India Marble Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Tiles, and Blocks), By Color Type (White, Black, Red, Others), By Application Type (Buildings & Decoration, Statues & Monuments, Furniture, Others), and India Marble Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingIndia Marble Market Insights Forecasts to 2035

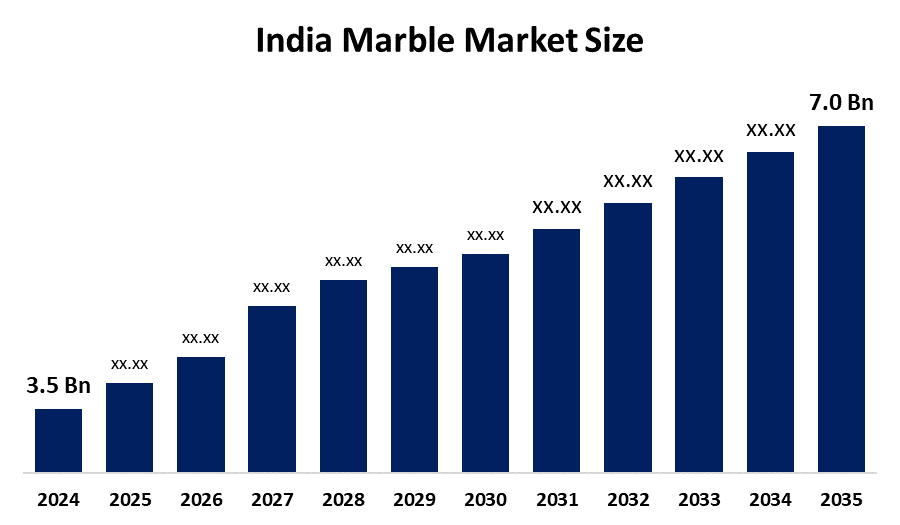

- The India Marble Market Size Was Estimated at USD 3.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.5% from 2025 to 2035

- The India Marble Market Size is Expected to Reach USD 7.0 Billion By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The India Marble Market Size Is Anticipated To Reach Usd 7.0billion By 2035, Growing At A CAGR Of 6.5% From 2025 To 2035. The market share is influenced by increased demand in real estate and construction industries, rapid urbanization, and growing disposable incomes. Furthermore, the usage of marble for interior designing, luxury residences, and commercial buildings, coupled with availability of varied varieties, is contributing to the India marble market growth.

Market Overview

The India Marble Market Size includes all the activities from the extraction of natural marble to its processing and then selling the final product. Marble is a dense, visually appealing metamorphic rock characterized by its smooth texture and luxurious appearance. The raw material for the India marble market is quarried in Rajasthan.

The processing of the material involves the use of resins, polishing compounds, cutting tools, adhesives, and surface treatments. The uses of the final product include flooring, wall coverings, kitchen tops, staircases, monuments, temples, table tops, and luxury hotels, malls, and so forth. The India marble market has been growing due to the surge in the urbanization of India, the rise in the construction of real estate, and the growing demand for luxury in residential homes.

The exports of the material are also contributing to the momentum of the India marble market. The cutting-edge technology in cutting the material has been contributing to the growth of the India marble market. The government has initiated several policies under the Mines and Minerals Development and Regulation Act for the mining activities. The initiatives of the government, such as the Make in India program, allowing 100% foreign direct investment in mining, have been aimed at speeding up the growth of the India marble market.

Report Coverage

This research report categorizes the market for the India marble market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India marble market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India marble market.

