India Psoriasis Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drugs Class (Topical Treatments, Systematic Therapies, Biologics, and Oral Therapies), By Application (Psoriasis Vulgaris, Psoriatic Arthritis, Inverse Psoriasis, and Postular Psoriasis), and India Psoriasis Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareIndia Psoriasis Drugs Market Size Insights Forecasts to 2035

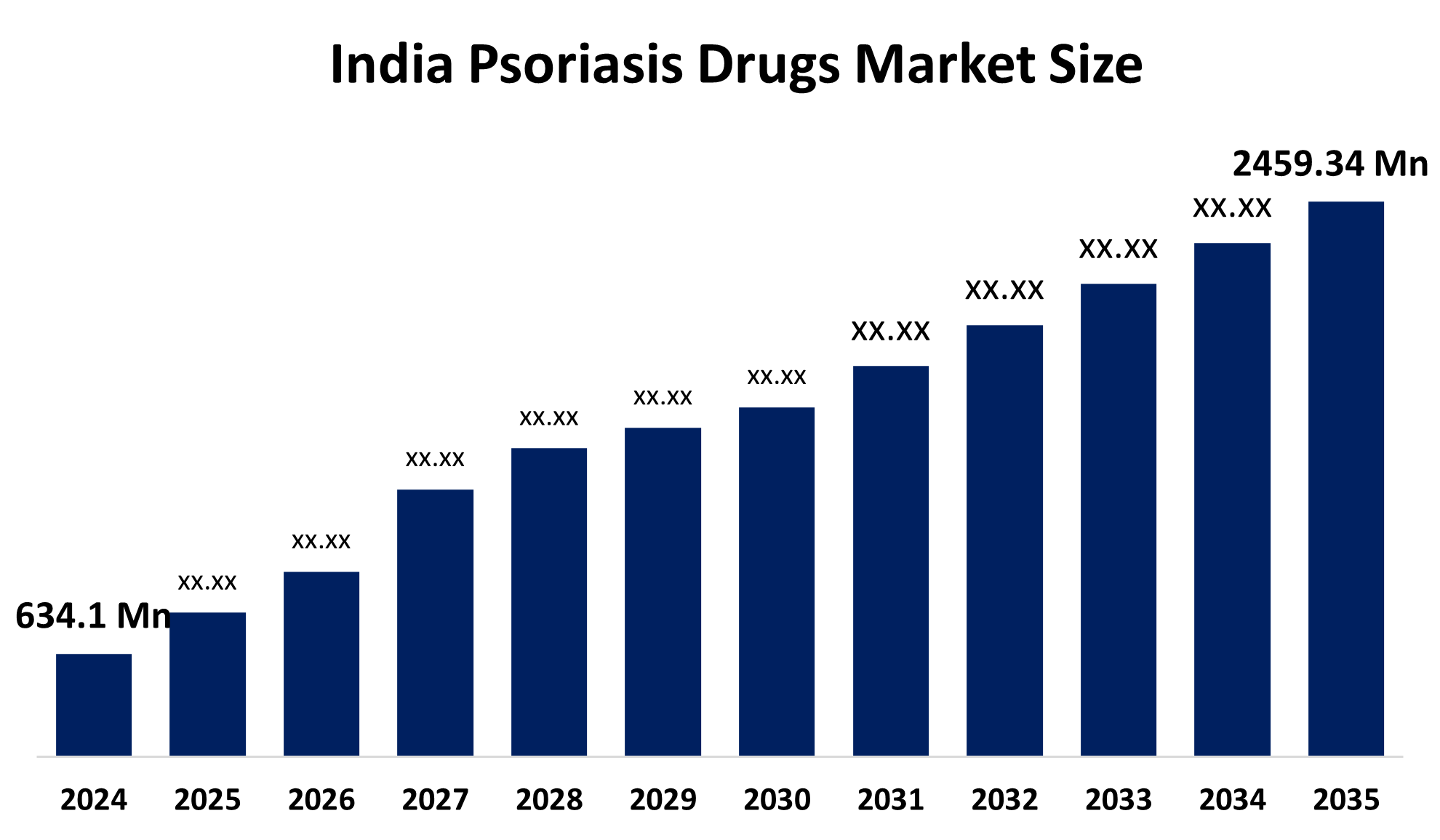

- The India Psoriasis Drugs Market Size Was Estimated at USD 634.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 13.11% from 2025 to 2035

