India Paraxylene Market Size, Share, and COVID-19 Impact Analysis, By Application (Purified Terephthalic Acid, Dimethyl Terephthalate, and Other), By End-User Industry (Plastics, Textile, and Other), and India Paraxylene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Paraxylene Market Insights Forecasts to 2035

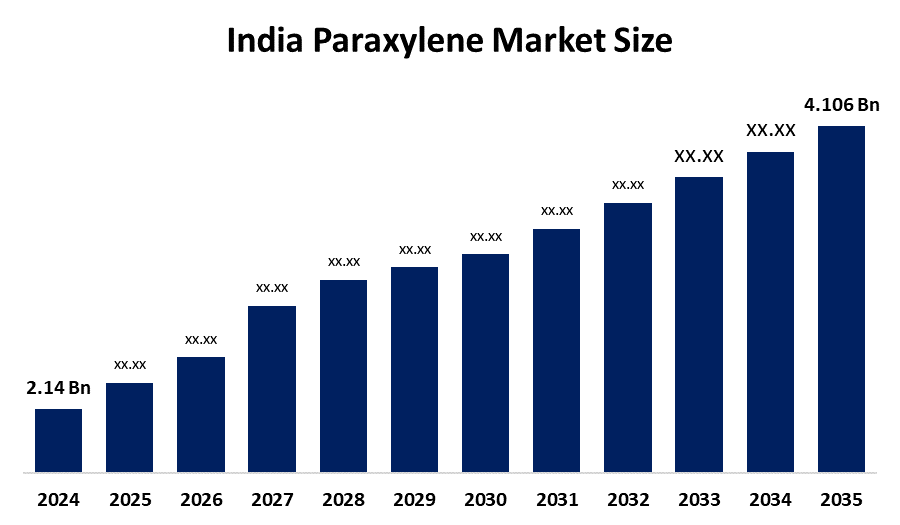

- The India Paraxylene Market Size Was Estimated at USD 2.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The India Paraxylene Market Size is Expected to Reach USD 4.106 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The India Paraxylene Market Size is Anticipated to Reach USD 4.106 Billion by 2035, Growing at a CAGR of 6.1% from 2025 to 2035. The India paraxylene market is driven by rising demand for purified terephthalic acid (PTA) in polyester production, growth in the textile and packaging industries, increasing PET bottle consumption, and expansion of downstream polyester fiber and resin manufacturing capacities.

Market Overview

Paraxylene (PX) is an aromatic hydrocarbon primarily used as a key feedstock to produce purified terephthalic acid (PTA), which is essential for polyester fiber, films, and PET bottle manufacturing. The India Paraxylene Market Size is witnessing strong growth due to increasing demand for polyester products in textiles, packaging, and beverage industries. Rising PET consumption in bottled beverages and growing domestic polyester production are driving PX demand. Additionally, expanding downstream manufacturing capacities, foreign investments in chemical processing, and the adoption of modern production technologies are further boosting market expansion, positioning India as an important player in the global PX supply chain.

Several key trends are shaping the India PX market. First, vertical integration of petrochemical and polyester plants is improving efficiency and reducing production costs. Second, sustainability initiatives encourage energy-efficient processes and the use of recycled PX, aligning with environmental regulations. Third, increased PET packaging adoption across beverages, pharmaceuticals, and personal care products is propelling PX consumption. Fourth, import dependence reduction is a priority, with domestic production ramping up to meet growing demand. On the technology front, advanced catalytic reforming and aromatics extraction technologies are enhancing PX yield and purity. Additionally, digital process monitoring and automation are reducing energy consumption and operational waste.

Government policies are strongly supporting market growth. Initiatives under Make in India and favorable tax incentives are encouraging domestic production of PX and PTA, attracting foreign investments and improving infrastructure. Policies promoting self-reliance reduce import dependency and strengthen the domestic petrochemical industry. With these technological advancements, sustainability initiatives, and government support, the India paraxylene market is poised for robust growth, meeting rising polyester demand while enhancing its competitive position in the global chemical sector.

Report Coverage

This research report categorizes the market for the India Paraxylene Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India paraxylene market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India paraxylene market.

India Paraxylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.14 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.1% |

| 2035 Value Projection: | USD 4.106 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Application , |

| Companies covered:: | Reliance Industries Limited, Indian Oil Corporation Limited, Indian Petrochemicals Corporation Limited (IPCL), Ridhdhi Sidhdhi Chemicals, Pon Pure Chemicals Group, Mangalore Refinery and Petrochemicals Limited (MRPL), ExxonMobil Corporation, Sinopec Group, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India Paraxylene Market Size is driven by rising demand for purified terephthalic acid (PTA), a key raw material for polyester fiber, films, and PET bottles. Growth in the textile and packaging industries, increasing consumption of PET in beverages and consumer goods, and expansion of downstream polyester manufacturing plants are major contributors. Additionally, government initiatives promoting domestic chemical production and foreign investments in petrochemical infrastructure support market growth. Adoption of advanced production technologies and focus on supply chain efficiency further enhance paraxylene production, fueling sustained market expansion.

Restraining Factors

The India Paraxylene Market Size faces restraints from high dependence on crude oil imports, leading to price volatility. Environmental regulations and stringent emission norms increase production costs. Fluctuating raw material availability, competition from alternative feedstocks, and the capital-intensive nature of PX production also limit market expansion, posing challenges for manufacturers in scaling operations efficiently.

Market Segmentation

The India Paraxylene Market share is classified into application and end-user industry.

- The purified terephthalic acid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Paraxylene Market Size is segmented by application into purified terephthalic acid, dimethyl terephthalate, and other. Among these, the purified terephthalic acid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The purified terephthalic acid (PTA) segment dominates the market because PX is mainly processed to produce PTA, a critical raw material for polyester fibers, films, and PET bottles. Rapid growth in the textile and packaging industries, along with increasing consumption of PET in beverages, pharmaceuticals, and consumer goods, has fueled PTA demand. Additionally, the expansion of domestic polyester manufacturing plants and investment in downstream production capacities ensures a consistent need for PTA, making it the largest and most influential segment in the paraxylene market.

- The textiles segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Paraxylene Market Size is segmented by end-user industry into plastics, textiles, and others. Among these, the textiles segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The textiles segment dominates the market because paraxylene is mainly converted into purified terephthalic acid (PTA), a crucial material for polyester fiber production used extensively in textiles. Rapid growth in domestic and export demand for polyester fabrics and garments drives consistent PTA consumption. Expansion of textile manufacturing units, increasing fashion and apparel markets, and government support for textile exports further strengthen this segment. Consequently, the textile industry remains the largest and most influential end-user of paraxylene in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Paraxylene Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Reliance Industries Limited

- Indian Oil Corporation Limited

- Indian Petrochemicals Corporation Limited (IPCL)

- Ridhdhi Sidhdhi Chemicals

- Pon Pure Chemicals Group

- Mangalore Refinery and Petrochemicals Limited (MRPL)

- ExxonMobil Corporation

- Sinopec Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Paraxylene Market Size based on the below-mentioned segments:

India Paraxylene Market, By Application

- Purified Terephthalic Acid

- Dimethyl Terephthalate

- Other

India Paraxylene Market, By End-User Industry

- Plastics

- Textile

- Other

Frequently Asked Questions (FAQ)

-

1. What is paraxylene used for in India?Paraxylene is mainly used to produce purified terephthalic acid (PTA), a key raw material for polyester fibers, films, and PET bottles.

-

2. Which industry is the largest consumer of paraxylene in India?The textile industry is the largest consumer due to high demand for polyester fibers in fabrics and garments.

-

3. What are the major growth drivers of the India paraxylene market?Growth is driven by rising polyester demand, increasing PET consumption, expansion of downstream manufacturing, and foreign investments in petrochemicals.

-

4. Who are the key players in the India paraxylene market?Major players include Reliance Industries, Indian Oil Corporation, IPCL, Ridhdhi Sidhdhi Chemicals, Pon Pure Chemicals, and MRPL.

-

5. What challenges does the India paraxylene market face?Challenges include crude oil price volatility, high import dependence, environmental regulations, and the capital-intensive nature of production.

Need help to buy this report?