India Sulphuric Acid Market Size, Share, By Raw Material (Elemental Sulphur, Base Metal Smelters, Pyrite Ore, And Others), By Application (Fertilizers, Chemical Manufacturing, Metal Processing, Petroleum Refining, Textile Industry, And Others), And India Sulphuric Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Sulphuric Acid Market Size Insights Forecasts to 2035

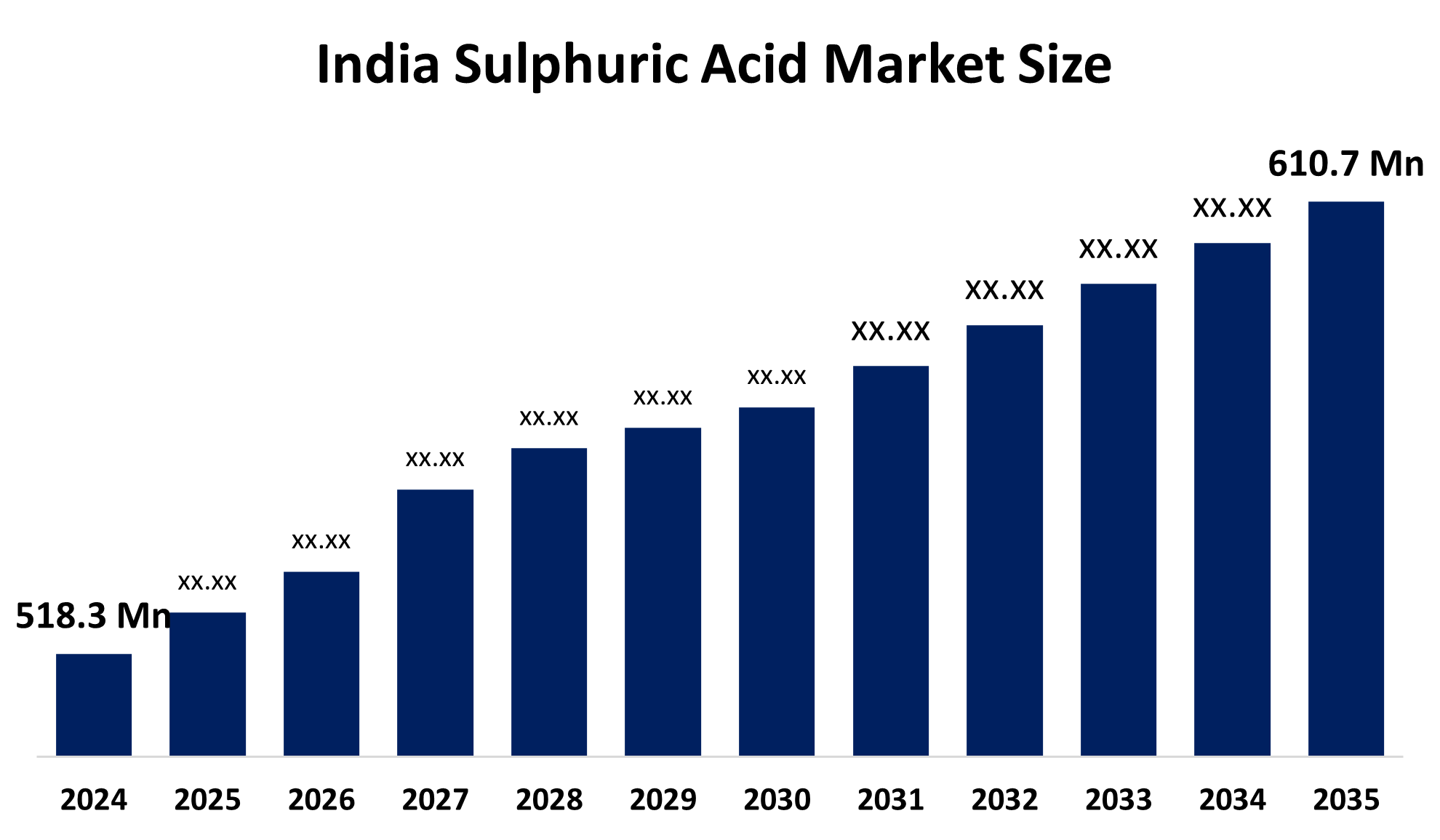

- India Sulphuric Acid Market Size 2024: USD 518.3 Million

- India Sulphuric Acid Market Size 2035: USD 610.7 Million

- India Sulphuric Acid Market CAGR 2024: 1.5%

- India Sulphuric Acid Market Segments: Raw Material and Application

Get more details on this report -

The India Sulphuric Acid Market refers to the entire domestic industry involved in producing, importing, distributing and consuming sulphuric acid, a key component of the chemical value chain for producing phosphate-based fertilisers such as diammonium phosphate and single super phosphate, and has many applications in several industries, including metal processing, petroleum refining, textiles, pulp & paper, water treatment, and battery manufacturing. The chemical's highly reactive yet corrosive nature makes it a necessity for all industry sectors.

The sulphuric acid in India is backed by government support, including the Government of India revised the Budget Estimate for the Department of Fertilizers to RS 1,91,836.29 crore, reflecting robust fiscal backing that includes large allocations under the Nutrient Based Subsidy (NBS) scheme to ensure fertilizer affordability and availability for farmers, driving the downstream demand for sulphuric acid.

As technology advances, Indian sulphuric acid providers are now using contact process technologies with more efficient emissions control systems and heat recovery systems to increase energy efficiency and decrease environmental impact. An increasing number of businesses are investing in efforts regarding the regeneration of spent acid and the circular economy leads to reduction of total waste by utilizing innovative technologies, implementing worker safety procedures that are safe for employees, and using automated activity systems. All these innovations will allow producers to remain competitive while also complying with more rigorous environmental and worker health standards.

