India Styrene Market Size, Share, By Product Type (Polystyrene, Acrylonitrile Butadiene Styrene, Styrene Butadiene Rubber, Styrene Acrylonitrile, And Others), By Application (Packaging, Automotive, Construction, Electronics, Footwear, And Others), And India Styrene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Styrene Market Insights Forecasts to 2035

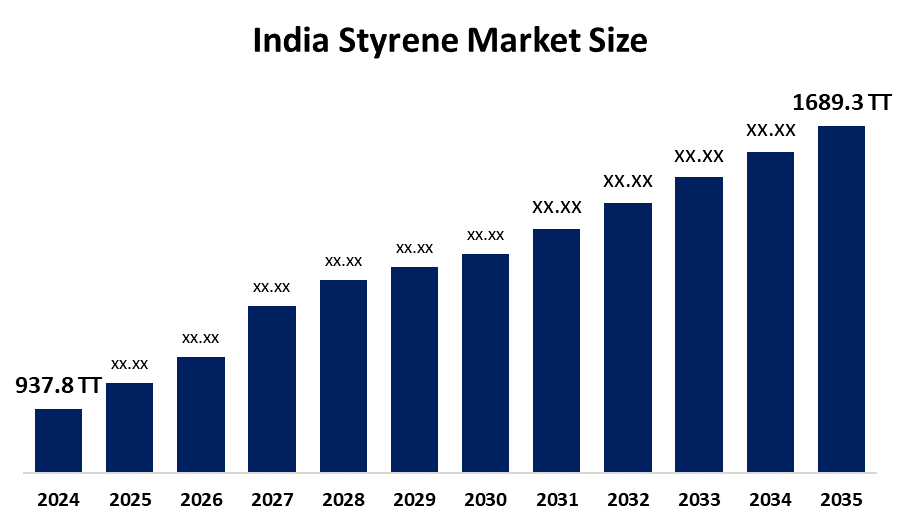

- India Styrene Market Size 2024: 937.8 Thousand Tonnes

- India Styrene Market Size 2035: 1689.3 Thousand Tonnes

- India Styrene Market CAGR 2024: 5.5%

- India Styrene Market Segments: Product Type and Application

Get more details on this report -

The India styrene market refers to all aspects of domestic formation, developments, and trade in styrene. Styrene is a key petrochemical monomer that is an important foundation for many types of polymers and resins including polystyrene, ABS, and SBR. Styrene is widely used in packaging, automotive, construction, electronics, and consumer goods because of its light weight, versatility, and performance benefits, enhancing fuel efficiency in vehicles and protecting products from damage.

The styrene in India are backed by government support, including the Atmanirbhar Bharat (Self-Reliant India) mission, exemplified by IndianOil’s strategic investment to establish India’s first domestic styrene monomer plant at the Panipat Refinery in Haryana with an expected capacity of about 387,000 tpa. Chemical industry support schemes from the government of India proposed Production Linked Incentive (PLI) frameworks targeted at chemicals provide financial and infrastructural support aimed at boosting domestic capabilities, innovation, and competitiveness in the styrene and petrochemical sectors.

As technology advances, India’s styrene providers are now using catalyst technologies, energy efficient process technologies, automation in the manufacturing processes has improved yields and made possible to develop higher performance styrene derivatives specifically for more advanced applications like lightweight automotive parts and improved polymer composite materials. Innovations surrounding the recycling of styrene, as well as developing sustainable processes to produce styrene by way of bio-based feedstock and closed loop recycling systems are becoming increasingly important in light of environmental and regulatory pressures; in addition, these innovative technologies offer competitive marketplace.

India Styrene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | 937.8 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.5% |

| 2035 Value Projection: | 1689.3 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 89 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | INEOS Styrolution India Limited, Bhansali Engineering Polymers Limited, LG Chem, SABIC, Lotte Chemical Corporation, Kumho Petrochemical Co., Ltd., Toray Industries, Supreme Petrochem Ltd., Haldia Petrochemicals Limited |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the India Styrene Market:

The India styrene market is driven by the rapidly growing end-use industries and macroeconomic trends, booming packaging demand, e-commerce growth, consumer preferences for lightweight and cost-effective materials, expansion in automotive production to reduce vehicle weight and improve fuel efficiency, parallel growth in infrastructure and construction activities, rising disposable incomes, and higher adoption of styrene derivatives in consumer electronics all contribute to sustained market expansion

The India styrene market is restrained by the high dependence on imports for styrene monomer, global supply chain volatility, price fluctuations, environmental and health concerns associated with styrene production, fluctuating feedstock prices and potential regulatory restrictions on certain plastics.

