India Microgrid Market Size, Share, By Energy Source (Natural Gas, Combined Heat & Power, Solar Photovoltaic, Diesel, Fuel Cell, And Others), By Application (Remote Systems, Institution & Campus, Community, Defence, And Others), And India Microgrid Market Insights, Industry Trend, Forecasts to 2035.

Industry: Energy & PowerIndia Microgrid Market Insights Forecasts to 2035

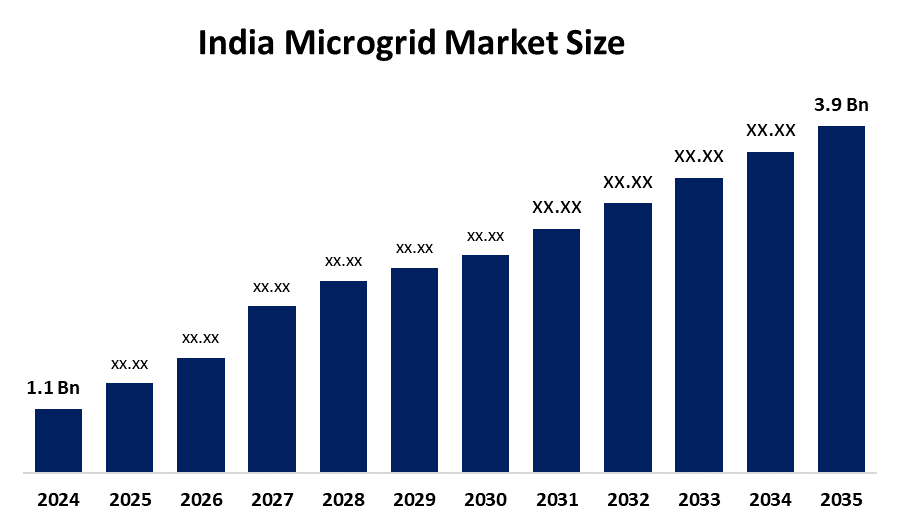

- India Microgrid Market Size 2024: USD 1.1 Bn

- India Microgrid Market Size 2035: USD 3.9 Bn

- India Microgrid Market CAGR 2024: 12.19%

- India Microgrid Market Segments: Energy Source and Application

Get more details on this report -

India microgrid market is defined as the portion of the power industry that produces power locally, on a small scale, and can create, hold and transmit electrical energy in its own right and through connection to the national grid network. Microgrids consist of a mix of renewable energy sources, including solar and wind energy, along with storage technology and intelligent controls to provide dependable, resilient sources of electrical power. Microgrids are frequently used in locations where the electrical grid is unstable, or for areas where centralized electrical distribution networks are not effective. Decentralized energy generation is rapidly growing to promote its clean energy transition, while supporting its goals for rural electricity access.

The microgrid in India are backed by government support, including the Decentralized Renewable Energy (DRE) scheme from the Ministry of New & Renewable Energy and other rural electrification initiatives aimed to enhance access to affordable electricity for remote communities through off-grid and mini-grid technologies. Programs such as the Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) as well as numerous rural electrification initiatives have help develop a large number of microgrids around the country, which offer communities an affordable and sustainable means to gain access to reliable electricity, without relying on traditional electricity transmission lines.

As technology advances, India’s microgrid providers are now microgrid efficiency, dependability, cost savings, and overall performance have been improved with the use of energy storage systems, along with improvements in energy usage and demand forecasting through modernized smart power electronics and digital monitoring, Integrated with AI and IoT based Controls. This enhanced ability to predict electricity demand, share their surplus energy batteries directly amongst their users, and otherwise utilize the features of the modern microgrid make them a preferred option for businesses, industries and communities.

Market Dynamics of the India Microgrid Market:

The India microgrid market is driven by the requirement of stable power generation, the increase in demand for electricity from businesses and industries, unreliability of power through the use of a grid, the encouragement by governments for the continued implementation of renewable energies and decentralised energy systems, the declining price of solar and battery storage systems and the ability to generate own energy for the increased interest in rural power generation.

The India microgrid market is restrained by the high initial capital costs associated with infrastructure, substantial upfront investment, required limited access to financing or subsidies, and inconsistent regulatory frameworks across states which may hinder widespread adoption.

