India Methyl Ethyl Ketone Market Size, Share, By Form (Liquid Form And Solid Form), By Application (Paints & Coatings, Adhesives & Thinners, Printing Inks, Pharmaceuticals, And Others), And India Methyl Ethyl Ketone Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsIndia Methyl Ethyl Ketone Market Size Insights Forecasts to 2035

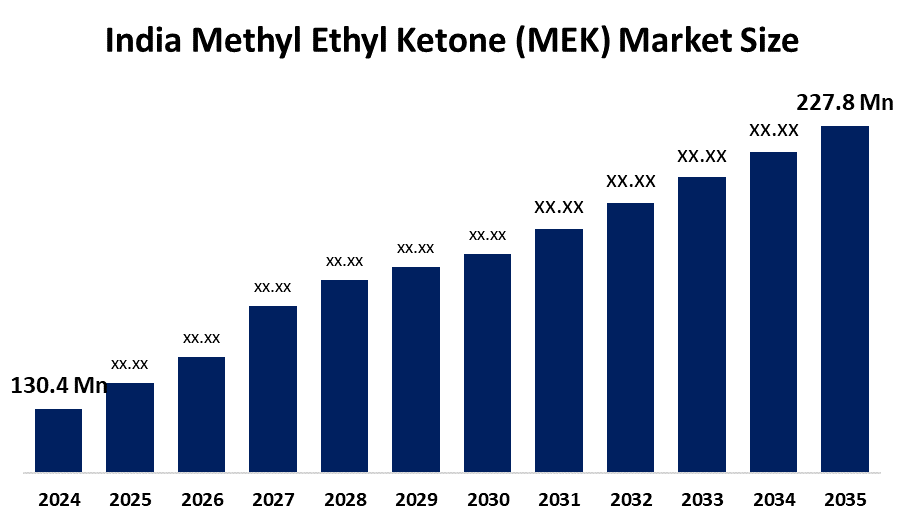

- India Methyl Ethyl Ketone Market Size 2024: USD 130.4 Million

- India Methyl Ethyl Ketone Market Size 2035: USD 227.8 Million

- India Methyl Ethyl Ketone Market CAGR 2024: 5.2%

- India Methyl Ethyl Ketone Market Segments: Form and Application

Get more details on this report -

The India Methyl Ethyl Ketone (MEK) Market Size encompasses an essential part of India's economy and many industries throughout the country for production and supply of methyl ethyl ketone products. It has multiple uses and applications from paint to adhesive manufacturing to chemical processing, and more. MEK's characteristics make it very useful for these purposes, including how quickly MEK evaporates various substances. The India methyl ethyl ketone market has been steadily growing within each of these end-user industries which are supported by both domestic production as well as international importation of MEK supplies.

The methyl ethyl ketone in India are backed by government support, including the Make in India have been instrumental in shaping the MEK market by promoting domestic manufacturing and attracting foreign investment into India’s chemical and wider manufacturing sectors. The broader Indian chemical industry which encompasses solvents like MEK is a significant contributor to the national economy, historically accounting for around 2.6–3% of the global chemical sector and placing India among the top chemical producers worldwide.

As technology advances, Indian methyl ethyl ketone providers are now using traditional methods of producing MEK, with advanced catalytic conversion process and automation efficiency of manufacturing is improved, waste reductions are achieved and the overall environmental performance of the process is improved. By integrating digital process control, real-time monitoring and analytics, manufacturing processes are improved with consistency and safety throughout each production step. In addition to these advances in technology, there are also ongoing investments taking place across the sector to improve energy efficiency through cleaner energy sources, treating and reducing waste and reducing emissions as part of a commitment to sustainability.

India Methyl Ethyl Ketone (MEK) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 130.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.2% |

| 2035 Value Projection: | USD 227.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Form, By Application |

| Companies covered:: | Cetex Petrochemicals Limited, Shell Chemical, Prasol Chemicals Pvt Ltd., ExxonMobil Co India Private Limited, Arkema, Sasol, Nouryon, Vizag Chemical, Gujarat State Fertilizers & Chemicals Ltd., AkzoNobel, Jigchem Universal, Galaxy Chemicals, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Methyl Ethyl Ketone Market:

The India Methyl Ethyl Ketone Market Size is driven by the rapid expansion of end-use industries, growth in the paints and coatings sector, rapid infrastructure development, increased automotive manufacturing, demand high-performance formulations, rise of e-commerce platforms, expanding chemical manufacturing sector, increasing use of MEK in adhesives, sealants, and pharmaceutical intermediates, increased advanced analytical techniques ensure high-purity MEK, and strong government policies that support local manufacturing and industrial growth further propel the market growth.

