India Polycarbonate Market Size, Share, and COVID-19 Impact Analysis, By End-User Industry (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, and Others), By Product Type (Sheet, Film, and Other), and India Polycarbonate Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Polycarbonate Market Insights Forecasts to 2035

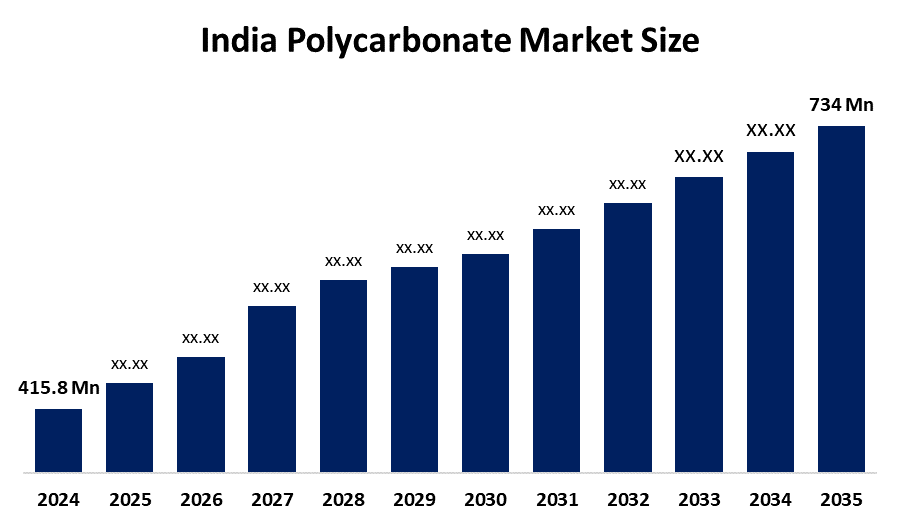

- The India Polycarbonate Market Size Was Estimated at USD 415.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.3% from 2025 to 2035

- The India Polycarbonate Market Size is Expected to Reach USD 734 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The India Polycarbonate Market Size is Anticipated to Reach USD 734 Million by 2035, Growing at a CAGR of 5.3% from 2025 to 2035. The India polycarbonate market is driven by rising demand in automotive, electrical & electronics, and construction sectors, growing use of lightweight, durable, and transparent materials, increasing infrastructure development, and expanding applications in consumer goods and packaging industries.

Market Overview

The India Polycarbonate Market Size refers to the production, distribution, and consumption of polycarbonate (PC), a high-performance thermoplastic known for its transparency, impact resistance, and lightweight properties. Polycarbonate is widely used in industries such as automotive, electrical & electronics, construction, and consumer goods. The market in India has witnessed significant growth due to increasing industrialization, rapid urbanization, and the rising demand for durable and versatile materials. Government initiatives promoting infrastructure development and the adoption of modern automotive and electronic solutions have further fueled market expansion.

Key trends driving the market include the growing use of polycarbonate in automotive components for lightweight and fuel-efficient vehicles, electrical & electronics applications such as connectors, housings, and lighting, and construction applications like roofing, glazing, and safety panels due to its strength and transparency. Additionally, the rise in consumer goods demand—including eyewear, sports equipment, and packaging—has expanded the material’s applications. Another emerging trend is sustainability efforts, with manufacturers increasingly focusing on recycling and developing bio-based polycarbonates to reduce environmental impact.

From a technological perspective, the market relies on injection molding and extrusion technologies. Injection molding allows complex polycarbonate components to be manufactured with high precision and efficiency, making it ideal for automotive and electronics applications. Extrusion technology, on the other hand, is used to produce sheets, films, and panels for construction and industrial uses. Advances in blending polycarbonate with other polymers have also enhanced material properties, including heat resistance, UV stability, and flame retardancy, driving adoption across multiple sectors.

Report Coverage

This research report categorizes the market for the India Polycarbonate Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India polycarbonate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India polycarbonate market.

