India Polyethylene Terephthalate Market Size, Share, and COVID-19 Impact Analysis, By Source Type (Virgin PET, Recycled PET, and Other), By End User Industry (Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, and Other), and India Polyethylene Terephthalate Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Polyethylene Terephthalate Market Insights Forecasts to 2035

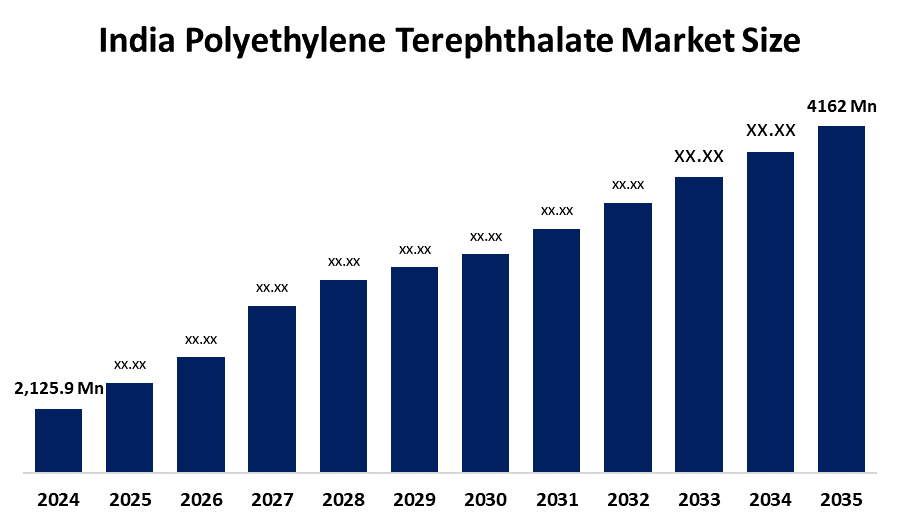

- The India Polyethylene Terephthalate Market Size Was Estimated at USD 2,125.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.3% from 2025 to 2035

- The India Polyethylene Terephthalate Market Size is Expected to Reach USD 4162 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India Polyethylene Terephthalate Market Size is anticipated to reach USD 4162 million by 2035, growing at a CAGR of 6.3% from 2025 to 2035. The India polyethylene terephthalate (PET) market is driven by rising demand for bottled beverages, growth of the food packaging industry, lightweight and recyclable properties of PET, expanding textile applications, and increasing urbanization with higher consumer spending.

Market Overview

The India Polyethylene Terephthalate Market Size represents a vital segment of the country’s polymer and packaging industry, as PET is a lightweight, durable, and recyclable thermoplastic widely used in bottles, food packaging, films, and polyester fibers. The market has witnessed steady growth due to increasing consumption of packaged food and beverages, rising urban population, and changing lifestyles. Strong demand from the textile sector for polyester yarn and fibers further supports market expansion. Additionally, PET’s cost-effectiveness, clarity, strength, and compatibility with recycling initiatives align well with India’s sustainability goals, making it a preferred material across multiple industries.

Several key trends are shaping the India PET market. First, the rapid growth of the bottled water and carbonated soft drinks segment is significantly boosting PET bottle demand, driven by health awareness and on-the-go consumption. Second, the shift toward sustainable and recyclable packaging is encouraging manufacturers to increase the use of PET over alternative plastics. Third, rising adoption of rPET (recycled PET) is gaining momentum as brands commit to circular economy targets and regulatory compliance. Fourth, expansion of the polyester textile industry, supported by exports and domestic apparel demand, continues to strengthen PET resin consumption, especially in fiber-grade applications.

In terms of new technology, advancements in chemical recycling of PET are emerging as a game-changer in India. Technologies such as depolymerization allow waste PET to be converted back into virgin-quality raw materials, improving recycling efficiency and material quality. Innovations in lightweighting technology are also reducing resin usage per bottle without compromising strength. Furthermore, improvements in barrier and heat-resistant PET grades are expanding applications into hot-fill beverages and food packaging, enhancing the overall value and future growth potential of the Indian PET market.

