India N-Hexane Market Size, Share, By Grade Type (Food Grade, Industrial Grade, Pharmaceutical Grade And Polymerization Grade), By Application (Edible Oil Extraction, Industrial Cleaning & Degreasing, Pharmaceutical & Healthcare, And Others), And N-Hexane Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia N-Hexane Market Size Insights Forecasts to 2035

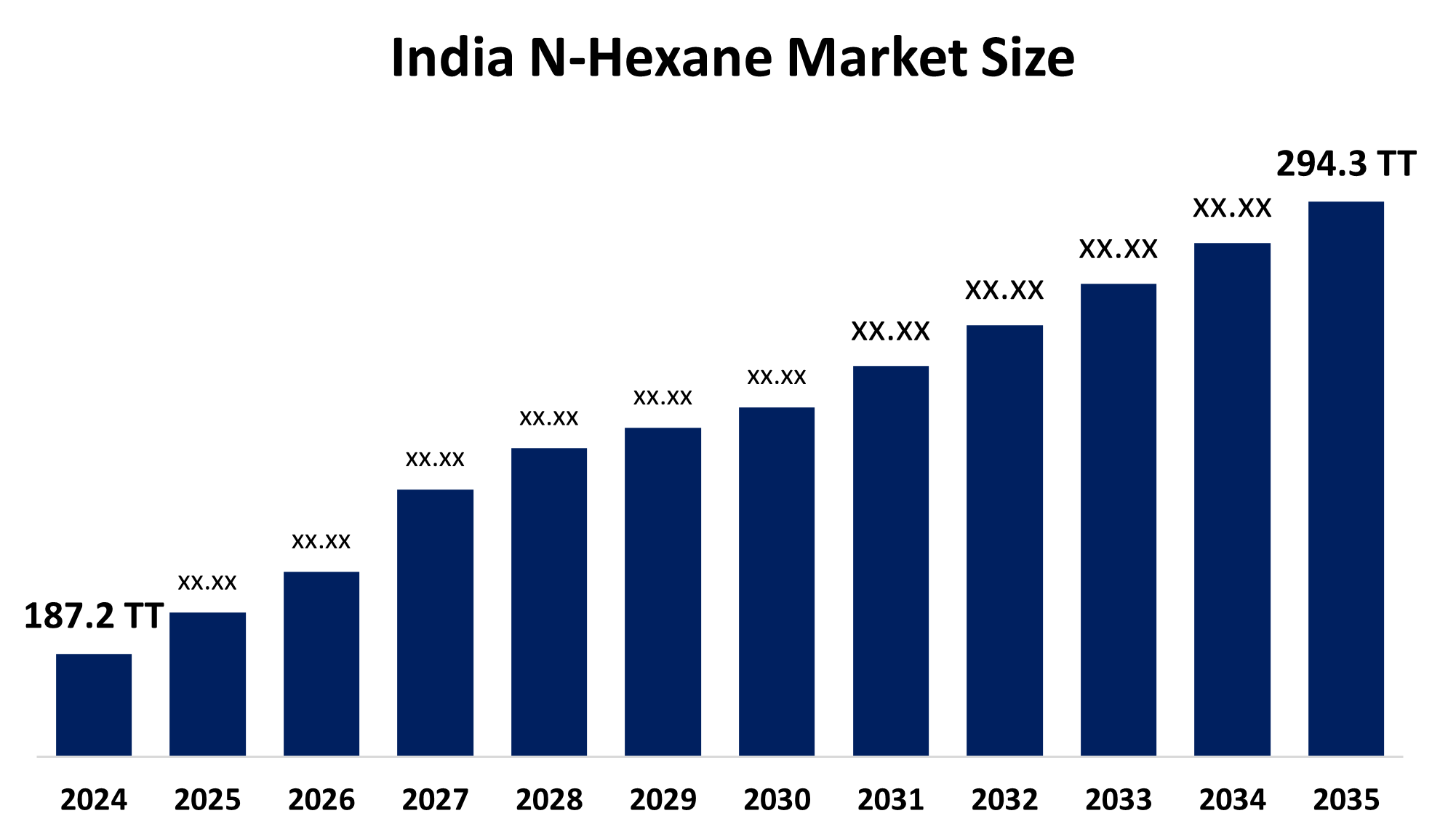

- India N-Hexane Market 2024: 187.2 Thousand Tonnes

- India N-Hexane Market Size 2035: 294.3 Thousand Tonnes

- India N-Hexane Market CAGR 2024: 4.2%

- India N-Hexane Market Segments: Grade Type and Application

Get more details on this report -

The India N-Hexane Market Size includes all aspects of n-hexane's development, factory production, transport, handling, and use across various application categories. N-Hexane is a clear, pure liquid that has a low boiling point, used in processes such as solvent extraction of edible oil, industrial degreasing, and in the production of adhesives, pharmaceuticals, and rubber because of its rapid evaporation and low cost per unit volume as well as the effectiveness for extracting oil and fat from seeds and other materials. India has instituted stricter controls on the use of n-hexane in product formulations through legislation governing workplace safety, industrial hygiene, and environmental protection.