- The India Psoriasis Drugs Market Size is Expected to Reach USD 2459.34 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India Psoriasis Drugs Market Size is Anticipated to Reach USD 2459.34 Million by 2035, Growing at a CAGR of 13.11% from 2025 to 2035. The India psoriasis drugs market is growing due to the rising prevalence of psoriasis, growing awareness and early diagnosis, improved patient access to treatment, and advancement in biologic and targeted therapies.

Market Overview

The India Psoriasis Drugs Market refers to the industry ecosystem that develops, manufactures, markets, sells, and prescribes pharmaceutical therapies specifically used to treat psoriasis and its symptoms in India. Psoriasis drugs are widely applied in the treatment of mild, moderate, and severe psoriasis, as well as psoriatic arthritis. Topical therapies are used for mild cases, systemic drugs for moderate cases, and biologics and targeted therapies for moderate-to-severe and refractory conditions. These treatments support India’s growing dermatology and rheumatology sectors and meet rising demand for advanced, long-term therapies. India psoriasis drugs market is growing due to the rising prevalence of psoriasis, advancements in biologic and targeted therapies, growing awareness and early diagnosis, improved patient access to treatment, research, and development in psoriasis drug discovery. In February 2026, India’s Union Budget proposed Biopharma SHAKTI with Rs. 10,000 crore over five years to boost biologics and biosimilars production, aiming to position India as a global biopharma leader and capture 5% of the market.

The India Psoriasis Drugs Market offers opportunities from rising patient awareness, growing adoption of biologics and targeted therapies, increasing access through biosimilars, insurance, healthcare infrastructure, emerging oral treatments, digital health platforms, and combination therapy approaches further support market growth and improved patient outcomes. In May 2025, India’s CDSCO published draft revised guidelines on biosimilars, which update marketing authorisation requirements for biosimilars in line with recent international guidelines.

Report Coverage

This research report categorizes the market for the India Psoriasis Drugs Market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India psoriasis drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India psoriasis drugs market.

India Psoriasis Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 634.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.11% |

| 2035 Value Projection: | USD 2459.34 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Drugs Class, By Application |

| Companies covered:: | Sun Pharmaceutical Industries Ltd, Dr. Reddy’s Laboratories Ltd, Glenmark Pharmaceuticals, Intas Pharmaceutical Ltd, Cipla Inc, Ipca Laboratories Ltd., Biocon Biologics Ltd, Lupin Limited, Johnson & Johnson, A.S. Pharmaceuticals and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The India Psoriasis Drugs Market is driven by rising prevalence of psoriasis, advancements in biologic and targeted therapies, growing awareness and early diagnosis, improved patient access to treatment, research and development in psoriasis drug discovery, supporting health insurance & reimbursement, increase healthcare infrastructure, rising the government initiatives for dermatological health, increasing adoption of digital health platforms and teledermatology, growing geriatric population prone to chronic skin condition, and greater patient willingness to seek specialized care.

Restraining Factors

The India Psoriasis Drugs Market is mostly constrained by the expensive treatment cost, adverse effects of biologic therapies, regulatory and pricing challenges, limited awareness in emerging markets, limited awareness in rural areas, and a fragmented healthcare infrastructure.

Market Segmentation

The India psoriasis drugs market share is classified into drug class and application.

- The biologics segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Psoriasis Drugs Market is segmented by drug class into topical treatments, systemic therapies, biologics, and oral therapies. Among these, the biologics segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period. Biologics lead revenue in the psoriasis drugs market because they are highly effective, used long-term, and priced higher than conventional treatments. Patent protection and limited competition help maintain premium pricing, while biosimilars increase patient access without greatly reducing revenue. Ongoing investment in production and research keeps biologics the most profitable segment.

