India Micro Mobility Charging Infrastructure Market Size, Share, By Vehicle Type (E-Scooters, E-Bikes, E-Unicylces, And E-Skateboards), By Power Source (Solar Powered And Battery Powered), By Charger Type (Slow Charger, Wired, Wireless, Fast Charger, CHAdeMO, CCS And Others), By End Use (Residential And Commercial), And India Micro Mobility Charging Infrastructure Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationIndia Micro Mobility Charging Infrastructure Market Size Insights Forecasts to 2035

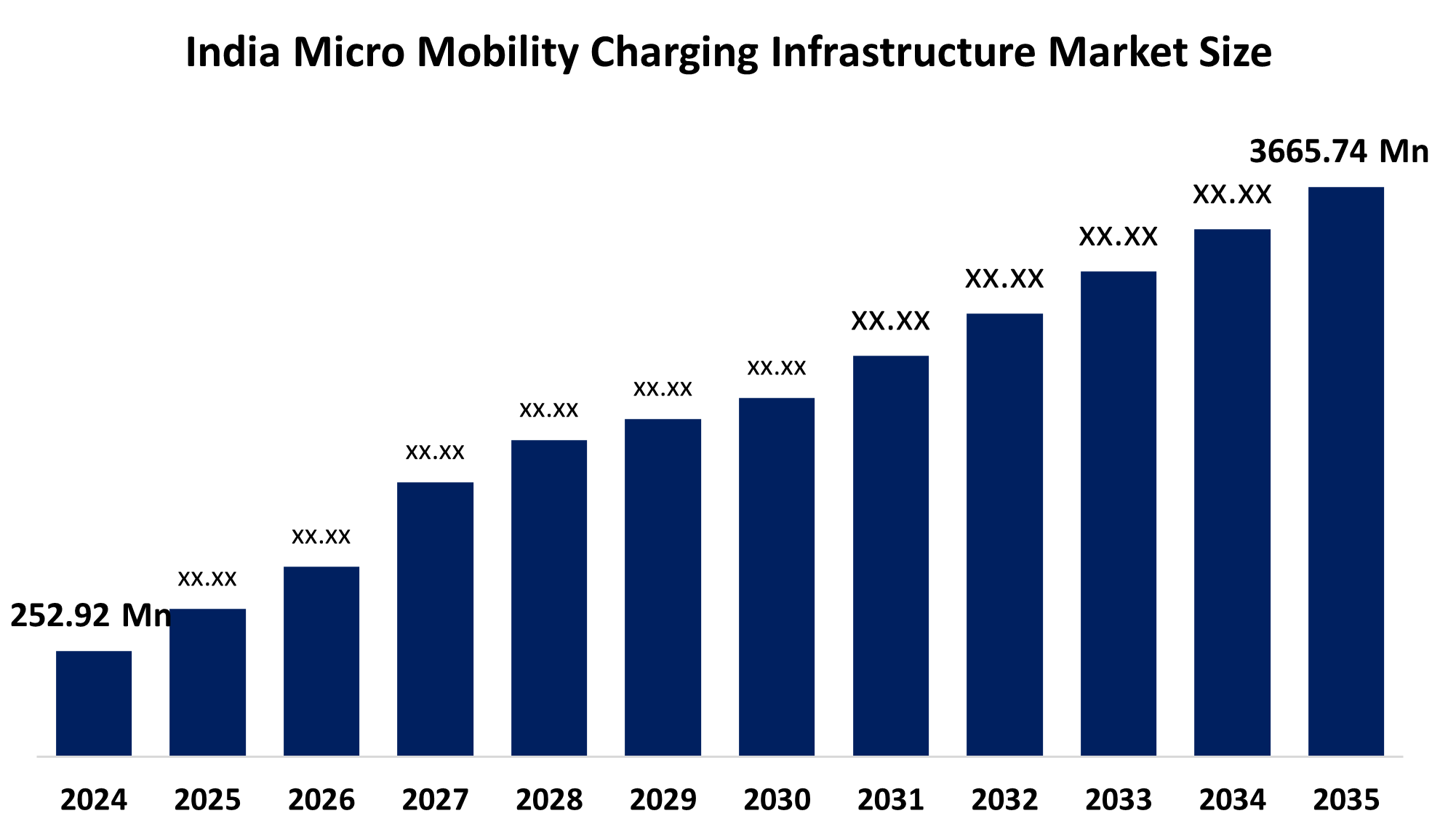

- India Micro Mobility Charging Infrastructure Market Size 2024: USD 252.92 Mn

- India Micro Mobility Charging Infrastructure Market Size 2035: USD 3665.74 Mn

- India Micro Mobility Charging Infrastructure Market CAGR 2024: 27.52%

- India Micro Mobility Charging Infrastructure Market Segments: Vehicle Type, Power Source, Charger Type, and End Use.

