India N-Nonylphenol Market Size, Share, By End Use (Chemicals, Textiles, Cosmetics & Personal Care, Automotive, Paper & Pulp, And Others), By Application (Antioxidant, Cleaning, Surfactants & Detergents, Emulsifiers, And Others), And India N-Nonylphenol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia N-Nonylphenol Market Size Insights Forecasts To 2035

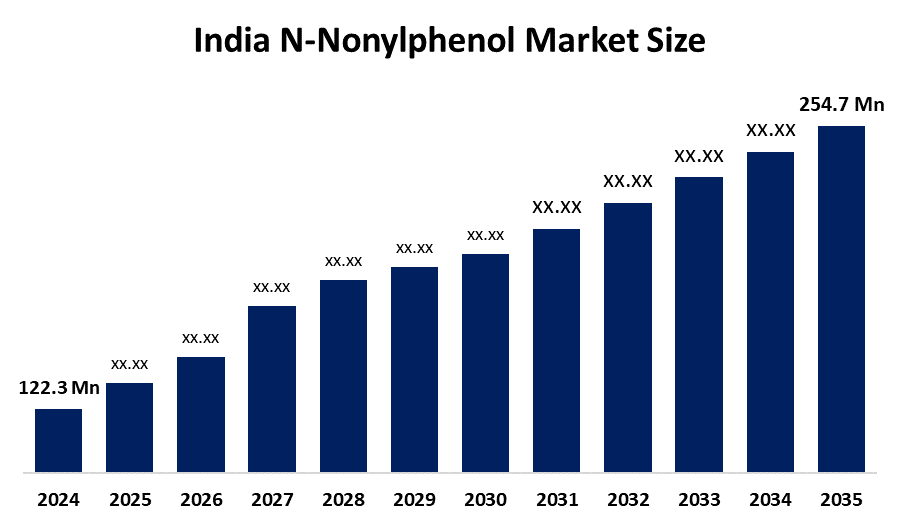

- India N-Nonylphenol Market Size 2024: 122.3 Thousand Tonnes

- India N-Nonylphenol Market Size 2035: 254.7 Thousand Tonnes

- India N-Nonylphenol Market Size CAGR 2024: 6.9%

- India N-Nonylphenol Market Size Segments: End Use and Application

Get more details on this report -

The India n-nonylphenol market size is the economic network comprising the manufacture, distribution, and sale of n-nonylphenol, an alkylphenol compound that has a 9-carbon alkyl chain attached to a phenolic ring, and that is used as a precursor to nonylphenol ethoxylates as well as a surfactant, an emulsifier, and as an intermediate in detergent, textile, agrochemical, paint and many other industrial products.

The n-nonylphenol in India are backed by government support, including the NITI Aayog’s Chemical Industry Powering India’s Participation in Global Value Chains, which aims to raise India’s share in global chemical value chains from approximately 3.5% in 2023 to 5-6% by 2040, targeting a USD 1 trillion chemical output and the creation of hundreds of thousands of jobs by 2030. This reflects the government’s strategic focus on boosting domestic chemical manufacturing capacity, export competitiveness, and industrial growth, indirectly underpinning demand and investment in key chemical intermediates markets like nonylphenol.

As technology advances, India’s n-nonylphenol providers are focused on improvements in production efficiency, lower energy and waste consumption, and enhanced quality of products have resulted from the use of innovative technologies like improved synthesis processes, greater use of catalytic materials, and the use of digital technologies enabled by Industry 4.0 such as automation and analytics. With the growing pressure on the environment, research is also accelerating around developing safer and biodegradable surfactants that perform the same functions as nonylphenol derivatives, leading to greater technological diversity and more sustainable manufacturing methods for chemical products.

India N-Nonylphenol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 122.3 |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 6.9% |

| 2023 Value Projection: | 254.7 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By End Use, By Application |

| Companies covered:: | India Glycols Limited, Dow, Huntsman Corporation, Stepan Company, Solvay, Clariant AG, Shree Vallabh Chemicals, Arihant Solvents and Chemicals, Excel Organics Pvt Ltd., Fibrol Non Ionics Pvt Ltd., Shiv Shakti India, Triveni Chemicals, Sterling Auxiliaries Pvt Ltd., A.B. Enterprises, Sanjay Chemicals Pvt Ltd., and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India N-Nonylphenol Market:

The India n-nonylphenol market size is driven by the growing demand from end-use industries, rapid industrialization, urban development, expanding manufacturing sectors contribute to steady consumption, increasing plastics and polymer production, strong both domestic demand, and supportive government boosts the requirement for chemical intermediates where nonylphenol plays a role.

