India N-Heptane Market Size, Share, By End Use (Pharmaceuticals, Solvent, Fuel Additive, And Others), By Sales Channel (Direct Sales And Indirect Sales), And India N-Heptane Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia N-Heptane Market Size Insights Forecasts to 2035

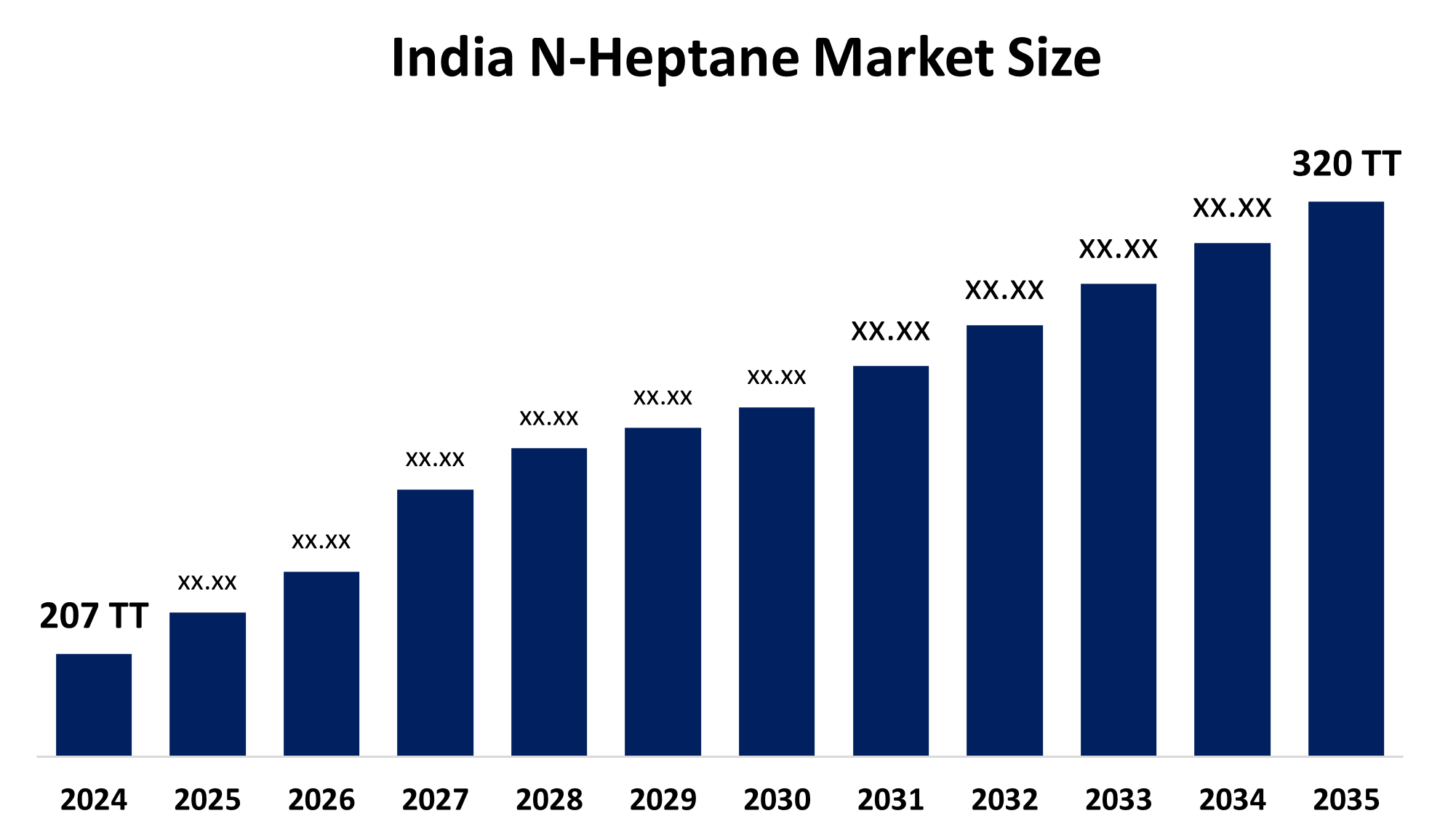

- India N-Heptane Market 2024: 207 Thousand Tonnes

- India N-Heptane Market Size 2035: 320 Thousand Tonnes

- India N-Heptane Market CAGR 2024: 4.04%

- India N-Heptane Market Segments: End Use and Sales Channel

Get more details on this report -

India N-Heptane Market Size encompasses all stages of production, distribution, and use of n-heptane, a colourless aliphatic hydrocarbon solvent produced via petroleum refinement, which is used extensively across many sectors because of its low-toxicity and strong solvent properties. N-heptane has become a key solvent for pharmaceutical synthesis, extraction, and chromatographic analysis. In India, n-heptane is driven by downstream demand from the pharmaceutical, coatings, electronic cleaning and petrochemical industries. The emphasis on n-heptane as a high purity solvent continue to grow due to more stringent quality standards for advanced applications.

The n-heptane in India are backed by government support, including the Petroleum, Chemical and Petrochemical Investment Regions (PCPIRs) policy implemented by the Government of India, which aims to attract investment and generate employment by promoting integrated, large-scale chemical and petrochemical production infrastructure. India’s chemicals and petrochemicals demand is expected to nearly triple and reach USD 1 trillion by 2040, highlights the structural market growth that also elevates consumption of critical solvents and intermediates like n-heptane across manufacturing and laboratory applications.

