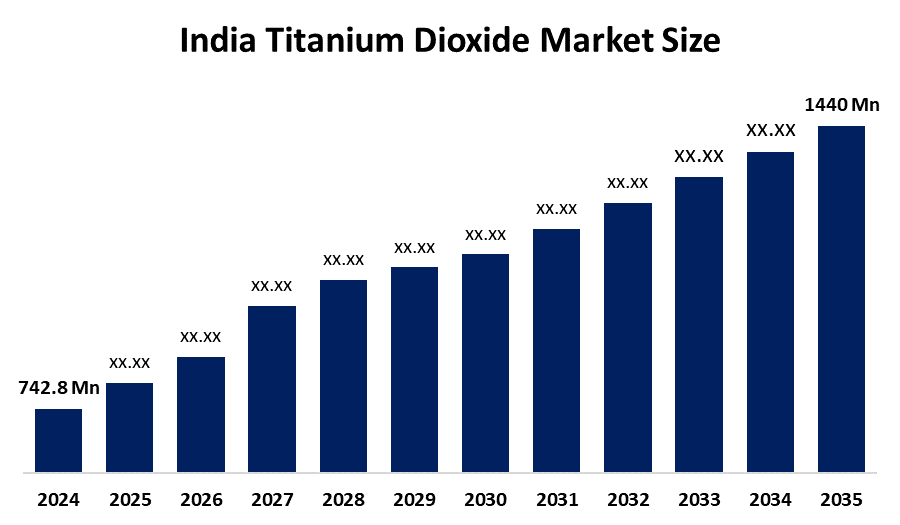

- The India Titanium Dioxide Market Size Was Estimated at USD 742.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.2% from 2025 to 2035

- The India Titanium Dioxide Market Size is Expected to Reach USD 1440 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The India Titanium Dioxide Market Size is Anticipated to Reach USD 1440 Million by 2035, Growing at a CAGR of 6.2% from 2025 to 2035. The India titanium dioxide market is driven by the rapid growth of end-use industries such as paints & coatings, plastics, and paper, rising urbanization, increasing construction activities, and growing demand for high-quality pigments in automotive and consumer goods sectors.

Market Overview

Titanium dioxide (TiO2) is a white pigment widely used for its excellent brightness, opacity, and UV resistance. It finds applications across paints & coatings, plastics, paper, cosmetics, and textiles. The India Titanium Dioxide Market Size has been witnessing significant growth due to rapid industrialization, urbanization, and rising construction activities. Increasing demand for decorative paints, automotive coatings, and high-quality plastics is further driving market expansion. Additionally, growing consumer awareness regarding aesthetic and protective coatings has fuelled the adoption of titanium dioxide in multiple end-use sectors.

One of the prominent trends in the India Titanium Dioxide Market Size is the shift towards eco-friendly and low-VOC (volatile organic compounds) formulations in paints and coatings. Manufacturers are increasingly focusing on sustainable solutions to meet stringent environmental regulations and consumer preferences for green products. Another trend is the expansion of domestic production capacities to reduce dependence on imports, driven by growing demand in the automotive, construction, and packaging sectors. Furthermore, the market is witnessing innovation in functional pigments, such as photocatalytic TiO2, which offers self-cleaning and antimicrobial properties, catering to advanced industrial applications.

The production of titanium dioxide in India primarily utilizes the sulphate and chloride processes, with the chloride process gaining prominence due to its higher efficiency, lower environmental footprint, and superior pigment quality. Advanced milling, dispersion, and surface treatment technologies are being adopted to enhance product performance across end-use industries. Government initiatives such as Make in India, coupled with incentives for domestic chemical manufacturing and investment-friendly policies, are supporting the expansion of TiO2 production capacities. Additionally, environmental regulations are encouraging manufacturers to adopt cleaner production techniques and sustainable raw material sourcing, further strengthening the market’s growth trajectory.

Report Coverage

This research report categorizes the market for the India Titanium Dioxide Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India titanium dioxide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India titanium dioxide market.