India Polycarbonate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 415.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.3% |

| 2035 Value Projection: | USD 734 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Product Type ,By End-User Industry |

| Companies covered:: | SABIC India Pvt. Ltd., Covestro (India) Pvt. Ltd., LG Chem India Pvt. Ltd., Trinseo India Pvt. Ltd., Mitsubishi Engineering-Plastics Corporation, Teijin Limited, Bhansali Engineering Polymers Ltd., MG Polyplast Industries Pvt. Ltd., Gallina India Pvt. Ltd., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The lithium carbonate market in Japan is driven by increasing investments in renewable energy infrastructure, the quick expansion of energy storage devices and electric vehicles (EVs), and the growing need for high-performance lithium-ion batteries. Furthermore, government subsidies for environmentally friendly transportation, improvements in battery technology, and growing uses in electronics, medicine, and specialty glass are all driving market expansion in Japan.

Restraining Factors

The lithium carbonate market in Japan is mostly constrained by price volatility, complicated extraction procedures, a high reliance on imported raw materials, limited domestic production, and environmental issues related to mining and brine operations can all hinder market growth.

Market Segmentation

The India Polycarbonate Market share is classified into end-user industry and product type.

- The automotive segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Polycarbonate Market Size is segmented by end user industry into aerospace, automotive, building and construction, electrical and electronics, industrial and machinery, packaging, and others. Among these, the automotive segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The automotive segment dominates the market due to the material’s lightweight, high-impact resistance, and thermal stability, making it ideal for components like headlamps, windows, dashboards, and exterior panels. Rising automotive production, increasing demand for fuel-efficient and electric vehicles, and stringent safety regulations have further driven its adoption. Polycarbonate also allows design flexibility and durability, essential for modern vehicle aesthetics and performance. These factors collectively position the automotive sector as the largest end-user segment in India.

- The sheet segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Polycarbonate Market Size is segmented by product type into sheet, film, and other. Among these, the sheet segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The sheet segment dominates the market due to its widespread use in construction, automotive, and electrical applications. Polycarbonate sheets offer high impact resistance, transparency, and thermal stability, making them ideal for roofing, glazing, safety panels, and signage. The growing infrastructure and building construction activities in India have further boosted demand. Their durability, lightweight nature, and versatility as a glass alternative make polycarbonate sheets the preferred choice across industries, positioning this segment as the largest in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India polycarbonate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SABIC India Pvt. Ltd.

- Covestro (India) Pvt. Ltd.

- LG Chem India Pvt. Ltd.

- Trinseo India Pvt. Ltd.

- Mitsubishi Engineering-Plastics Corporation

- Teijin Limited

- Bhansali Engineering Polymers Ltd.

- MG Polyplast Industries Pvt. Ltd.

- Gallina India Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Polycarbonate Market Size based on the below-mentioned segments:

India Polycarbonate Market, By End-User Industry

- Aerospace

- Automotive

- Building and Construction

- Electrical and Electronics

- Industrial and Machinery

- Packaging

- Others

India Polycarbonate Market, By Product Type

- Sheet

- Film

- Other

Frequently Asked Questions (FAQ)

-

1. What is polycarbonate and where is it used?Polycarbonate is a high-performance thermoplastic known for its transparency, impact resistance, and lightweight properties. It is used in automotive components, construction (sheets and glazing), electrical & electronics, packaging, and consumer goods.

-

2. Which segment dominates the India polycarbonate market?The automotive segment dominates due to polycarbonate’s use in headlamps, windows, dashboards, and exterior panels, driven by rising vehicle production and demand for lightweight, fuel-efficient vehicles

-

3. Which product type is most used in India?The sheet segment leads the market, primarily for construction, roofing, glazing, and safety panels, because of its durability, transparency, and versatility as a glass alternative.

-

4. What are the key growth drivers of the market?Market growth is driven by increasing automotive production, infrastructure development, rising demand for durable materials, and the expanding use of polycarbonate in electronics, packaging, and consumer goods.

Need help to buy this report?