Get more details on this report -

The India Micro Mobility Charging Infrastructure Market Size is a growing ecosystem of physical charging stations, networks and technologies supporting electric micro mobility vehicles like e-scooters, e-bikes, e-rickshaws, etc. used for short trip/urban travel. The market include both private or public charging stations, as well as solutions to charge small electric vehicles such as e-scooters and e-bikes via DC or AC Charging points and upcoming technology such as battery swap locations specifically developed for smaller EVs. The India micro mobility charging infrastructure market is designed to provide a means for consumers to conveniently recharge their vehicles on-the-go, alleviate range Anxiety, support shared micromobility fleets, and assist with the integration of clean transportation in cities and towns throughout the country.

The micro mobility charging infrastructure in India are backed by government support, including the Faster Adoption and Manufacturing of Electric Vehicles (FAME) Scheme), dedicated to the construction of an EV charging infrastructure throughout the country. Under FAME-II, the Government provided subsidies to oil industry players for establishing thousands of Electric Vehicle Public Charging Stations (EVPCS) across India. Additionally, the Government established targets for installing charging stations nationwide along national highways and critical urban areas. Current figure shows India has more than 29,000 public EV charging stations and the country's ongoing rapid development in EV charging infrastructure represents a 5,000 stations in 2022 with +500% growth rates in just three years. This explosive growth rate indicates strong local, regional and national cooperation in expanding charging networks for all EVs, including micro-mobility vehicles.

As technology advances, India’s micro mobility charging infrastructure providers are now using fast charging technologies that can drastically decrease the time it takes to charge a vehicle, many companies are gaining traction and working on developing chargers that can charge micro-mobility vehicles in less than an hour. Therefore, these pieces of equipment will greatly increase user convenience. Furthermore, integrating the power infrastructure associated with smart grid solutions allows users to track and monitor their energy use in real time, better allocate available energy sources, and ultimately lower costs related to charging electric vehicles. The integration of these technologies with IoT connectivity provides manufacturers with a wealth of data analytics that can be used to gain insight into customer behaviours and optimize the placement of charging stations. Renewable Energy powered charging stations have generated increased interest in combining solar or wind energy with the emerging electric vehicle support network to decrease costs and reduce carbon footprints.

Market Dynamics of the India Micro Mobility Charging Infrastructure Market:

The India Micro Mobility Charging Infrastructure Market Size is driven by the demand for more charging stations in city areas, increases in public's environmental concern, partnerships to deploy charging infrastructure between the public and private sectors, growth in network expansion of charging stations on highways, technological innovation and both state and federal government incentives are motivating private companies people to invest in the establishment of charging stations.

The India Micro Mobility Charging Infrastructure Market Size is restrained by the large upfront cost to establish charging stations, lack of consistent standards across the industry, variable reliability of the electrical grid, slows down the roll-out of charging stations on a large scale, especially in small cities and rural areas.

The future of India Micro Mobility Charging Infrastructure Market Size is bright and promising, with versatile opportunities emerging from the rise of battery swap networks, especially with two and three wheeled vehicles, will create a new way to quickly recharge batteries and increase the ease of use for consumers in high traffic urban environments. With further development of ultra-fast standardised solutions to charge batteries, greater private sector investment will be drawn in the marketplace because of the significantly shortened amount of time required to recharge, the integration of charging infrastructure into renewable energy sources and smart city initiatives is also beneficial providing a green brand image and cost savings for charging infrastructure.

India Micro Mobility Charging Infrastructure Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 252.92 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 27.52% |

| 2035 Value Projection: | USD 3665.74 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Vehicle Type, By Power Source |

| Companies covered:: | Tata Power EZ Charge, Ather Energy, Bolt.Earth, Jio-bp Pulse, Charge Zone, Statiq, Fortum GLIDA, Delta Electronics India, Servotech EV Infra, Exicom Telesystems, Okaya EV Charging Solutions, ABB India, Magenta ChargeGrid, Sun Mobility, Charzer, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The India Micro Mobility Charging Infrastructure Market share is classified into vehicle type, power source, charger type, and end use.

