India Plastic additives Market Size, Share, and COVID-19 Impact Analysis, By Additives Type (Toys, Hobby and DIY, Furniture and Appliances, Food and Personal Care, Electronics and Media, Fashion, and Others), By Plastic Type (Business-to-Business, Business-to-Consumer, and Consumer-to-Consumer), and India Plastic additives Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsIndia Plastic Additives Market Size Insights Forecasts to 2035

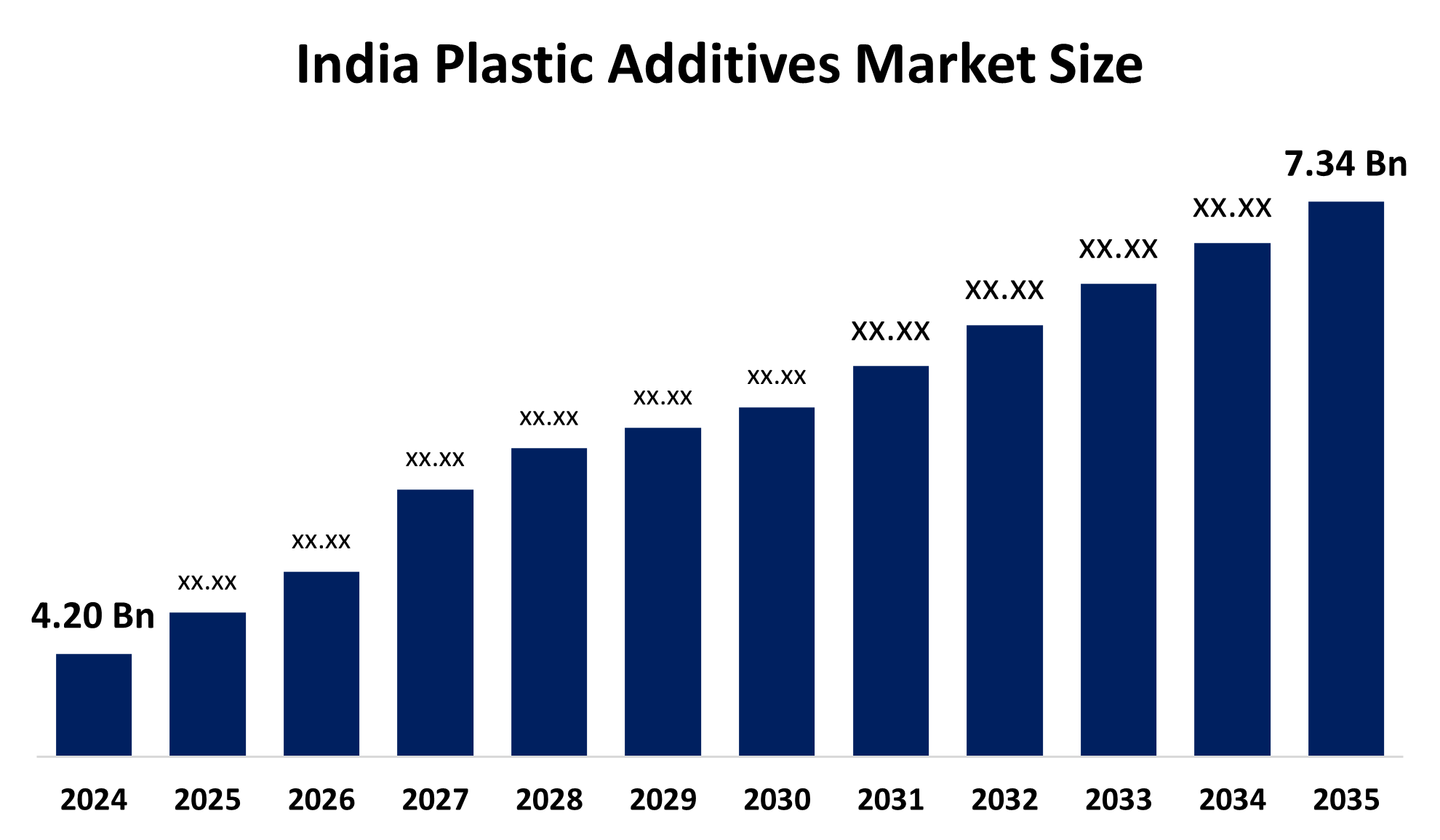

- The India Plastic Additives Market Size Was Estimated at USD 4.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.21% from 2025 to 2035

- The India Plastic additives Market Size is Expected to Reach USD 7.34 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The India Plastic Additives Market Size is Anticipated to Reach USD 7.34 Billion by 2035, Growing at a CAGR of 5.21% from 2025 to 2035. The plastic additives market in India is driven by the increasing demand for packaging, automotive, and construction applications; rapid urbanization; growing manufacturing activities; increasing consumption of polymers; and technological advancements in high-performance and sustainable additive solutions.

Market Overview

The India Plastic Additives Market includes specialty chemical compounds that are mixed with base polymers to improve physical properties like strength, flexibility, hardness, flame resistance, UV resistance, and ease of processing. These additives help turn basic plastics into high-performance plastics that can be used in more demanding applications. The production process involves petrochemical raw materials like ethylene, propylene, benzene, and other chemical intermediates, besides mineral fillers and specialty compounds. Crude oil price fluctuations and raw material availability have a direct impact on production costs and material availability.

