India Returnable Transport Packaging Market Size, Share, By Material (Plastic, Metal, Wood), By Product Type (Pallets, Crates and Trays, Intermediate Bulk Containers, and More), By End-User Industry (Automotive, Food and Beverage, Consumer Goods and Retail, and More), By Circulation Mode (Closed-Loop, Open/Pooling), By Ownership Model (Rental/Leasing, In-House Ownership), India Returnable Transport Packaging Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsIndia Returnable Transport Packaging Market Insights Forecasts to 2035

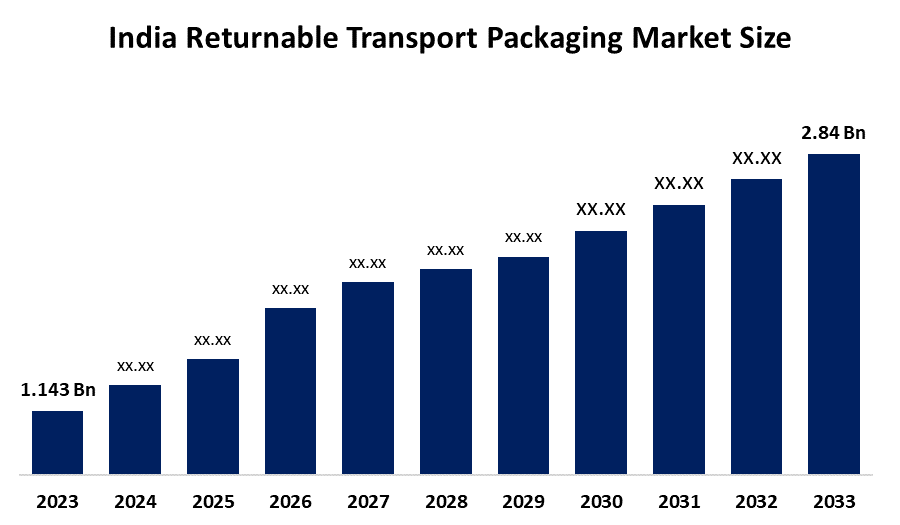

- India Returnable Transport Packaging Market Size 2024: USD 1.143 Bn

- India Returnable Transport Packaging Market Size 2035: USD 2.84 Bn

- India Returnable Transport Packaging Market CAGR 2024: 8.6%

- India Returnable Transport Packaging Market Segments: Material, Product Type, End-User Industry, Circulation Mode, Ownership Model

Get more details on this report -

The India returnable transport packaging (RTP) market includes reusable pallets, crates, trays, and intermediate bulk containers that are designed for repeated usage in industrial and commercial supply chains, thus helping in waste reduction, cutting logistics costs, and supporting circular economy goals. RTP solutions are extensively used in automotive, food and beverage, consumer goods, and ecommerce distribution sectors, which enable efficient reverse logistics and standardized material handling.

Market expansion is mainly attributed to the rapid growth of automotive manufacturing, organized retail, and ecommerce, which in turn require scalable, reusable packaging solutions. Innovations such as RFID, IoT tracking, and digital asset management are effective in circulation, saving from asset loss, and making the system more efficient. Government steps like the National Logistics Policy, Multi, Modal Logistics Parks and Plastic Waste Management Rules 2024 are establishing a good climate for the RTP to be accepted, while private investments like LEAP Indias CHEP acquisition and Infinite Loop PET plant development are going further in building the sustainable packaging sector.

There are several future opportunities such as the pharmaceutical sector and cold chain logistics, open, loop pooling models for SMEs, and the integration of digital tracking systems that will enhance operational efficiency and environmental compliance.

Market Dynamics of the India Returnable Transport Packaging Market:

India's returnable transport packaging (RTP) market is largely influenced by factors such as the stringent focus on sustainability, the expansion of the automobile, food and beverage, and consumer goods sectors, as well as the increased demand for economical packaging solutions that can be reused. Reducing packaging waste, making reverse logistics more efficient, and complying with circular economy regulations are some of the reasons why companies are implementing RTP systems. Besides that, there are a number of technological improvements such as RFID, IoT, enabled tracking, and digital asset management platforms that not only make circulation more efficient but also reduce asset loss and enhance operational performance.

The India RTP market is challenged by factors such as the requirement for a significant amount of money for the initial capital investment, the complicated reverse logistics infrastructure, and difficulties experienced by small enterprises in implementing large, scale reusable systems. The slow rate of adoption and increased total costs may result from operational challenges in the collection, cleaning, and redistribution of RTP assets, as well as possible asset losses in open, loop models.

India's RTP market has a bright future with the potential of open, loop pooling models, the growth of the pharmaceutical and cold chain sectors, the integration of digital tracking, and the corporate and government focus on environmentally friendly packaging practices. It is expected that advanced material innovations and the rental/leasing models will not only lead to the optimization of asset utilization, but also to the wider market adoption.

India Returnable Transport Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.143 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.6% |

| 2035 Value Projection: | USD 2.84 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Material, By Product Type |

| Companies covered:: | Nilkamal Limited,Supreme Industries Limited,Time Technoplast Limited,Schoeller Allibert India,CHEP India,IFCO Systems India,Loscam India, ORBIS India,Tosca India, Nefab India, And others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Returnable Transport Packaging Market share is classified into material, product type, end-user industry, circulation mode, and ownership model.