The future of India microgrid market is bright and promising, with versatile opportunities emerging from the expanding the focus on hybrid microgrids that combine renewable energy sources combined with advanced storage technologies as well as supportive policies and the growth of partnerships between private entities and public institutions. These types of systems create the opportunity to deploy hybrid microgrid technology in large scale throughout the Indian energy market.

India Microgrid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.1 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 12.19% |

| 2035 Value Projection: | USD 3.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Siemens India Ltd., ABB India Ltd., Schneider Electric India Pvt Ltd., Cummins India Ltd., General Electric India, Eaton Corporation, Hitachi Energy India Ltd., Tata Power Solar Systems Ltd., Adani Energy Solutions Ltd., Waaree Energies Ltd., Vikram Solar, Azure Power, Jakson Group, Mera Gao Micro Grid Power Pvt Ltd., Novergy Energy Solutions Pvt Ltd., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Microgrid Market share is classified into energy source and application.

By Energy Source:

The India microgrid market is divided by energy source into natural gas, combined heat & power, solar photovoltaic, diesel, fuel cell, and others. Among these, the combined heat & power segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Cost effective, reduce energy waste, strong demand from key industries, technological advancements, and rising need for decentralised power solutions in the commercial and industrial sectors all contribute to the combined heat & power segment's largest share and higher spending on microgrid when compared to other energy source.

By Application:

The India microgrid market is divided by application into remote systems, institution and campus, community, defence, and others. Among these, the remote systems segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The remote systems segment dominates because of critical need to provide reliable and consistent energy access, integration of renewable sources, enhanced energy security and reliability, and strong government initiative in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India microgrid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Microgrid Market:

- Siemens India Ltd.

- ABB India Ltd.

- Schneider Electric India Pvt Ltd.

- Cummins India Ltd.

- General Electric India

- Eaton Corporation

- Hitachi Energy India Ltd.

- Tata Power Solar Systems Ltd.

- Adani Energy Solutions Ltd.

- Waaree Energies Ltd.

- Vikram Solar

- Azure Power

- Jakson Group

- Mera Gao Micro Grid Power Pvt Ltd.

- Novergy Energy Solutions Pvt Ltd.

- Others

Recent Developments in India Microgrid Market:

In November 2025, Tata Power Solar Systems Ltd. continued its push for rural electrification, highlighting the deployment of solar-plus-battery microgrids in remote areas like Mayurbhanj, Odisha, to ensure critical loads like clinics and water pumps remain operational during main grid outages.

In August 2025, Tata Power Solar Systems Ltd. announced the use of artificial intelligence and machine learning for designing and remotely monitoring its microgrids, making operations more efficient and cost effective.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India microgrid market based on the below-mentioned segments:

India Microgrid Market, By Energy Source

- Natural Gas

- Combined Heat & Power

- Solar Photovoltaic

- Diesel

- Fuel Cell

- Others

India Microgrid Market, By Application

- Remote Systems

- Institution & Campus

- Community

- Defence

- Others

Frequently Asked Questions (FAQ)

-

Q:What is the India microgrid market size?A:India microgrid market is expected to grow from USD 1.1 billion in 2024 to USD 3.9 billion by 2035, growing at a CAGR of 12.19% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by the growing need for reliable power in rural and remote areas, rising electricity demand from commercial and industrial users, frequent grid disruptions, strong government support for renewable and decentralized energy systems, declining costs of solar and battery storage technologies, and increasing focus on sustainability and carbon emission reduction.

-

Q:What factors restrain the India microgrid market?A:Constraints include the high initial capital costs associated with infrastructure, substantial upfront investment required, limited access to financing or subsidies, and inconsistent regulatory frameworks across states which may hinder widespread adoption.

-

Q:How is the market segmented by energy source?A:The market is segmented into natural gas, combined heat & power, solar photovoltaic, diesel, fuel cell, and others.

-

Q:Who are the key players in the India microgrid market?A:Key companies Siemens India Ltd., ABB India Ltd., Schneider Electric India Pvt Ltd., Cummins India Ltd., General Electric India, Eaton Corporation, Hitachi Energy India Ltd., Tata Power Solar Systems Ltd., Adani Energy Solutions Ltd., Waaree Energies Ltd., Vikram Solar, Azure Power, Jakson Group, Mera Gao Micro Grid Power Pvt Ltd., Novergy Energy Solutions Pvt Ltd., and Others.

-

Q:Who are the target audiences for this market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?