India Solar Panel Market Size, Share, and COVID-19 Impact Analysis, By Type (Monocrystalline Solar Panel, Polycrystalline, Thin-Film), By Technology (Photovoltaic, Concentrated Solar Power), By System (On-Grid, Off-Grid and Hybrid), and India Solar Panel Market Insights, Industry Trends, Forecasts to 2035

Industry: Energy & PowerIndia Solar Panel Market Insights forecasts to 2035

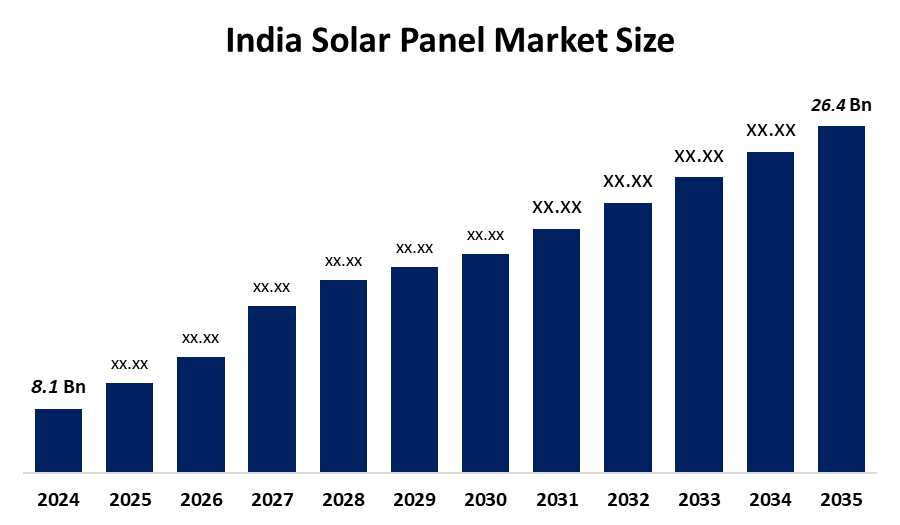

- The Indian Solar Panel Market Size Was Estimated at USD 8.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.5% from 2025 to 2035

- The Indian Solar Panel Market Size is Expected to Reach USD 26.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Indian Solar Panel Market Size is anticipated to reach USD 26.4 Billion by 2035, Growing at a CAGR of 11.5% from 2025 to 2035. The solar panel market in India is driven by the government’s aggressive policies on renewable energy and reducing dependence on fossil fuels for energy. Moreover, it intends to achieve 280 GW of solar power by 2030, which will eventually contribute to 500 GW of renewable energy. Furthermore, the electrification of remote areas and the fulfilment of growing demand for commercial and utility-scale projects, along with government support through subsidies.

Market Overview

The Indian solar panel market refers to the production, distribution, and utilisation of photovoltaic panels. The photovoltaic panels are also called solar panels. They are the primary technology, which are basically devices that produce electricity by harnessing sunlight, offering a clean and renewable energy source. A solar cell is the major component, and its structural form forms a solar panel. The main benefit of solar panels is that they provide an alternative source of electricity. They application are implemented across industries, consisting of residential, commercial, agricultural and transportation. Its residential applications include solar batteries or solar-powered fans and small pumps, ventilation fans and batteries charged up. Whereas commercial and industrial include powering generators, batteries, and vehicles. Such renewable energy reduces dependence on fossil fuels, helps in lowering environmental impact and energy cost.

The Indian government has made solar power its main priority for its transition to clean and renewable energy, and photovoltaic panels are the most important component for this. Moreover, has launched several subsidy schemes and policies for the promotion of solar energy, such as a solar panel scheme called as PM Surya Ghar Muft Bijli Yojna for providing a subsidy on the cost of solar panels up to 40%. In 2024, India's installed renewable energy capacity was 201.46 GW, of which around 90.76 GW came from solar plants. India increased its solar module production capacity by over 25.3 GW in 2024

Report Coverage

This research report categorises the market for the Indian solar panel market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Indian solar market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Indian solar panel market.

India Solar Panel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.1 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 11.5 % |

| 2035 Value Projection: | USD 26.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type |

| Companies covered:: | Tata Power Solar, Vikram Solar, Waaree Energies, Premier Energies, Navitas Solar, Rayzon Solar, Adani Solar, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Indian solar panel market is largely driven by the solar energy sector, which creates an immense demand for panels. Industries such as manufacturing, agriculture, data centres, IT parks, and commercial buildings require heavy electricity to operate, which increases costs as well as carbon footprint. So, to reduce this impact, they are installing different types of solar panel connections to generate electricity and fulfil the demand. Moreover, technological development, such as TOPCon technology in monocrystalline panels and bifacial solar panel modules, which generate electricity from both sides of the panel, thereby increasing overall power generation. Furthermore, a decline of 70% in solar panel module cost in the previous decade and low-cost raw material purchase from China have further driven the demand. India aims to achieve 280 GW of solar power by 2030, which will significantly contribute to the nation's overall goal of 500 GW of renewable energy. Moreover, strong demand from solar projects led to an increase in manufacturing capacity to 25.3GW, and now total national panel capacity accounts for 90.9 GW by 2024.

