India Plastic Recycling Market Size, Share, By Technology (Conventional Recycling Technologies And Advanced Recycling Technologies), By End Use (Packaging, Construction, Automotive, Textiles, Electronics, And Consumer Goods), And India Plastic Recycling Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Plastic Recycling Market Insights Forecasts to 2035

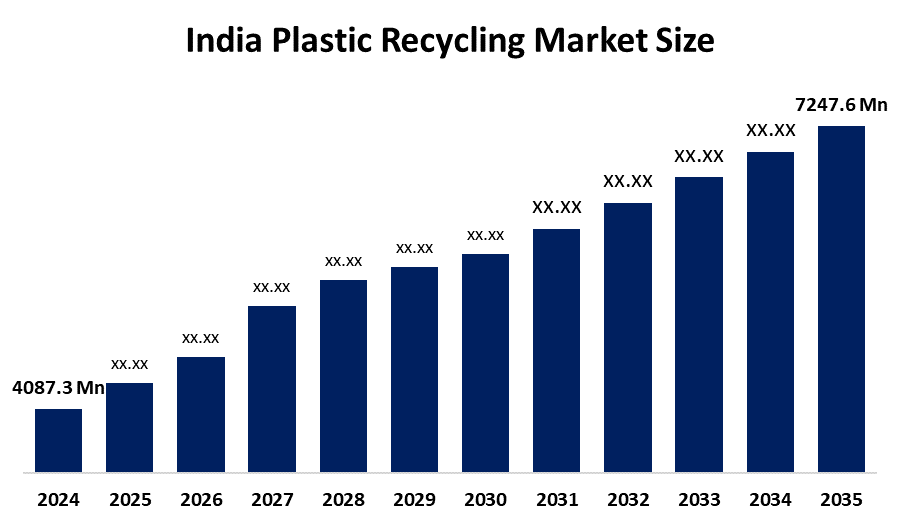

- India Plastic Recycling Market Size 2024: USD 4087.3 Mn

- India Plastic Recycling Market Size 2035: USD 7247.6 Mn

- India Plastic Recycling Market CAGR 2024: 5.35%

- India Plastic Recycling Market Segments: Technology and End Use

Get more details on this report -

The India plastic recycling market includes all aspects of the economy that deal with collecting, treating and recycling waste plastic, and turning it back into new plastic products or raw materials to be used again, without sending it to landfills or being incinerated. It is an important area of India’s ongoing move towards a circular economy and will help solve the country’s growing problem of poor waste management and the impact of plastic on the environment. The activities performed can range from collecting waste plastic, to separating different types of plastics, sorting them out, recycling plastics using mechanical and chemical methods, and producing new material that can be fed back into manufacturing processes.

The plastic recycling in India are backed by government support, including the Plastic Waste Management Rules, which include a comprehensive Extended Producer Responsibility (EPR) framework. Under EPR, producers, importers, and brand owners are mandated to ensure a certain proportion of the plastic they place on the market is collected and recycled, effectively making them responsible for end-of-life management of their products.

As technology advances, India’s plastic recycling providers are now using artificial intelligence-based sorting systems that utilize sensors and machine learning to correctly identify and separate various polymer types. Recyclers also utilize advanced mechanical recycling technologies, smart waste collection systems taking advantage of IoT for optimized routing and real-time fill level monitoring, and developing chemical recycling techniques to assist with mixed plastic streams. The development of these technologies has enabled recyclers to increase their throughput, improve their finished products quality, and broaden the pallet of plastic types that can be recycled economically.

India Plastic Recycling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4087.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.35% |

| 2035 Value Projection: | USD 7247.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 163 |

| Segments covered: | By Technology,By End Use |

| Companies covered:: | Gravita India Limited, Ganesha Ecosphere Ltd., The Shakti Plastic Industries, Banyan Nation, Srichakra Polyplast, Pashupati Group, Gem Enviro Management Ltd., Jagriti Polymers, Pondy Oxides & Chemicals Ltd., Saahas Zero Waste, Deshwal Waste Management, Antony Waste Handling Cell Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Plastic Recycling Market:

The India plastic recycling market is driven by the growing environmental awareness among consumers and businesses, increased demand for sustainable materials and practices, regulatory mandates such as EPR and recycled content requirements, rising corporate sustainability commitments, expansion of recycling technologies, increasing industry collaboration to integrate informal waste collectors into formal value chains, and rising need to manage the large volumes of municipal solid waste generated by India’s expanding population.

