India NDT Market Size, Share, By Component (Equipment, Software, Services, Consumables), By Testing Method (Ultrasonic Testing, Radiographic Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Eddy Current Testing, Visual Testing and Others.), By Technique (Traditional/Conventional, AI-Enabled), By End-User Industry (Oil & Gas, Power Generation, Aerospace & Defense, Automotive & Transportation, Marine and Shipbuilding, and Others.), India NDT Market Insights, Industry Trends, Forecasts to 2035.

Industry: Machinery & EquipmentIndia Non-Destructive Testing (NDT) Market Insights Forecasts to 2035

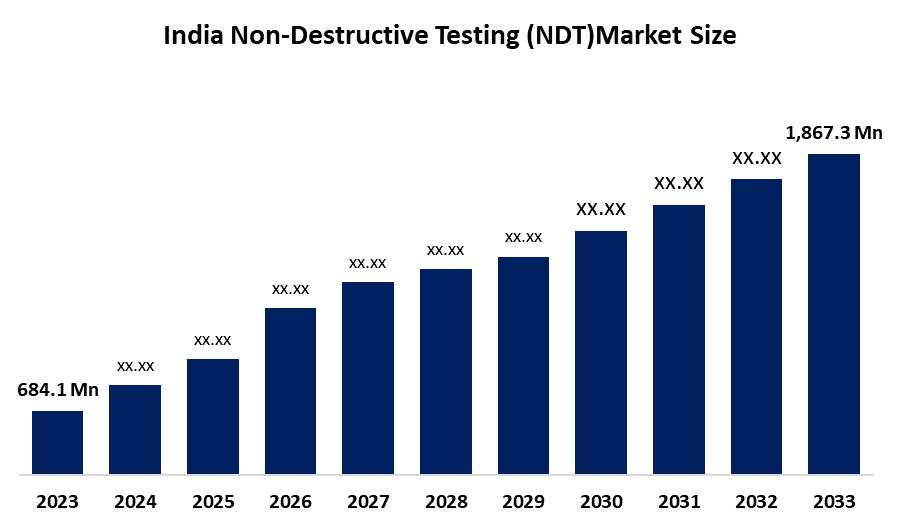

- India NDT Market Size 2024: USD 684.1 Million

- India NDT Market Size 2035: USD 1,867.3 Million

- India NDT Market CAGR (2025-2035): 9.56%

- India NDT Market Segments: Component, Testing Method, Technique, End-User Industry

Get more details on this report -

The India Non, Destructive Testing (NDT) market is a multi, faceted sector that involves the use of various techniques to inspect and evaluate the integrity of materials, the reliability of structures, and the quality of components without causing any damage. NDT services and equipment have been extensively utilized in industries such as oil & gas pipelines, power plants, aerospace components, automotive manufacturing, railways, defense systems, and heavy engineering infrastructure, primarily for safety, regulatory compliance, and operational efficiency purposes.

NDT is instrumental in preventive maintenance, quality assurance, and lifecycle management of industrial assets. The factors such as infrastructure investments, refinery capacity expansion, domestic manufacturing growth, and rising focus on asset integrity management are collectively driving the demand for advanced inspection solutions. As per the official infrastructure and industrial production data, India's rapid capacity additions in power generation, hydrocarbons, and transportation are leading to a significant increase in inspection volumes.

Technological innovation is revolutionizing the market with the aid of digital radiography, phased array ultrasonic testing, automated inspection systems, and AI, enabled defect analysis. Several government initiatives like Make in India, National Infrastructure Pipeline, and more stringent safety regulations under PESO, DGCA, and ASME, aligned standards are contributing to the increasing NDT adoption. The next horizon of opportunities is mostly centered on AI, driven inspections, drone, based testing, renewable energy assets, and smart manufacturing ecosystems.

Market Dynamics of the India Non-Destructive Testing (NDT) Market:

The India NDT market is driven by the compliance requirements of safety and quality across various sectors such as oil & gas, power generation, aerospace, defense, automotive, and heavy manufacturing. Expansion of the infrastructure at a fast pace, refinery modernization, pipeline integrity programs, and stricter inspection norms are leading to higher demand for ultrasonic, radiographic, and advanced NDT solutions for critical assets and industrial operations.

The market is restrained due to the high capital investment needed for advanced NDT equipment, the limited number of certified and skilled inspection professionals, and the considerable training and certification costs. Small and mid, sized industries mostly use conventional inspection methods due to budget constraints, thus the adoption of digital and AI, enabled NDT technologies is slow.

There are significant opportunities in the India NDT market with the adoption of AI, enabled inspection, digital radiography, automated ultrasonic testing, and data, driven asset integrity management. The growth of renewable energy, defense manufacturing under the Make in India initiative, infrastructure life, extension projects, and Industry 4.0 integration will lead to a sustained demand for advanced as well as software, based NDT solutions.

India Non-Destructive Testing (NDT) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 684.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.56% |

| 2035 Value Projection: | USD 1,867.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 157 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Component, By Testing Method |

| Companies covered:: | SGS India Pvt Ltd,Bureau Veritas India Pvt Ltd,Intertek India Pvt Ltd,Applus+ Velosi India Pvt Ltd,Mistras Group (India) Pvt Ltd,GE Sensing and Inspection Technologies India Pvt Ltd,Olympus India Pvt Ltd, And others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India NDT Market share is classified into component, testing method, technique, and end-user industry.

