India Molded Fibre Packaging Market Size, Share, By Type (Thick Wall, Transfer, Thermoformed, And Processed), By Product (Trays, End Caps, Bowls &Cups, Clamshells, Plates, And Others), By Source (Wood Pulp And Non-Wood Pulp), By End Use (Food & Beverages, Electronics, Healthcare, Industrial, And Others), And India Molded Fibre Packaging Market Size Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareIndia Molded Fibre Packaging Market Size Insights Forecasts to 2035

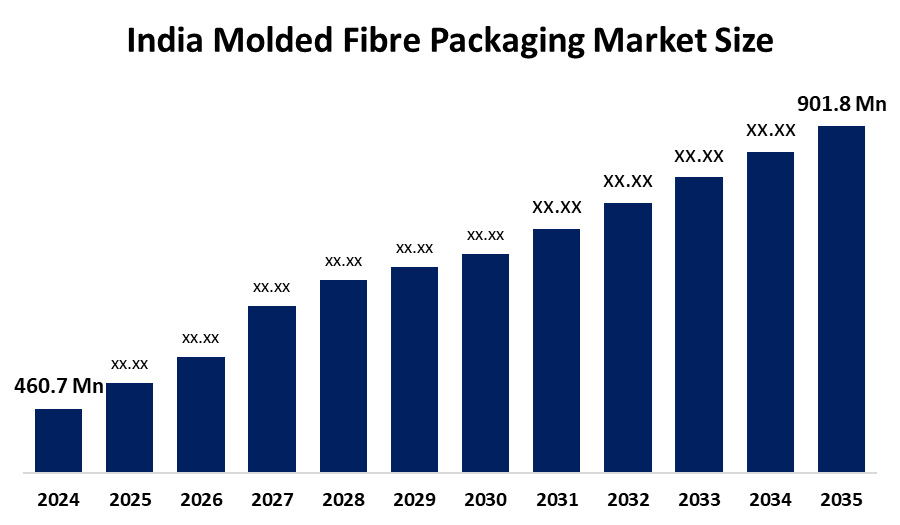

- India Molded Fibre Packaging Market Size 2024: USD 460.7 Mn

- India Molded Fibre Packaging Market Size 2035: USD 901.8 Mn

- India Molded Fibre Packaging Market Size CAGR 2024: 6.3%

- India Molded Fibre Packaging Market Size Segments: Type, Product, Source, and End Use

Get more details on this report -

The India Molded Fibre Packaging Market Size includes the production and provision of biodegradable, recyclable packaging items made from materials such as wood pulp, recycled paper, and other plant-derived fibre sources. These products include clamshell packaging, trays, protective packaging, cup, and industrial packaging, which are increasingly taking the place of traditional plastic and foam-based packaging options in the food and drink, e-commerce, electronics, and consumer goods industries. The increasing environmental awareness of consumers, increased regulations banning single-use plastics, increased e-commerce and food delivery services and the increasing demand for sustainable packaging solutions that are able to reduce carbon footprints and reduce waste are contributing factors to the growth of the molded fibre packaging market in India.

The Molded Fibre Packaging in India are backed by government support including the Indian government implementation, EPR, Extended Producer Responsibility and plastic waste management laws which require producers to recycle all packaging responsibly, comply with the law regarding eco-friendly packaging, and promote the adoption of environmentally friendly forms of packaging such as molded fibre.

As technology advances, India’s molded fibre packaging manufacturers are now using molding technologies such as thermoforming, thermal forming, and transfer molding continue to gain popularity within the industry as manufacturers seek greater product customization, strength, improved barrier properties, increased aesthetics, reduced production costs, and reduced material costs associated with the finished product.

India Molded Fibre Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 460.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.3% |

| 2035 Value Projection: | 901.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Product |

| Companies covered:: | Huhtamaki PPL Limited, JK Paper Ltd., Ecoware Solutions, Pakka Limited, Shree Kias Pack, Neeyog Packaging, Pulp2pack, Maspack, Discover India Packaging, Cirkla, Claridge Moulded Fibre Ltd., S.M Pulp Packaging Pvt. Ltd., Bambrew, Dinearth Eco Friendly Tableware, PaperFoam India Pvt Ltd, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Molded Fibre Packaging Market:

The India Molded Fibre Packaging Market Size is driven by the increasing demand for eco-friendly, sustainable, and biodegradable packaging solutions, increased government regulations and bans on single-use plastics, an increase in the number of e-commerce stores, food & beverage service providers, and growing consumer preference for eco-friendly brands, and rise of circular economy initiatives, increased use of technology to enhance manufacturing efficiencies, quality, and cost-effectiveness.

The India molded fibre packaging market is restrained by the higher production expenses than equally qualified plastic options, limited moisture and oil resistance in some cases, complex distribution/logistics issues, and limitations in the uses of eco-friendly packaging materials throughout all sectors of the packaging industry.

