India Polypropylene Market Size, Share, By Type (Homopolymer And Copolymer), By Process (Injection Molding, Blow Molding, Extrusion, And Others), And India Polypropylene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Polypropylene Market Insights Forecasts to 2035

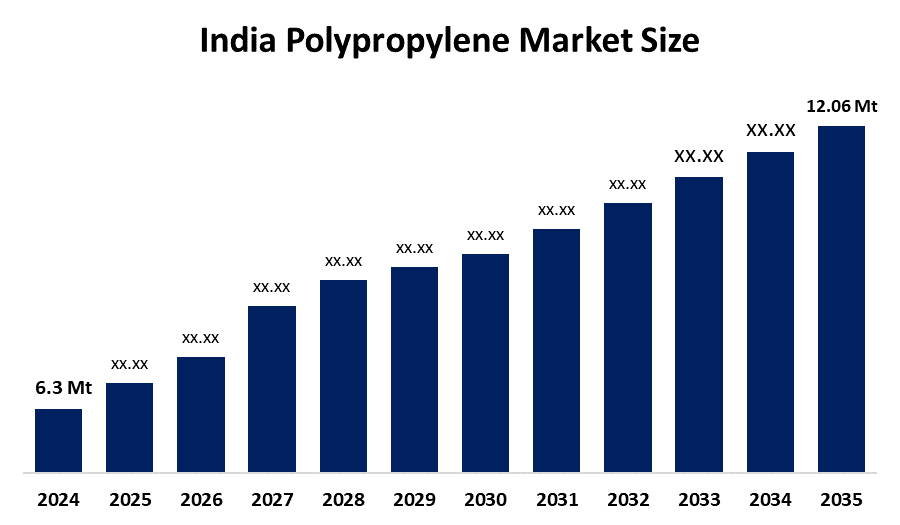

- India Polypropylene Market Size 2024: 6.3 Million Tons

- India Polypropylene Market Size 2035: 12.06 Million Tons

- India Polypropylene Market CAGR 2024: 6.08%

- India Polypropylene Market Segments: Type and Process

Get more details on this report -

The India Polypropylene (PP) Market Size includes manufacturing, expanding, and monitoring the use of polypropylene for packaging, automobiles, everyday consumer goods, textiles, and healthcare. Polypropylene is a lightweight, tensile-strength, resistant-to-chemicals thermoplastic polymer. It can be easily manufactured utilizing various manufacturing processes includes injection moulding, extrusion, and blowing. Industrial manufacturers are expanding with all of this, and the increasing number of people using these products is increasing demand for polypropylene market.

The polypropylene in India are backed by government support, including the Make in India programme, aims to strengthen India’s position in the global polymer value chain by attracting investment, improving infrastructure, and enhancing technological capabilities, thereby creating a favourable environment for PP manufacturers and downstream converters. Polypropylene accounted for the largest share of India’s thermoplastic demand totaling about 6.1 million tonnes highlighting its dominant role among polymer materials and its significant contribution to the domestic plastics industry.

As technology advances, India’s polypropylene providers are now using advanced polymerization catalysts to increase the molecular control and create custom polypropylene grades with specific properties, including high clarity and fresh impact, making them applicable in high-performance applications. Improvements in digital process controls, automation and real-time quality monitoring contribute to improved efficiency & consistency throughout the production process for all polypropylene manufacturing facilities. Additionally, the development of recycling technologies and circular-economy initiatives is gaining traction to promote sustainability and the management of post-consumer polypropylene products.

India Polypropylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 6.3 Million Tons |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.08% |

| 2035 Value Projection: | 12.06 Million Tons |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type ,By Process |

| Companies covered:: | Reliance Industries Limited, Indian Oil Corporation Limited, HPCL-Mittal Energy Limited, Haldia Petrochemicals Limited, ONGC Petro additions Ltd., Mangalore Refinery and Petrochemicals Ltd., Brahmaputra Cracker and Polymer Limited, GAIL (India) Ltd., and Other Key Players |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the India Polypropylene Market:

The India Polypropylene Market Size is driven by the robust demand from packaging, cost-effectiveness, growth in e-commerce sectors, rising automotive production, improve fuel efficiency and reduce emissions, growth in infrastructure and construction activities, high demand for piping systems, geo-membranes, and protective films, expanding consumer goods manufacturing contributes to sustained consumption, and investments in petrochemical capacity expansion propel India’s industrial ecosystem.

