India Styrene Acrylonitrile Market Size, Share, By Type (Emulsion, Continuous mass Polymerization, and Suspension), By Application (Food Container, Kitchenware, Electronics Covers, Plastic Optical Fiber, and Others), India Styrene Acrylonitrile Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Styrene Acrylonitrile Market Size Insights Forecasts to 2035

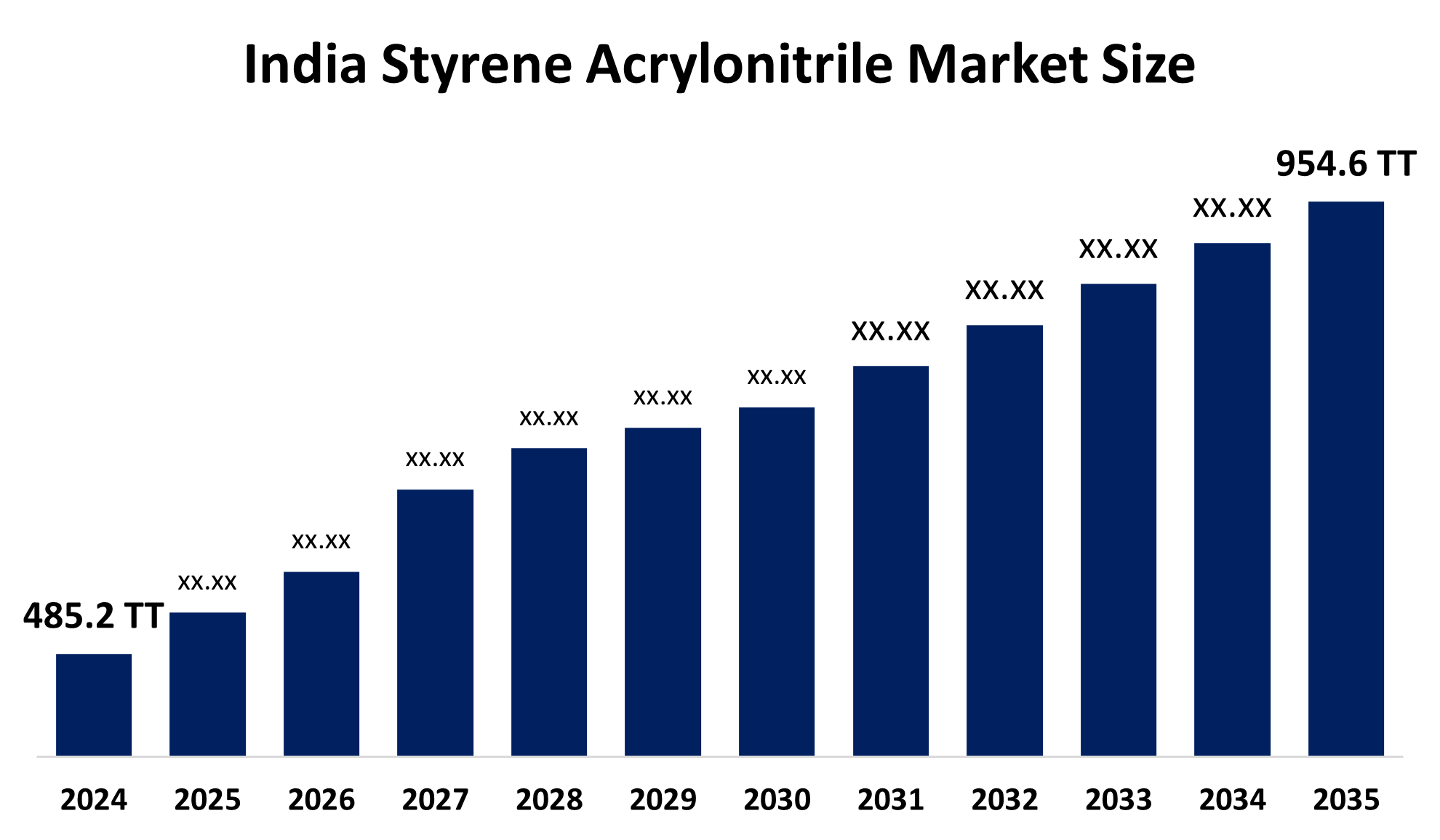

- India Styrene Acrylonitrile Market Size 2024: 485.2 Thousand Tonnes

- India Styrene Acrylonitrile Market Size 2035: 954.6 Thousand Tonnes

- India Styrene Acrylonitrile Market CAGR 2024: 6.35%

- India Styrene Acrylonitrile Market Segments: Type and Application

Get more details on this report -

The India Styrene Acrylonitrile Market Size refers to the production, distribution, and consumption of SAN resin, a rigid and transparent copolymer made from styrene and acrylonitrile. The automotive parts and electrical components, household appliances, packaging, kitchenware and cosmetic containers use SAN because it provides clarity, heat resistance and chemical stability.

