India Polyvinyl Chloride Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Rigid PVC, Flexible PVC, and Other), By Manufacturing Process (Suspension PVC, Emulsion PVC, and Other), and India Polyvinyl Chloride Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Polyvinyl Chloride Market Insights Forecasts to 2035

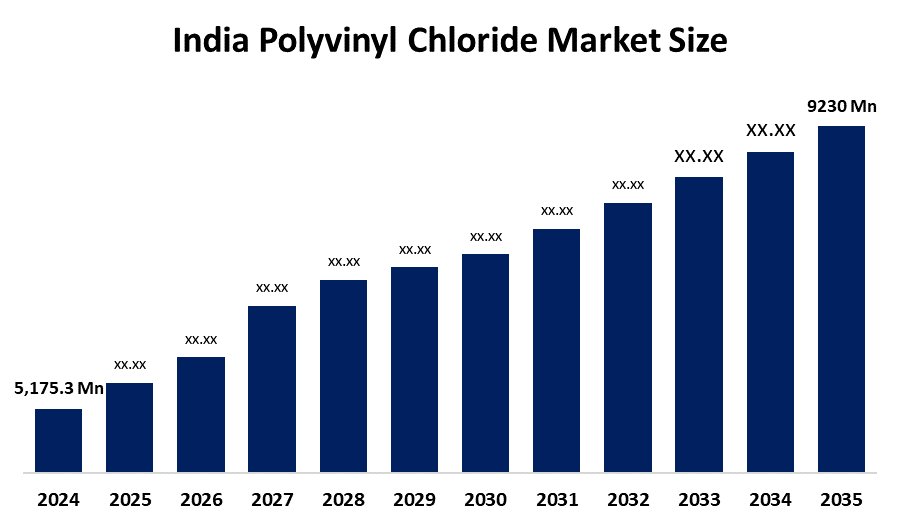

- The India Polyvinyl Chloride Market Size Was Estimated at USD 5,175.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.4% from 2025 to 2035

- The India Polyvinyl Chloride Market Size is Expected to Reach USD 9230 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India Polyvinyl Chloride Market Size size is anticipated to reach USD 9230 million by 2035, growing at a CAGR of 5.4% from 2025 to 2035. The India polyvinyl chloride (PVC) market is driven by rapid infrastructure development, rising construction activity, growing urbanization, increasing demand for pipes and fittings, expanding electrical and cable applications, affordability of PVC materials, and strong government initiatives supporting housing and water management projects.

Market Overview

The India Polyvinyl Chloride Market Size refers to the domestic production and consumption of PVC, a widely used thermoplastic polymer known for its durability, flexibility, chemical resistance, and cost efficiency. PVC is extensively applied in construction, infrastructure, packaging, electrical cables, automotive components, and healthcare products. Market growth is primarily driven by rapid urbanization, rising housing and infrastructure development, increasing demand for water supply and sanitation systems, and strong government initiatives such as Smart Cities Mission and Jal Jeevan Mission. Additionally, growth in packaging, automotive manufacturing, and industrialization continues to boost PVC demand across India.

One major trend in the India PVC market is the growing focus on sustainability, with manufacturers adopting lead-free stabilizers, recyclable formulations, and eco-friendly additives to meet environmental regulations. Another key trend is the rising demand for PVC pipes and fittings, supported by irrigation expansion, wastewater management, and urban infrastructure projects. Technological improvements in extrusion and compounding processes are enabling the production of high-performance PVC grades with better strength, flexibility, and heat resistance. Additionally, the increasing use of PVC in electrical and telecom cables, driven by renewable energy projects and digital infrastructure expansion, is emerging as a strong growth trend.

Technological advancements are playing a critical role in shaping the future of the India PVC market. The adoption of advanced manufacturing technologies such as automated extrusion lines, digital quality control systems, and energy-efficient processing equipment is improving product consistency and reducing production waste. Oriented PVC (PVC-O) technology is gaining traction due to its superior mechanical strength, longer lifespan, and suitability for high-pressure water distribution systems. Innovations in bio-based plasticizers and non-toxic stabilizer systems are enhancing PVC’s acceptance in medical, food-contact, and sustainable construction applications. Furthermore, the integration of smart technologies, including sensor-enabled PVC piping for leak detection and water management, is expected to create new growth opportunities, positioning PVC as a future-ready material in India’s evolving infrastructure landscape.