Market Dynamics of the India Sulphuric Acid Market:

The India Sulphuric Acid Market is driven by expanding agricultural sector, increased need for fertilizers to support high crop yields, rapid industrialization, increasing battery production for energy storage, rise in electric vehicles market, urbanization, rapid infrastructure development projects, increased focus on wastewater treatment and environmental remediation, and enhancements in sulphuric acid regeneration technologies further propel the market growth.

The India Sulphuric Acid Market is restrained by the environmental and safety concerns, production and handling risks, potential groundwater contamination, high production costs, relies on imported raw materials challenges, price volatility, supply chain uncertainties, and infrastructure and logistics challenges.

The future of India Sulphuric Acid Market is bright and promising, with versatile opportunities emerging from the increasing emphasis on the treatment of wastewater and environmental clean-up is creating a larger segment of the market, with the use of sulphuric acid for both neutralizing effluents and purifying industrial water. The growth of the electric vehicle industry and the increase in battery manufacturing, especially for lead-acid batteries and all future battery chemistries, may also create new opportunities. Emerging technologies in the area of sulphuric acid regeneration and circular economy initiatives present numerous opportunities for growth based on sustainability principles.

India Sulphuric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 518.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.5% |

| 2035 Value Projection: | USD 610.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Raw Material, By Application |

| Companies covered:: | Aarti Industries Ltd., Coromandel International Ltd., Hindalco Industries Ltd., Tata Chemicals Ltd., UPL Limited, Indian Farmers Fertilizer Cooperative Ltd., Atul Ltd., Gujarat State Fertilizers & Chemicals Limited, BASF India Ltd., Khaitan Chemicals and Fertilizers Ltd., Oriental Carbon & Chemicals Ltd., Paradeep Phosphate Ltd., and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The India Sulphuric Acid Market share is classified into raw material and application.

By Raw Material:

The India Sulphuric Acid Market is divided by raw material into elemental sulphur, base metal smelters, pyrite ore, and others. Among these, the elemental sulphur segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. High abundance as a primary raw material, easily available, cost effectiveness, high efficient, generates lower emissions, and vertical integration in fertilizer production creating large-scale demand all contribute to the elemental sulphur segment's largest share and higher spending on sulphuric acid when compared to other raw material.

By Application:

The India Sulphuric Acid Market is divided by application into fertilizers, chemical manufacturing, metal processing, petroleum refining, textile industry, and others. Among these, the fertilizers segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The fertilizers segment dominates because of high demand for phosphate fertilizers, strong agriculture foundation enhancing crop yields, and widely used to process phosphate rock into phosphoric acid which is then used in fertilizer production.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Sulphuric Acid Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Sulphuric Acid Market:

- Aarti Industries Ltd.

- Coromandel International Ltd.

- Hindalco Industries Ltd.

- Tata Chemicals Ltd.

- UPL Limited

- Indian Farmers Fertilizer Cooperative Ltd.

- Atul Ltd.

- Gujarat State Fertilizers & Chemicals Limited

- BASF India Ltd.

- Khaitan Chemicals and Fertilizers Ltd.

- Oriental Carbon & Chemicals Ltd.

- Paradeep Phosphate Ltd.

- Others

Recent Developments in India Sulphuric Acid Market:

- In January 2026, Gujarat State Fertilizers & Chemicals Ltd. commenced commercial production at its new 600 Metric Tonnes Per Day sulphuric acid plant at its Fertilizernagar complex in Vadodara, Gujarat.

- In October 2025, Paradeep Phosphates Limited commissioned a new 1500 MTPD sulphuric acid plant at its Paradeep facility in Odisha, with an investment of Rs510 crores.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Sulphuric Acid Market based on the below-mentioned segments:

India Sulphuric Acid Market, By Raw Material

- Elemental Sulphur

- Base Metal Smelters

- Pyrite Ore

- Others

India Sulphuric Acid Market, By Application

- Fertilizers

- Chemical Manufacturing

- Metal Processing

- Petroleum Refining

- Textile Industry

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India sulphuric acid market size?A: India sulphuric acid market is expected to grow from USD 518.3 million in 2024 to USD 610.7 million by 2035, growing at a CAGR of 1.5% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the expanding agricultural sector, increased need for fertilizers to support high crop yields, rapid industrialization, increasing battery production for energy storage, rise in electric vehicles market, urbanization, rapid infrastructure development projects, increased focus on wastewater treatment and environmental remediation, and enhancements in sulphuric acid regeneration technologies further propel the market growth.

-

Q: What factors restrain the India sulphuric acid market?A: Constraints include the environmental and safety concerns, production and handling risks, potential groundwater contamination, high production costs, relies on imported raw materials challenges, price volatility, supply chain uncertainties, and infrastructure and logistics challenges.

-

Q: How is the market segmented by raw material?A: The market is segmented into elemental sulphur, base metal smelters, pyrite ore, and others.

-

Q: Who are the key players in the India sulphuric acid market?A: Key companies include Aarti Industries Ltd., Coromandel International Ltd., Hindalco Industries Ltd., Tata Chemicals Ltd., UPL Limited, Indian Farmers Fertilizer Cooperative Ltd., Atul Ltd, Gujarat State Fertilizers & Chemicals Limited, BASF India Ltd., Khaitan Chemicals and Fertilizers Ltd., Oriental Carbon & Chemicals Ltd., Paradeep Phosphate Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?