India Methanol Market Size, Share, By End Use (Formaldehyde, MTO/MTP, MTBE, Acetic Acid, Gasoline Blending, And Others), By Sales Channel (Direct Sales And Indirect Sales), And India Methanol Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsIndia Methanol Market Insights Forecasts to 2035

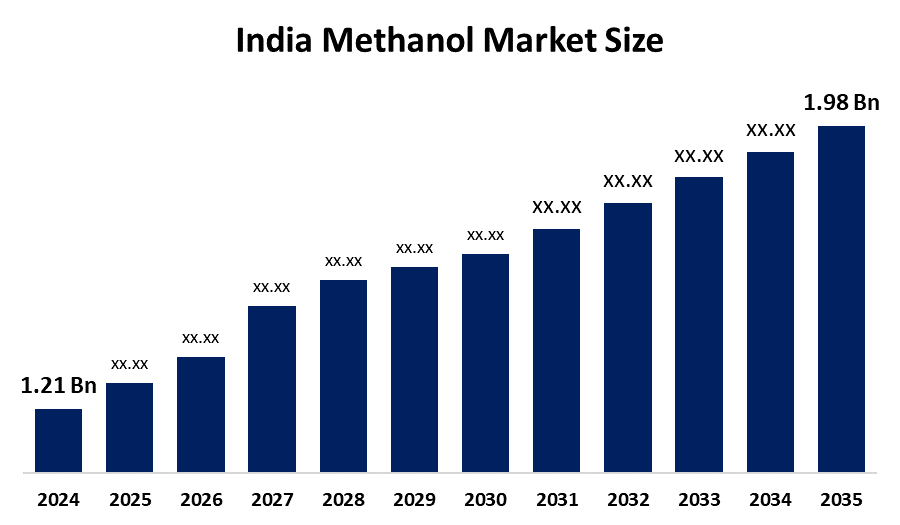

- India Methanol Market Size 2024: USD 1.21 Bn

- India Methanol Market Size 2035: USD 1.98 Bn

- India Methanol Market CAGR 2024: 4.58%

- India Methanol Market Segments: End Use and Sales Channel

Get more details on this report -

The India Methanol Market Size encompasses whole system for producing, importing, distributing, and using methanol. Methanol is a chemically simple and versatile alcohol that is both a chemical feedstock and an alternative fuel. It is an important raw material in many industrial processes, where methanol is used to manufacture formaldehyde, acetic acid, and methyl tertiary butyl ether, as well as plastics, adhesives, coatings, and solvents. The use of methanol as a fuel blend in transportation, energy, and in production of dimethyl ether which can be used to partially replace liquid propane gas in cooking applications.

The methanol in India is backed by government support, including the Methanol Economy programme spearheaded by NITI Aayog, which advocates for using methanol as a low-carbon fuel alternative to petrol, diesel, LPG, and other conventional energy sources. India currently produces about 0.7 million metric tonnes of methanol annually against domestic demand exceeding 3 million tonnes, with imports covering over 90% of the gap, highlighting the scale of opportunity for domestic capacity expansion.

As technology advances, Indian methanol providers are now using traditional production techniques currently being maximized by reducing the cost and increasing the quantity of produced materials. Researchers and developers are making significant contributions to methanol and carbon dioxide conversion methods by adopting digital control systems, modern catalysts, and energy-effective plant designs. In addition, progress has been made toward developing engine technologies for methanol, direct methanol fuel cells, and building a network for blending and distributing fuel in India.

Market Dynamics of the India Methanol Market:

The India Methanol Market Size is driven by expanding demand from the chemicals and petrochemicals sectors, rapid industrialization, growth in automotive and construction sectors, increasing production of consumer goods, high push for alternative and cleaner fuels, supported by government policies, increased environmental concerns, rising awareness of methanol’s potential to reduce import dependence and lower emissions further strengthens demand.

The India Methanol Market Size is restrained by the heavy reliance on imports, global price volatility, supply chain disruptions, foreign exchange risk, high production costs associated with conventional and green methanol technologies, limited domestic production infrastructure, and stringent environmental and safety regulations.