By Component:

The India NDT market is divided by component into equipment, software, services, and consumables. Among these, the equipment segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Growth is largely attributed to the numerous industrial inspections, refinery shutdowns, infrastructure expansion, and safety compliance, among others, that have necessitated the use of NDT. Also, the rise in demand for ultrasonic and radiographic equipment as well as the capital investments by big manufacturing and energy companies have contributed to this growth.

By Testing Method:

The India NDT market is divided by testing method into ultrasonic testing, radiographic testing, magnetic particle testing, liquid penetrant testing, eddy current testing, visual testing, and others. Among these, ultrasonic testing dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth of the technology is supported by its high accuracy, deeper penetration, portability, and cost efficiency, among other factors. Additionally, it is highly suitable for welds and pipelines, does not expose users to high radiation levels, and is easily accepted by oil, gas, power, and heavy manufacturing sectors that are rapidly growing.

By Technique:

The India NDT market is divided by technique into traditional/conventional and AI-enabled methods. Among these, the traditional/conventional segment dominated the share in 2024 and is anticipated to grow at a steady CAGR during the forecast period. Conventional NDT methods are still very much in use due to the presence of established standards, availability of skilled workforce, and lower implementation costs, among other factors. In addition, they have regulatory approvals, have been proven to be reliable, are easy to maintain, and have a high penetration rate among legacy industrial assets.

By End-User Industry:

The India NDT market is divided by end-user industry into oil & gas, power generation, aerospace & defense, automotive & transportation, marine and shipbuilding, and others. Among these, the oil & gas segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The demand for NDT is being fueled by the existence of extensive pipeline networks, the aging of assets, and the frequency of inspections, among other factors. In addition, refinery maintenance cycles, strict safety norms, leakage prevention requirements, and government focus on energy security are also significantly contributing to the NDT demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India non-destructive testing (NDT) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Non-Destructive Testing (NDT) Market:

- SGS India Pvt Ltd

- Bureau Veritas India Pvt Ltd

- Intertek India Pvt Ltd

- Applus+ Velosi India Pvt Ltd

- Mistras Group (India) Pvt Ltd

- GE Sensing and Inspection Technologies India Pvt Ltd

- Olympus India Pvt Ltd

- Zetec India Pvt Ltd

- Eddyfi Technologies India Pvt Ltd

- Vikram NDT Services Pvt Ltd

Recent Developments in India Non-Destructive Testing (NDT) Market:

In January 2025, PNGRB has revealed plans for an 11,000 km expansion of the city gas pipeline network all over India. Such a project is likely to create a significant volume of radiographic and ultrasonic commissioning work in urban and semi, urban areas, as well as work that will be necessary for local infrastructure development. This will lead to a rise in inspection requirements and will also have positive ripple effects for the NDT service sectors of various industries.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Non-Destructive Testing (NDT) market based on the below-mentioned segments:

India NDT Market, By Component

- Equipment

- Software

- Services

- Consumables

India NDT Market, By Testing Method

- Ultrasonic Testing

- Radiographic Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Visual Testing

- Others

India NDT Market, By Technique

- Traditional/Conventional

- AI-Enabled

India NDT Market, By End-User Industry

- Oil & Gas

- Power Generation

- Aerospace & Defense

- Automotive & Transportation

- Marine and Shipbuilding

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India Non-Destructive Testing (NDT) market size?A: India Non-Destructive Testing (NDT) Market is expected to grow from USD 684.1 million in 2024 to USD 1,867.3 million by 2035, growing at a CAGR of 9.56% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by expanding industrial infrastructure, refinery capacity additions, increased pipeline networks, aging assets, strict safety regulations, rising manufacturing and energy investments, and growing adoption of advanced NDT solutions including AI-enabled inspections, digital radiography, and automated ultrasonic testing across key industries.

-

A: Market growth is driven by expanding industrial infrastructure, refinery capacity additions, increased pipeline networks, aging assets, strict safety regulations, rising manufacturing and energy investments, and growing adoption of advanced NDT solutions including AI-enabled inspections, digital radiography, and automated ultrasonic testing across key industries.A: Constraints include high capital investments for advanced NDT equipment, limited skilled and certified inspection professionals, high training and certification costs, and slow adoption of digital and AI-enabled technologies by small and mid-sized industries.

-

Q: How is the market segmented by component?A: The market is segmented into equipment, software, services, and consumables.

-

Q: How is the market segmented by testing method?A: The market is segmented into ultrasonic testing, radiographic testing, magnetic particle testing, liquid penetrant testing, eddy current testing, visual testing, and others.

-

Q: How is the market segmented by end-user industry?A: The market is segmented into oil & gas, power generation, aerospace & defense, automotive & transportation, marine and shipbuilding, and others.

-

Q: Who are the key players in the India NDT market?A: Key companies include SGS India Pvt Ltd, Bureau Veritas India Pvt Ltd, Intertek India Pvt Ltd, Applus+ Velosi India Pvt Ltd, Mistras Group (India) Pvt Ltd, GE Sensing and Inspection Technologies India Pvt Ltd, Olympus India Pvt Ltd, Zetec India Pvt Ltd, Eddyfi Technologies India Pvt Ltd, and Vikram NDT Services Pvt Ltd.

Need help to buy this report?