India Polystyrene Market Size, Share, and COVID-19 Impact Analysis, By Type (General Purpose Polystyrene, High Impact Polystyrene, and Other), By Application (Packaging, Building & Construction, Automotive, Electrical & Electronics, Agriculture, Household Leisure & Sports, and Others), and India Polystyrene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Polystyrene Market Insights Forecasts to 2035

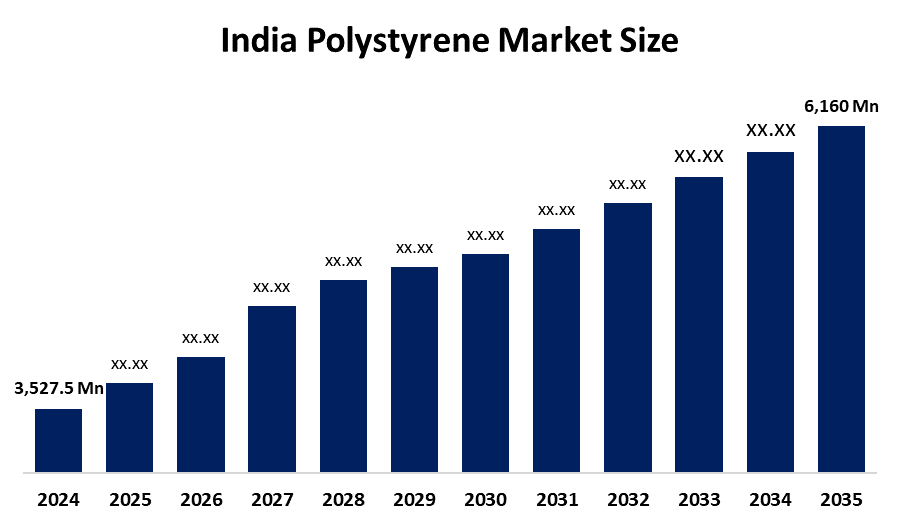

- The India Polystyrene Market Size Was Estimated at USD 3,527.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.2% from 2025 to 2035

- The India Polystyrene Market Size is Expected to Reach USD 6,160 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The India Polystyrene Market Size is Anticipated to Reach USD 6,160 Million by 2035, Growing at a CAGR of 5.2% from 2025 to 2035. The India polystyrene market is driven by rising demand from packaging, consumer electronics, and appliances, rapid urbanization, growth of the food service industry, expanding construction activities, and increasing use of lightweight, cost-effective, and recyclable plastic materials.

Market Overview

The India Polystyrene Market Size includes the production and consumption of general-purpose polystyrene (GPPS), high-impact polystyrene (HIPS), and expanded polystyrene (EPS), widely used across packaging, construction, electronics, appliances, and consumer goods. Polystyrene is valued for its lightweight nature, insulation properties, ease of processing, and cost efficiency. Market growth is primarily driven by rapid urbanization, increasing construction of residential and commercial buildings, rising demand for protective and food packaging, and growth of the consumer electronics and appliance industries. Expansion of e-commerce and cold-chain logistics further accelerates demand for EPS-based packaging solutions.

A major trend in the India Polystyrene Market Size is the growing preference for expanded polystyrene in thermal insulation applications, supported by energy-efficient building practices and infrastructure development. Demand for high-impact polystyrene is increasing in electronics and appliances due to its superior strength, impact resistance, and design flexibility. Sustainability is another key trend, with manufacturers focusing on recyclable grades and improved waste management practices to address environmental concerns. Additionally, customized and lightweight packaging solutions are gaining traction in food delivery, pharmaceuticals, and e-commerce sectors, where product safety and cost reduction are critical.

Technological advancements are playing a crucial role in shaping the market. Producers are adopting advanced polymerization, extrusion, and molding technologies to enhance product quality, production efficiency, and consistency. Automation and digital monitoring systems are being integrated into manufacturing plants to reduce waste and energy consumption. Recent developments also include increased focus on recycling technologies, such as mechanical and chemical recycling of polystyrene waste, to support circular economy goals. Capacity expansions and the introduction of specialized grades, including flame-retardant and high-performance EPS, reflect rising domestic demand. Collectively, these developments strengthen India’s polystyrene market competitiveness while aligning with sustainability and regulatory expectations.

