India Open Banking Market Size, Share, and COVID-19 Impact Analysis, By Services (Banking & Capital Markets, Payments, Digital Currencies, and Value Added Services), By Deployment (Cloud and On-premise), By Distribution Channel (Bank Channels, App Markets, Distributors, and Aggregators), and India Open Banking Market, Insight, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialIndia Open Banking Market Size Insights Forecasts to 2035

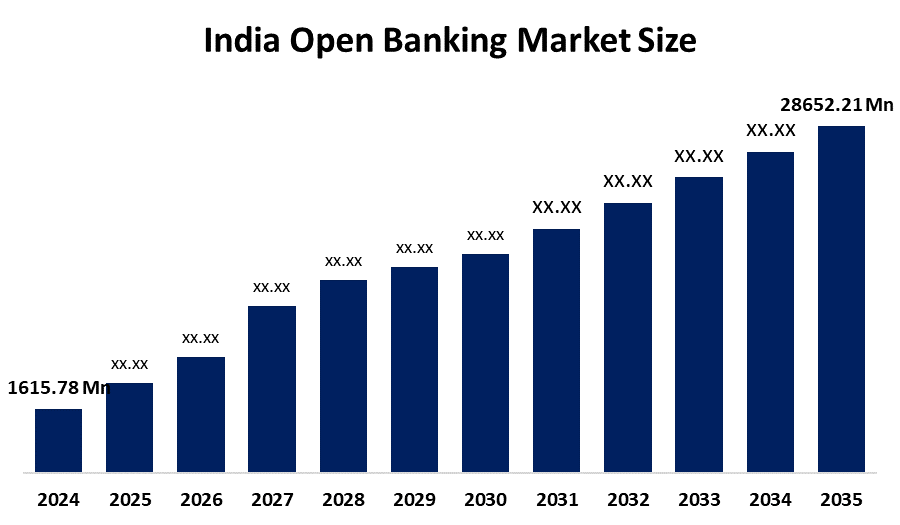

- India Open Banking Market Size 2024: USD 1615.78 Million

- India Open Banking Market Size 2035: USD 28652.21 Million

- India Open Banking Market CAGR: 29.87%

- India Open Banking Market Segments: Services, Deployment, and Distribution Channel

Get more details on this report -

The open banking market is basically a developing environment in which banks and other financial institutions share customers' financial data with third parties in a secure way through APIs, the sharing being only with the data that the customer has permitted, to deliver innovative financial services. Open banking is a system that allows greater transparency, competition, and personalization as users get the power to control and share their banking data. Some of the main applications are digital payments, account aggregation, personal finance management, lending and credit scoring, wealth management, and fraud detection, thus the rapid adoption of the retail and SME financial services globally.

Open banking is a regulated financial system allowing banks to securely share customer-consented data via APIs with third-party providers. This way, banks open up to transparency and innovation. Legislation like the EU's PSD2 and India's Account Aggregator framework facilitates these changes by requiring consent, based on data sharing. Bangalore-based fintech Open raised $50 million in a Series D funding round led by IIFL. The new investment takes the company’s valuation up to $1 billion, making it India’s 100th unicorn. The blindside of that data point is achieving financial inclusion. At the same time, several measures are taken to ensure the safety of data, maintain consumer control, and keep the compliance of the whole financial ecosystem with regulations.

Open banking is fuelling the significant innovation that API, based data sharing allows for real-time payments, AI-driven personal finance tools, and embedded finance solutions. It opens up various areas such as digital lending, alternative credit scoring, SME financing, wealth management, and fraud prevention. Fintechs and banks have the capacity to jointly create new products, for example, account aggregation, buy now, pay later services, and hyper-personalized financial offerings. Moreover, it enhances the possibilities of financial inclusion, cross-platform ecosystems, and data, driven decision, making for consumers and businesses.

Market Dynamics of the India Open Banking Market:

The major elements influencing the market dynamics of the Open Banking Market in India are rapid digitalization, strong regulatory support, and the massive adoption of fintech in the country. Some of the main factors driving the market include the widespread use of UPI, the increase of API, based financial services, and the setting up of the Account Aggregator framework allowing secure, consent, based data sharing. Rising need for personalized banking, better credit access for MSMEs, and the spreading of digital payments are just some of the ways the market is growing. At the same time, collaboration between banks and fintech companies is speeding up the innovation happening in the whole financial ecosystem.

