India Synthetic Rubber Market Size, Share, By Type (Styrene Butadiene Rubber, Ethylene Propylene Diene Rubber, Polyisoprene, Polybutadiene Rubber, And Others), By Form (Liquid Synthetic Rubber And Solid Synthetic Rubber), And India Synthetic Rubber Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsIndia Synthetic Rubber Market Insights Forecasts to 2035

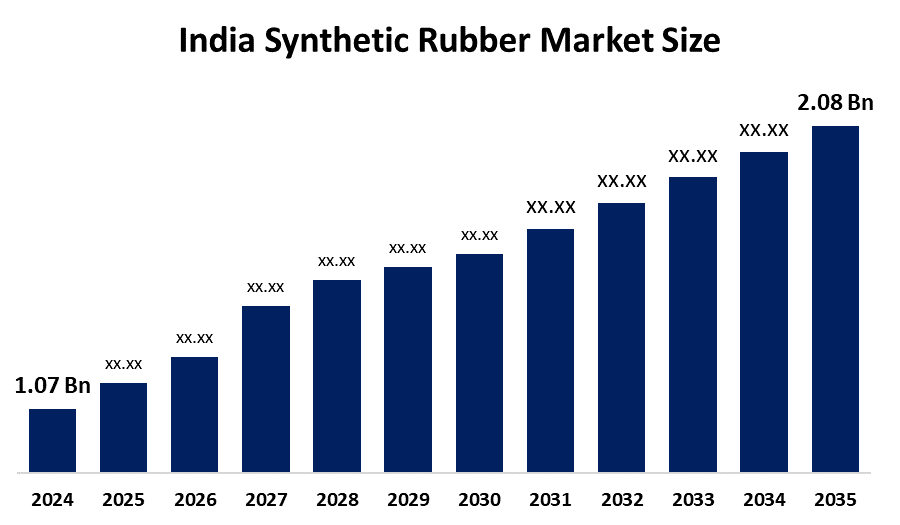

- India Synthetic Rubber Market Size 2024: USD 1.07 Bn

- India Synthetic Rubber Market Size 2035: USD 2.08 Bn

- India Synthetic Rubber Market CAGR 2024: 6.23%

- India Synthetic Rubber Market Segments: Type and Form

Get more details on this report -

The India synthetic rubber market encompasses to rubber that is produced synthetically or artificial elastomers. Synthetic rubber is a blend of various chemicals including styrene butadiene and polybutadiene along with other synthetic polymers made from petroleum-based chemical feedstock. Synthetic rubber has many similar properties as natural rubber but allows the end user to customize some physical and chemical characteristics required for the unique application of synthetic rubber. Some of the applications of synthetic rubber include passenger vehicles and heavy duty vehicles used in manufacturing, construction, and production as well as various consumer products such as tires and conveyor belt systems.

The synthetic rubber in India are backed by government support, including the Make in India and the Atmanirbhar Bharat mission promote domestic manufacturing capacity and import substitution, encouraging investments in petrochemicals and downstream industries such as synthetic rubber production. The Department of Chemicals and Petrochemicals has approved significant projects for synthetic rubber manufacturing aimed at reducing import dependency.

As technology advances, Indian synthetic rubber providers are using new technology from Industry includes automation, IoT, and AI enabled automated process controls used to optimize production and minimize waste while increasing uniformity. Manufacturers have developed new elastomer formulations with better elasticity, durability, and thermal stability for advanced applications such as electric vehicle tires and industrial seals. Research and development of specialty and high performance elastomers such as ethylene propylene diene monomer which are weather resistant enabling Indian manufacturers to effectively differentiate themselves from global commodity manufacturers.

Market Dynamics of the India Synthetic Rubber Market:

The India synthetic rubber market is driven by booming automotive industry, rising vehicle production, transition toward electric vehicles creating new material demands, increased infrastructure projects under the National Infrastructure Pipeline and Smart Cities Mission, rising demand for industrial and construction rubber goods, urbanization, rising disposable incomes, demand for synthetic rubber in footwear, consumer products, and industrial goods, and a shift toward higher performing synthetic elastomers further propel the market growth.

The India synthetic rubber market is restrained by the heavy dependency on imported feedstocks, global price volatility, supply chain disruption, constraining cost predictability and profit margins, high raw material costs, stringent environmental regulations, limited domestic capacity in high end specialty grades and a skills gap in advanced rubber technology issues.