Report Coverage

This research report categorizes the market for the India Polyvinyl Chloride Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India polyvinyl chloride market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India polyvinyl chloride market.

India Polyvinyl Chloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5,175.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.4% |

| 2035 Value Projection: | USD 9230 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Product Type ,By Manufacturing Process |

| Companies covered:: | Reliance Industries Limited, Chemplast Sanmar Limited, DCW Limited, DCM Shriram Limited, Finolex Industries Limited, The Supreme Industries Limited, Astral Limited, Prince Pipes and Fittings Limited, Dutron Polymers Limited, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India Polyvinyl Chloride Market Size is driven by rapid infrastructure development, expanding construction and housing activities, and increasing investments in water supply, sanitation, and irrigation projects. Rising urbanization and population growth are boosting demand for PVC pipes, fittings, and profiles. The growing electrical and telecom sectors are increasing the use of PVC in cables and conduits. Additionally, the expansion of packaging, automotive, and healthcare industries, coupled with PVC’s durability, versatility, and cost-effectiveness, supports sustained market growth. Supportive government initiatives further accelerate PVC consumption across key end-use sectors.

Restraining Factors

The India Polyvinyl Chloride Market Size faces restraints from environmental concerns related to non-biodegradable plastic waste and the use of harmful additives like phthalates and heavy metal stabilizers. Stringent government regulations on plastic usage, recycling challenges, and increasing competition from alternative materials such as HDPE, PEX, and biodegradable polymers also limit market growth. High energy costs in production further constrain expansion.

Market Segmentation

The India Polyvinyl Chloride Market share is classified into product type and manufacturing process.

- The rigid PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Polyvinyl Chloride Market Size is segmented by product type into rigid PVC, flexible PVC, and other. Among these, the rigid PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rigid PVC dominates the market because of its widespread use in construction and infrastructure projects. Its excellent durability, chemical resistance, and low maintenance make it ideal for pipes, windows, doors, and fittings. Government initiatives like Smart Cities Mission, Jal Jeevan Mission, and urban housing projects are increasing demand for high-quality water supply and sanitation systems, further driving rigid PVC consumption. In contrast, flexible PVC, used in cables and flooring, caters to niche applications, making rigid PVC the market leader.

- The suspension PVC segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Polyvinyl Chloride Market Size is segmented by manufacturing process into suspension PVC, emulsion PVC, and other. Among these, the suspension PVC segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Suspension PVC (s-PVC) dominates the market due to its versatility, affordability, and ease of processing. It is widely used in construction, infrastructure, and industrial applications, including pipes, window profiles, fittings, and electrical cables. s-PVC’s compatibility with both rigid and flexible formulations makes it suitable for diverse end-use industries. In contrast, emulsion PVC is limited to specialized applications such as coatings and adhesives, giving suspension PVC a clear advantage in terms of volume and market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Polyvinyl Chloride Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Reliance Industries Limited

- Chemplast Sanmar Limited

- DCW Limited

- DCM Shriram Limited

- Finolex Industries Limited

- The Supreme Industries Limited

- Astral Limited

- Prince Pipes and Fittings Limited

- Dutron Polymers Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Polyvinyl Chloride Market Size based on the below-mentioned segments:

India Polyvinyl Chloride Market, By Product Type

- Rigid PVC

- Flexible PVC

- Other

India Polyvinyl Chloride Market, By Manufacturing Process

- Suspension PVC

- Emulsion PVC

- Other

Frequently Asked Questions (FAQ)

-

Q1: What is polyvinyl chloride (PVC)?PVC is a versatile thermoplastic polymer widely used in construction, infrastructure, packaging, electrical, automotive, and healthcare applications due to its durability, chemical resistance, and cost-effectiveness.

-

Q2: What are the major types of PVC in India?The India PVC market is mainly segmented into rigid PVC (uPVC), flexible PVC (fPVC), and other specialty grades.

-

Q3: Which PVC manufacturing process is most used in India?Suspension PVC (s-PVC) is the dominant manufacturing process due to its versatility, affordability, and suitability for multiple applications.

-

Q4: What are the key growth drivers of the India PVC market?Growth is driven by urbanization, infrastructure and housing projects, water supply and sanitation initiatives, increasing demand from packaging, automotive, and electrical sectors, and supportive government programs.

-

Q5: What factors restrain the India PVC market?Environmental concerns, strict regulations on plastics, competition from alternative materials like HDPE and PEX, recycling challenges, and high energy costs in production limit market growth.

Need help to buy this report?