India Propylene Market Size, Share, By Type (Homopolymer And Copolymer), By Derivative (Polypropylene, Propylene Oxide, Phenol, Acrylic Acid, Alcohols, And Others), And India Propylene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Propylene Market Insights Forecasts to 2035

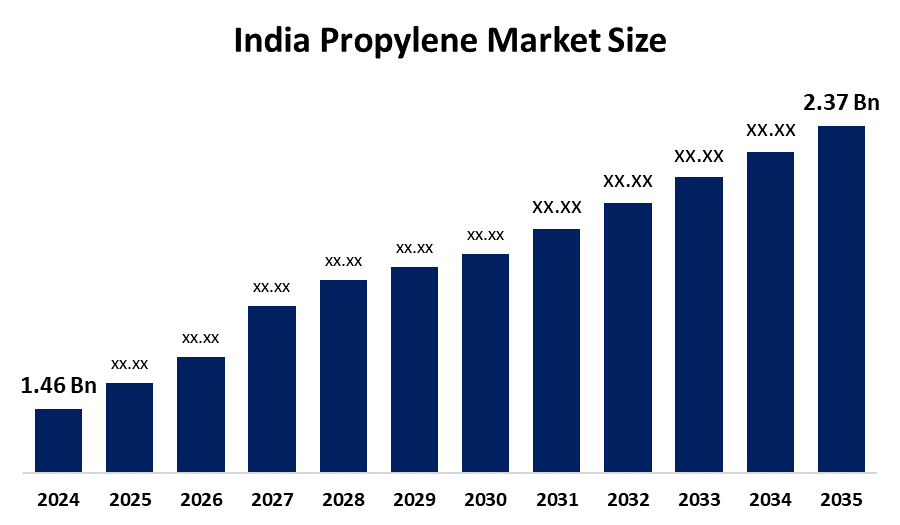

- India Propylene Market Size 2024: USD 1.46 Billion

- India Propylene Market Size 2035: USD 2.37 Billion

- India Propylene Market CAGR 2024: 4.5%

- India Propylene Market Segments: Type and Derivative

Get more details on this report -

India propylene market includes the manufacture, consumption, import, export and trading of propylene in India. India’s propylene is primarily produced from the processing of crude oil and natural gas using hydrocarbon cracking or steam cracking. Propylene is an odourless, colourless, and flammable hydrocarbon gas, which is used to produce a wide range of chemicals, polymers, along with by-products of Propylene such as acrylonitrile, propylene oxide, and acrylic acid, which are used in various applications, including packaging, automotive parts, construction, textiles, and consumer goods.

The propylene in India are backed by government support, including the Production Linked Incentive (PLI) Scheme, which was designed to boost domestic manufacturing across key sectors. Under the PLI framework and allied policies, incentives are offered to companies that expand or modernize facilities for producing advanced materials and derivatives, thereby stimulating investment in propylene production and downstream uses.

As technology advances, India’s propylene providers are now using propylene production technology utilising both propane dehydrogenation and olefin conversion technology which allows flexibility, and cost-effectively creating propylene. Refiners and petrochemical facilities are using energy efficient catalysts, automation processes and integrating processing facilities to increase yields as well as decrease their operating costs. This trend towards technology-based production capabilities have been reflected through the creation of India's first process specific propylene production facility that uses OCT, and capital expenditures within integrated petrochemical complexes.

India Propylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.46 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.5% |

| 2035 Value Projection: | USD 2.37 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Derivative |

| Companies covered:: | Reliance Industries Limited, Indian Oil Corporation Limited, HMEL, Haldia Petrochemicals Limited, ONGC Petro additions Ltd., Mangalore Refinery and Petrochemicals Ltd., Brahmaputra Cracker and Polymer Limited, LyondellBasell Industries N.V., GAIL (India) Ltd., Bharat Petroleum Corporation Limited, Manali Petrochemicals Limited, SABIC, BASF SE, Exxon Mobil Corporation, INEOS Group Limited, Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the India Propylene Market:

The India propylene market is driven by the surging demand for polypropylene in packaging, automotive components, and consumer plastics, rising disposable incomes, urbanization, increase in automobile production, used extensively in interiors, bumpers, and battery housings, and expanding infrastructure and construction activity drive demand for propylene derivatives used in adhesives, coatings, and building materials, creating a strong consumption base.