Restraining Factors

Although there has been 80% solar photovoltaics in the last decade, efficiency improvement still lags to be competitive in the market, and the manufacturing of excellent efficiency panels is expensive because of high-quality and costly raw material which need to be reduced to get affordable solar energy. A complex supply chain leads to delays in the production and distribution of components and products. China holds 75-95% of the PV supply chain, and India purchases about 60% of solar components from it.

Market Segmentation

The India solar panel market is classified by type, technology, and system.

- The monocrystalline solar panel has the largest market share in India by 59% and is expected to grow at a significant CAGR during the forecast period.

The monocrystalline, polycrystalline, and thin-film are the types of solar panels. Among these, the monocrystalline panel dominates the market and offers the highest efficiency (18-22%). It's built from a single crystal of silicon and used on rooftops, utility-scale projects, and solar farms. A recent advancement in this type is TOPCon technology, which is gaining popularity due to its higher efficiency capacity. Polycrystalline solar panel offers moderate efficiency (15-17%) and are less costly. The least costly and efficient are thin-slim solar panels, produced from the application of thin layers of photovoltaic materials to glass, plastic or metals.

- The photovoltaic segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The classification of India's solar panel market based on technology includes photovoltaics and concentrated solar power. The segmental growth can be attributed to its easy adoption, lower cost and excellent efficiency. This is mostly used on rooftops and industrial projects. The concentrated solar power holds a very small market, mostly due to its high cost, larger required area and operational complexity.

- The on-grid system has the highest market share in 2024, and the off-grid system showed a significant growth of 197% compared to 2023

The systems of solar panels are categorised into on-grid, off-grid and hybrid. Among these, the on-grid solar system accounted for the largest market share in 2024, mainly due to being the least expensive and widely preferred in urban and semi-urban areas. It is basically connected to the grid and produces its own electricity, and any surplus is sent back to the grid. whereas an off-grid system has its own excess electricity storage battery and is not linked to the grid. In 2024, off-grid added 1.48 GW, a 197% rise from the year before. This shows the growing demand for distributed solar systems, especially in isolated and disadvantaged areas.

Competitive Analysis

The report provides an appropriate analysis of the key organisations/companies involved in the Indian solar panel market, along with a comparative evaluation based on their product offerings, business overviews, geographical presence, entry strategies, market segment share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current new and growth of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

- Tata Power Solar

- Vikram Solar

- Waaree Energies

- Premier Energies

- Navitas Solar

- Rayzon Solar

- Adani Solar

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

Recent developments

- In October 2024, at REI Expo 2024, Rayzon Solar introduced the TOPCon-210R panel with enhanced efficiency up to 23% and can be utilised at both residential and commercial.

- In April 2024, the introduction of N-type module series by Vikram Solar Limited with132 half-cut rectangular cells, offering up to 630 Wp and 23,32% efficiency. It provides excellent adoption capability for commercial and utility-scale projects.

- In February 2024, at Intersolar India, Navitas Solar launched the next-generation N-type TOPCon module, that give excellent performance in low light.

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Indian solar panel market based on the below mentioned segments.

India Solar Panel Market, By Type

- Monocrystalline Solar Panel

- Polycrystalline Solar Panel

- Thin-Film Solar Panels

India Solar Panel Market, By Technology

- Photovoltaic

- Concentrated Solar Power

India Solar Panel Market, By System

- On-Grid System

- Off-Grid System

- Hybrid System

Frequently Asked Questions (FAQ)

-

What is the Indian solar panel market size?The Indian solar panel market size was estimated at USD 8.1 billion in 2024 and is expected to reach USD 26.4 billion by 2035, at a CAGR of 11.5%.

-

Which is the major selling technology of the solar panel market?The TOPCon technology is the major technology in the market.

-

What are the factors driving the solar panel market in India?The solar panel market in India is driven by consumers' urge to be free from rising electricity bills, net metering policies and energy independence. Moreover, the electrification of remote areas and the fulfilment of growing demand for commercial and utility-scale projects, along with government support through subsidies

-

Which are the major solar panel companies in India?Tata Power Solar, Vikram Solar, Waaree Energies, Premier Energies, Navitas Solar, Rayzon Solar Adani Solar are the major solar panel companies in India

Need help to buy this report?