India Phthalic Anhydride Market Size, Share, By Type (Ortho-Phthalic Anhydride, Isophthalic Anhydride, Terephthalic Anhydride, and Others), By Sales Channel (Direct Sale and Indirect Sale), India Phthalic Anhydride Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Phthalic Anhydride Market Insights Forecasts to 2035

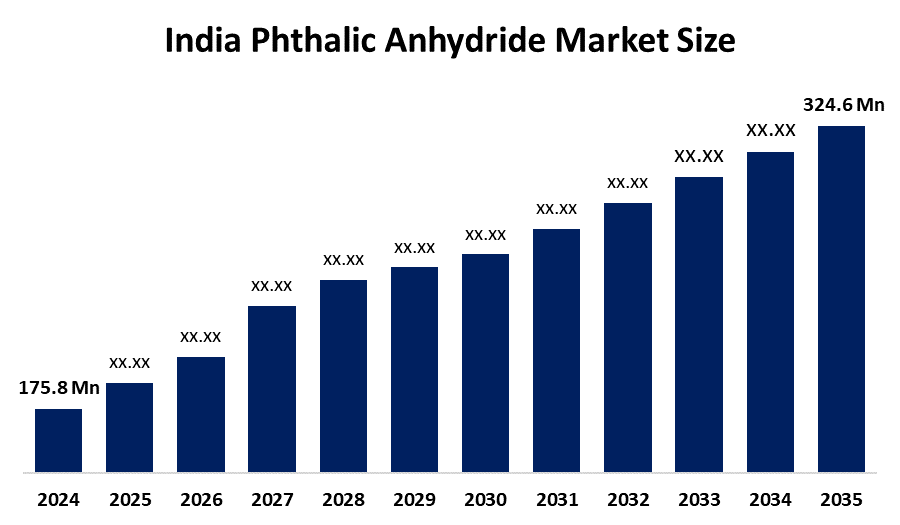

- India Phthalic Anhydride Market Size 2024: USD 175.8Million

- India Phthalic Anhydride Market Size 2035: USD 324.6Million

- India Phthalic Anhydride Market CAGR 2024: 5.73%

- India Phthalic Anhydride Market Segments: Type and Sales Channel

Get more details on this report -

The India Phthalic Anhydride Market Size refers to the domestic production, distribution, and consumption of phthalic anhydride, which serves primarily as a component for plasticizers and resins, paints and coatings and construction-related applications.

The production operations at I G Petrochemicals Limited's new brownfield manufacturing facility, PA-5, in Taloja Industrial Area, Maharashtra, began in February 2024. The facility operates at a production capacity that reaches 53,000 MTPA of phthalic anhydride.

The chemical and petrochemical sector receives momentum from government initiatives, which include Production-Linked Incentive (PLI) programs and Remission of Duties and Taxes on Exported Products (RoDTEP) and investment projects that establish Chemicals and Petrochemicals Investment Regions (CPIRs) and plastic parks. This development creates benefits for markets that utilize phthalic anhydride through resins and plasticizers although those markets do not target the compound.

The India Phthalic Anhydride Market Size will develop future business prospects because plasticizers and construction materials, coatings and resins will increase their demand. This growth will occur because infrastructure projects, housing developments and domestic manufacturing facilities will expand.

India Phthalic Anhydride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 175.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.73% |

| 2035 Value Projection: | USD 324.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Sales |

| Companies covered:: | IG Petrochemicals Limited, Thirumalai Chemicals Ltd., SI Group - India Private Limited, BASF India Limited, LGC Petrochemical India Pvt. Ltd., OCI Company Limited, KLJ Group, Vizag Chemical International, Aekyung Petrochemical Co., Ltd., Sanjay Chemicals India Pvt Ltd.,and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Phthalic Anhydride Market:

The India Phthalic Anhydride Market Size is driven by the demand from plasticizers together with the PVC, paints and coatings and construction sectors, which receive support from infrastructure development, housing growth and increased domestic chemical manufacturing capacity, driving industry growth.

The India Phthalic Anhydride Market Size is restrained by the production costs, together with the demand growth restrictions, experiencing an effect from volatile crude oil prices, environmental regulations and health concerns about phthalates and the presence of alternative products.

The future of India's phthalic anhydride market is bright and promising, with the construction sector, together with the plastics and coatings industries, which experience rising demand, and the increasing infrastructure investment, expanding domestic production capacity and supportive government policies, will drive long-term market growth.

Market Segmentation

The India Phthalic Anhydride Market share is classified into type and sales channel.

By Type:

The India Phthalic Anhydride Market Size is divided by type into ortho-phthalic anhydride, isophthalic anhydride, terephthalic anhydride, and others. Among these, the ortho-phthalic anhydride segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to its extensive use in plasticizers, alkyd resins, paints, coatings, and construction materials, driving high-volume and consistent industrial demand.

By Sales Channel:

The India Phthalic Anhydride Market Size is divided by sales channel into direct sales and indirect sales. Among these, the direct sale segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Large manufacturers, through long-term contracts, ensure cost efficiency, stable supply, consistent quality, and strong supplier–customer relationships.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Phthalic Anhydride Market Size , along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Phthalic Anhydride Market:

- IG Petrochemicals Limited

- Thirumalai Chemicals Ltd.

- SI Group - India Private Limited

- BASF India Limited

- LGC Petrochemical India Pvt. Ltd.

- OCI Company Limited

- KLJ Group

- Vizag Chemical International

- Aekyung Petrochemical Co., Ltd.

- Sanjay Chemicals India Pvt Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Phthalic Anhydride Market Size based on the below-mentioned segments:

India Phthalic Anhydride Market, By Type

- Ortho-Phthalic Anhydride

- Isophthalic Anhydride

- Terephthalic Anhydride

India Phthalic Anhydride Market, By Sales Channel

- Direct Sale

- Indirect Sale

Frequently Asked Questions (FAQ)

-

Q: What is the India phthalic anhydride market size?A: India phthalic anhydride market is expected to grow from USD 175.8 million in 2024 to USD 324.6 million by 2035, growing at a CAGR of 5.73% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the unpredictable nature of crude oil prices, together with the increasing market demand for natural gas-based feedstock, the implementation of strict environmental regulations, the supply chain disruptions and the industry's heavy reliance on imports, which create challenges that impede pricing stability and profitability for end-users.

-

Q: What factors restrain the India phthalic anhydride market?A: Constraints include the unpredictable nature of crude oil prices, together with the increasing market demand for natural gas-based feedstock, the implementation of strict environmental regulations, the supply chain disruptions and the industry's heavy reliance on imports, which create challenges that impede pricing stability and profitability for end-users.

-

Q: How is the market segmented by type?A: The market is segmented into ortho-phthalic anhydride, isophthalic anhydride, terephthalic anhydride, and others.

-

Q: Who are the key players in the India phthalic anhydride market?A: Key companies include IG Petrochemicals Limited, Thirumalai Chemicals Ltd., SI Group – India Private Limited, BASF India Limited, LGC Petrochemical India Pvt. Ltd., OCI Company Limited, KLJ Group, Vizag Chemical International, Aekyung Petrochemical Co., Ltd., Sanjay Chemicals India Pvt. Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?