India Pulp And Paper Chemical Market Size, Share, By Raw Material (Wood Based, Agro-Residue Based, And Recycled Fiber), By Distribution Channel (Direct Sales And Indirect Sales), And India Pulp And Paper Chemical Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Pulp And Paper Chemical Market Insights Forecasts to 2035

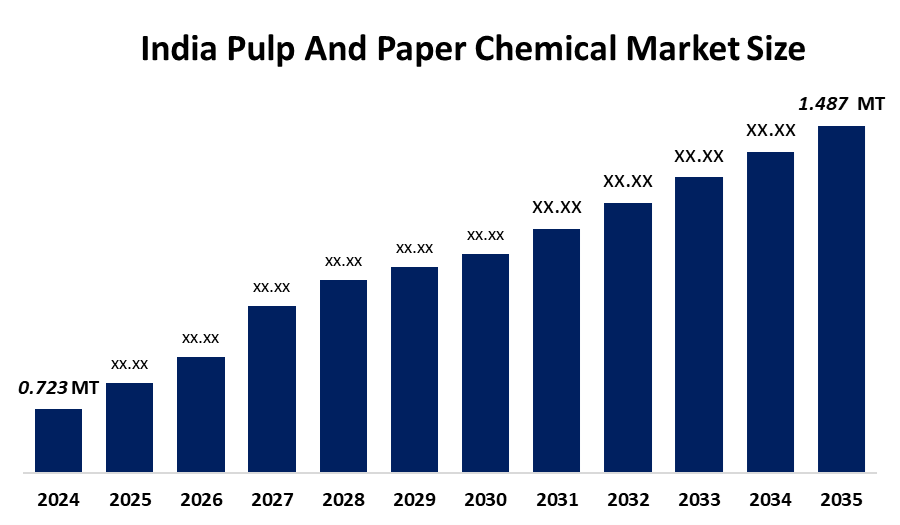

- India Pulp And Paper Chemical Market 2024: 0.723 Million Tonnes

- India Pulp And Paper Chemical Market Size 2035: 1.487 Million Tonnes

- India Pulp And Paper Chemical Market CAGR 2024: 6.78%

- India Pulp And Paper Chemical Market Segments: Raw Material and Distribution Channel

Get more details on this report -

The India pulp and paper chemical market encompasses the sector used to create and process pulp and paper products. These chemical products includes pulping agents, bleaching agents, sizing agents, retention aids, coatings and specialty additives, all of which enhance the finished product with respect to strength, brightness, printability and resistance to water. In addition to an increase in the demand for packaging materials in India, there is also an increase in the supply of chemicals used in the pulp & paper industry, as many of the manufacturers of these chemicals are changing their processes to offer more advanced and environmentally friendly product solutions.

The pulp and paper chemical in India are backed by government support, including the National Pulp and Paper Technology Mission and broader environmental and green chemistry agendas. Government actions such as promoting wastewater treatment infrastructure and green chemical adoption highlighted by approvals for substantial sewage treatment capacity expansion encourage pulp and paper manufacturers to improve effluent management and shift toward eco-friendly chemical solutions.

As technology advances, India’s pulp and paper chemical providers are now using green chemical technologies and digital manufacturing operations. Companies are creating enzyme-based applications, coatings that include nanoparticles, and biobased additives to mitigate their impact on the environment and improve the quality of paper materials. Manufacturers have also received significant benefits due to the implementation of automation, data analysis, and real-time monitoring systems by increasing process efficiencies, decreasing waste and ensuring uniform product quality. With advancements in technology, manufacturers are able to meet stricter environmental and performance criteria.

Market Dynamics of the India Pulp And Paper Chemical Market:

The India pulp and paper chemical market is driven by the rapid expansion of the paper and packaging sectors, growth in e-commerce for corrugated and specialty packaging materials, rising consumer awareness of sustainability, increased use of eco-friendly and recyclable paper products, government policies support for curbing plastic usage, and shift toward high-quality paper grades for printing, hygiene, and industrial applications.

The India pulp and paper chemical market is restrained by the volatility in raw material prices for chemical, stricter environmental regulations, push toward reduced paper consumption in some segments, and competition from alternative materials.