The India n-nonylphenol market size is restrained by the health and environmental concerns, stricter regulatory scrutiny internationally, rising pressures to limit nonylphenol and its ethoxylates in certain applications, regulatory uncertainty within India, and high compliance costs.

The future of India n-nonylphenol market size is bright and promising, with versatile opportunities emerging from the innovative alternatives to petroleum-based products and eco-friendly surfactants that meet environmental and regulatory requirements, while also providing solutions to industry requirements. There are numerous opportunities within underdeveloped industrial segments and developing new uses for chemicals. In addition, the continued government support for the manufacturing of chemicals, the building of the infrastructure to support this growth, and the integration of chemical manufacturing into the global supply chain will provide a number of opportunities for companies to innovate and develop and capture niche markets in India and around the world, in addition to the existing nonylphenol value chain.

Market Segmentation

The India N-Nonylphenol Market share is classified into end use and application.

By End Use:

The India n-nonylphenol market size is divided by end use into chemicals, textiles, cosmetics & personal care, automotive, paper & pulp, and others. Among these, the chemicals segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Widely used in textile and detergents industries, low cost intermediate in production of nonylphenol ethoxylates, and sustained high demand all contribute to the chemicals segment's largest share and higher spending on n-nonylphenol when compared to other end use.

By Application:

The India n-nonylphenol market size is divided by application into antioxidants, Cleaning, surfactants & detergents, emulsifiers, and others. Among these, the surfactants & detergents segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The surfactants & detergents segment dominates because of massive demand for nonylphenol ethoxylates in industrial cleaning, cleaning textiles, and emulsion polymerization, growing Indian FMCG sector, and strict regulations on its use in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India n-nonylphenol market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India N-Nonylphenol Market:

- India Glycols Limited

- Dow

- Huntsman Corporation

- Stepan Company

- Solvay

- Clariant AG

- Shree Vallabh Chemicals

- Arihant Solvents and Chemicals

- Excel Organics Pvt Ltd.

- Fibrol Non Ionics Pvt Ltd.

- Shiv Shakti India

- Triveni Chemicals

- Sterling Auxiliaries Pvt Ltd.

- A.B. Enterprises

- Sanjay Chemicals Pvt Ltd.

- Others

Recent Developments in India N-Nonylphenol Market:

- In January 2026, Reliance Industries is actively expanding into phenol production, which is a raw material for n-nonylphenol. A new, large-scale facility in Jamnagar is expected to be operational by 2026, which will significantly boost the domestic availability of phenol, supporting the local production of downstream derivatives like n-nonylphenol.

- In 2024-2025, India Glycols was recognized as a key player in the Indian n-nonylphenol ethoxylates market, which was seeing sustained demand in industrial cleaning and surfactants, with market sizes tracked through 2024 and projected to grow through 2030.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insigths has segmented the India n-nonylphenol market based on the below-mentioned segments:

India N-Nonylphenol Market, By End Use

- Chemicals

- Textiles

- Cosmetics & Personal Care

- Automotive

- Paper & Pulp

- Others

India N-Nonylphenol Market, By Application

- Antioxidant

- Cleaning

- Surfactants & Detergents

- Emulsifiers

- Others

Frequently Asked Questions (FAQ)

-

What is the India n-nonylphenol market size?India n-nonylphenol market is expected to grow from 122.3 thousand tonnes in 2024 to 254.7 thousand tonnes by 2035, growing at a CAGR of 6.9% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the growing demand from end-use industries, rapid industrialization, urban development, expanding manufacturing sectors contribute to steady consumption, increasing plastics and polymer production, strong both domestic demand, and supportive government boosts the requirement for chemical intermediates where nonylphenol plays a role.

-

What factors restrain the India n-nonylphenol market?Constraints include the health and environmental concerns, stricter regulatory scrutiny internationally, rising pressures to limit nonylphenol and its ethoxylates in certain applications, regulatory uncertainty within India, and high compliance costs.

-

How is the market segmented by End Use?The market is segmented into chemicals, textiles, cosmetics & personal care, automotive, paper & pulp, and others.

-

Who are the key players in the India n-nonylphenol market?Key companies include India Glycols Limited, Dow, Huntsman Corporation, Stepan Company, Solvay, Clariant AG, Shree Vallabh Chemicals, Arihant Solvents and Chemicals, Excel Organics Pvt Ltd., Fibrol Non Ionics Pvt Ltd., Shiv Shakti India, Triveni Chemicals, Sterling Auxiliaries Pvt Ltd., A.B. Enterprises, Sanjay Chemicals Pvt Ltd., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Need help to buy this report?