- The psoriasis vulgaris segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The India Psoriasis Drugs Market is segmented by application into psoriasis vulgaris, psoriatic arthritis, inverse psoriasis, and pustular psoriasis. Among these, the psoriasis vulgaris segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Psoriasis vulgaris, the most common form affecting 80-90% of patients, drives the highest treatment demand and drug spending. Its chronic, visible nature requires long-term therapy and frequent healthcare visits, unlike rarer subtypes with smaller patient populations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Psoriasis Drugs Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sun Pharmaceutical Industries Ltd

- Dr. Reddy’s Laboratories Ltd

- Glenmark Pharmaceuticals

- Intas Pharmaceutical Ltd

- Cipla Inc

- Ipca Laboratories Ltd.

- Biocon Biologics Ltd

- Lupin Limited

- Johnson & Johnson

- A.S. Pharmaceuticals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Sun Pharma introduced ILUMYA, an IL-23 inhibitor biologic, in India for moderate-to-severe plaque psoriasis. The launch marks the first entry of this advanced biologic directly in the Indian market from a global portfolio, broadening high-efficacy options beyond traditional systemic drugs.

- In August 2025, Dr Reddy’s Laboratories gets CDSCO panel approval to begin phase III trial of tapinarof cream1%, a novel non-steroidal topical treatment for plaque psoriasis.

- In November 2024, Johnson & Johnson announced positive phase 3 topline results for icotrokinra (JNJ-2113), a first-in-class targeted oral IL-23 receptor drug for moderate to severe plaque psoriasis, showing it met its key co-primary endpoints in clinical trials. This is a major clinical advancement toward potential regulatory submissions and eventual market entry.

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Psoriasis Drugs Market based on the below-mentioned segments:

India Psoriasis Drugs Market, By Drug Class

- Topical Treatments

- Systematic Therapies

- Biologics

- Oral Therapies

India Psoriasis Drugs Market, By Application

- Psoriasis Vulgaris

- Psoriatic Arthritis

- Inverse Psoriasis

- Pastular Psoriasis

Frequently Asked Questions (FAQ)

-

Q: What is the current and expected size of the India psoriasis drugs market?A: The India psoriasis drugs market was USD 634.1 million in 2024 and is expected to reach USD 2459.34 million by 2035, growing at a CAGR of 13.11%.

-

Q. What are the key growth drivers for the India psoriasis drugs market?A: India psoriasis drugs market is driven by rising prevalence, biologic and targeted therapy advancements, early diagnosis, patient access, research & development, and insurance coverage. Increasing healthcare infrastructure, government initiatives, digital platforms, and teledermatology also support growth.

-

Q. What are the main restraints in the India psoriasis drugs market?A: India psoriasis drugs market restraints by high treatment costs, adverse effects of biologics, regulatory and pricing challenges, limited awareness in rural areas, and fragmented healthcare infrastructure. These factors limit access and adoption, especially in emerging regions.

-

Q. Which drug classes and applications dominate the India psoriasis drugs market?A: The market is segmented into topical treatments, systemic therapies, biologics, and oral therapies. Biologics accounted for the largest revenue in 2024 and are expected to grow rapidly due to their high efficacy and targeted mechanisms. Applications include psoriasis vulgaris, psoriatic arthritis, inverse psoriasis, and pustular psoriasis, with psoriasis vulgaris being the most common type. Biosimilars and supportive government policies enhance accessibility. Emerging oral therapies add further growth potential.

-

Q. How is the India psoriasis drugs market evolving with clinical developments?A: Recent developments include Sun Pharma launching ILUMYA in Dec 2025, Dr. Reddy’s Phase III approval for Tapinarof Cream 1% in Jul 2025, and Johnson & Johnson’s positive Phase III results for icotrokinra in Nov 2024. These indicate growing adoption of biologics, targeted therapies, and novel treatments. Clinical progress, digital health, and biosimilars are shaping future growth. Patients benefit from increased treatment options and access to advanced therapies.

Need help to buy this report?