India Marble Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.5% |

| 2035 Value Projection: | USD 7.0 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Color Type |

| Companies covered:: | R K Marble Pvt. Ltd., Classic Marble Company Pvt. Ltd., A-Class Marble India Pvt. Ltd., Pacific Industries Ltd., Mumal Marbles Pvt. Ltd., Hindustan Marble Pvt. Ltd., Maruti Granites & Marbles Pvt. Ltd., Suraj Marbles Pvt. Ltd., Bhandari Marble Group, Shree Rishabh Marmo Pvt. Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India Marble Market Size functions as a result of increasing urban development together with the ongoing growth of construction projects that include residential buildings, commercial structures, and infrastructure works. The increasing demand for high-quality interior design materials from homes, hotels, shopping malls, and corporate offices leads to higher marble usage. The presence of extensive high-quality marble reserves in India, especially located in Rajasthan, enables the country to meet its domestic needs while boosting its export capabilities. The market expansion occurs because exports to the United States, the UAE, and European nations are increasing. The development of new quarrying methods together with advanced cutting and polishing techniques results in better operational efficiency and higher product standards. The government develops infrastructure and housing and manufacturing sectors, which leads to increased investments and production activities within the marble sector.

Restraining Factors

The India Marble Market Size in India mostly constrained by the high price sensitivity among consumers, particularly in rural and semi-urban areas. The presence of counterfeit and cheaper unorganized local products in the market increases competition for organized brands. Variations in raw material prices and the use of imported high-tech materials increase the cost of production. In addition, low penetration of high-end brands in rural markets and high competition among global and local players pose challenges to market growth.

Market Segmentation

The India marble market share is classified into product type, color type, and application.

- The tiles segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India marble market is segmented by product type into tiles and blocks. Among these, the tiles segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. These to its extensive use in residential and commercial floors, ease of installation, lower shipping costs compared to marble blocks, and the growing demand for available polished marble tiles, the market has a bright prospect for growth. The market is expected to grow at a high CAGR in the coming years, with the rise in housing projects in urban areas and renovation activities.

- The white segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The India marble market is segmented by color type into white, black, red, and others. Among these, the white segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is premium appearance, wide use in flooring and temples, strong domestic demand, and high export potential. Increasing luxury housing projects and commercial construction further boost demand. Black and red marble are also growing due to rising preference for modern, decorative, and customized interior designs.

- The buildings & decoration segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The India marble market is segmented by application into buildings & decoration, statues & monuments, furniture, and others. Among these, the buildings & decoration segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. These segment is expected to witness growth owing to an increase in residential and commercial constructions, an increase in the need for premium and luxury interior designs, and the popularity of marble in flooring, wall cladding, facades, and architectural designs. In addition to that, the progress of smart city projects, urban housing developments, and renovation works is also expected to boost the segment at an impressive CAGR during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India marble market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- R K Marble Pvt. Ltd.

- Classic Marble Company Pvt. Ltd.

- A-Class Marble India Pvt. Ltd.

- Pacific Industries Ltd.

- Mumal Marbles Pvt. Ltd.

- Hindustan Marble Pvt. Ltd.

- Maruti Granites & Marbles Pvt. Ltd.

- Suraj Marbles Pvt. Ltd.

- Bhandari Marble Group

- Shree Rishabh Marmo Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India marble market based on the below-mentioned segments

India Marble Market, By Product Type

- Tiles

- Blocks

India Marble Market, By Color Type

- White

- Black

- Red

- Others

India Marble Market, By Application

- Buildings and Decoration

- Statues and Monuments

- Furniture

Others

Frequently Asked Questions (FAQ)

-

Q: What is the India marble market size?A: India marble market size is expected to grow from USD 3.5billion in 2024 to USD 7.0billion by 2035, growing at a CAGR of 6.5% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: The market growth is driven by rapid urbanization, expanding construction activities, rising demand for luxury interiors, increasing exports, and supportive government infrastructure initiatives.

-

Q: What factors restrain the India marble market?A: Constraints include the high price sensitivity, fluctuating raw material costs, strict environmental regulations, unorganized competition, and substitutes like tiles and engineered stones restrict growth.

-

Q: Who are the key players in the India marble market?A: Key companies include R K Marble Pvt. Ltd., Classic Marble Company, A-Class Marble, Pacific Industries Ltd., and Mumal Marbles Pvt. Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?