India Polyamide Market Size, Share, By Type (Aliphatic Polyamides And Aromatic Polyamides), By Application (Polyamide Fibers & Films And Engineering Plastics), And India Polyamide Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Polyamide Market Insights Forecasts to 2035

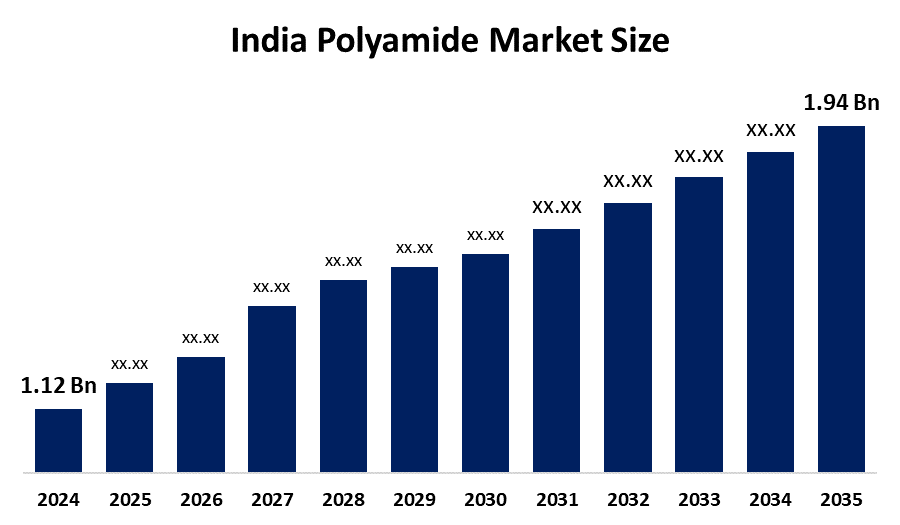

- India Polyamide Market Size 2024: USD 1.12 Bn

- India Polyamide Market Size 2035: USD 1.94 Bn

- India Polyamide Market CAGR 2024: 5.12%

- India Polyamide Market Segments: Type and Application

Get more details on this report -

The India Polyamide Market Size includes the manufacture, distribution, and application of synthetic polymers known as polyamide or nylon, which have an amide linkage in their molecular structure. In addition to providing the aesthetic appearance of high mechanical strength, thermal stability, chemical resistance, and other properties of a durable lightweight material for many industries, these materials support many levels of performance for numerous types of industry applications including automotive, electronic, textiles, packaging, consumer goods, and engineering plastics.

The polyamide in India are backed by government support, including the Make in India and sector-specific incentives such as the Production Linked Incentive (PLI) Scheme promoting domestic manufacturing and industrial growth. the government aims for 30% of new vehicle sales to be electric by 2030, a shift that encourages use of lightweight polymers including polyamides in electric vehicles for battery casings, connectors, and other components to improve efficiency and reduce weight.

As technology advances, India’s polyamide providers are now using specialty grades with superior mechanical, thermal, and chemical properties, to develop an extensive range of specialized applications to improve the performance of polyamide formulations. Research and development efforts will be directed at specialty polyamides with improved performance alternatives available through the innovation of application areas including hydrogen fuel cells and high-growth applications including electronics and aerospace, thereby creating an even broader technology base in the field of polyamide development in India.

India Polyamide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.12 Bn |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.12% |

| 2035 Value Projection: | USD 1.94 Bn |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application |

| Companies covered:: | BASF India Ltd., Toray Industries India Limited, UBE Industries India Private Ltd., Ascend Performance Materials India Pvt Ltd., Domo Engineering Plastics India Pvt Ltd., Arkema Chemical India Pvt Ltd., Solvay Specialities India Pvt Ltd., Century Enka Limited, Gujarat State Fertilizers & Chemicals Limited, Sarla Performance Fibers Ltd., All Around Polymer, Macro Polymers Pvt. Ltd., Synpol Products Pvt. Ltd., Ester Industries Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Polyamide Market:

The India Polyamide Market Size is driven by the rapid expansion in the automotive sector, rising vehicle production, increasing adoption of electric vehicles, demand for lightweight and high-strength materials, growth in electrical and electronics industries, demand for polyamides due to their excellent electrical insulation and durability, infrastructure development and increased consumer spending on durable goods contribute to expanding applications.