The India Polypropylene Market Size is restrained by the limited petrochemical feedstock availability, crude oil price volatility, environmental and regulatory pressures, reducing single-use plastics impose constraints on certain PP applications, increase operational costs, and competitive pressures from cheaper imports challenges.

The future of India Polypropylene Market Size is bright and promising, with versatile opportunities emerging from the goal to achieve greater independence from imported petrochemical products by increasing the amount of substitution and expansion in local production as part of federal government objectives. Major growth of local petrochemical manufacturing capabilities will generate additional capabilities needed to support local production of a wider selection of polypropylene product types. Furthermore, the development and integration of circular economy principles and use of mechanical and chemical recycling technologies may create additional opportunities to generate revenues of the polypropylene value chain while addressing sustainability principles associated with resin use.

Market Segmentation

The India Polypropylene Market share is classified into type and process.

By Type:

The India Polypropylene Market Size is divided by type into homopolymer and copolymer. Among these, the homopolymer segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Superior mechanical properties, widely used for rigid packaging, cost effectiveness, widespread application in textiles and industry, and suitable for injection molding all contribute to the homopolymer segment’s largest share and higher spending on polypropylene segment when compared to other type.

By Process:

The India Polypropylene Market Size is divided by process into injection molding, blow molding, extrusion, and others. Among these, the injection molding segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The injection molding segment dominates because of versatility with high volume production, high demand from automotive industry, explosion of organized retail and food delivery services in India, and it offers high scalability and cost efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Polypropylene Market Size , along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Polypropylene Market:

- Reliance Industries Limited

- Indian Oil Corporation Limited

- HPCL-Mittal Energy Limited

- Haldia Petrochemicals Limited

- ONGC Petro additions Ltd.

- Mangalore Refinery and Petrochemicals Ltd.

- Brahmaputra Cracker and Polymer Limited

- GAIL (India) Ltd.

- Others

Recent Developments in India Polypropylene Market:

In April 2025, Indian Oil Corporation Limited, signed an MoU with the Government of Odisha to set up a new Petrochemical Complex at Paradip, which include a major polypropylene unit as part of a Rs61,007 crore investment.

In February 2025, GAIL (India) Ltd. committed Rs300 billion for petrochemical and pipeline assests, including acquiring JBF Petrochemicals to increase feedstock flexibility.

In April 2024, Haldia Petrochemicals Ltd signed a 10-year naphtha purchase agreement with QatarEnergy to secure feedstock for its expansion, including its on-purpose propylene plant using Olefin Conversion Technology.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035.Spherical Insights has segmented the India Polypropylene Market Size based on the below-mentioned segments:

India Polypropylene Market, By Type

- Homopolymer

- Copolymer

India Polypropylene Market, By Process

- Injection Molding

- Blow Molding

- Extrusion

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India polypropylene market size?A: India polypropylene market is expected to grow from 6.3 million tons in 2024 to 12.06 million tons by 2035, growing at a CAGR of 6.08% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the robust demand from packaging, cost-effectiveness, growth in e-commerce sectors, rising automotive production, improve fuel efficiency and reduce emissions, growth in infrastructure and construction activities, high demand for piping systems, geo-membranes, and protective films, expanding consumer goods manufacturing contributes to sustained consumption, and investments in petrochemical capacity expansion, propel India’s industrial ecosystem

-

Q: What factors restrain the India polypropylene market?A: Constraints include the limited petrochemical feedstock availability, crude oil price volatility, environmental and regulatory pressures, reducing single-use plastics impose constraints on certain PP applications, increase operational costs, and competitive pressures from cheaper imports challenges.

-

Q: How is the market segmented by type?A: The market is segmented into homopolymer and copolymer.

-

Q: Who are the key players in the India polypropylene market?A: Key companies include Reliance Industries Limited, Indian Oil Corporation Limited, HPCL-Mittal Energy Limited, Haldia Petrochemicals Limited, ONGC Petro additions Ltd., Mangalore Refinery and Petrochemicals Ltd., Brahmaputra Cracker and Polymer Limited, GAIL (India) Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?