The future of India styrene market is bright and promising, with versatile opportunities emerging from the increased investment and support for the establishment of a domestic production base for styrene creating new markets and enable producers to expand their capacity to create products using styrene and its derivatives such as ABS, polystyrene, and others. The introduction of environmentally sustainable and recycled styrene will further facilitate innovation in the development of new providing excellent opportunities for styrene-related growth potential through the end of this decade and beyond.

Market Segmentation

The India Styrene Market share is classified into product type and application.

By Product Type:

The India styrene market is divided by product type into polystyrene, acrylonitrile butadiene styrene, styrene butadiene rubber, styrene acrylonitrile, and others. Among these, the polystyrene segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High demand in the packaging and construction industries, easy to handle, cost effective, growth in e-commerce, and rapid urbanization all contribute to the polystyrene segment's largest share and higher spending on styrene when compared to other product type.

By Application:

The India styrene market is divided by application into packaging, automotive, construction, electronics, footwear, and others. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The packaging segment dominates because of rapid expansion of e-commerce platforms, easy to carry, cost effective, ideal for manufacturing various packaging products, and heavy demand from food and beverages industry in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India styrene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Styrene Market:

- INEOS Styrolution India Limited

- Bhansali Engineering Polymers Limited

- LG Chem

- SABIC

- Lotte Chemical Corporation

- Kumho Petrochemical Co., Ltd.

- Toray Industries

- Supreme Petrochem Ltd.

- Haldia Petrochemicals Limited

- Others

Recent Developments in India Styrene Market:

In October 2025, the Indian government officially withdrew the Quality Control Orders for acrylonitrile, maleic anhydride, and styrene, which were initially issued by the Ministry of Chemicals and Fertilizers.

In September 2025, Supreme Petrochem commissioned its first line of the acrylonitrile butadiene styrene (ABS) project with a capacity of 70,000 TPA at its Amdoshi, Maharashtra plant. An ABS compounding facility also started production the same month.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India styrene market based on the below-mentioned segments:

India Styrene Market, By Product Type

- Polystyrene

- Acrylonitrile Butadiene Styrene

- Styrene Butadiene Rubber

- Styrene Acrylonitrile

- Others

India Styrene Market, By Application

- Packaging

- Automotive

- Construction

- Electronics

- Footwear

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India styrene market size?A: India styrene market is expected to grow from 937.8 thousand tonnes in 2024 to 1689.3 thousand tonnes by 2035, growing at a CAGR of 5.5% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rapidly growing end-use industries and macroeconomic trends, booming packaging demand, e-commerce growth, consumer preferences for lightweight and cost-effective materials, expansion in automotive production to reduce vehicle weight and improve fuel efficiency, parallel growth in infrastructure and construction activities, rising disposable incomes, and higher adoption of styrene derivatives in consumer electronics all contribute to sustained market expansion

-

Q: What factors restrain the India styrene market?A: Constraints include the high dependence on imports for styrene monomer, global supply chain volatility, price fluctuations, environmental and health concerns associated with styrene production, fluctuating feedstock prices and potential regulatory restrictions on certain plastics.

-

Q: How is the market segmented by product type?A: The market is segmented into polystyrene, acrylonitrile butadiene styrene, styrene butadiene rubber, styrene acrylonitrile, and others.

-

Q: Who are the key players in the India styrene market?A: Key companies include INEOS Styrolution India Limited, Bhansali Engineering Polymers Limited, LG Chem, SABIC, Lotte Chemical Corporation, Kumho Petrochemical Co., Ltd., Toray Industries, Supreme Petrochem Ltd., Haldia Petrochemicals Limited, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?