India Petroleum Coke Market Size, Share, By Grade Type (Fuel Grade Coke And Calcined Petroleum Coke), By End Use (Cement Industry, Aluminium Industry, Power Generation, Steel Industry, And Others), And India Petroleum Coke Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Petroleum Coke Market Insights Forecasts to 2035

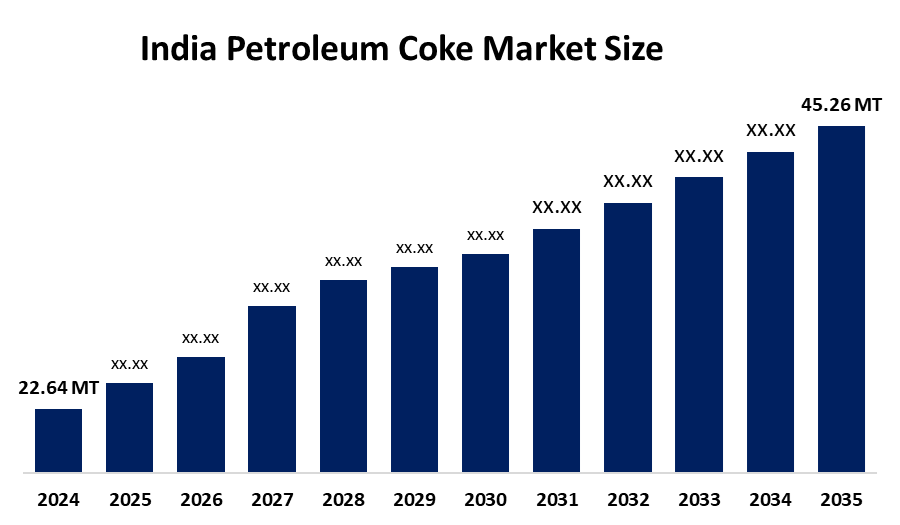

- India Petroleum Coke Market 2024: 22.64 Million Tonnes

- India Petroleum Coke Market Size 2035: 45.26 Million Tonnes

- India Petroleum Coke Market CAGR 2024: 6.5%

- India Petroleum Coke Market Segments: Grade Type and End Use

Get more details on this report -

The India petroleum coke market refers to a sector where petroleum coke is produced, sold, and consumed in India Petroleum coke is a solid carbon material produced as a by-product of the coking of heavy, residual oil at an oil refinery to upgrade the residual oils to lighter, more usable petroleum-based products. Petroleum Coke is valued in India because of its high calorific value and lower cost compared to other traditional fuels such as coal, making it a desired source of energy for cement manufacturing, electric power generation, lime kilns, gasification units and aluminium industries.

The petroleum coke in India are backed by government support, including the Directorate General of Foreign Trade (DGFT) import allocation policy for petroleum coke, which regulates quantities of Raw Petroleum Coke (RPC) and Calcined Petroleum Coke. DGFT set import limits allowing upto 1.9 million MT of RPC for CPC manufacturing and up to 0.8 million MT of CPC for the aluminium sector. This initiative helps balance environmental concerns with industrial feedstock needs, ensuring supply while aiming to control pollution from petcoke usage.

As technology advances, India’s petroleum coke providers are now using variety of ways to reduce the sulphur dioxide emissions associated with burning high sulphur petcoke fuel. Flue gas desulfurization systems and desulfurization technologies can help reduce these emissions in both power plants and provides another avenue for sending cleaner fuels to market, while promoting the transition to a different energy source. Upgrading refineries and digitally optimizing processes improves performance and product quality, while allowing for more flexible use of petroleum coke-derived products.

Market Dynamics of the India Petroleum Coke Market:

The India petroleum coke market is driven by the robust demand from the cement industry, high energy content and lower ash yield compared with coal, widely used by power generation sector, reliable and economical fuel, India’s expanding refinery capacity, strategic emphasis on energy security, broader economic growth and infrastructure development, and demand for energy-intensive production inputs like petroleum coke across multiple sectors.

The India petroleum coke market is restrained by the strict environmental concerns and regulatory scrutiny, high sulfur emissions from petcoke combustion, costly mitigation technologies, increasing operational expenses, volatility in crude oil refining patterns, production of high-value transport fuels over lower-margin byproducts, and import restrictions and quota controls can create supply uncertainties.

