India Reverse Osmosis Membrane Market Size, Share, By Type (Thin-Film Composite Membranes And Cellulose-Based Membranes), By Application (Industrial Water Treatment, Desalination, Residential Water Purification, And Others), And India Reverse Osmosis Membrane Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Reverse Osmosis Membrane Market Insights Forecasts to 2035

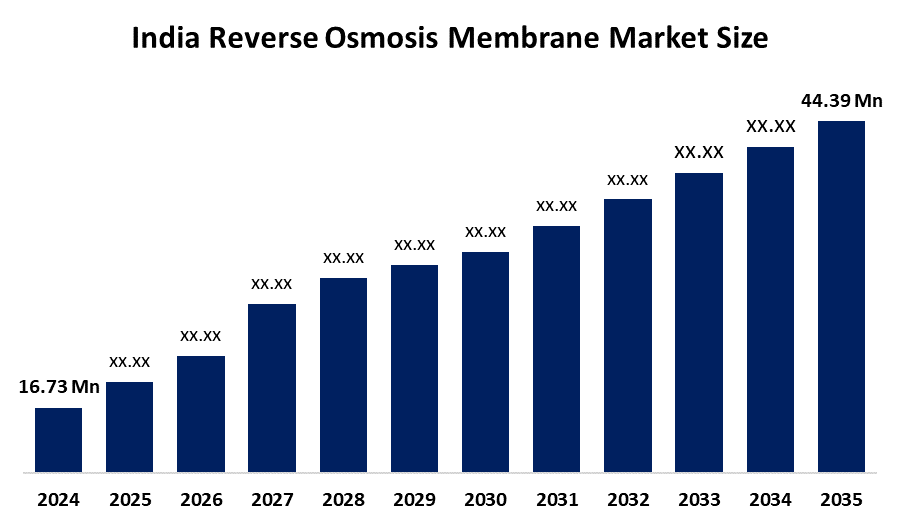

- India Reverse Osmosis Membrane Market Size 2024: 16.73 Million Units

- India Reverse Osmosis Membrane Market Size 2035: 44.39 Million Units

- India Reverse Osmosis Membrane Market CAGR 2024: 9.28%

- India Reverse Osmosis Membrane Market Segments: Type and Application

Get more details on this report -

The India Reverse Osmosis Membrane Market Size includes both manufacturing, distribution, and consumption as well as other types of membrane technology that remove dissolved salts, contaminants, and impurities from water through the use of pressure driven filtration methods to produce water that is ready to use for drinking, industrial and municipal purposes. RO membranes form an integral part of the water purification system, industrial waste water treatment, desalination, and home water purifiers, and they provide a very high removal efficiency of dissolved solids while also allowing for the reuse and recycling of water to prevent water scarcity.

The India Reverse Osmosis Membrane Market Size are backed by government support, including the Water Technology Initiative (WTI), launched in August 2007 under the Department of Science & Technology to promote research and development aimed at providing safe drinking water at affordable cost and adequate quantity. National programs like the Jal Jeevan Mission have significantly expanded access to tap water across rural households, with states like Uttar Pradesh certifying over 26,000 villages as having tap water in every home, indicating the scale of investment and infrastructure expansion that indirectly drives demand for advanced water treatment solutions including RO membranes.

As technology advances, India’s reverse osmosis membrane providers are now using advanced composite membrane materials to achieve better resistance against fouling and increased longevity, while improvements to the design of membranes result in lower operating costs and wider applications. In addition, by implementing digital monitoring systems, automation, and real-time analytics, maintenance scheduling can be improved along with reliability, providing operators with the ability to optimize system performance in various residential, industrial, and municipal installations. Ultimately, these technologies allow for the adaptation of RO systems for the purposes of wastewater reclamation and decentralized water alternatives, thereby creating greater resource efficiencies in India.

India Reverse Osmosis Membrane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 16.73 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 9.28% |

| 2035 Value Projection: | 44.39 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type ,By Application |

| Companies covered:: | DuPont Water Solutions, Toray Industries, LG Chem, Hydranautics, Vontron Technology, CSM Membranes, Permionics Membranes Private Limited, Pentair X-Flow, Ion Exchange India Ltd., Kaveri, Aquatech, SUEZ Water Technologies, Applied Membranes, Inc., Axeon Water Technologies, Shiva Global Environmental Pvt. Ltd., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Reverse Osmosis Membrane Market:

The India Reverse Osmosis Membrane Market Size is driven by the increasing water scarcity and deteriorating groundwater quality, demand for reliable water purification solutions, rapid urbanization and industrial expansion, demand for treated water for processes and sanitation, rising health and environmental awareness among consumers and policymakers, continued expansion of municipal water infrastructure, and regulatory frameworks aimed at improving water quality further stimulate adoption of RO systems across sectors.