The future of India pulp and paper chemical market is bright and promising, with versatile opportunities emerging from the biodegradable chemicals and bio-based chemicals that support circular economic principles to create avenues for premium pricing and product differentiation. Other opportunities exist in servicing fast growing markets such as packaging and hygiene paper, where the growth in the use of specialty chemicals continues to rise and in the export potential of Indian pulp and paper producers through their entry into the global marketplace. Continued investment in R&D to develop greener and more efficient chemical technologies can create opportunities for sustained long-term growth of India's pulp and paper chemical market.

India Pulp And Paper Chemical Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 0.723 Million Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.78% |

| 2035 Value Projection: | 1.487 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Raw |

| Companies covered:: | BASF India, Kemira Chemicals India Pvt Ltd., Solenis, Clariant Chemicals, Buckman Laboratories India, Ecolab Inc., Arkema Chemicals India, Cargill India, Nouryon, Tata Chemicals Ltd., Sri Ram Starch Products, Ritu Dye Chem, Kabir Alkalies And Chemicals Pvt. Ltd., and Other key palyers |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Pulp And Paper Chemical Market share is classified into raw material and distribution channel.

By Raw Material:

The India pulp and paper chemical market is divided by raw material into wood based, agro residue based, and recycled fiber. Among these, the recycled fiber segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Cost effectiveness, environmental sustainability, need for improved quality, high demand in packaging, and the scarcity of virgin wood fiber in the country all contribute to the recycled fiber segment's largest share and higher spending on pulp and paper chemical when compared to other raw material.

By Distribution Channel:

The India pulp and paper chemical market is divided by distribution channel into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct sales segment dominates because it provides customization and technical services, large scale manufacturing, high volatility in raw material costs, strict environmental regulations, and high demand for advanced and specialized chemicals in India

.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India pulp and paper chemical market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Pulp And Paper Chemical Market:

- BASF India

- Kemira Chemicals India Pvt Ltd.

- Solenis

- Clariant Chemicals

- Buckman Laboratories India

- Ecolab Inc.

- Arkema Chemicals India

- Cargill India

- Nouryon

- Tata Chemicals Ltd.

- Sri Ram Starch Products

- Ritu Dye Chem

- Kabir Alkalies And Chemicals Pvt. Ltd.

- Others

Recent Developments in India Pulp And Paper Chemical Market:

In March 2025, Kemira announced capacity expansion in Thailand to produce 100,000 tons of paper chemicals annually by 2026, aimed at enhancing supply to India. In 2024, they introduced ISCC-certified renewable based wet strength resins.

In June 2024, Solenis and PhaBuilder partnered to develop PHA-based biodegradable paper packaging solutions to provide eco-friendly alternatives in the Indian market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035.Spherical Insights has segmented the India pulp and paper chemical market based on the below-mentioned segments:

ndia Pulp And Paper Chemical Market, By Raw Material

- Wood Based

- Agro Residue Based

- Recycled Fiber

India Pulp And Paper Chemical Market, By Distribution Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

What is the India pulp and paper chemical market size?India pulp and paper chemical market is expected to grow from 0.723 million tonnes in 2024 to 1.487 million tonnes by 2035, growing at a CAGR of 6.78% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rapid expansion of the paper and packaging sectors, growth in e-commerce for corrugated and specialty packaging materials, rising consumer awareness of sustainability, increased use of eco-friendly and recyclable paper products, government policies support for curbing plastic usage, and shift toward high-quality paper grades for printing, hygiene, and industrial applications.

-

What factors restrain the India pulp and paper chemical market?Constraints include the volatility in raw material prices for chemical, stricter environmental regulations, push toward reduced paper consumption in some segments, and competition from alternative materials.

-

How is the market segmented by raw material?The market is segmented into wood based, agro residue based, and recycled fiber.

-

Who are the key players in the India pulp and paper chemical market?Key companies include BASF India, Kemira Chemicals India Pvt Ltd., Solenis, Clariant Chemicals, Buckman Laboratories India, Ecolab Inc., Arkema Chemicals India, Cargill India, Nouryon, Tata Chemicals Ltd., Sri Ram Starch Products, Ritu Dye Chem, Kabir Alkalies And Chemicals Pvt. Ltd., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?