As technology advances, India’s n-heptane providers are now using advanced refining techniques, including purification and quality control system, to create ultra-high-purity grades that meet the standards of highly regulated industries continues to evolve. New advancements in distillation, automated process controls, and solvent recycling technologies are increasing the efficiency and consistency of production while minimizing their environmental footprint and energy demands. In addition, there continues to be increased innovation in the formulation of customized solvent grades that are produced through environmentally friendly processes and compliant with evolving regulations and sustainable practices.

Market Dynamics of the India N-Heptane Market:

The India N-Heptane Market Size is driven by the rapid expansion of the pharmaceutical sector, robust growth in the paints, coatings, and adhesives industries, rising electronics manufacturing requiring precision cleaning solvents, urbanization and infrastructure development, expansion of India’s specialty chemical manufacturing capacity, and supported by government initiatives and integrated industrial clusters.

The India N-Heptane Market Size is restrained by the environmental regulations, high initial and operational costs, stringent handling and safety protocols, feedstock price volatility, and competition from alternative and greener solvent technologies limitations.

The future of India N-Heptane Market Size is bright and promising, with versatile opportunities emerging from the growing demand for ultra-pure solvents driven by an increase in the use of high-value, regulated applications like pharmaceuticals and electronics. Growth in India’s specialty chemical manufacturing capacity with government support and integrated industrial clusters achieve a greater share of value added in the domestic economy through reduced reliance on imports. Other opportunities exist in developing more environmentally friendly or bio-based alternatives to VOC solvent products that can meet environmental sustainability objectives, including leveraging India’s expanding chemical ecosystem and creating opportunities through export markets as foreign markets witness an increase in the global demand for specialty solvents.

India N-Heptane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 207 thousand tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.04% |

| 2035 Value Projection: | 320 thousand tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By End Use, By Sales Channel |

| Companies covered:: | Alpha Chemika, Caspray Chemicals, Riddhi Siddhi Industries, Triveni Chemicals, Vardhman and Sons, Leo Chemo Plast Pvt Ltd., Hi Tech Chemicals, Anand Agencies, Gomoswa International, Sujata Chemicals, Chintan Enterprise, Meru Chem Private Limited, A B Enterprises, Standard Reagents Pvt Ltd. and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The India N-Heptane Market share is classified into end use and sales channel.

By End Use:

The India N-Heptane Market Size is divided by end use into pharmaceuticals, solvent, fuel additive, and others. Among these, the solvent held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High performance, non-polar, fast-evaporating cleaning agent in key industries, increased domestic production, and well established infrastructure in India all contribute to the solvent segment's largest share and higher spending on n-heptane when compared to other end use.

By Sales Channel:

The India N-Heptane Market Size is divided by sales channel into direct sales and indirect sales. Among these, the indirect sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The indirect sales segment dominates because of fragmented nature of end-user industries, require localized inventory, logistical support, flexible payment terms, and service facilities crucial for maintaining relationships with small regional manufacturers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India N-Heptane Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India N-Heptane Market:

- Alpha Chemika

- Caspray Chemicals

- Riddhi Siddhi Industries

- Triveni Chemicals

- Vardhman and Sons

- Leo Chemo Plast Pvt Ltd.

- Hi Tech Chemicals

- Anand Agencies

- Gomoswa International

- Sujata Chemicals

- Chintan Enterprise

- Meru Chem Private Limited

- A B Enterprises

- Standard Reagents Pvt Ltd.

- Others

Recent Developments in India N-Heptane Market:

- In September 2025, domestic n-heptane prices in India for 99% min purity showed resilience with a 0.47% improvement in Q3 2025 compared to the previous quarter, driven by strong consumption in paint, adhesives, and specialty chemical industries.

- In May 2024, Chevron Phillips Chemical Company announced it was stepping up research into sustainable, greener methods of developing n-heptane, which influences the import-dependent Indian market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India N-Heptane Market Size based on the below-mentioned segments:

India N-Heptane Market, By End Use

- Pharmaceuticals

- Solvent

- Fuel Additive

- Others

India N-Heptane Market, By Sales Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

Q: What is the India n-heptane market size?A: India n-heptane market is expected to grow from 207 thousand tonnes in 2024 to 320 thousand tonnes by 2035, growing at a CAGR of 4.04% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rapid expansion of the pharmaceutical sector, robust growth in the paints, coatings, and adhesives industries, rising electronics manufacturing requiring precision cleaning solvents, urbanization and infrastructure development, expansion of India’s specialty chemical manufacturing capacity, and supported by government initiatives and integrated industrial clusters.

-

Q: What factors restrain the India n-heptane market?A: Constraints include the environmental regulations, high initial and operational costs, stringent handling and safety protocols, feedstock price volatility, and competition from alternative and greener solvent technologies limitations.

-

Q: How is the market segmented by end use?A: The market is segmented into pharmaceuticals, solvent, fuel additive, and others.

-

Q: Who are the key players in the India n-heptane market?A: Key companies include Alpha Chemika, Caspray Chemicals, Riddhi Siddhi Industries, Triveni Chemicals, Vardhman and Sons, Leo Chemo Plast Pvt Ltd., Hi Tech Chemicals, Anand Agencies, Gomoswa International, Sujata Chemicals, Chintan Enterprise, Meru Chem Private Limited, A B Enterprises, Standard Reagents Pvt Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?