By Material:

The India returnable transport packaging market is divided by material into plastic, metal, and wood. Among these, the plastic segment dominated the market share in 2024 and is expected to grow at a notable CAGR during the forecast period. The dominance of plastic RTP is attributed to its lightweight nature, durability, resistance to corrosion, ease of cleaning, and suitability for high-frequency reuse across automotive, food, and retail supply chains compared to metal and wood alternatives.

By Product Type:

The India returnable transport packaging market is divided by product type into pallets, crates and trays, intermediate bulk containers, and others. Among these, the pallets segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. High compatibility with automated warehouses, standardized material handling systems, and large-scale industrial transportation requirements contribute to the strong adoption of pallets across Indian logistics networks.

By End-User Industry:

The India returnable transport packaging market is segmented by end-user industry into automotive, food and beverage, consumer goods and retail, and others. Among these, the automotive segment dominated the market share in 2024 and anticipated to grow at a significant CAGR during the forecast period. High-volume component movement, just-in-time manufacturing practices, and the need for robust and reusable packaging solutions across tiered supplier networks drive strong RTP adoption in the automotive sector.

By Circulation Mode:

The India returnable transport packaging market is divided by circulation mode into closed-loop and open/pooling systems. Among these, the closed-loop segment dominated the market share in 2024 and is expected to grow at a notable CAGR during the forecast period. The dominance of closed-loop systems is attributed to better control over asset movement, reduced loss rates, higher circulation efficiency, and improved asset utilization within manufacturer-owned and captive logistics networks compared to open and pooled systems.

By Ownership Model:

The India returnable transport packaging market is divided by ownership model into rental/leasing and in-house ownership. Among these, the rental and leasing segment dominated the market share in 2024 and is expected to grow at a notable CAGR during the forecast period. The dominance of rental and leasing models is attributed to reduced upfront capital investment, asset-light operational preference, higher flexibility, and efficient management of packaging assets across large-scale and geographically dispersed supply chains compared to in-house ownership.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India returnable transport packaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies India returnable transport packaging market:

- LEAP India

- Nilkamal Limited

- Supreme Industries Limited

- Time Technoplast Limited

- Schoeller Allibert India

- CHEP India

- IFCO Systems India

- Loscam India

- ORBIS India

- Tosca India

- Nefab India

- Signode India

- Mahindra Logistics (BoxNow)

- Montara Logistics

Recent Developments in Japan Clinical Trials Support Services Market:

October 2024, TOPPAN Inc. introduced a recyclable polypropylene, based reusable packaging film primarily for logistics and industrial transport use. The product is designed for use in closed, loop supply chains, allows compliance with the Plastic Resource Circulation Act of Japan, and thus helps manufacturers to lower the use of single, use packaging and raise the level of material circularity in the domestic distribution networks.

June 2024, CHEP Japan has diversified its pallet pooling services for the supply chains of the automotive and FMCG sectors through the launching of the digital asset tracking for reusable pallets. Thus, the broadening of the service turns the pallet pool into a more efficient unit of distribution, lessens the disappearance of pallets, and adjusts Japanese manufacturers eco, friendly transition needs towards a system of standard and returnable logistics packaging.

March 2024, The Ministry of the Environment, Japan has enhanced the implementation guidance under the Plastic Resource Circulation Act, which in turn facilitates the use of a reusable and returnable transport packaging system in the logistics and manufacturing sectors. This policy talent is speeding up the requirement for RTP solutions by diminishing the waste generated, enacting the reuse mandate, and implementing circular supply chain practices, mainly in the industries.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India returnable transport packaging market based on the below-mentioned segments:

India Returnable Transport Packaging Market, By Material

- Plastic

- Metal

- Wood

India Returnable Transport Packaging Market, By Product Type

- Pallets

- Crates and Trays

- Intermediate Bulk Containers

- Others

India Returnable Transport Packaging Market, By End-User Industry

- Automotive

- Food and Beverage

- Consumer Goods and Retail

- Others

India Returnable Transport Packaging Market, By Circulation Mode

- Closed-Loop

- Open/Pooling

India Returnable Transport Packaging Market, By Ownership Model

- Rental/Leasing

- In-House Ownership

Frequently Asked Questions (FAQ)

-

Q: What is the India returnable transport packaging market size?A: The India returnable transport packaging market is expected to grow from USD 1.143 billion in 2024 to USD 2.84 billion by 2035, registering a CAGR of 8.6% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the India returnable transport packaging market?A: Market growth is driven by rising sustainability focus, rapid expansion of automotive, food and beverage, consumer goods, and ecommerce sectors, increasing demand for cost-efficient reusable packaging, advancements in RFID and IoT tracking, and supportive government initiatives such as the National Logistics Policy and Plastic Waste Management Rules.

-

Q: What factors restrain the India returnable transport packaging market?A: Key restraints include high initial capital investment, complex reverse logistics requirements, operational challenges in asset collection and redistribution, asset loss risks in open-loop systems, and limited adoption among small and medium enterprises.

-

Q: How is the India returnable transport packaging market segmented?A: The market is segmented by material (plastic, metal, wood), product type (pallets, crates and trays, intermediate bulk containers, others), end-user industry (automotive, food and beverage, consumer goods and retail, others), circulation mode (closed-loop, open/pooling), and ownership model (rental/leasing, in-house ownership).

-

Q: Who are the key players in the India returnable transport packaging market?A: Key companies include LEAP India, Nilkamal Limited, Supreme Industries Limited, Time Technoplast Limited, Schoeller Allibert India, CHEP India, IFCO Systems India, Loscam India, ORBIS India, Tosca India, Nefab India, Signode India, Mahindra Logistics (BoxNow), and Montara Logistics

Need help to buy this report?