By Vehicle Type:

The India Micro Mobility Charging Infrastructure Market Size is divided by vehicle type into e-scooters, e-bikes, e-unicycles, and e-skateboards. Among these, the e-scooters segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Compact design, convenience, suitable for short urban trips, lower cost, low maintenance, smart features and app connectivity, and incentives for EVs from government all contribute to the e-scooters segment's largest share and higher spending on micro mobility charging infrastructure when compared to other vehicle type.

By Power Source:

The India Micro Mobility Charging Infrastructure Market Size is divided by power source into solar powered and battery powered. Among these, the battery powered segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The battery powered segment dominates because of user convenience, utilizing portable chargers with standard electricity, flexible for daily commutes, and easier integration of battery-powered charging into existing residential and commercial settings.

By Charger Type:

The India Micro Mobility Charging Infrastructure Market Size is divided by charger type into slow charger, wired, wireless, fast charger, CHAdeMO, CCS, and others. Among these, the fast charger segment held the largest market share in 2024 and is predicted to grow at a significant CAGR during the forecast period. Micro mobility fleet operators, reduced downtime equals higher utilization and revenue, and offers flexibility and range anxiety all contribute to the fast charger segment's largest share and higher spending on micro mobility charging infrastructure when compared to other charger type.

By End Use:

The India Micro Mobility Charging Infrastructure Market Size is divided by end use into residential and commercial. Among these, the residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The residential segment dominates because of high personal adoption of affordable vehicles for daily commutes, low maintenance required, convenient home charging solution, rising urban populations and short distance transport.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Micro Mobility Charging Infrastructure Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Micro Mobility Charging Infrastructure Market:

- Tata Power EZ Charge

- Ather Energy

- Bolt.Earth

- Jio-bp Pulse

- Charge Zone

- Statiq

- Fortum GLIDA

- Delta Electronics India

- Servotech EV Infra

- Exicom Telesystems

- Okaya EV Charging Solutions

- ABB India

- Magenta ChargeGrid

- Sun Mobility

- Charzer

- Others

Recent Developments in India Micro Mobility Charging Infrastructure Market:

- In October 2025, Tata Motors in partnership with Thunderplus to launch 5000 fast-charging stations specifically for electric small commercial vehicles across various Tier 2 and Tier 3 cities to support commercial fleets.

- In June 2025, OMCs have installed 8,885 public charging stations out of a sanctioned 9,332, marking a major step in expanding national infrastructure.

- In February 2025, Tata Motors via TATA.ev announced plans to establish 400,000 charging points nationwide by 2027 and operationalize 500 new “Mega Chargers” in collaboration with partners such as Tata Power, ChargeZone, Statiq, and Zeon.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Micro Mobility Charging Infrastructure Market Size based on the below-mentioned segments:

India Micro Mobility Charging Infrastructure Market, By Vehicle Type

- E-Scooters

- E-Bikes

- E-Unicycles

- E-Skateboards

India Micro Mobility Charging Infrastructure Market, By Power Source

- Solar Powered

- Battery Powered

India Micro Mobility Charging Infrastructure Market, By Charger Type

- Slow Charger

- Wired

- Wireless

- Fast Charger

- CHAdeMO

- CCS

- Others

India Micro Mobility Charging Infrastructure Market, End Use

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

Q: What is the India micro mobility charging infrastructure market size?A: India micro mobility charging infrastructure market is expected to grow from USD 252.92 million in 2024 to USD 3665.74 million by 2035, growing at a CAGR of 27.52% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing demand for charging points in urban areas, rising fuel costs and growing environmental awareness, public-private partnerships focused on charging infrastructure deployment, expand in the network across highways, cities, and commercial complexes, technological innovations and government policies both central and state incentives are encouraging private investment into charging stations.

-

Q: What factors restrain the India micro mobility charging infrastructure market?A: Constraints include the high initial investment cost for setting up charging stations, including land, equipment, and grid upgrades, along with limited standardization and uneven grid reliability, which slows large-scale deployment, especially in smaller cities and rural areas.

-

Q: How is the market segmented by vehicle type?A: The market is segmented into e-scooters, e-bikes, e-unicycles, and e-skateboards.

-

Q: Who are the key players in the India micro mobility charging infrastructure market?A: Key companies include Tata Power EZ Charge, Ather Energy , Bolt.Earth, Jio-bp Pulse, Charge Zone, Statiq, Fortum GLIDA, Delta Electronics India, Servotech EV Infra, Exicom Telesystems, Okaya EV Charging Solutions, ABB India, Magenta ChargeGrid, Sun Mobility, Charzer, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?