India Nano Urea Market Size, Share, By Crop Type (Cereals, Cash Crops, Horticulture Crops, And Others), By Sales Channel (Direct Sales And Indirect Sales), And India Nano Urea Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureIndia Nano Urea Market Insights Forecasts to 2035

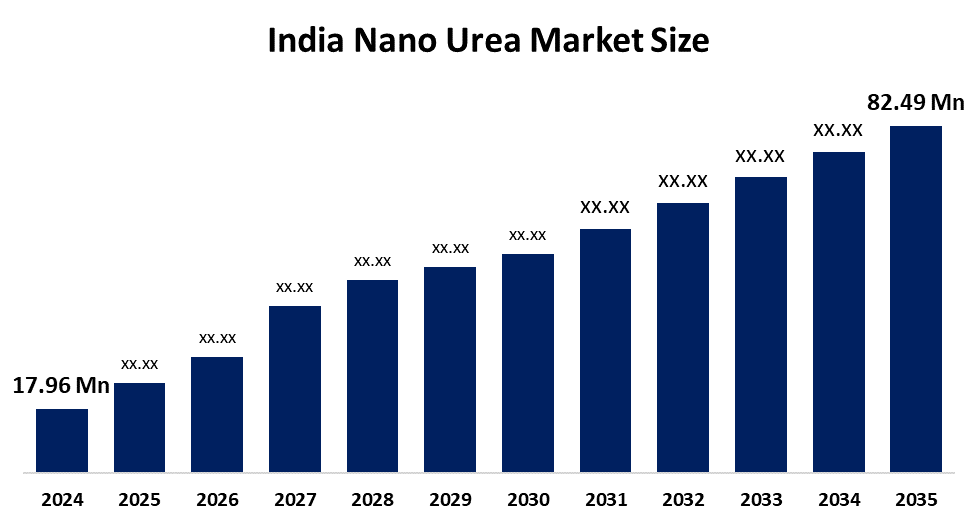

- India Nano Urea Market Size 2024: 17.96 Million Liters

- India Nano Urea Market Size 2035: 82.49 Million Liters

- India Nano Urea Market CAGR 2024: 14.87%

- India Nano Urea Market Segments: Crop Type and Sales Channel

Get more details on this report -

The India nano urea market encompasses production, distribution and uptake of the nanotechnology-based liquid fertilizer known as nano urea. This product is manufactured to provide plants with more efficient nitrogen delivery than conventional granular urea. Nano urea is comprised of nano-particles typically measuring from 20-40 nm in size, allowing for better plant roots absorption of nutrients and increased overall efficiency for plants in utilizing these nutrients, result lower environmental impact and potential to enhance crop yield and profit for farmers.

The nano urea in India are backed by government support, including the Indian government’s strategic plan to scale up nano urea production capacity dramatically targeting an increase from around 50 million bottles per year to roughly 440 million bottles annually by 2025, which is estimated to be equivalent to about 20 million tonnes of conventional urea replacement. India’s nano urea output and adoption are being linked to the nation’s goal of achieving near-self-sufficiency in urea production by the end of 2025, alongside conventional urea production policy objective expected to save substantial foreign exchange and reduce import dependence.

As technology advances, India’s nano urea providers are now using nanotechnology and precision agriculture, where researchers work together to refine the formulation to optimise particle size, particle size stability, and leaf adhesion to improve nitrogen utilise efficiency at lower application rates. With advanced production methods, producers can ensure a consistent distribution of nano-scale particles, which enhances plant absorption and allows for greater accuracy of nutrient delivery. Furthermore, innovations in digital application methods, such as drone-based foliar spraying systems being tested across many states, represent the augmentation of modern technology applications in agriculture; therefore, increasing the value proposition of nano-fertiliser products.

India Nano Urea Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 17.96 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 14.87% |

| 2035 Value Projection: | 82.49 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 59 |

| Segments covered: | By Crop Type, By Sales Channel |

| Companies covered:: | Indian Farmers Fertiliser Cooperative Limited, National Fertilizers Limited, Rashtriya Chemicals and Fertilizers Limited, Coromandel International Limited, Gujarat Narmada Valley Fertilizers & Chemicals Ltd., Hindustan Urvarak & Rasayan Limited, Paradeep Phosphates Limited, Krishak Bharati Cooperative Limited, Meghmani Organics Limited, Madras Fertilizers Limited, Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the India Nano Urea Market:

The India nano urea market is driven by the increasing demand for efficient, cost-effective, and environmentally sustainable fertiliser solutions, increased demand of nano urea to reduce nitrogen losses, lower input costs, improve crop yields and soil health, advancement in nanotechnology, strong government support, and reducing the environmental impact of excessive chemical fertiliser use.

The India nano urea market is restrained by the few farmer acceptance, practical efficacy concerns issue, challenges in crop response variability and yield outcomes under real-world conditions, logistical challenges, and skepticism among certain farming groups.