The Department of Chemicals & Petrochemicals under the Ministry of Chemicals & Fertilizers is implementing a Plastic Park Scheme to support cluster-based downstream plastic processing infrastructure. The scheme provides grant funding which covers 50% of project costs up to RS 40 crores for both facility construction and common infrastructure development and service creation to enhance processing and production, and investment and export activities within plastics value chains that include SAN products.

The styrene acrylonitrile market in India will experience future growth because the automotive, appliance and packaging industries will increase demand, and the country will develop its own production capacity and choose to expand its facilities and create sustainable, high-performance, recyclable SAN materials.

Market Dynamics of the India Styrene Acrylonitrile Market:

The India Styrene Acrylonitrile Market Size is driven by the rising demand from automotive, electrical & electronics, household appliances, and packaging sectors. Increasing urbanization, growth in consumer goods manufacturing, and expanding middle-class consumption are boosting the need for durable, transparent, and heat-resistant engineering plastics like SAN across diverse industrial applications in India.

The India Styrene Acrylonitrile Market Size is restrained by volatility in raw material prices such as styrene and acrylonitrile, high import dependence, and competition from alternative polymers like ABS and polycarbonate, which may limit margin stability and market growth.

The future of India styrene acrylonitrile market is bright and promising, with increasing domestic production capacity, growing focus on sustainable and recyclable polymers, rising investments in petrochemicals, and strong downstream demand from automotive, electronics, and consumer goods industries.

India Styrene Acrylonitrile Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 485.2 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.35% |

| 2035 Value Projection: | 954.6 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Prakash Chemicals International Ltd (PCIPL), Supreme Plasticizers, Indiaglycols Pvt Ltd, Vikas Organo Chem, APEX Petrochemicals Limited, Nishant Enterprises Pvt Ltd, Aims Chemicals Pvt Ltd, Etho Polymers & Chem Pvt Ltd, Gleam Chemic and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The India styrene acrylonitrile market share is classified into type and application.

By Type:

The India Styrene Acrylonitrile Market is divided by type into emulsion, continuous mass polymerization, and suspension. Among these, the continuous mass polymerization segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to higher production efficiency, consistent product quality, lower operational costs, and suitability for large-scale SAN manufacturing, it is preferred by major producers in India.

By Application:

The India Styrene Acrylonitrile Market is divided by application into food containers, kitchenware, electronics covers, plastic optical fiber, and others. Among these, the kitchenware segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Kitchenware leads due to strong demand for transparent, heat-resistant, and durable materials used in food storage containers, utensils, and household products, driven by rising urban consumption.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Styrene Acrylonitrile Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Styrene Acrylonitrile Market:

- Prakash Chemicals International Ltd (PCIPL)

- Supreme Plasticizers

- Indiaglycols Pvt Ltd

- Vikas Organo Chem

- APEX Petrochemicals Limited

- Nishant Enterprises Pvt Ltd

- Aims Chemicals Pvt Ltd

- Etho Polymers & Chem Pvt Ltd

- Gleam Chemic

- Others

Key Target Audience

- Market Players

- Investors

- Applicationrs

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Styrene Acrylonitrile Market Size based on the below-mentioned segments:

India Styrene Acrylonitrile Market, By Type

- Emulsion

- Continuous mass Polymerization

- Suspension

India Styrene Acrylonitrile Market, By Application

- Food Container

- Kitchenware

- Electronics Covers

- Plastic Optical Fiber

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India styrene acrylonitrile market size?A: India styrene acrylonitrile market is expected to grow from 485.2 thousand tonnes in 2024 to 954.6 thousand tonnes by 2035, growing at a CAGR of 6.35% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising demand from automotive, electrical & electronics, household appliances, and packaging sectors. Increasing urbanization, growth in consumer goods manufacturing, and expanding middle-class consumption are boosting the need for durable, transparent, and heat-resistant engineering plastics like SAN across diverse industrial applications in India.

-

Q: What factors restrain the India styrene acrylonitrile market?A: Constraints include the volatility in raw material prices such as styrene and acrylonitrile, high import dependence, and competition from alternative polymers like ABS and polycarbonate, which may limit margin stability and market growth.

-

Q: Who are the key players in the India styrene acrylonitrile market?A: Key companies include Prakash Chemicals International Ltd (PCIPL), Supreme Plasticizers, Indiaglycols Pvt Ltd, Vikas Organo Chem, APEX Petrochemicals Limited, Nishant Enterprises Pvt Ltd, Aims Chemicals Pvt Ltd, Etho Polymers & Chem Pvt Ltd, Gleam Chemic, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, Applicationrs, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?