The future of India molded fibre packaging market is bright and promising, with versatile opportunities emerging from the company has formed partnerships with international companies to create eco-friendly molded fibre packaging solutions that have been utilized in such sectors as food packaging with high barriers to environmental effects, premium branded retail packaging, healthcare and pharmaceutical and exporting cost effective solutions in this category.

Market Segmentation

The India Molded Fibre Packaging Market Size share is classified into type, product, source, and end use.

By Type:

The India molded fibre packaging market is divided by type into thick wall, transfer, thermoformed, and processed. Among these, the transfer segment holds the largest revenue market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. High demand for food & beverages sector, cost effective and eco-friendly solution, high demand for trays, and shock-absorbing solutions for delicate items all contribute to the transfer segment's largest share and higher spending on molded fibre packaging when compared to other type.

By Product:

The India molded fibre packaging market is divided by product into trays, end caps, bowls & cups, clamshells, plates, and others. Among these, the trays segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The trays segment dominates because of their versatility for electronics provide secure cushioning for diverse items, consumer preference for eco-friendly packaging, cost effective option making them a financially viable choice for large-scale packaging.

By Source:

The India molded fibre packaging market is divided by source into wood pulp and non-wood pulp. Among these, the wood pulp segment accounted for the largest market share in 2024 and is predicted to grow at a significant CAGR during the forecast period. Wide availability ensuring consistent supply of raw material, cost effectiveness, preferred choice for manufacturers, established infrastructure facilitates large-scale production, and growing environmental concerns all contribute to the wood pulp segment's largest share and higher spending on molded fibre packaging when compared to other source.

By End Use:

The India molded fibre packaging market is divided by end use into food & beverages, electronics, healthcare, industrial, and others. Among these, the food & beverages service segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The food & beverages service segment dominates because of their sustainable alternatives to plastic, growth in e-commerce food deliveries need for protective packaging for fresh products, and consumer eco-friendly consciousness and regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India molded fibre packaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Molded Fibre Packaging Market:

- Huhtamaki PPL Limited

- JK Paper Ltd.

- Ecoware Solutions

- Pakka Limited

- Shree Kias Pack

- Neeyog Packaging

- Pulp2pack

- Maspack

- Discover India Packaging

- Cirkla

- Claridge Moulded Fibre Ltd.

- S.M Pulp Packaging Pvt. Ltd.

- Bambrew

- Dinearth Eco Friendly Tableware

- PaperFoam India Pvt Ltd

- Others

Recent Developments in India Molded Fibre Packaging Market:

In January 2025, Huhtamaki Company hosted a forum with the Confederation of Indian Industry to accelerate standards for designing recyclable flexible packaging, which includes promoting the use of fibre-based solutions where possible.

In February 2024, ITC outlined plans to expand its “Filo” series of sustainable paperboards, which includes products like FiloBev, FiloPack, and FiloTub. These are designed as replacements for single use plastic and LDPE-coated packaging in the food and beverage industry, with plans to potentially target the personal care segment as well.

In January 2024, JK Paper collaborated with AIC-JKLU to launch an accelerator program aimed at supporting startups developing innovative and sustainable biomaterial-based packaging solutions, including molded fibre applications.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India molded fibre packaging market based on the below-mentioned segments:

India Molded Fibre Packaging Market, By Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

India Molded Fibre Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

India Molded Fibre Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

India Molded Fibre Packaging Market, By End Use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

Frequently Asked Questions (FAQ)

-

What is the India molded fibre packaging market size?India molded fibre packaging market is expected to grow from USD 460.7 million in 2024 to USD 901.8 million by 2035, growing at a CAGR of 6.3% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the growing demand for sustainable and biodegradable packaging solutions, strict government regulations, including single-use plastic bans and EPR norms, expansion of e-commerce, food delivery, and the food & beverage sector, demand for protective and food-grade packaging, rising consumer preference for eco-friendly brands, circular economy initiatives, and technological advancements improving efficiency, quality, and cost-effectiveness.

-

What factors restrain the India molded fibre packaging market?Constraints include the higher production costs compared with plastic alternatives, limited moisture and grease resistance in some applications, and infrastructure/logistics challenges constrain broader adoption across all packaging segment.

-

How is the market segmented by type?The market is segmented into thick wall, transfer, thermoformed, and processed.

-

Who are the key players in the India molded fibre packaging market?Key companies include Huhtamaki PPL Limited, JK Paper, Ecoware, Pakka Limited, Shree Kias Pack, Neeyog, Pulp2pack, Maspack, Discover India Packaging, Cirkla, Claridge Moulded Fibre Ltd., S.M Pulp Packaging Pvt. Ltd., Bambrew, Dinearth Eco Friendly Tableware, PaperFoam India Pvt Ltd, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?