India Polyols Market Size, Share, and COVID-19 Impact Analysis, By Type (Polyether Polyols, Polyester Polyols, and Other), By Application (Flexible Polyurethane Foam, Rigid Polyurethane Foam, CASE, and Other), By End Use Industry (Building & Construction, Automotive, Electronics, and Other), and India Polyols Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Polyols Market Insights Forecasts to 2035

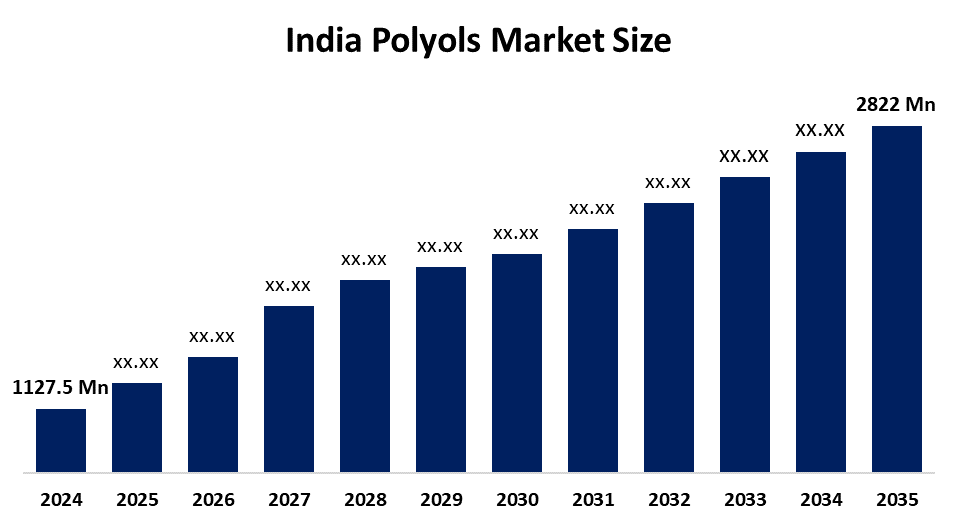

- The India Polyols Market Size Was Estimated at USD 1,127.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.7% from 2025 to 2035

- The India Polyols Market Size is Expected to Reach USD 2822 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The India Polyols Market Size Is Anticipated To Reach USD 2822 Million By 2035, Growing At A CAGR Of 8.7% From 2025 To 2035. India polyols market is driven by rapid growth in the construction and automotive sectors, rising demand for polyurethane foams, increasing insulation needs, expanding refrigeration and appliance manufacturing, and supportive government initiatives promoting energy efficiency and infrastructure development.

Market Overview

The India polyols market refers to the production and consumption of polyether and polyester polyols, which are key raw materials used in manufacturing polyurethane products such as flexible and rigid foams, coatings, adhesives, sealants, and elastomers. The market is witnessing steady growth due to the rapid expansion of end-use industries, including construction, automotive, furniture, packaging, and appliances. Rising urbanization, infrastructure development, and increasing demand for insulation materials to improve energy efficiency are major growth factors. Additionally, growth in cold chain logistics, refrigeration, and comfort-oriented consumer products is further boosting polyols consumption across India.

One of the key trends in the India polyols market is the rising demand for rigid polyurethane foams in the construction sector, driven by green building practices and thermal insulation requirements. Another major trend is the growing use of flexible polyurethane foams in furniture, bedding, and automotive seating due to changing lifestyles and increasing disposable income. A third trend is the shift toward sustainable and bio-based polyols as manufacturers respond to environmental regulations and sustainability goals. Lastly, increasing demand from the appliance and refrigeration industry is notable, as polyols are essential for producing energy-efficient refrigerators, freezers, and cooling systems.

New technology developments in the India polyols market focus on sustainability, performance enhancement, and process efficiency. Bio-based polyols derived from natural oils and renewable feedstocks are gaining attention as alternatives to conventional petroleum-based products. Advanced production technologies are improving consistency, reducing emissions, and enhancing product properties such as thermal stability and mechanical strength. In addition, innovations in low-VOC and high-performance polyols are supporting the development of eco-friendly polyurethane systems, aligning the market with evolving regulatory standards and end-user expectations.

Report Coverage

This research report categorizes the market for the India polyols market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India polyols market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India polyols market.