The future of India methanol market is bright and promising, with versatile opportunities emerging from the increasing ambitions related to energy security and transitioning towards low-carbon sources of energy. There have been significant investments in the production of methanol from renewable feedstocks and green methanol due to the declining costs of renewable electricity and supportive policy frameworks; moreover, the expanding use of methanol to blend with both diesel and gasoline, as well as the potential use of methanol to produce derivatives, adds additional opportunities. Since methanol can play a role in hydrogen production as well as storage and transportation of hydrogen, it will provide many new opportunities for growth, especially given India's ambitions to expand its renewable energy base.

India Methanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.21 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.58% |

| 2035 Value Projection: | USD 1.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By End Use, By Sales Channel |

| Companies covered:: | Gujarat Narmada Valley Fertilizers & Chemicals Limited Deepak Fertilisers and Petrochemicals Corporation Ltd. Assam Petrochemicals Limited Rashtriya Chemicals and Fertilizers Reliance Industries Limited Vinati Organics Limited Simalin Chemical Industries Ltd. Methanex Corporation Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Methanol Market share is classified into end use and sales channel.

By End Use:

The India Methanol Market Size is divided by end use into formaldehyde, MTO/MTP, MTBE, acetic acid, gasoline blending, and others. Among these, the formaldehyde segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Robust construction and infrastructure growth, widely used in furniture, automobile, and healthcare industries, and serves fundamental raw material for producing formaldehyde resins all contribute to the formaldehyde segment's largest share and higher spending on methanol when compared to other end use.

By Sales Channel:

The India methanol market is divided by sales channel into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct sales segment dominates because of need for high volume, consistent supply from major industrial consumers, efficient logistics due to direct interaction, and have established direct relationships with consumers in industrial hubs in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India methanol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Methanol Market:

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- Deepak Fertilisers and Petrochemicals Corporation Ltd.

- Assam Petrochemicals Limited

- Rashtriya Chemicals and Fertilizers

- Reliance Industries Limited

- Vinati Organics Limited

- Simalin Chemical Industries Ltd.

- Methanex Corporation

- Others

Recent Developments in India Methanol Market:

In January 2026, Assam Petrochemicals Ltd signed an MoU with Deendayal Port Authority to set up a 150 TPD e-methanol plant at Kandla Port, Gujarat. This project aims to create an integrated value chain for green marine fuels.

In June 2025, NTPC commissioned India’s first Green Methanol pilot plant at NTPC Vindhyachal, Madhya Pradesh, developed with Toyo Engineering India.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India methanol market based on the below-mentioned segments:

India Methanol Market, By End Use

- Formaldehyde

- MTO/MTP

- MTBE

- Acetic Acid

- Gasoline Blending

- Others

India Methanol Market, By Sales Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

What is the India methanol market size?India methanol market is expected to grow from USD 1.21 billion in 2024 to USD 1.98 billion by 2035, growing at a CAGR of 4.58% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Market growth is driven by the expanding demand from the chemicals and petrochemicals sectors, rapid industrialization, growth in automotive and construction sectors, increasing production of consumer goods, high push for alternative and cleaner fuels, supported by government policies, increased environmental concerns, rising awareness of methanol’s potential to reduce import dependence and lower emissions further strengthens demand

-

What factors restrain the India methanol market?Constraints include the heavy reliance on imports, global price volatility, supply chain disruptions, foreign exchange risk, high production costs associated with conventional and green methanol technologies, limited domestic production infrastructure, and stringent environmental and safety regulations

-

How is the market segmented by end use?The market is segmented into formaldehyde, MTO/MTP, MTBE, acetic acid, gasoline blending, and others

-

Who are the key players in the India methanol market?Key companies include Gujarat Narmada Valley Fertilizers & Chemicals Limited, Deepak Fertilisers and Petrochemicals Corporation Ltd., Assam Petrochemicals Limited, Rashtriya Chemicals and Fertilizers, Reliance Industries Limited, Vinati Organics Limited, Simalin Chemical Industries Ltd., Methanex Corporation, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?