Demand is increasing in the packaging, automotive, construction, agriculture, electrical and electronics, and consumer goods industries. Additives increase storage life and safety in packaging, provide lightness and heat resistance in vehicles, and improve durability in construction materials. Urbanization, infrastructure development, and consumption of packaged foods are fueling the growth of the market. The market is moving towards more sustainable and biodegradable additives, recyclable plastics, and high-performance materials that are more in line with environmental goals. Opportunities are also being created in the electric vehicle, renewable energy, and flexible packaging sectors. Government initiatives like the Production Linked Incentive (PLI) scheme for chemicals, Make in India, Plastic Waste Management Rules, Swachh Bharat Mission, and support for recycling infrastructure and petrochemical parks are boosting local manufacturing, sustainability, and investment in the sector.

Report Coverage

This research report categorizes the market for the India Plastic Additives Market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India plastic additives market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India plastic additives market.

India Plastic Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.20 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.21% |

| 2035 Value Projection: | USD 7.34 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Additives Type, By Plastic Type |

| Companies covered:: | BASF SE, Clariant AG, The Dow Chemical Company, Akzo Nobel N.V., Lanxess AG, Songwon Industrial Co. Ltd., Baerlocher India Additives, Goldstab Organics, Platinum Industries Ltd, Fine Organics, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The India Plastic Additives Market is driven by the increasing demand in the packaging, automotive, construction, agriculture, and electrical industries. The increasing urbanization, infrastructure development, and development of the FMCG and e-commerce packaging industry are driving the growth of plastic additives. The automotive industry's focus on developing light-weight and fuel-efficient vehicles is boosting the demand for performance-enhancing additives. The increasing number of renewable energy installations and the development of electric vehicles are further driving the demand for specialized plastics. Advances in technology related to polymer processing, as well as the growing need for heat-resistant and UV-stable plastics, are also driving the market. In addition, the development of the domestic manufacturing industry and the increased investment in the specialty chemicals industry are improving production capacity.

Restraining Factors

The India Plastic Additives Market encounters obstacles because crude oil price fluctuations create direct effects on petrochemical feedstock prices. The market demand for certain traditional additives will decrease because of strict environmental rules that control plastic usage and rising public concerns about plastic waste. The presence of affordable imported products creates pricing challenges for domestic production companies. The need to follow changing environmental protection and safety regulations will lead to higher operational expenses. The dual impact of raw material supply changes and economic downturns that affect construction and automotive sectors will create additional obstacles to ongoing market growth.

Market Segmentation

The India plastic additives market share is classified into additives type and plastic type.

- The plasticizers segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Plastic Additives Market is segmented by additives type into plasticizers, stabilizers, flame retardants, impact modifiers, and others. Among these, the Plasticizers segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment market growth due to high consumer demand for PVC in the construction, infrastructure, and real estate sectors. The demand for flexible PVC in the form of pipes, flooring, roofing membranes, and wall coverings has been increasing and has been a major contributor to the growth of the plasticizers market. The growth in the wire and cable industry, fueled by power transmission and renewable energy projects, has also contributed to the demand for plasticizers. The automotive industry has been a contributor to the plasticizers market through flexible interiors, dashboards, and coatings.

- The commodity plastic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The India Plastic Additives Market is categorized by plastic type into commodity plastic, engineering plastic, and high performance plastic. Among these, the commodity plastic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This segment is experiencing rapid growth demand for polyethylene, polypropylene, and PVC in the packaging, construction, agriculture, and consumer goods sectors. The factors of rapid urbanization, infrastructure development, and increased consumption of FMCG products are driving large-scale production and the use of additives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Plastic Additives Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Clariant AG

- The Dow Chemical Company

- Akzo Nobel N.V.

- Lanxess AG

- Songwon Industrial Co. Ltd.

- Baerlocher India Additives

- Goldstab Organics

- Platinum Industries Ltd

- Fine Organics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Plastic Additives Market based on the below-mentioned segments:

India plastic additives Market, By Additives Type

- Plasticizers

- Stabilizers

- Flame Retardants

- Impact Modifiers

- Others

India Plastic additives Market, By Plastic Type

- Commodity Plastic

- Engineering Plastic

- High Performance Plastic

Frequently Asked Questions (FAQ)

-

Q: What is the India plastic additives market size??A: India plastic additives market size is expected to grow from USD 4.20 billion in 2024 to USD 7.34 billion by 2035, growing at a CAGR of 5.21% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Growth is driven by expanding e-commerce, rising internet and smartphone penetration, low startup costs, digital payment adoption, improved logistics, and increasing entrepreneurial interest in online businesses.

-

Q: What factors restrain the India plastic additives market?A: The market faces restrain such as intense competition, thin profit margins, supplier dependency, delivery delays, high return rates, regulatory complexities, and reduced consumer spending during economic slowdowns.

-

Q: How is the market segmented by product?A: The market is segmented into plasticizers, stabilizers, flame retardants, impact modifiers, antioxidants, and other specialty additives.

-

Q: Who are the key players in the India plastic additives market?A: Key players include BASF SE, Clariant AG, Dow, LANXESS AG, Songwon Industrial, Baerlocher India Additives, Goldstab Organics, Platinum Industries Ltd., Fine Organics, and other domestic specialty chemical manufacturers.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?