The India Methyl Ethyl Ketone Market Sizeis restrained by the inadequate infrastructure, limitations in logistics, transportation, and storage facilities, increased operational costs, regulatory hurdles aimed at controlling emissions, environmental impacts impose compliance challenges, continued dependence on imports, and global price volatility and supply disruptions issues.

The future of India Methyl Ethyl Ketone Market Size is bright and promising, with versatile opportunities emerging from the increase of downstream industrial activities such as automotive, infrastructure, pharmaceuticals and industrial chemical sectors will lead to continuously high demands for quality intermediate solvent mixtures and high quality intermediary products. There is also much potential for further import substitution, as well as for production capacity expansion via increased domestic production capacity through governmental encouragement and public-private partnership to construct and develop additional facilities and technology. There is also opportunity to develop environmentally sustainable MEK based products and pathways into other types of applications.

Market Segmentation

The India methyl ethyl ketone market share is classified into form and application.

By Form:

TheIndia Methyl Ethyl Ketone Market Size is divided by form into liquid form and solid form. Among these, the liquid form segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High effectiveness as a solvent, offer fast evaporation rate, excellent solvency power for resins, ideal viscosity with quick drying, and ease of use in industrial applications all contribute to the liquid form segment's largest share and higher spending on methyl ethyl ketone when compared to other form.

By Application:

The India Methyl Ethyl Ketone Market Sizeis divided by application into paints & coatings, adhesives & thinners, printing inks, pharmaceuticals, and others. Among these, the paints & coatings segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The paints & coatings segment dominates because of rapid urbanization, increasing construction spending in India, growing vehicle production, and favoured for its strong solvency, low viscosity, and fast evaporation rates.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India methyl ethyl ketone market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Methyl Ethyl Ketone Market:

- Cetex Petrochemicals Limited

- Shell Chemical

- Prasol Chemicals Pvt Ltd.

- ExxonMobil Co India Private Limited

- Arkema

- Sasol

- Nouryon

- Vizag Chemical

- Gujarat State Fertilizers & Chemicals Ltd.

- AkzoNobel

- Jigchem Universal

- Galaxy Chemicals

- Others

Recent Developments in India Methyl Ethyl Ketone Market:

- In September 2025, Vizag Chemicals focusing on launching methyl ethyl ketone products with purity levels exceeding 99.5%, in response to the increasing demand for high-performance, environmentally compliant product.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India methyl ethyl ketone market based on the below-mentioned segments

India Methyl Ethyl Ketone Market, By Form

- Liquid Form

- Solid Form

India Methyl Ethyl Ketone Market, By Application

- Paints & Coatings

- Adhesives & Thinners

- Printing Inks

- Pharmaceuticals

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India methyl ethyl ketone market size?A: India methyl ethyl ketone market is expected to grow from USD 130.4 million in 2024 to USD 227.8 million by 2035, growing at a CAGR of 5.2% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rapid expansion of end-use industries, growth in the paints and coatings sector, rapid infrastructure development, increased automotive manufacturing, demand high-performance formulations, rise of e-commerce platforms, expanding chemical manufacturing sector, increasing use of MEK in adhesives, sealants, and pharmaceutical intermediates, increased advanced analytical techniques ensure high-purity MEK, and strong government policies that support local manufacturing and industrial growth further propel the market growth.

-

Q: What factors restrain the India methyl ethyl ketone market?A: Constraints include the inadequate infrastructure, limitations in logistics, transportation, and storage facilities, increased operational costs, regulatory hurdles aimed at controlling emissions, environmental impacts impose compliance challenges, continued dependence on imports, and global price volatility and supply disruptions issues.

-

Q: Who are the key players in the India methyl ethyl ketone market?A: Key companies include Cetex Petrochemicals Limited, Shell Chemical, Prasol Chemicals Pvt Ltd., ExxonMobil Co India Private Limited, Arkema, Sasol, Nouryon, Vizag Chemical, Gujarat State Fertilizers & Chemicals Ltd., AkzoNobel, Jigchem Universal, Galaxy Chemicals, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?