India Maleic Anhydride Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Unsaturated Polyester Resin, 1, 4-Butanediol, Lubricant Additives, and Other), By Raw Material (N-Butane, Benzene, and Other), By Physical Form (Solid, Molten, and Other), and India Maleic Anhydride Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Maleic Anhydride Market Insights Forecasts to 2035

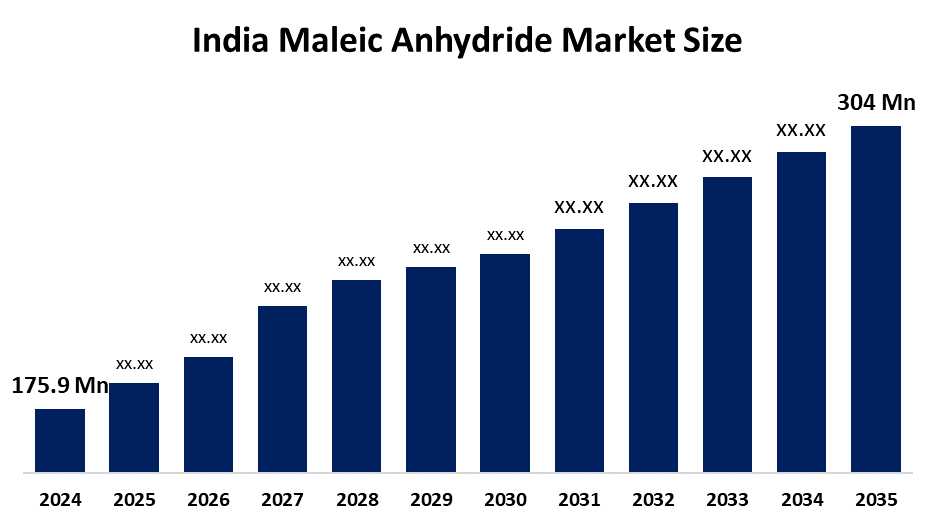

- The India Maleic Anhydride Market Size Was Estimated at USD 175.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The India Maleic Anhydride Market Size is Expected to Reach USD 304 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The India Maleic Anhydride Market Size Is Anticipated To Reach USD 304 Million By 2035, Growing At A CAGR Of 5.1% From 2025 To 2035. The India maleic anhydride market is driven by rising demand in unsaturated polyester resins, increasing applications in coatings and adhesives, growing automotive and construction industries, and expanding use in agricultural chemicals, lubricants, and specialty polymers.

Market Overview

Maleic anhydride is an organic compound widely used as a chemical intermediate in the production of unsaturated polyester resins, coatings, adhesives, and plasticizers. The India maleic anhydride market is witnessing steady growth due to increasing industrialization, expanding automotive and construction sectors, and rising demand for high-performance polymers. Its application in agricultural chemicals, lubricants, and specialty chemicals further drives market expansion. The growth is also supported by the country’s push towards chemical manufacturing and increasing exports to global markets, positioning India as a key player in Asia.

One key trend is the rising use of maleic anhydride in unsaturated polyester resins for automotive and construction applications, driven by durability and cost-effectiveness. Second, the expansion of the coatings and adhesives sector is increasing demand for specialty chemicals. Third, manufacturers are focusing on sustainable production techniques, such as bio-based maleic anhydride, to reduce environmental impact. Fourth, the growing pharmaceutical and agrochemical industries in India are increasing maleic anhydride consumption as a raw material for intermediates and formulations, reflecting its versatility.

Technological advancements in production, such as improved oxidation processes of benzene and butane, have enhanced the yield, purity, and cost-efficiency of maleic anhydride. Additionally, Indian government initiatives supporting the chemical industry, including “Make in India” and incentives for manufacturing units, are promoting domestic production. Policies encouraging export-oriented growth and investment in R&D further strengthen the market. Combined with technological innovation, government backing enables companies to expand capacity, optimize operations, and meet rising domestic and global demand efficiently.

Report Coverage

This research report categorizes the market for the India maleic anhydride market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India maleic anhydride market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India maleic anhydride market.

