India Software Market Size, Share, and COVID-19 Impact Analysis, By Type (Application Software, System Infrastructure Software, Development and Deployment Software, Productivity Software, Others), By Industry Vertical (IT and Telecom, BFSI, Retail, Government/Public Sector, Energy and Utilities, Healthcare, and Others), and India Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyIndia Software Market Insights Forecasts to 2035

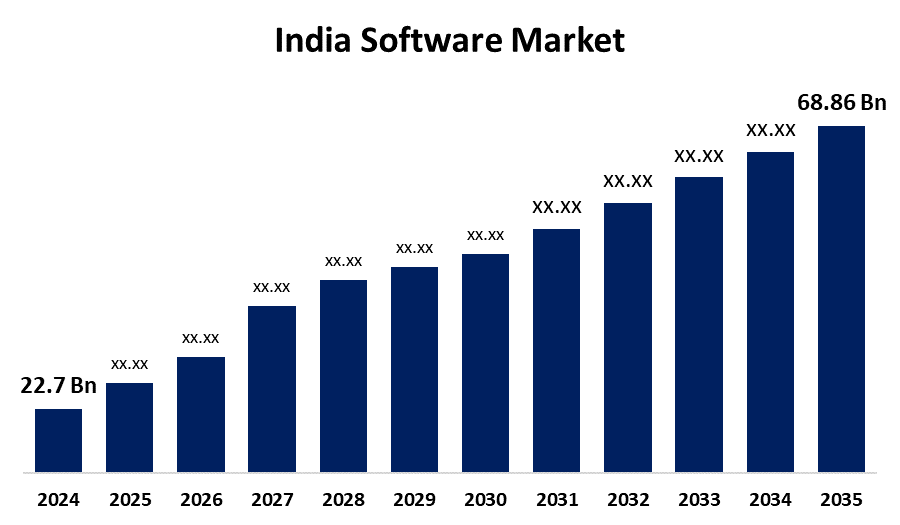

- The India Software Market Size Was Estimated at USD 22.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.1% from 2025 to 2035

- The India Software Market Size is Expected to Reach USD 68.86 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India software market size is anticipated to reach USD 68.86 billion by 2035, growing at a CAGR of 10.1% from 2025 to 2035. India's software market is growing, driven by technological transformation across industries, increasing adoption of cloud services, and the rise of new startups. It has also received a boost from government initiatives such as "Digital India," with more citizens going online, using smartphones, and with a strong demand for artificial intelligence and cybersecurity services. India is also a major outsourcing hub for IT services globally.

Market Overview

The India software market represents one of the fastest-growing segments of the country’s digital economy, which experiences growth due to fast technological progress and higher digital technology usage across various sectors. The system encompasses all processes that involve creating, launching, and sustaining enterprise software solutions and cloud services and mobile software and security systems and artificial intelligence software and data analysis instruments.

The solutions enable organizations to boost operational efficiency while handling business processes and delivering better customer service across multiple industries, which include banking and healthcare and retail and manufacturing and education and government services. The software industry depends on three essential components, which include skilled IT professionals and programming languages and development frameworks and cloud infrastructure and data centers and servers and machine learning systems and automation technologies. Strong internet connectivity and digital infrastructure further support growth.

The software applications function as essential tools that businesses utilize for enterprise resource planning and customer relationship management and digital payment processing and e-commerce activities and workflow automation and real-time data analysis. Businesses increasingly rely on these tools to reduce costs and gain competitive advantages. The current growth trend receives its drive from organizations adopting cloud technology together with rising needs for SaaS products, the growing startup ecosystem, and high awareness about cybersecurity. The market presents new opportunities that focus on AI solutions and tech developments and digital transformation for MSMEs and international outsourcing. The government programs, which include Digital India and Startup India, and open foreign direct investment regulations have established India as a software development canter for global business operations.

Report Coverage

This research report categorizes the market for the India software market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India software market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India software market.

India Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 22.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.1% |

| 2035 Value Projection: | USD 68.86 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Type, By Industry Vertical |

| Companies covered:: | Tata Consultancy Services (TCS), Infosys, HCLTech, Wipro, Tech Mahindra, LTIMindtree, Persistent Systems, Coforge, Mphasis, Zoho Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India software market is fueled by the industries undergo digital transformation and internet and smartphone usage increases and businesses require cloud-based solutions. Businesses modernize themselves through the increased use of artificial intelligence together with data analytics and cybersecurity solutions. The demand for Software as a Service platforms increases because startups and micro-small and medium enterprises adopt digital technologies. India serves as a worldwide outsourcing destination because its strong IT workforce and lower operational costs make it attractive to international clients. The combined effect of government support and growing enterprise spending on automation technologies creates a positive impact on market expansion.

Restraining Factors

The India Software market in India mostly constrained by the high price sensitivity and the market faces cybersecurity threats and data privacy issues and there is a lack of advanced technology experts who possess essential skills. The startup and small IT business sector faces multiple growth obstacles because of high infrastructure expenses and their need to import hardware components and because of fierce market competition and their need to meet regulatory standards.

Market Segmentation

The India software market share is classified into type and industry vertical.

- The application software segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India software market is segmented by type into application software, system infrastructure software, development and deployment software, productivity software, and others. Among these, the monitoring segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. These application software segment experienced strong growth because enterprises increased their digitalization efforts and more businesses adopted ERP and CRM systems and fintech and e-commerce platforms expanded rapidly and demand for cloud-based SaaS solutions grew and companies across all industries concentrated on automation and productivity improvement and customer experience enhancement.

- The IT and telecom segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The India software market is segmented by industry vertical into it and telecom, BFSI, retail, government/public sector, energy and utilities, healthcare, and others. Among these, the it and telecom and is anticipated to grow at a remarkable CAGR during the forecast period. The high incidence experience rapid growth because of rising investments in 5G networks and cloud computing and data centers and cybersecurity solutions. The software market expands because of increasing demand for digital communication services and OTT platforms and IoT integration and enterprise digital transformation. The long-term growth prospects of the industry benefit from expanding internet access and ongoing technological improvements by telecom operators.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Software market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tata Consultancy Services (TCS)

- Infosys

- HCLTech

- Wipro

- Tech Mahindra

- LTIMindtree

- Persistent Systems

- Coforge

- Mphasis

- Zoho Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India software market based on the below-mentioned segments:

India Software Market, By Type

- Application Software

- System Infrastructure Software

- Development Software

- Productivity Software

- Others

India Software Market, By Industry Vertical

- IT and Telecom

- BFSI

- Retail

- Government and Public Sector

- Energy and Utilities

- Healthcare

- Others

Frequently Asked Questions (FAQ)

-

What is the India software market size?India software market size is expected to grow from USD 22.7billion in 2024 to USD 68.86billion by 2035, growing at a CAGR of 10.1% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?The market growth is driven by rapid digitalization, cloud adoption, rising AI integration, expanding startups, and increasing demand for cybersecurity and data analytics solutions.

-

What factors restrain the India software market?Constraints include the high implementation costs, cybersecurity risks, skilled workforce shortages, intense competition, and limited digital infrastructure in rural areas restrict market growth.

-

How is the market segmented by product?The market is segmented into application software, system infrastructure software, development and deployment software, productivity software, and other specialized solutions.

-

Who are the key players in the India software market?The Key players include Tata Consultancy Services, Infosys, HCLTech, Wipro, Tech Mahindra, LTIMindtree, Persistent Systems, Coforge, Mphasis, and Zoho Corporation, and others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?