Report Coverage

This research report categorizes the market for the India polystyrene market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India polystyrene market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India polystyrene market.

India Polystyrene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3,527.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.2% |

| 2035 Value Projection: | USD 6,160 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Type ,By Application |

| Companies covered:: | INEOS Styrolution, BASF India Ltd., LG Chem, Supreme Petrochem Ltd., Reliance Industries Limited, Styrenix Performance Materials, Trinseo LLC, TotalEnergies, Kumho Petrochemical, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysi |

Get more details on this report -

Driving Factors

The India Polystyrene Market Size is driven by strong growth in the packaging, construction, and consumer goods industries. Rising urbanization and infrastructure development increase demand for expanded polystyrene used in insulation and lightweight construction materials. Growth of e-commerce, food delivery, and cold-chain logistics fuels demand for protective and thermal packaging. Expanding consumer electronics and appliance manufacturing boosts usage of high-impact polystyrene. Additionally, cost-effectiveness, ease of processing, and wide availability of raw materials support adoption. Government initiatives promoting domestic manufacturing and industrial investments further strengthen market growth across diverse end-use sectors.

Restraining Factors

The India Polystyrene Market Size faces restraints from growing environmental concerns and strict regulations on single-use plastics, which limit polystyrene usage in packaging. Volatility in raw material prices, especially styrene, affects production costs. Additionally, low recycling rates, waste management challenges, and rising preference for biodegradable alternatives hinder overall market growth.

Market Segmentation

The India Polystyrene Market share is classified into type and application.

- The high-impact polystyrene segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Polystyrene Market Size is segmented by type into general-purpose polystyrene, high-impact polystyrene, and other. Among these, the high-impact polystyrene segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. High-impact polystyrene dominates the market because it offers better toughness, impact resistance, and design flexibility compared to general-purpose polystyrene. These properties make it ideal for manufacturing consumer electronics housings, home appliances, packaging containers, and automotive interior components. Rapid growth in electronics, appliances, and packaged consumer goods industries in India significantly boosts HIPS demand. Additionally, its cost-effectiveness, ease of processing, and compatibility with mass production support its widespread adoption across diverse industrial applications.

- The packaging segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Polystyrene Market Size is segmented by application into packaging, building & construction, automotive, electrical & electronics, agriculture, household leisure & sports, and others. Among these, the packaging segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The packaging segment dominates the market due to its extensive use in food packaging, disposable containers, protective packaging, and thermal insulation for cold-chain logistics. Rapid growth of e-commerce, food delivery services, and organized retail has significantly increased demand for lightweight, cost-effective, and protective packaging materials. Expanded polystyrene is widely preferred for cushioning and temperature control, while polystyrene’s ease of molding and affordability make it ideal for high-volume packaging applications across multiple industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Polystyrene Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INEOS Styrolution

- BASF India Ltd.

- LG Chem

- Supreme Petrochem Ltd.

- Reliance Industries Limited

- Styrenix Performance Materials

- Trinseo LLC

- TotalEnergies

- Kumho Petrochemical

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Polystyrene Market Size based on the below-mentioned segments:

India Polystyrene Market, By Type

- General Purpose Polystyrene

- High Impact Polystyrene

- Other

India Polystyrene Market, By Application

- Packaging

- Building & Construction

- Automotive

- Electrical & Electronics

- Agriculture

- Household Leisure & Sports

- Others

Frequently Asked Questions (FAQ)

-

1. What is polystyrene and where is it used in India?Polystyrene is a lightweight thermoplastic widely used in packaging, construction insulation, electronics, appliances, and consumer goods.

-

2. Which type of polystyrene is most commonly used in India?High-impact polystyrene is widely used due to its strength, durability, and suitability for electronics and appliance applications.

-

3. Which application segment dominates the Indian market?Packaging dominates the market, driven by food packaging, e-commerce, cold-chain logistics, and protective packaging needs.

-

4. What factors are driving market growth in India?Growth is driven by urbanization, construction activity, rising consumer goods demand, expansion of e-commerce, and cost-effective material properties.

Need help to buy this report?