The future of India petroleum coke market is bright and promising, with versatile opportunities emerging from the use of low sulfur and low volatile green petroleum coke meet environmental sustainability objectives. The advancement of petcoke gasification technology into producing syngas and hydrogen presents a growth avenue that is connected to India’s long-term clean energy plans. Industrial growth continues in both primary metals and power sectors, and refiners are expected to grow their capacity as global energy dynamics change. These create opportunities for both increased domestic use and export for petroleum coke with the right capital investment to support emission control technologies along with the diversification of feedstock, India’s petroleum coke could have greater competitiveness and resiliency.

India Petroleum Coke Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 22.64 Million Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.5% |

| 2035 Value Projection: | 45.26 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Grade Type |

| Companies covered:: | Reliance Industries Limited, Indian Oil Corporation Limited, Nayara Energy Limited, Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, Rain Carbon Inc., Numaligarh Refinery Limited, Mangalore Refinery and Petrochemicals Ltd., HPCL-Mittal Energy Limited, Oxbow Corporation, Goa Carbon Limited, Digboi Carbon Private Limited, Brahmaputra Carbon Limited, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Petroleum Coke Market share is classified into grade type and end use.

By Grade Type:

The India petroleum coke market is divided by grade type into fuel grade coke and calcined petroleum coke. Among these, the fuel grade coke segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High demand from the cement industry, cost-effective fuel, high calorific value, competitive pricing compared to coal, and rapid expansion of India’s infrastructure and construction sectors all contribute to the fuel grade coke segment's largest share and higher spending on petroleum coke when compared to other grade type.

By End Use:

The India petroleum coke market is divided by end use into cement industry, aluminium industry, power generation, steel industry, and others. Among these, the cement industry segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The cement industry segment dominates because of cost effectiveness, high calorific fuel need, superior heat value, lower ask content compared to coal, and have maintained exemptions from certain import bans, allowing continued reliance on petcoke for production in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India petroleum coke market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Petroleum Coke Market:

- Reliance Industries Limited

- Indian Oil Corporation Limited

- Nayara Energy Limited

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited

- Rain Carbon Inc.

- Numaligarh Refinery Limited

- Mangalore Refinery and Petrochemicals Ltd.

- HPCL-Mittal Energy Limited

- Oxbow Corporation

- Goa Carbon Limited

- Digboi Carbon Private Limited

- Brahmaputra Carbon Limited

- Others

Recent Developments in India Petroleum Coke Market:

In February 2025, CAQM, the government authorized higher imports for the 2025-26 fiscal year. The quota for Raw Petroleum Coke for calcining was increased to 1.9 million tonnes per year, and Calcined Petroleum Coke for the aluminium industry was set at 0.8 million tonnes.

In February 2025, Reliance Industries Limited sharply increased its petcoke prices by INR 902/t month-on-month to INR 13,450/t, compared to INR 12,548/t in January 2025.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India petroleum coke market based on the below-mentioned segments

India Petroleum Coke Market, By Grade Type

- Fuel Grade Coke

- Calcined Petroleum Coke

India Petroleum Coke Market, By End Use

- Cement Industry

- Aluminium Industry

- Power Generation

- Steel Industry

- Others

Frequently Asked Questions (FAQ)

-

What is the India petroleum coke market size?India petroleum coke market is expected to grow from 22.64 million tonnes in 2024 to 45.26 million tonnes by 2035, growing at a CAGR of 6.5% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the robust demand from the cement industry, high energy content and lower ash yield compared with coal, widely used by power generation sector, reliable and economical fuel, India’s expanding refinery capacity, strategic emphasis on energy security, broader economic growth and infrastructure development, and demand for energy-intensive production inputs like petroleum coke across multiple sectors.

-

What factors restrain the India petroleum coke market?Constraints include the strict environmental concerns and regulatory scrutiny, high sulfur emissions from petcoke combustion, costly mitigation technologies, increasing operational expenses, volatility in crude oil refining patterns, production of high-value transport fuels over lower-margin byproducts, and import restrictions and quota controls can create supply uncertainties.

-

How is the market segmented by grade type?The market is segmented into fuel grade coke and calcined petroleum coke.

-

Who are the key players in the India petroleum coke market?Key companies include Reliance Industries Limited, Indian Oil Corporation Limited, Nayara Energy Limited, Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, Rain Carbon Inc., Numaligarh Refinery Limited, Mangalore Refinery and Petrochemicals Ltd., HPCL-Mittal Energy Limited, Oxbow Corporation, Goa Carbon Limited, Digboi Carbon Private Limited, Brahmaputra Carbon Limited, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?