The future of India nano urea market is bright and promising, with versatile opportunities emerging from the India's agricultural sector focusing on sustainable intensification of its agriculture operations. Nano urea can play a role in integrated soil fertility management (IFM) programmes that provide farmers with the opportunity to enhance their farm practices. To accelerate the adoption of nano-fertilisers, there is great potential for increasing the range of products available both domestically and globally by including nano DAP and other nano-nutrient-blend products, in addition to providing farmers with tools to access AR/VR technologies and other smart farming services.

Market Segmentation

The India Nano Urea Market share is classified into crop type and sales channel.

By Crop Type:

The India nano urea market is divided by crop type into cereals, cash crops, horticulture crops, and others. Among these, the cereals segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Massive use, widespread adoption among consumer, strong government focus on reducing conventional urea consumption in staple food production, cost effective, and lower transportation all contribute to the cereals segment's largest share and higher spending on crop type when compared to other crop type.

By Sales Channel:

The India nano urea market is divided by sales channel into direct sales and indirect sales. Among these, the indirect segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The indirect segment dominates because of widespread distribution network of India, strong government policies providing nano urea, well established infrastructure for bulk movement, and crucial for overcoming farmer skepticism and driving adoption.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India nano urea market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Nano Urea Market:

- Indian Farmers Fertiliser Cooperative Limited

- National Fertilizers Limited

- Rashtriya Chemicals and Fertilizers Limited

- Coromandel International Limited

- Gujarat Narmada Valley Fertilizers & Chemicals Ltd.

- Hindustan Urvarak & Rasayan Limited

- Paradeep Phosphates Limited

- Krishak Bharati Cooperative Limited

- Meghmani Organics Limited

- Madras Fertilizers Limited

- Others

Recent Developments in India Nano Urea Market:

In December 2025, IFFCO inaugurated a new, state-of-the-art Nano Fertilizer Plant in Devanahalli, Bengaluru. This facility was designed to bolster the production of advanced nano-fertilizers, marking a major step in promoting sustainable agriculture and precision farming in South India.

In July 2025, HURL developed 7 specialized nano urea plant with a total annual production capacity of 27.22 crore bottles (500ml each). These efforts were part of a government-backed goal to make India self-sufficient in urea by the end of 2025.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India nano urea market based on the below-mentioned segments:

India Nano Urea Market, By Crop Type

- Cereals

- Cash Crops

- Horticulture Crops

- Others

India Nano Urea Market, By Sales Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

Q: What is the India nano urea market size?A: India nano urea market is expected to grow from 17.96 million liters in 2024 to 82.49 million liters by 2035, growing at a CAGR of 14.87% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing demand for efficient, cost-effective, and environmentally sustainable fertiliser solutions, increased demand of nano urea to reduce nitrogen losses, lower input costs, improve crop yields and soil health, advancement in nanotechnology, strong government support, and reducing the environmental impact of excessive chemical fertiliser use.

-

Q: What factors restrain the India nano urea market?A: Constraints include the few farmer acceptance, practical efficacy concerns issue, challenges in crop response variability and yield outcomes under real-world conditions, logistical challenges, and skepticism among certain farming groups.

-

Q: How is the market segmented by crop type?A: The market is segmented into cereals, cash crops, horticulture crops, and others.

-

Q: Who are the key players in the India nano urea market?A: Key companies include Indian Farmers Fertiliser Cooperative Limited, National Fertilizers Limited, Rashtriya Chemicals and Fertilizers Limited, Coromandel International Limited, Gujarat Narmada Valley Fertilizers & Chemicals Ltd., Hindustan Urvarak & Rasayan Limited, Paradeep Phosphates Limited, Krishak Bharati Cooperative Limited, Meghmani Organics Limited, Madras Fertilizers Limited, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

-

Q: What is the India nano urea market size?A: India nano urea market is expected to grow from 17.96 million liters in 2024 to 82.49 million liters by 2035, growing at a CAGR of 14.87% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing demand for efficient, cost-effective, and environmentally sustainable fertiliser solutions, increased demand of nano urea to reduce nitrogen losses, lower input costs, improve crop yields and soil health, advancement in nanotechnology, strong government support, and reducing the environmental impact of excessive chemical fertiliser use.

-

Q: What factors restrain the India nano urea market?A: Constraints include the few farmer acceptance, practical efficacy concerns issue, challenges in crop response variability and yield outcomes under real-world conditions, logistical challenges, and skepticism among certain farming groups.

-

Q: How is the market segmented by crop type?A: The market is segmented into cereals, cash crops, horticulture crops, and others.

-

Q: Who are the key players in the India nano urea market?A: Key companies include Indian Farmers Fertiliser Cooperative Limited, National Fertilizers Limited, Rashtriya Chemicals and Fertilizers Limited, Coromandel International Limited, Gujarat Narmada Valley Fertilizers & Chemicals Ltd., Hindustan Urvarak & Rasayan Limited, Paradeep Phosphates Limited, Krishak Bharati Cooperative Limited, Meghmani Organics Limited, Madras Fertilizers Limited, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?