India Sodium Lauryl Ether Sulphate Market Size, Share, By Type (Palm Oil, Coconut Oil, And Others), By End Use (Cosmetics, Textiles, Cleaners & Detergents, Pharmaceuticals, And Others), And India Sodium Lauryl Ether Sulphate Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Sodium Lauryl Ether Sulphate Market Insights Forecasts to 2035

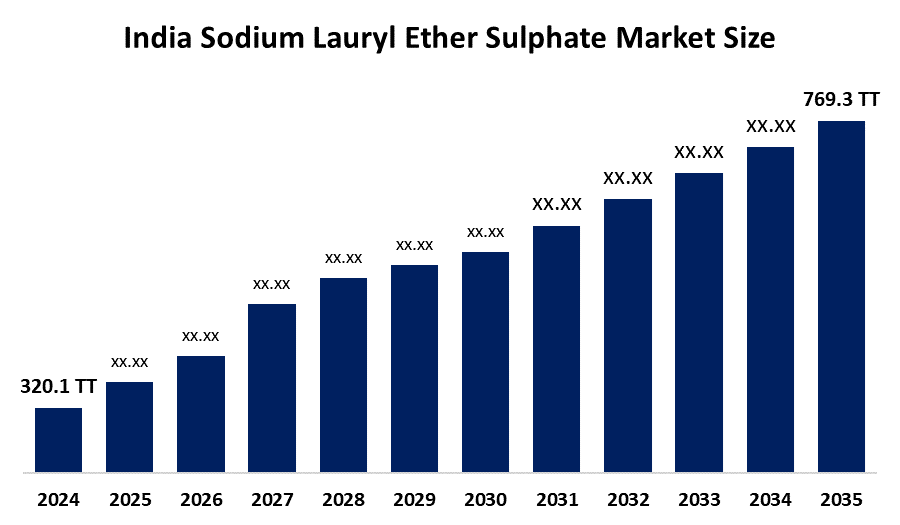

- India Sodium Lauryl Ether Sulphate Market Size 2024: 320.1 Thousand Tonnes

- India Sodium Lauryl Ether Sulphate Market Size 2035: 769.3 Thousand Tonnes

- India Sodium Lauryl Ether Sulphate Market CAGR 2024: 8.3%

- India Sodium Lauryl Ether Sulphate Market Segments: Type and End Use

Get more details on this report -

The India Sodium Lauryl Ether Sulphate (SLES) Market Size encompasses a sector that produces surfactant found in personal care and household cleaning products across the country as well as a growing component of many other chemical sectors SLES is produced in India via both local manufacturers and through foreign imports. Manufacturers throughout India will have access to a large variety of different surfactant products. In terms of major economies, India ranks 6th largest chemical producer globally and generates substantial economic activity for SLES

The sodium lauryl ether sulfate in India is backed by government support, including the Chemical Promotion and Development Scheme (CPDS) implemented by India’s Department of Chemicals and Petrochemicals. India’s chemicals sector, which encompasses surfactants like SLES, contributes around 1.4% to the nation’s GDP and about 9% of gross value added, and India ranks as the sixth-largest chemical producer in the world. This scale underscores the strategic importance of chemicals in the national economy, with considerable domestic consumption and export potential that help drive markets for key intermediates like SLES.

As technology advances, Indian sodium lauryl ether sulfate providers are now using manufacturing process of ethoxylation and sulfation to create pure products, better controlled concentrations, and higher manufacturing efficiencies with less impact on the environment. In addition, digitally controlled processes are being used by manufacturers and they are sourcing feedstocks sustainably, including responsible certification for palm oil derivatives, to comply with tightening environmental regulations and sustainability expectations in India.

India Sodium Lauryl Ether Sulphate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 320.1 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.3% |

| 2035 Value Projection: | 769.3 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type ,By End Use |

| Companies covered:: | Galaxy Surfactants Limited, Godrej Industries Limited, BASF India, Prakash Chemicals International Pvt Ltd., Sai Sulphonate, Suvidhi Industries, Alpha Chemicals Private Limited, Novochem Engineering India LLP, Vinamax Organics Pvt Ltd., Dadia Chemical Industries, Swadesh India Chemicals Pvt Ltd., Kao Corporation, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Sodium Lauryl Ether Sulphate Market:

The India Sodium Lauryl Ether Sulphate Market Size is driven by the rising disposable incomes, rapid urbanization, increased awareness of hygiene and personal care, demand for shampoos, liquid soaps, and household cleaning products, growth in e-commerce distribution channels, expanding industrial applications, increasing need for effective surfactants across both consumer and institutional segments, and shift toward eco-friendly formulations further propel the market growth.