The n-hexane in India are backed by government support, including the National Mission on Edible Oils (NMEO) launched by the Government of India to strengthen the domestic edible oil ecosystem, where n-hexane is the principal solvent used in oilseed extraction. The NMEO aims to enhance domestic oilseed and crude palm oil production and reduce import dependence, backed by multi-thousand crore rupee allocations and ambitious production targets, anticipating a substantial increase in oilseed output by 2030-31

As technology advances, India’s n-hexane providers are now using advanced processes for distilling, purifying, and recovering solvents to improve their product's quality, while also minimizing their emissions and solvent losses. These improvements come from both the addition of new technologies such as advanced catalytic reforming and improvements to existing technologies such as process automation, thus resulting in increased yield and operational efficiency, as well as decreased energy consumption with the goal of reducing VOC emissions and helping to create environmentally sustainable methods for producing solvents.

Market Dynamics of the India N-Hexane Market:

The India N-Hexane Market Size is driven by the increasing major industrial processes, growth in end-use sectors, booming edible oil extraction industry, ongoing growth in population, dietary shifts toward packaged and processed foods , expanding pharmaceutical manufacturing where high-purity solvents are essential for active ingredient extraction and purification, broader industrialization, expanding domestic industrial capacity, and efforts to boost self-reliance in chemical inputs also support market expansion.

The India N-Hexane Market Size is restrained by the environmental and health concerns associated with n-hexane, increasing compliance costs, regulatory complexity slower adoption in mitigation technologies, price volatility in crude oil, and economic instability.

The future of India n-hexane market is bright and promising, with versatile opportunities emerging from the growing opportunity for advanced technologies that allow recovery and purification of solvents thus increasing the sustainability and compliance of regulations governing these solvents in sectors that use solvents in a sensitive manner. There is an increase in the use of n-hexane with the new opportunity toward bio-based feedstocks and green alternatives to solvents in order to achieve environmental objectives. In addition, the government's efforts to strengthen domestic chemical manufacturing capacity and encourage participation in global value chains create significant opportunities with long-term growth for manufacturers.

India N-Hexane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 187.2 thousand tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.2% |

| 2035 Value Projection: | 294.3 thousand tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Grade Type, By Application |

| Companies covered:: | Indian Oil Corporation Ltd., Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, Chennai Petroleum Corporation Ltd., Numaligarh Refinery Limited, Arham Petrochem Private Limited, Deepak Nitrite and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The India N-Hexane Market share is classified into grade type and application.

By Grade Type:

The India N-Hexane Market Size is divided by grade type into food grade, industrial grade, pharmaceutical grade, and polymerization grade. Among these, the food grade held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Massive edible oil extraction demand, high extraction efficiency, rising consumption, urbanization, and superior ability to dissolve oil making it a standard preference all contribute to the food grade segment's largest share and higher spending on n-hexane when compared to other grade type.

By Application:

The India N-Hexane Market Size is divided by application into edible oil extraction, industrial cleaning & degreasing, pharmaceutical & healthcare, and others. Among these, the edible oil extraction segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The edible oil extraction segment dominates because of its high efficiency extraction requirements for massive domestic oilseed processing, superior solvent properties, cost effectiveness, and country’s growing demand for edible oil as a crucial ingredient in food processing.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India n-hexane market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India N-Hexane Market:

- Indian Oil Corporation Ltd.

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited

- Reliance Industries Limited

- Chennai Petroleum Corporation Ltd.

- Numaligarh Refinery Limited

- Arham Petrochem Private Limited

- Deepak Nitrite

- Others

Recent Developments in India N-Hexane Market:

- In September 2025, BPCL announced a price increase for hexane in the Indian domestic market. This followed a previous announcement in May 2025, where BPCL indicated adjustments to its hexane pricing to navigate market dynamics, supply changes, and strengthen its market share in the edible oil and industrial solvent sectors.

- In November 2024, BPCL announced plans to expand its industrial-grade hexane production capacity in India to meet rising demand, especially within the Asia-Pacific region.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India N-Hexane Market Size based on the below-mentioned segments:

India N-Hexane Market, By Grade Type

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

- Polymerization Grade

India N-Hexane Market, By Application

- Edible Oil Extraction

- Industrial Cleaning & Degreasing

- Pharmaceutical & Healthcare

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India n-hexane market size?A: India n-hexane market is expected to grow from 187.2 thousand tonnes in 2024 to 294.3 thousand tonnes by 2035, growing at a CAGR of 4.2% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing major industrial processes, growth in end-use sectors, booming edible oil extraction industry, ongoing growth in population, dietary shifts toward packaged and processed foods , expanding pharmaceutical manufacturing where high-purity solvents are essential for active ingredient extraction and purification, broader industrialization, expanding domestic industrial capacity, and efforts to boost self-reliance in chemical inputs also support market expansion.

-

Q: What factors restrain the India n-hexane market?A: Constraints include the environmental and health concerns associated with n-hexane, increasing compliance costs, regulatory complexity slower adoption in mitigation technologies, price volatility in crude oil, and economic instability.

-

Q: How is the market segmented by grade type?A: The market is segmented into food grade, industrial grade, pharmaceutical grade, and polymerization grade.

-

Q: Who are the key players in the India n-hexane market?A: Key companies include Indian Oil Corporation Ltd., Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, Reliance Industries Limited, Chennai Petroleum Corporation Ltd., Numaligarh Refinery Limited, Arham Petrochem Private Limited, Deepak Nitrite, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?