India low Density Polyethylene LDPE Market Size, Share, By Sales Channel (Direct Sale and Indirect Sale), By End-Use (Extrusion coating, General purpose, Adhesive, Liquid packaging, Heavy Duty, Others), India low Density Polyethylene LDPE Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia low Density Polyethylene LDPE Market Insights Forecasts to 2035

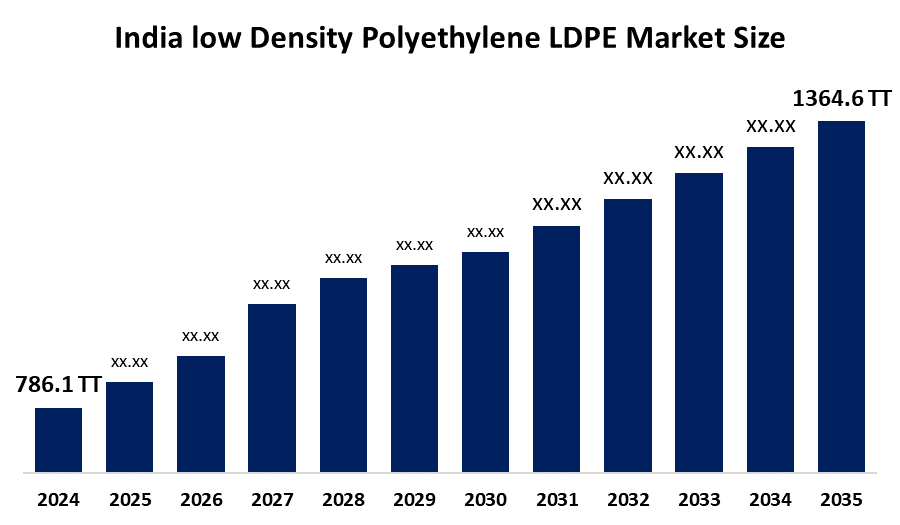

- India low Density Polyethylene LDPE Market Size 2024: 786.1 Thousand Tonnes

- India low Density Polyethylene LDPE Market Size 2035: 1364.6 Thousand Tonnes

- India low Density Polyethylene LDPE Market CAGR 2024: 5.14%

- India low Density Polyethylene LDPE Market Segments: Sales Channel and End-Use

Get more details on this report -

Low-density polyethylene (LDPE) functions as a thermoplastic polymer that manufacturers produce through ethylene synthesis, and which exhibits flexibility and lightweight properties along with moisture protection and chemical stability. In India market, LDPE functions as the primary material for manufacturing packaging films and plastic bags, shrink wraps, squeeze bottles, wire and cable insulation, agricultural films and flexible containers.

Univision Technologies created the UNIGILITY Tubular High-Pressure PE Process as a licensed platform that enables manufacturers to produce LDPE and EVA copolymer resins with enhanced flexibility and performance options.

The Government of India has approved the establishment of 10 Plastic Parks across different states to promote downstream processing activities and waste management, and circular economy initiatives. The parks offer infrastructure resources, which include recycling units, effluent treatment plants and other facilities that support the plastics value chain development, which includes LDPE processing and reuse operations.

The Indian LDPE market will experience strong future growth potential because of increasing demand for flexible packaging and rising e-commerce activities, agricultural films and infrastructure projects and growing usage of recyclable and sustainable LDPE materials.

India low Density Polyethylene LDPE Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 786.1 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.14% |

| 2035 Value Projection: | 1364.6 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 145 |

| Segments covered: | By Sales Channel,By End-Use |

| Companies covered:: | Reliance Industries Limited, Gail (India) Limited, Indian Oil Corporation Limited, Haldia Petrochemicals Limited, ONGC Petro Additions Limited, UFLEX Limited, EPL Limited, Time Technoplast Limited, TCPL Packaging Limited, Mohit Polybag Industries,and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India low Density Polyethylene LDPE Market:

The India low density polyethylene LDPE market is driven by the demand for flexible packaging solutions, which continues to grow in the food, FMCG, and e-commerce industries because flexible packaging solutions meet their operational requirements.

The India low density polyethylene LDPE market is restrained by the crude oil price fluctuations, which directly impact raw material expenses, while plastic waste regulations become more stringent, and environmental issues increase pressure to cut down on single-use plastic usage.

The future of India low density polyethylene LDPE market is bright and promising, as the market for recyclable and sustainable packaging solutions grows because new recycling technologies emerge and existing recycling facilities expand to meet rising demand from the agriculture and consumer goods industries.

Market Segmentation

The India low density polyethylene LDPE market share is classified into sales channels and end-use.

By Sales Channel:

The India low density polyethylene LDPE market is divided by sales channel type into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The large manufacturers of industrial products choose to buy LDPE materials through bulk procurement contracts because this approach provides them with cost savings and reliable product delivery, and permanent business relationships with LDPE suppliers and distributors.

By End-Use:

The India low density polyethylene LDPE market is divided by end-use into extrusion coating, general purpose, adhesive, liquid packaging, heavy duty, and others. Among these, the general purpose segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The strong demand for flexible packaging and plastic bags, films and consumer goods has led to plastic material development in the FMCG, retail and agriculture industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India low density polyethylene LDPE market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India low Density Polyethylene LDPE Market:

- Reliance Industries Limited

- Gail (India) Limited

- Indian Oil Corporation Limited

- Haldia Petrochemicals Limited

- ONGC Petro Additions Limited

- UFLEX Limited

- EPL Limited

- Time Technoplast Limited

- TCPL Packaging Limited

- Mohit Polybag Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India low density polyethylene LDPE market based on the below-mentioned segments:

India low Density Polyethylene LDPE Market, By Sales Channel

- Direct Sale

- Indirect Sale

India low Density Polyethylene LDPE Market, By End-Use

- Extrusion coating

- General purpose

- Adhesive

- Liquid packaging

- Heavy Duty

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India low density polyethylene LDPE market size?A: India low density polyethylene LDPE market is expected to grow from 786.1 thousand tonnes in 2024 to 1364.6 thousand tonnes by 2035, growing at a CAGR of 5.14% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the demand for flexible packaging solutions, which continues to grow in the food, FMCG, and e-commerce industries because flexible packaging solutions meet their operational requirements.

-

Q: What factors restrain the India low density polyethylene LDPE market?A: Constraints include the crude oil price fluctuations, which directly impact raw material expenses, while plastic waste regulations become more stringent, and environmental issues increase pressure to cut down on single-use plastic usage.

-

Q: How is the market segmented by sales channel?A: The market is segmented into direct sales and indirect sales.

-

Q: Who are the key players in the India low density polyethylene LDPE market?A: Key companies include Reliance Industries Limited, Gail (India) Limited, Indian Oil Corporation Limited, Haldia Petrochemicals Limited, ONGC Petro Additions Limited, UFLEX Limited, EPL Limited, Time Technoplast Limited, TCPL Packaging Limited, Mohit Polybag Industries and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?