The India Sodium Lauryl Ether Sulphate Market Size is restrained by the fluctuating raw material costs, volatility in production costs, increasing pricing pressure, growing regulatory and consumer pressure, quality control and counterfeit products challenges, and supply chain volatility issues.

The future of India Sodium Lauryl Ether Sulphate Market Size is bright and promising, with versatile opportunities emerging from the changing demographics, increasing awareness of hygiene, and a trend toward premiumizing personal care products. There is also an increase in regulatory focus on developing eco-friendly and biodegradable formulas, which may lead to new opportunities for innovation in producing Specialty SLES variants. Additionally, there has been strong growth in related industries which further expands the customer base for these products within the country and globally.

Market Segmentation

The India Sodium Lauryl Ether Sulphate Market share is classified into type and end use.

By Type:

The India Sodium Lauryl Ether Sulphate Market Size is divided by type into palm oil, coconut oil, and others. Among these, the palm oil segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High affordability, superior foaming properties, extensive use as a renewable and plant based feedstock for manufacturing, and strong regional supply chains all contribute to the palm oil segment's largest share and higher spending on sodium lauryl ether sulfate when compared to other type.

By End Use:

The India Sodium Lauryl Ether Sulphate Market Size is divided by end use into cosmetics, textiles, cleaners & detergents, pharmaceuticals, and others. Among these, the cleaners & detergents segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The cleaners & detergents segment dominates because of high demand from the home and industrial cleaning industry, offering superior foaming, emulsifying, and dirt removal properties, and well established manufacturing sector for SLES in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Sodium Lauryl Ether Sulphate Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Sodium Lauryl Ether Sulphate Market:

- Galaxy Surfactants Limited

- Godrej Industries Limited

- BASF India

- Prakash Chemicals International Pvt Ltd.

- Sai Sulphonate

- Suvidhi Industries

- Alpha Chemicals Private Limited

- Novochem Engineering India LLP

- Vinamax Organics Pvt Ltd.

- Dadia Chemical Industries

- Swadesh India Chemicals Pvt Ltd.

- Kao Corporation

- Others

Recent Developments in India Sodium Lauryl Ether Sulphate Market:

In June 2025, Galaxy Surfactants reported to grow its specialty care volume by 14% and performance surfactants volume which included SLES by 6% till 2026.

In November 2024, HUL signed a MoU with the Ministry of Housing and Urban Affairs to launch a Centre of Excellence to improve public hygiene and sanitation, which involved the use of high performance cleaning surfactants.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Sodium Lauryl Ether Sulphate Market Size based on the below-mentioned segments:

India Sodium Lauryl Ether Sulphate Market, By Type

- Palm Oil

- Coconut Oil

- Others

India Sodium Lauryl Ether Sulphate Market, By End Use

- Cosmetics

- Textiles

- Cleaners & Detergents

- Pharmaceuticals

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India sodium lauryl ether sulfate market size?A: India sodium lauryl ether sulfate market is expected to grow from 320.1 thousand tonnes in 2024 to 769.3 thousand tonnes by 2035, growing at a CAGR of 8.3% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising disposable incomes, rapid urbanization, increased awareness of hygiene and personal care, demand for shampoos, liquid soaps, and household cleaning products, growth in e-commerce distribution channels, expanding industrial applications, increasing need for effective surfactants across both consumer and institutional segments, and shift toward eco-friendly formulations further propel the market growth.

-

Q: What factors restrain the India sodium lauryl ether sulfate market?A: Constraints include the fluctuating raw material costs, volatility in production costs, increasing pricing pressure, growing regulatory and consumer pressure, quality control and counterfeit products challenges, and supply chain volatility issues.

-

Q: How is the market segmented by type?A: The market is segmented into palm oil, coconut oil, and others.

-

Q: Who are the key players in the India sodium lauryl ether sulfate market?A: Key companies include Galaxy Surfactants Limited, Godrej Industries Limited, BASF India, Prakash Chemicals International Pvt Ltd., Sai Sulphonate, Suvidhi Industries, Alpha Chemicals Private Limited, Novochem Engineering India LLP, Vinamax Organics Pvt Ltd., Dadia Chemical Industries, Swadesh India Chemicals Pvt Ltd., Kao Corporation, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?