India Polyols Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,127.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.7% |

| 2035 Value Projection: | USD 2822 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Type, By Application, By End Use Industry |

| Companies covered:: | BASF India Limited, Covestro India Pvt. Ltd., Manali Petrochemicals Limited, Dow Chemical International Pvt. Ltd., Huntsman International (India) Pvt. Ltd., Shivathene Linopack Ltd, Shakun Industries, Otto Chemie Pvt. Ltd., Bharat Petroleum Corporation Limited, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The India polyols market is driven by strong growth in the construction, automotive, furniture, and appliance industries, which extensively use polyurethane products. Increasing demand for thermal insulation materials to improve energy efficiency in buildings and refrigeration systems is a major factor. Rapid urbanization, rising disposable income, and changing consumer lifestyles are boosting demand for flexible foams in bedding and furniture. Additionally, expansion of cold chain infrastructure, growth in packaging applications, and increasing focus on sustainable and high-performance materials are further accelerating market growth.

Restraining Factors

The India polyols market faces restraints due to volatility in raw material prices, as polyols are largely derived from petroleum-based feedstocks. Fluctuating crude oil prices increase production costs and impact profit margins. Additionally, strict environmental regulations, high initial investment requirements, and limited availability of bio-based alternatives pose challenges to market growth.

Market Segmentation

The India polyol market share is classified into type, application, and end-use industry.

- The polyether polyols segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India polyols market is segmented by type into polyether polyols, polyester polyols, and others. Among these, the polyether polyols segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Polyether polyols dominate the market because they are widely used in high-volume applications such as flexible foams for furniture and bedding, rigid foams for insulation, and automotive seating. They offer superior moisture resistance, good mechanical properties, and cost efficiency compared to polyester polyols. Additionally, their compatibility with diverse polyurethane formulations and growing demand from the construction, appliance, and automotive sectors further strengthens their market leadership in India.

- The flexible polyurethane foam segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India polyols market is segmented by application into flexible polyurethane foam, rigid polyurethane foam, CASE, and other. Among these, the flexible polyurethane foam segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Flexible polyurethane foam dominates the market due to its widespread application in furniture, mattresses, bedding, and automotive seating. Growing urbanization, rising disposable incomes, and increased demand for comfort-oriented household products are key drivers. The expanding real estate and hospitality sectors further boost the consumption of flexible foams. Additionally, flexible polyurethane foam offers durability, comfort, and cost-effectiveness, making it the preferred choice for manufacturers and end users across India.

- The building & construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India polyols market is segmented by end-use industry into building & construction, automotive, electronics, and other. Among these, the building & construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The building and construction segment dominates the market because of the extensive use of rigid polyurethane foams for thermal insulation in buildings, roofs, walls, and cold storage units. Rapid urbanization, large-scale infrastructure projects, and government initiatives promoting energy-efficient and green buildings are major contributors. Rising demand for affordable housing and commercial spaces further increases polyols consumption, making construction the leading end-use industry in the Indian market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India polyols market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF India Limited

- Covestro India Pvt. Ltd.

- Manali Petrochemicals Limited

- Dow Chemical International Pvt. Ltd.

- Huntsman International (India) Pvt. Ltd.

- Shivathene Linopack Ltd

- Shakun Industries

- Otto Chemie Pvt. Ltd.

- Bharat Petroleum Corporation Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In April 2025, Rymbal introduced FluidX, a fully recyclable, water-blown polyurethane made with 100% biobased polyols. The ultra-lightweight, chemical-free material lowers carbon footprint and supports sustainability and circularity in the footwear polyurethane industry.

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India polyols market based on the below-mentioned segments:

India Polyols Market, By Type

- Polyether Polyols

- Polyester Polyols

- Other

India Polyols Market, By Application

- Flexible Polyurethane Foam

- Rigid Polyurethane Foam

- CASE

- Other

India Polyols Market, By End Use Industry

- Building & Construction

- Automotive

- Electronics

- Other

Frequently Asked Questions (FAQ)

-

1. What are polyols used for in India?Polyols are mainly used to manufacture polyurethane products such as flexible and rigid foams, coatings, adhesives, sealants, and elastomers for construction, furniture, automotive, appliances, and insulation applications.

-

2. Which type of polyols is most widely used in India?Polyether polyols are the most widely used due to their versatility, cost-effectiveness, and extensive application in flexible and rigid polyurethane foams.

-

3. Which end-use industry drives the highest demand for polyols in India?The building and construction industry drives the highest demand, particularly for rigid polyurethane foams used in thermal insulation and energy-efficient buildings.

-

4. What are the major factors driving the India polyols market?Key drivers include rapid urbanization, infrastructure development, growth in furniture and bedding demand, expansion of cold storage and refrigeration, and rising focus on energy efficiency.

-

5. What challenges does the India polyols market face?Major challenges include volatility in raw material prices, dependence on petroleum-based feedstocks, environmental regulations, and high production and compliance costs.

Need help to buy this report?