The future of India synthetic rubber market is bright and promising, with versatile opportunities emerging from the automobile and industrial manufacturing sector for a significant increase in demand for synthetic rubber, especially for high-performance, application-specific elastomers designed for use in EVs, energy efficient infrastructure, and long-lasting industrial products. Additionally, the current government policy focuses on building domestic capabilities to process chemicals and providing incentives for investment in domestic chemicals production, which creates opportunities for capacity expansion, positioning India as a regional supplier and global exporter of synthetic rubber products.

India Synthetic Rubber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.07 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.23% |

| 2035 Value Projection: | USD 2.08 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type,By Form |

| Companies covered:: | GRP Ltd,Rishiroop Ltd,Arlanxeo India,Bhavik Enterprise,Sujan Industries And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Synthetic Rubber Market share is classified into type and form.

By Type:

The India synthetic rubber market is divided by type into styrene butadiene rubber, ethylene propylene diene rubber, polyisoprene, polybutadiene rubber, and others. Among these, the styrene butadiene rubber segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Massive used in the production of automotive tires, cost effectiveness, provides superior wear resistance, rapid expansion of automotive sector, and strong growing shift towards green tires all contribute to the styrene butadiene rubber segment's largest share and higher spending on synthetic rubber when compared to other type.

By Form:

The India synthetic rubber market is divided by form into liquid synthetic rubber and solid synthetic rubber. Among these, the solid synthetic rubber segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The solid synthetic rubber segment dominates because of high dominance in tire manufacturing, heavily used in producing industrial goods, easy to store and handle, and ideal for the diverse requirements of the Indian manufacturing sector in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations companies involved within the India synthetic rubber market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Synthetic Rubber Market:

- Apcotex Industries Ltd.

- GRP Ltd

- Rishiroop Ltd.

- Arlanxeo India

- Bhavik Enterprise

- Sujan Industries

- Others

Recent Developments in India Synthetic Rubber Market:

In January 2025, Arlanxeo formally launched Keltan Eco EPDM with up to bio content in India, targeting automotive weatherstrips and roofing membranes to meet sustainability goals.

In August 2024, Sumitomo Rubber Industries launched a high performance solid styrene butadiene rubber compound for tire treads in India, focused on improved wear resistance and rolling efficiency for electric vehicles.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India synthetic rubber market based on the below-mentioned segments:

India Synthetic Rubber Market, By Type

- Styrene Butadiene Rubber

- Ethylene Propylene Diene Rubber

- Polyisoprene

- Polybutadiene Rubber

- Others

India Synthetic Rubber Market, By Form

- Liquid Synthetic Rubber

- Solid Synthetic Rubber

Frequently Asked Questions (FAQ)

-

Q: What is the India synthetic rubber market size?A: India synthetic rubber market is expected to grow from USD 1.07 billion in 2024 to USD 2.08 billion by 2035, growing at a CAGR of 6.23% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the booming automotive industry, rising vehicle production, transition toward electric vehicles creating new material demands, increased infrastructure projects under the National Infrastructure Pipeline and Smart Cities Mission, rising demand for industrial and construction rubber goods, urbanization, rising disposable incomes, demand for synthetic rubber in footwear, consumer products, and industrial goods, and a shift toward higher performing synthetic elastomers further propel the market growth.

-

Q: What factors restrain the India synthetic rubber market?A: Constraints include the heavy dependency on imported feedstocks, global price volatility, supply chain disruption, constraining cost predictability and profit margins, high raw material costs, stringent environmental regulations, limited domestic capacity in high-end specialty grades and a skills gap in advanced rubber technology issues.

-

Q: How is the market segmented by type?A: The market is segmented into styrene butadiene rubber, ethylene propylene diene rubber, polyisoprene, polybutadiene rubber, and others.

-

Q: Who are the key players in the India synthetic rubber market?A: Key companies include Apcotex Industries Ltd., Indian Synthetic Rubber Pvt Ltd., Reliance Sibur Elastomers Pvt Ltd., Lanxess India Private Limited, Zeon India Private Limited, TSRC (India) Pvt Ltd., GRP Ltd, Rishiroop Ltd., Arlanxeo India, Bhavik Enterprise, Vishal Rubber Industries, Sujan Industries, United Rubber Industries Pvt Ltd., Tinna Rubber and Infrastructure Ltd., Polybond India Pvt Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?