The India Reverse Osmosis Membrane Market Size is restrained by the high initial investment and operational costs, periodic replacement of membrane elements, technical challenges in some regions, complicate system performance and lifespan, and cost reduction without proper pretreatment and maintenance strategies.

The future of India Reverse Osmosis Membrane Market Size is bright and promising, with versatile opportunities emerging from the continually growing, creating a higher demand for water has led to new opportunities for creating large-scale water treatment and desalting facilities. Moreover, the increased need for treated wastewater is part of a sustainable approach to managing our water resources. New technologies that provide the opportunity for differentiation in the market and greater penetration into the market include energy-efficient membranes, hybrid filtration systems, and intelligent monitoring devices. In addition, ongoing government investment in water infrastructure will also enhance water security and improve public health outcomes.

Market Segmentation

The India Reverse Osmosis Membrane Market share is classified into type and application.

By Type:

The India Reverse Osmosis Membrane Market Size is divided by type into thin-film composite membranes and cellulose-based membranes. Among these, the thin-film composite membranes segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Superior performance, high durability in saline water conditions, cost-effectiveness, and energy efficient in both industrial and residential applications all contribute to the thin-film composite membranes segment's largest share and higher spending on reverse osmosis membrane when compared to other type.

By Application:

The India Reverse Osmosis Membrane Market Size is divided by application into industrial water treatment, desalination, residential water purification, and others. Among these, the industrial water treatment segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The industrial water treatment segment dominates because of strict environmental regulations on wastewater discharge, high demand for high-purity water in manufacturing, and the necessity for industrial water recycling amid acute water scarcity in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Reverse Osmosis Membrane Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Reverse Osmosis Membrane Market:

- DuPont Water Solutions

- Toray Industries

- LG Chem

- Hydranautics

- Vontron Technology

- CSM Membranes

- Permionics Membranes Private Limited

- Pentair X-Flow

- Ion Exchange India Ltd.

- Kaveri

- Aquatech

- SUEZ Water Technologies

- Applied Membranes, Inc.

- Axeon Water Technologies

- Shiva Global Environmental Pvt. Ltd.

- Others

Recent Developments in India Reverse Osmosis Membrane Market:

In January 2026, V-Guard updated its Rejive RO water purifier series to deliver 40% water savings, specifically addressing high TDS conditions in India.

In December 2025, Livpure launched a new range of residential water purifiers equipped with 2X Power Filters that last upto 2 years, capable of handling TDS levels upto 1500 ppm.

In November 2025, Toyobo MC, a global player, made its official debut in India by introducing its high-performance Spiral Wound RO Membranes in partnership with BI Marketing and Services Pvt. Ltd. This aimed to address rising industrial water needs, including recycling and zero liquid discharge systems.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India Reverse Osmosis Membrane Market Size based on the below-mentioned segments:

ndia Reverse Osmosis Membrane Market, By Type

- Thin-Film Composite Membranes

- Cellulose-Based Membranes

India Reverse Osmosis Membrane Market, By Application

- Industrial Water Treatment

- Desalination

- Residential Water Purification

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India reverse osmosis membrane market size?A: India reverse osmosis membrane market is expected to grow from 16.73 million units in 2024 to 44.39 million units by 2035, growing at a CAGR of 9.28% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing water scarcity and deteriorating groundwater quality, demand for reliable water purification solutions, rapid urbanization and industrial expansion, demand for treated water for processes and sanitation, rising health and environmental awareness among consumers and policymakers, continued expansion of municipal water infrastructure, and regulatory frameworks aimed at improving water quality further stimulate adoption of RO systems across sectors.

-

Q: What factors restrain the India reverse osmosis membrane market?A: Constraints include the high initial investment and operational costs, periodic replacement of membrane elements, technical challenges in some regions, complicate system performance and lifespan, and cost reduction without proper pretreatment and maintenance strategies.

-

Q: How is the market segmented by type?A: The market is segmented into thin-film composite membranes and cellulose-based membranes.

-

Q: Who are the key players in the India reverse osmosis membrane market?A: Key companies include DuPont Water Solutions, Toray Industries, LG Chem, Hydranautics, Vontron Technology, CSM Membranes, Permionics Membranes Private Limited, Pentair X-Flow, Ion Exchange India Ltd., Kaveri, Aquatech, SUEZ Water Technologies, Applied Membranes, Inc., Axeon Water Technologies, Shiva Global Environmental Pvt. Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?