India Maleic Anhydride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 175.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Product Type, By Raw Material, By Physical Form |

| Companies covered:: | IG Petrochemicals Limited, Thirumalai Chemicals Ltd., Huntsman Corporation, LANXESS AG, Meru Chem Pvt. Ltd., Central Drug House (P) Ltd., Mitansh Chemicals International Pvt. Ltd., M.K. Industrial Corporation, SGS & Company, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

India Maleic Anhydride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 175.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Product Type, By Raw Material, By Physical Form |

| Companies covered:: | IG Petrochemicals Limited, Thirumalai Chemicals Ltd., Huntsman Corporation, LANXESS AG, Meru Chem Pvt. Ltd., Central Drug House (P) Ltd., Mitansh Chemicals International Pvt. Ltd., M.K. Industrial Corporation, SGS & Company, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India maleic anhydride market is primarily driven by the growing demand for unsaturated polyester resins in the automotive, construction, and electrical industries. Rising applications in coatings, adhesives, and plasticizers further fuel consumption. Expansion of the pharmaceutical and agricultural chemical sectors increases their use as an intermediate. Additionally, the push for high-performance polymers and specialty chemicals, coupled with industrial growth and increasing exports, supports market growth. Sustainable production methods and rising awareness of eco-friendly chemical alternatives also contribute to driving the market forward.

Restraining Factors

The India maleic anhydride market faces restraints due to fluctuating raw material prices, particularly benzene and butane, which impact production costs. Strict environmental regulations and the high energy consumption of manufacturing processes limit expansion. Additionally, the availability of cheaper imports and competition from alternative chemicals can hinder domestic market growth, affecting profitability and investment in new production capacities.

Market Segmentation

The India maleic anhydride market share is classified into product type, raw material, and physical form.

- The unsaturated polyester resin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India maleic anhydride market is segmented by product type into unsaturated polyester resin, 1, 4-butanediol, lubricant additives, and other. Among these, the unsaturated polyester resin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The unsaturated polyester resin segment dominates the market because it is a key raw material for producing fiberglass-reinforced plastics used in automotive, construction, and electrical industries. Its properties, such as high strength, lightweight, and chemical resistance, make it ideal for diverse applications. Rapid industrialization and infrastructure development in India are driving demand for durable and cost-effective materials. Additionally, the growing adoption of composite materials and increased manufacturing of coatings and adhesives further boost the consumption of maleic anhydride in this segment.

- The n-butane segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India maleic anhydride market is segmented by raw material into n-butane, benzene, and others. Among these, the n-butane segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The n-butane segment dominates the market because it provides a more efficient and environmentally friendly production process compared to benzene. N-butane oxidation yields higher-purity maleic anhydride with lower emissions, making it suitable for large-scale industrial applications. Its widespread availability and lower production costs support growing demand from key end-use industries such as unsaturated polyester resins, coatings, adhesives, and specialty chemicals. Additionally, stricter environmental regulations favor n-butane-based processes, further strengthening its dominance in the market.

- The molten segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India maleic anhydride market is segmented by physical form into solid, molten, and other. Among these, the molten segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The molten segment dominates the market because it offers easier handling, storage, and transportation compared to solid forms. Its liquid state enables uniform mixing and faster processing in industrial applications, particularly in unsaturated polyester resins, coatings, and chemical intermediates. Molten maleic anhydride also reduces handling losses and ensures consistent product quality, which is crucial for large-scale manufacturing. These advantages make it the preferred choice for manufacturers, supporting its leading position in the Indian market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India maleic anhydride market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IG Petrochemicals Limited

- Thirumalai Chemicals Ltd.

- Huntsman Corporation

- LANXESS AG

- Meru Chem Pvt. Ltd.

- Central Drug House (P) Ltd.

- Mitansh Chemicals International Pvt. Ltd.

- M.K. Industrial Corporation

- SGS & Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India maleic anhydride market based on the below-mentioned segments:

India Maleic Anhydride Market, By Product Type

- Unsaturated Polyester Resin

- 1, 4-Butanediol

- Lubricant Additives

- Other

India Maleic Anhydride Market, By Raw Material

- N-Butane

- Benzene

- Other

India Maleic Anhydride Market, By Physical Form

- Solid

- Molten

- Other

Frequently Asked Questions (FAQ)

-

1. What is maleic anhydride mainly used for in India?Maleic anhydride is mainly used to produce unsaturated polyester resins, which are widely applied in construction, automotive parts, coatings, adhesives, and fiberglass-reinforced plastics.

-

2. Why is the demand for maleic anhydride increasing in India?Demand is increasing due to rapid growth in construction, automotive manufacturing, infrastructure development, and the rising use of composites and specialty chemicals across industries.

-

3. Which raw material is most commonly used for production in India?N-butane is the most commonly used raw material because it is cost-effective, efficient, and environmentally safer compared to benzene-based production.

-

4. Which physical form is preferred by manufacturers?Molten maleic anhydride is preferred as it allows easier handling, better process integration, reduced losses, and consistent quality in large-scale industrial applications.

-

5. How do environmental regulations impact the market?Strict environmental norms increase compliance costs and energy requirements but also encourage cleaner production technologies, especially n-butane-based processes.

Need help to buy this report?