India Titanium Dioxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 742.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.2% |

| 2035 Value Projection: | USD 1440 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Application ,By End-User Industry |

| Companies covered:: | Kerala Minerals & Metals Limited (KMML), Travancore Titanium Products Ltd, Meghmani Organics Limited, V.V. Titanium Pigments Pvt. Ltd, BMC Titania, Neelkanth Minechem, Saraf Agencies Private Limited, Cochin Minerals & Rutile Ltd (CMRL), Indian Rare Earths Limited (IREL), and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India Titanium Dioxide Market Size is primarily driven by the booming paints and coatings industry, fuelled by rapid urbanization, infrastructure development, and rising real estate activities. Increasing demand for plastics, paper, and automotive coatings also supports growth, as titanium dioxide enhances brightness, opacity, and durability. The expanding cosmetics and personal care sector further contributes, owing to the pigment’s whitening and UV-protection properties. Additionally, technological advancements in pigment production and the shift toward eco-friendly, high-performance products are encouraging manufacturers to invest in domestic capacities, strengthening market expansion across multiple end-use industries.

Restraining Factors

The growth of the India Titanium Dioxide Market Size is restrained by the high production costs and fluctuating raw material prices, which impact profitability. Environmental regulations regarding chemical waste and emissions also pose challenges for manufacturers. Additionally, dependence on imports for high-quality TiO2 and competition from alternative pigments limit market expansion, slowing overall growth despite increasing demand.

Market Segmentation

The India Titanium Dioxide Market share is classified into application and end-user industry.

- The paints and coatings segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Titanium Dioxide Market Size is segmented by application into paints and coatings, plastics, paper and pulp, cosmetics, and other. Among these, the paints and coatings segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the paints and coatings segment in the market is due to the pigment’s ability to provide high opacity, brightness, and long-lasting durability, which are essential for both decorative and industrial coatings. Rapid urbanization, infrastructure expansion, and a growing construction sector have increased demand for high-quality paints. Additionally, the automotive and furniture industries are adopting advanced coatings that require superior pigment performance. These factors collectively make paints and coatings the largest and fastest-growing application segment for titanium dioxide in India.

- The construction segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Titanium Dioxide Market Size is segmented by end user industry into construction, automotive and transportation, packaging, and other. Among these, the construction segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The construction segment dominates the market because TiO2 is widely used in paints, coatings, and building materials, providing enhanced brightness, opacity, and durability essential for aesthetic and protective purposes. Rapid urbanization, increased residential and commercial construction, and large-scale infrastructure development are driving strong demand. Additionally, the rising adoption of decorative and weather-resistant paints in buildings further boosts consumption. Government initiatives supporting housing and infrastructure projects, coupled with the need for high-performance materials in construction, make this segment the largest and most influential end-user industry for titanium dioxide in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Titanium Dioxide Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kerala Minerals & Metals Limited (KMML)

- Travancore Titanium Products Ltd

- Meghmani Organics Limited

- V.V. Titanium Pigments Pvt. Ltd

- BMC Titania

- Neelkanth Minechem

- Saraf Agencies Private Limited

- Cochin Minerals & Rutile Ltd (CMRL)

- Indian Rare Earths Limited (IREL)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Titanium Dioxide Market Size based on the below-mentioned segments:

India Titanium Dioxide Market, By Application

- Paints and Coatings

- Plastics

- Paper and Pulp

- Cosmetics

- Other

India Titanium Dioxide Market, By End-User Industry

- Construction

- Automotive and Transportation

- Packaging

- Other

Frequently Asked Questions (FAQ)

-

1. What is titanium dioxide, and what is its primary use?Titanium dioxide (TiO2) is a white pigment known for its brightness, opacity, and durability. It is primarily used in paints & coatings, plastics, paper, cosmetics, and textiles.

-

2. Which segment dominates the India titanium dioxide market?The paints and coatings segment dominates due to high demand in construction, automotive, and decorative applications.

-

3. What are the key driving factors for the market?Rapid urbanization, infrastructure development, growth in the construction and automotive sectors, and increasing demand for high-performance pigments drive the market.

-

4. What are the major challenges restraining the market?High production costs, fluctuating raw material prices, environmental regulations, and competition from alternative pigments limit growth.

-

5. Which end-user industry is the largest consumer of titanium dioxide in India?The construction industry is the largest end-user, as TiO2 is widely used in paints, coatings, and building materials.

-

6. What are the key trends in the market?Trends include eco-friendly and low-VOC paints, expansion of domestic production, and functional pigments like photocatalytic TiO2 with self-cleaning and antimicrobial properties.

Need help to buy this report?