The India plastic recycling market is restrained by the inadequate collection and segregation infrastructure, low-quality feedstock for recyclers, increased operational costs, dominance of informal recycling, inconsistent product quality, and high capital requirements for advanced recycling facilities.

The future of India plastic recycling market is bright and promising, with versatile opportunities emerging from the implementation of EPR and recycled content regulations generates continued demand for recycled plastic, thus providing consistent market signals favorable to attracting investment. Technological innovations, especially in the area of chemical recycling, allow the ability to recycle plastics which have been previously un-recyclable, opening the possibility to feed a larger alternative waste stream into the system. Increased opportunity for the integration of both the formal and informal sectors can increase material feedstock availability and create jobs while increasing recycling rates.

Market Segmentation

The India Plastic Recycling Market share is classified into technology and end use.

By Technology:

The India plastic recycling market is divided by technology into conventional recycling technologies and advanced recycling technologies. Among these, the conventional recycling technologies segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Low capital expenditure for high-tech chemical methods, well established infrastructure, high efficiency for PET, and produce low carbon emissions with less energy-intensive all contribute to the conventional recycling technologies segment's largest share and higher spending on plastic recycling when compared to other technology.

By End Use:

The India plastic recycling market is divided by end use into packaging, construction, automotive, textiles, electronics, and consumer goods. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The packaging segment dominates because of high volume of single-use plastics from the food sectors, growth in e-commerce platforms, strict government regulations, and growing consumer demand for sustainable and circular packaging solutions in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India plastic recycling market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Plastic Recycling Market:

- Gravita India Limited

- Ganesha Ecosphere Ltd.

- The Shakti Plastic Industries

- Banyan Nation

- Srichakra Polyplast

- Pashupati Group

- Gem Enviro Management Ltd.

- Jagriti Polymers

- Pondy Oxides & Chemicals Ltd.

- Saahas Zero Waste

- Deshwal Waste Management

- Antony Waste Handling Cell Ltd.

- Others

Recent Developments in India Plastic Recycling Market:

In January 2026, Avro India launched India’s largest flexible plastic recycling plant in Ghaziabad through its subsidiary, AVRO Recycling Limited, with an initial investment of Rs25 crore.

In January 2025, a Chandigarh-based start-up announced the launch of its patented Generation VI chemical recycling technology. This technology converts hard-to-recycle, contaminated plastics into food-grade polymers and sustainable fuels.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India plastic recycling market based on the below-mentioned segments:

India Plastic Recycling Market, By Technology

- Conventional Recycling Technologies

- Advanced Recycling Technologies

India Plastic Recycling Market, By End Use

- Packaging

- Construction

- Automotive

- Textiles

- Electronics

- Consumer Goods

Frequently Asked Questions (FAQ)

-

Q: What is the India plastic recycling market size?A: India plastic recycling market is expected to grow from USD 4087.3 million in 2024 to USD 7247.6 million by 2035, growing at a CAGR of 5.35% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growing environmental awareness among consumers and businesses, increased demand for sustainable materials and practices, regulatory mandates such as EPR and recycled content requirements, rising corporate sustainability commitments, expansion of recycling technologies, increasing industry collaboration to integrate informal waste collectors into formal value chains, and rising need to manage the large volumes of municipal solid waste generated by India’s expanding population.

-

Q: What factors restrain the India plastic recycling market?A: Constraints include the inadequate collection and segregation infrastructure, low-quality feedstock for recyclers, increased operational costs, dominance of informal recycling, inconsistent product quality, and high capital requirements for advanced recycling facilities.

-

Q: How is the market segmented by technology?A: The market is segmented into conventional recycling technologies and advanced recycling technologies.

-

Q: Who are the key players in the India plastic recycling market?A: Key companies include Gravita India Limited, Ganesha Ecosphere Ltd., The Shakti Plastic Industries, Banyan Nation, Srichakra Polyplast, Pashupati Group, Gem Enviro Management Ltd., Jagriti Polymers, Pondy Oxides & Chemicals Ltd., Saahas Zero Waste, Deshwal Waste Management, Antony Waste Handling Cell Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?