The India propylene market is restrained by the feedstock dependency, high crude oil and naphtha prices, inconsistent feedstock supply constrain stable production, environmental concerns, complex regulatory pressures around petrochemical emissions, and plastic waste management issues.

The future of India propylene market is bright and promising, with versatile opportunities emerging from the technological innovation, industrial demand and policy support which enhance domestic production capacity and value-chain integration. The opening of new technologies for production of propylene and the establishment of integrated petrochemical complexes provide opportunities to improve downstream units and increased manufacturing connections in support of both reducing import dependence and developing products that produce greater value for export. The rising use and demand for propylene derivatives in advance applications combined with government-backed manufacturing incentives provide opportunity for capital investments, capacity expansion and innovation in propylene market.

Market Segmentation

The India Propylene Market share is classified into type and derivative.

By Type:

The India propylene market is divided by type into homopolymer and copolymer. Among these, the homopolymer segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Superior stiffness, high tensile strength, excellent chemical resistance, cost-efficiency, and widely used for rigid packaging, textiles, and automotive components all contribute to the homopolymer segment's largest share and higher spending on propylene when compared to other type.

By Derivative:

The India propylene market is divided by derivative into polypropylene, propylene oxide, phenol, acrylic acid, alcohols, and others. Among these, the polypropylene segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The polypropylene segment dominates because of massive demand from end user industries, rise in e-commerce platform, demand for flexible and rigid packaging solutions, and increasing domestic manufacturing through Government “Make in India” Initiative.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India propylene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Propylene Market:

- Reliance Industries Limited

- Indian Oil Corporation Limited

- HMEL

- Haldia Petrochemicals Limited

- ONGC Petro additions Ltd.

- Mangalore Refinery and Petrochemicals Ltd.

- Brahmaputra Cracker and Polymer Limited

- LyondellBasell Industries N.V.

- GAIL (India) Ltd.

- Bharat Petroleum Corporation Limited

- Manali Petrochemicals Limited

- SABIC

- BASF SE

- Exxon Mobil Corporation

- INEOS Group Limited

- Others

Recent Developments in India Propylene Market:

In October 2025, Reliance Industries Limited decreased polypropylene prices in the Indian market. The company is also developing a large-scale crude-to-chemicals refinery in Jamnagar, where propylene will be manufactured, through the project completion expected by 2027.

In July 2025, Manali Petrochemicals Limited inaugurated an expanded propylene glycol facility in India, increasing its capacity by 50,000 tonnes per annum to a total of 72,000 KTPA. This expansion is aimed at reducing India’s reliance on propylene glycol imports and supports the “Make in India” initiative.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India propylene market based on the below-mentioned segments:

India Propylene Market, By Type

- Homopolymer

- Copolymer

India Propylene Market, By Derivative

- Polypropylene

- Propylene Oxide

- Phenol

- Acrylic Acid

- Alcohols

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India propylene market size?A: India propylene market is expected to grow from USD 1.46 billion in 2024 to USD 2.37 billion by 2035, growing at a CAGR of 5.5% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the surging demand for polypropylene in packaging, automotive components, and consumer plastics, rising disposable incomes, urbanization, increase in automobile production, used extensively in interiors, bumpers, and battery housings, and expanding infrastructure and construction activity drive demand for propylene derivatives used in adhesives, coatings, and building materials, creating a strong consumption base.

-

Q: What factors restrain the India propylene market?A: Constraints include the feedstock dependency, high crude oil and naphtha prices, inconsistent feedstock supply constrain stable production, environmental concerns, complex regulatory pressures around petrochemical emissions, and plastic waste management issues.

-

Q: How is the market segmented by type?A: The market is segmented into homopolymer and copolymer.

-

Q: Who are the key players in the India propylene market?A: Key companies include Reliance Industries Limited, Indian Oil Corporation Limited, HMEL, Haldia Petrochemicals Limited, ONGC Petro additions Ltd., Mangalore Refinery and Petrochemicals Ltd., Brahmaputra Cracker and Polymer Limited, LyondellBasell Industries N.V., GAIL (India) Ltd., Bharat Petroleum Corporation Limited, Manali Petrochemicals Limited, SABIC, BASF SE, Exxon Mobil Corporation, INEOS Group Limited, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?