The open banking market in India faces several challenges, including concerns over data privacy and cybersecurity, a lack of standardized API infrastructure among banks, and limited awareness among consumers and small financial institutions. Adherence to regulations in terms of compliance and integration issues with legacy banking systems also hampers the adoption, thus limiting the pace of open banking spread throughout India.

The India open banking market shows several positive aspects, such as the strong regulatory support via the Account Aggregator framework, fast expansion of digital payments, and more and more collaboration between fintech and banks. There are also more reasons for the adoption of personalized banking services, such as enhancing credit availability for MSMEs and the launch of smartphones in all classes of the population. Moreover, the availability of affordable cloud infrastructure and the increasing consumer faith in digital finance represent fundamental factors that are driving the future growth of open banking in India.

Market Segmentation

The India open banking market share is classified into services, deployment, and distribution channel

By Services:

The India open banking market is divided by services into banking & capital markets, payments, digital currencies, and value added services. Among these, the payments segment controlled the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The payment segment dominated due to increasing use of open APIs by fintechs for seamless payments, merchant solutions, and embedded finance, further strengthening the growth outlook of the payments segment compared to banking & capital markets, digital currencies, and value-added services.

Deployment:

The India open banking market is divided by deployment into cloud and on-premise. Among these, the cloud-based segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment dominance is driven by growing preference for real-time data access, regulatory flexibility, and rapid digital transformation among banks and fintechs, which continues to accelerate cloud adoption across India.

By Distribution Channel:

The India open banking market is divided by distribution channel into bank channels, app markets, distributors, and aggregators. Among these, the aggregators segment accounted for the highest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This growth is supported by their ability to connect multiple banks and fintechs through a single platform, enabling seamless data aggregation and supporting consent-based data sharing under India’s Account Aggregator framework, making them central to scalable open banking adoption.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India open banking market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Open Banking Market:

- AOPAY

- Axis Bank

- Cashfree Payments

- Enexa

- Federal Bank

- FidyPay

- FinBox

- Fincare Small Finance Bank

- M2P Fintech

- Paytm Payments Bank

- Razorpay

- Sarvatra Technologies

- Setu

- Others

Recent Developments in India Open Banking Market:

- In February 2026, Federal Bank, one of India’s leading private sector banks, launched FedOne, a new digital transaction banking platform. This is powered by Nucleus Software’s FinnAxia solution. This marks a major step in its digital transformation strategy, particularly in corporate and SME banking.

- In January 2026, the Reserve Bank of India approved Setu's full acquisition of Agya lechnologius, with the target company receiving official recognition as a Non-Banking Financial Company-Account Aggregator (NBFC-AA). The regulatory clearance enables the transaction to proceed to closing, representing a strategic consolidation in India's fintech sector. The deal positions Setu to expand its presence in the account aggregation space through complete ownership of the newly classified NBFC-AA entity.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India open banking market based on the below-mentioned segments:

India Open Banking Market, By Services

- Banking & Capital Markets

- Payments

- Digital Currencies

- Value Added Services

India Open Banking Market, By Deployment

- Cloud

- On-premise

India Open Banking Market, By Distributional Channel

- Bank Channels

- App Markets

- Distributors

- Aggregators

Frequently Asked Questions (FAQ)

-

Q: What is open banking?A: Open banking is a regulated system where banks securely share customer-permitted financial data with third parties through APIs to deliver innovative and personalized financial services.

-

Q: What is the current size of the India open banking market?A: The India open banking market was valued at USD 1,615.78 million in 2024 and is projected to grow significantly by 2035.

-

Q: What factors are driving the growth of open banking in India?A: Key drivers include widespread UPI adoption, strong regulatory support, fintech innovation, API-based services, and the Account Aggregator framework enabling secure data sharing.

-

Q: Which service segment dominates the India open banking market?A: The payments segment dominated the market in 2024 due to increasing use of open APIs for digital payments, merchant services, and embedded finance solutions.

-

Q: Which deployment model leads the market?A: The cloud-based deployment segment led the market in 2024, driven by scalability, real-time data access, cost efficiency, and rapid digital transformation.

-

Q: Which distribution channel holds the largest market share?A: The aggregators segment accounted for the highest market share in 2024, as they enable seamless data aggregation and consent-based data sharing across banks and fintechs.

-

Q: What are the key challenges facing the India open banking market?A: Major challenges include data privacy and cybersecurity concerns, lack of standardized APIs, integration issues with legacy systems, and limited awareness among smaller institutions and consumers.

Need help to buy this report?