The India Polyamide Market Size is restrained by the raw material price volatility, high production costs and profit margins for manufacturers, competition from alternative polymers poses market pressure, global supply chain fluctuations, cost and supply uncertainties, and complex regulatory and sustainability compliance requirements.

The future of India Polyamide Market Size is bright and promising, with versatile opportunities emerging from the demand for bio-based polyamides and recycled materials continues to increase due to environmental regulations and consumer preferences. Advanced manufacturing techniques that incorporate polyamide materials provide new design opportunities and significantly shorten production timeframes, allowing companies to rapidly develop specialty and precision components. Continued penetration of electric vehicles and smart electronics into mass-market will create new application spaces for polymers; therefore, creating a robust environment for long-term growth of polyamide.

Market Segmentation

The India Polyamide Market share is classified into type and application.

By Type:

The India polyamide market is divided by type into aliphatic polyamides and aromatic polyamides. Among these, the aliphatic polyamides segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High strength-to-weight ratio, durable action, cost effectiveness, rapid growth of Indian automotive sector, and increasing industrial machinery applications all contribute to the aliphatic polyamide segment's largest share and higher spending on polyamide when compared to other type.

By Application:

The India polyamide market is divided by application into polyamide fibers & films and engineering plastics. Among these, the polyamide fibers & films segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The polyamide fibers & films segment dominates because of high demand for automotive, electrical, and industrial applications, shift towards light weighting in vehicles, rapid industrialization, and strong demand for durable electric vehicles.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India polyamide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Polyamide Market:

- BASF India Ltd.

- Toray Industries India Limited

- UBE Industries India Private Ltd.

- Ascend Performance Materials India Pvt Ltd.

- Domo Engineering Plastics India Pvt Ltd.

- Arkema Chemical India Pvt Ltd.

- Solvay Specialities India Pvt Ltd.

- Century Enka Limited

- Gujarat State Fertilizers & Chemicals Limited

- Sarla Performance Fibers Ltd.

- All Around Polymer

- Macro Polymers Pvt. Ltd.

- Synpol Products Pvt. Ltd.

- Ester Industries Ltd.

- Others

Recent Developments in India Polyamide Market:

In September 2025, BASF launched Ultramid H33 L, a unique thermoplastic polyamide with high water permeability for artificial sausage casings, gaining traction in the Indian textile and automotive supply chains.

In March 2025, JPFL Films launched Biaxially Oriented Polyamide nylon films in India, marking a significant step in providing advanced flexible packaging materials.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India polyamide market based on the below-mentioned segments:

India Polyamide Market, By Type

- Aliphatic Polyamides

- Aromatic Polyamides

India Polyamide Market, By Application

- Polyamide Fibers & Films

- Engineering Plastics

Frequently Asked Questions (FAQ)

-

Q: What is the India polyamide market size?A: India polyamide market is expected to grow from USD 1.12 billion in 2024 to USD 1.94 billion by 2035, growing at a CAGR of 5.12% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rapid expansion in the automotive sector, rising vehicle production, increasing adoption of electric vehicles, demand for lightweight and high-strength materials, growth in electrical and electronics industries, demand for polyamides due to their excellent electrical insulation and durability, infrastructure development and increased consumer spending on durable goods contribute to expanding applications.

-

Q: What factors restrain the India polyamide market?A: Constraints include the raw material price volatility, high production costs and profit margins for manufacturers, competition from alternative polymers poses market pressure, global supply chain fluctuations, cost and supply uncertainties, and complex regulatory and sustainability compliance requirements.

-

Q: How is the market segmented by type?A: The market is segmented into aliphatic polyamides and aromatic polyamides.

-

Q: Who are the key players in the India polyamide market?A: Key companies include BASF India Ltd., Toray Industries India Limited, UBE Industries India Private Ltd., Ascend Performance Materials India Pvt Ltd., Domo Engineering Plastics India Pvt Ltd., Arkema Chemical India Pvt Ltd., Solvay Specialities India Pvt Ltd., Century Enka Limited, Gujarat State Fertilizers & Chemicals Limited, Sarla Performance Fibers Ltd., All Around Polymer, Macro Polymers Pvt. Ltd., Synpol Products Pvt. Ltd., Ester Industries Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?