India Polybutylene Terephthalate Market Size, Share, By Sales Channel (Direct/Institutional Sales, Retail Sales, and Other), By End-Use (Electronics and Appliances, Automotive and Others), India Polybutylene Terephthalate Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Polybutylene Terephthalate Market Insights Forecasts to 2035

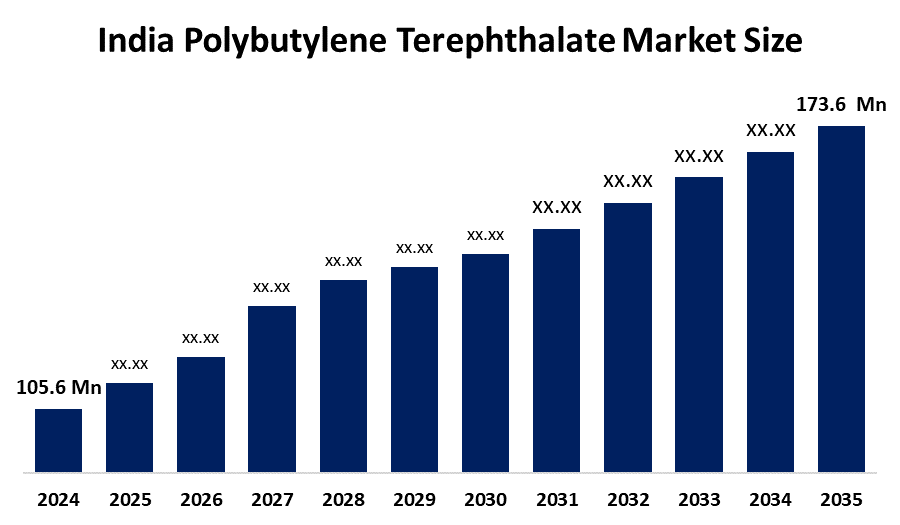

- India Polybutylene Terephthalate Market Size 2024: USD 105.6 Million

- India Polybutylene Terephthalate Market Size 2035: USD 173.6 Millon

- India Polybutylene Terephthalate Market CAGR 2024: 4.62%

- India Polybutylene Terephthalate Market Segments: Sales Channel and End-Use

Get more details on this report -

Polybutylene terephthalate (PBT) is a thermoplastic engineering polymer that belongs to the polyester family. This material demonstrates high strength while providing electrical insulation, chemical resistance and maintaining dimensional stability. Indian industries use PBT materials to manufacture automotive components and electrical connectors, electronic housings, switches, appliance parts and industrial machinery because PBT materials provide durability and heat resistance benefits.

The Budget proposals for the polymer sector support, according to industry groups, which requested government implementation of a Production-Linked Incentive (PLI) program for the plastics sector. The industry seeks to enhance its competitiveness while expanding production capacity and boosting exports of high-performance polymers, which include PBT.

India’s PBT market will experience strong growth opportunities because of electric vehicle adoption, electronics manufacturing growth and increasing demand for lightweight engineering plastics, Make-in-India programs and growing use of high-performance recyclable polymer materials.

India Polybutylene Terephthalate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 105.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.62% |

| 2035 Value Projection: | USD 173.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Sales Channel ,By End-Use |

| Companies covered:: | Ester Industries Ltd., BASF India Ltd., Toray Industries India, SABIC India Pvt Ltd., Lanxess Performance Materials India, Dainichi Color India Pvt Ltd., DuPont India, Celanese Corporation, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysi |

Get more details on this report -

Market Dynamics of the India Polybutylene Terephthalate Market:

The India Polybutylene Terephthalate (PBT) Market Size is driven by the growing demand from the automotive, electrical, and electronics industries due to its excellent mechanical strength, thermal stability, and chemical resistance. Rapid industrialization, increasing vehicle production, expansion of consumer electronics manufacturing, and rising adoption of lightweight, high-performance engineering plastics further accelerate market growth across diverse end-use sectors.

The India Polybutylene Terephthalate Market Size is restrained by the volatility in raw material prices, dependence on petrochemical feedstocks, and competition from alternative engineering plastics. Environmental concerns and recycling challenges also limit wider adoption.

The future of the India Polybutylene Terephthalate Market Size is bright and promising, with rising demand from electric vehicles, consumer electronics, renewable energy components, and expanding domestic manufacturing, supported by infrastructure growth and increasing preference for lightweight, high-performance engineering plastics.

Market Segmentation

The India Polybutylene Terephthalate Market share is classified into sales channels and end-use.

By Sales Channel:

The India Polybutylene Terephthalate Market Size is divided by sales channel type into direct/institutional sales, retail sales, and other. Among these, the direct/institutional sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The Direct/Institutional Sales segment is dominant owing to bulk procurement by OEMs and industrial buyers, long-term supply contracts, cost efficiency, and strong manufacturer–client relationships.

By End-Use:

The India Polybutylene Terephthalate Market Size is divided by end-use into electronics and appliances, automotive and others. Among these, the electronics and appliances segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to rising consumer electronics demand, rapid urbanization, increasing household appliance adoption, and continuous technological advancements, driving consistent product consumption.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Polybutylene Terephthalate Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Polybutylene Terephthalate Market:

- Ester Industries Ltd.

- BASF India Ltd.

- Toray Industries India

- SABIC India Pvt Ltd.

- Lanxess Performance Materials India

- Dainichi Color India Pvt Ltd.

- DuPont India

- Celanese Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Polybutylene Terephthalate Market Size based on the below-mentioned segments:

India Polybutylene Terephthalate Market, By Sales Channel

- Direct/Institutional Sales

- Retail Sales

- Other

India Polybutylene Terephthalate Market, By End-Use

- Electronics and Appliances

- Automotive

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India polybutylene terephthalate market size?A: India polybutylene terephthalate market is expected to grow from USD 105.6 million in 2024 to USD 173.6 million by 2035, growing at a CAGR of 4.62% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growing demand from the automotive, electrical, and electronics industries due to its excellent mechanical strength, thermal stability, and chemical resistance. Rapid industrialization, increasing vehicle production, expansion of consumer electronics manufacturing, and rising adoption of lightweight, high-performance engineering plastics further accelerate market growth across diverse end-use sectors.

-

Q: What factors restrain the India polybutylene terephthalate market?A: Constraints include the volatility in raw material prices, dependence on petrochemical feedstocks, and competition from alternative engineering plastics. Environmental concerns and recycling challenges also limit wider adoption.

-

Q: Who are the key players in the India polybutylene terephthalate market?A: Key companies include Ester Industries Ltd., BASF India Ltd., Toray Industries India, SABIC India Pvt Ltd., Lanxess Performance Materials India, Dainichi Color India Pvt Ltd., DuPont India, Celanese Corporation, and Others.

Need help to buy this report?