Report Coverage

This research report categorizes the market for the India Polyethylene Terephthalate Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India polyethylene terephthalate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India polyethylene terephthalate market.

India Polyethylene Terephthalate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,125.9 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.3% |

| 2035 Value Projection: | USD 4162 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Source Type ,By End User Industry |

| Companies covered:: | Indorama Ventures, Reliance Industries Limited, Dhunseri Petrochem (IVL Dhunseri), JBF Industries, Ester Industries, Toray Industries, Nan Ya Plastics Corporation, SABIC, BASF SE, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India Polyethylene Terephthalate Market Size is driven by strong growth in the packaged food and beverage industry, particularly bottled water, soft drinks, and ready-to-eat products. Rapid urbanization, rising disposable incomes, and changing consumer lifestyles have increased demand for convenient and lightweight packaging. Expansion of the polyester textile industry further boosts PET consumption in fiber applications. Additionally, PET’s recyclability, cost-effectiveness, and compliance with sustainability initiatives support its widespread adoption across various applications, including packaging, textiles, and industry.

Restraining Factors

The India Polyethylene Terephthalate Market Size faces restraints from fluctuating raw material prices linked to crude oil volatility, which impacts production costs. Environmental concerns over plastic waste and stricter government regulations on single-use plastics also limit market growth. Inadequate recycling infrastructure in certain regions further hinders the adoption of sustainable PET.

Market Segmentation

The India Polyethylene Terephthalate Market share is classified into source type and end user industry.

- The virgin PET segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Polyethylene Terephthalate Market Size is segmented by source type into virgin PET, recycled PET, and other. Among these, the virgin PET segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Virgin PET dominates the market because it offers high purity, uniform quality, and excellent mechanical and barrier properties required for food and beverage packaging. Beverage manufacturers prefer virgin PET to meet strict food safety and regulatory standards. Additionally, the large-scale polyester textile industry relies on virgin PET for consistent fiber quality. Limited collection efficiency and processing capacity for recycled PET further restrict its widespread adoption, reinforcing the dominance of virgin PET in India.

- The industrial and machinery segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Polyethylene Terephthalate Market Size is segmented by end user industry into automotive, building and construction, electrical and electronics, industrial and machinery, and other. Among these, the industrial and machinery segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The industrial and machinery segment dominates the market due to PET’s wide application in strapping, protective films, sheets, and industrial packaging solutions. Its high tensile strength, dimensional stability, and resistance to chemicals make it suitable for heavy-duty and continuous-use environments. Rapid growth of manufacturing, logistics, and warehousing activities in India further increases demand for PET-based industrial materials, reinforcing this segment’s leading position in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Polyethylene Terephthalate Market Size , along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Indorama Ventures

- Reliance Industries Limited

- Dhunseri Petrochem (IVL Dhunseri)

- JBF Industries

- Ester Industries

- Toray Industries

- Nan Ya Plastics Corporation

- SABIC

- BASF SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Polyethylene Terephthalate Market Size based on the below-mentioned segments:

India Polyethylene Terephthalate Market, By Source Type

- Virgin PET

- Recycled PET

- Other

India Polyethylene Terephthalate Market, By End User Industry

- Automotive

- Building and Construction

- Electrical and Electronics

- Industrial and Machinery

- Other

Frequently Asked Questions (FAQ)

-

1. What is polyethylene terephthalate (PET)?PET is a lightweight, strong, and recyclable thermoplastic polymer widely used in packaging, bottles, films, and polyester fibers.

-

2. What is driving the growth of the PET market in India?Growth is driven by rising demand for packaged food and beverages, expansion of the textile industry, urbanization, and increasing preference for recyclable packaging materials.

-

3. Which segment dominates the India PET market by source type?Virgin PET dominates due to its superior quality, food-grade safety, and consistent performance in packaging and textile applications.

-

4. Which end-user industry leads the PET market in India?The industrial and machinery segment leads because of the extensive use of PET in strapping, films, sheets, and industrial packaging.

-

5. What are the key challenges faced by the PET market in India?Major challenges include crude oil price volatility, environmental concerns over plastic waste, and limited recycling infrastructure.

Need help to buy this report?