India Liquid Sulphur Dioxide Market Size, Share, By Grade (Food Grade, Industrial Grade, And Pharmaceutical Grade), By Application (Food & Beverages, Chemical Manufacturing, Fertilizer, Pulp & Paper, Water Treatment, And Others), And India Liquid Sulphur Dioxide Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsIndia Liquid Sulphur Dioxide Market Insights Forecasts to 2035

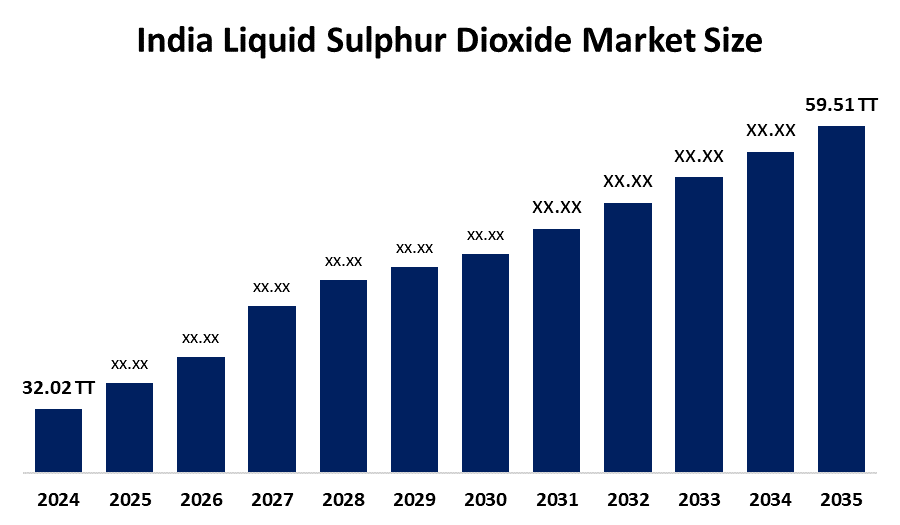

- India Liquid Sulphur Dioxide Market 2024: 32.02 Thousand Tonnes

- India Liquid Sulphur Dioxide Market Size 2035: 59.51 Thousand Tonnes

- India Liquid Sulphur Dioxide Market CAGR 2024: 5.8%

- India Liquid Sulphur Dioxide Market Segments: Grade and Application

Get more details on this report -

The liquid sulphur dioxide market in India comprises the production and supply of liquid sulphur dioxide (SO2), a chemical primarily produced by burning sulfur or through the treatment of sulphite compounds with acid, followed by cooling and liquefaction. Liquid sulphur dioxide is widely used across industries such as chemicals, food processing, wastewater treatment (for neutralizing chlorine-based waste), and oil refineries due to its versatile chemical properties. However, it is also highly toxic and corrosive, requiring strict handling and storage measures.

The liquid sulphur dioxide industry in India operates within a framework of government regulations and environmental initiatives. One key program is the National Clean Air Programme (NCAP), launched by the Ministry of Environment, Forest and Climate Change to systematically address air pollution, including emissions of pollutants such as sulphur dioxide. Under NCAP, the Central Pollution Control Board (CPCB) and State Pollution Control Boards monitor SO2 levels at numerous monitoring stations across the country and set air quality improvement targets for non-attainment cities. These regulations influence how industries manage, monitor, and report sulphur dioxide emissions and related substances.

With technological advancements, Indian producers of liquid sulphur dioxide are upgrading their manufacturing and handling systems to improve safety, purity, and operational efficiency. These improvements include advanced containment and transportation systems for managing the highly reactive and corrosive nature of the chemical, modern plant automation for real-time process control, and digital quality assurance tools to ensure consistent product standards and minimize risk. Such developments not only enhance operational safety but may also support the expansion of downstream applications, indirectly contributing to market growth.

India Liquid Sulphur Dioxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 32.02 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.8% |

| 2035 Value Projection: | 59.51 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 233 |

| Tables, Charts & Figures: | 175 |

| Segments covered: | By Grade,By Application |

| Companies covered:: | Hindalco Industries Ltd., Coromandel International Ltd., Aarti Industries Ltd., Paradeep Phosphates Ltd., Hindustan Zinc Limited, Atul Ltd., Indian Farmers Fertiliser Cooperative Ltd., Khaitan Chemicals & Fertilizers Ltd., Oriental Carbon & Chemicals Ltd., Kutch Chemical Industries Limited, Panoli Intermediates India Pvt. Ltd., Sai Sulphonate Pvt. Ltd., The Andhra Sugars Limited, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Liquid Sulphur Dioxide Market:

The India liquid sulphur dioxide market is driven by the increasing demand from industrial applications, rising water treatment needs due to industrial effluent compliance requirements, expanding industrial base, strong government support, technological advancements, and growth in sectors like textiles, chemicals, and food processing further elevate the demand for liquid sulphur dioxide.

The India liquid sulphur dioxide market is restrained by the hazardous and toxic nature imposes high safety, complex handling, high storage costs on manufacturers and users, regulatory constraints on emissions, increase operational compliance costs, and fluctuating sulphur feedstock challenges.

The future of India liquid sulphur dioxide market is bright and promising, with versatile opportunities emerging from the continued growth of the food processing industry, pharmaceutical companies, and specialty chemical manufacturing, there is an increasing opportunity for high-purity, liquid sulphur dioxide products with food grades specifically designed for very niche applications or end uses. The opportunity for investing in advanced safety technology could be an entry point for new market applications, such as improved water treatment systems or refined chemical intermediates. In addition, increased environmental compliance requirements could lead to increased demand for both cleaner and more efficient SO2 management and reduction technologies.

Market Segmentation

The India Liquid Sulphur Dioxide Market share is classified into grade and application.

By Grade:

The India liquid sulphur dioxide market is divided by grade into food grade, industrial grade, and pharmaceutical grade. Among these, the industrial grade segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Dominance of the fertilizer industry, cost efficiency, versatility in industrial applications, and high volume consumption all contribute to the industrial grade segment's largest share and higher spending on liquid sulphur dioxide when compared to other grade.

By Application:

The India liquid sulphur dioxide market is divided by application into food & beverages, chemical manufacturing, fertilizer, pulp & paper, water treatment, and others. Among these, the fertilizer segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The fertilizer segment dominates because massive production of phosphoric acid, improve soil quality and boost crop yields, strong government support with subsidies, and well established integrated plants with raw material availability.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India liquid sulphur dioxide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Liquid Sulphur Dioxide Market:

- Hindalco Industries Ltd.

- Coromandel International Ltd.

- Aarti Industries Ltd.

- Paradeep Phosphates Ltd.

- Hindustan Zinc Limited

- Atul Ltd.

- Indian Farmers Fertiliser Cooperative Ltd.

- Khaitan Chemicals & Fertilizers Ltd.

- Oriental Carbon & Chemicals Ltd.

- Kutch Chemical Industries Limited

- Panoli Intermediates India Pvt. Ltd.

- Sai Sulphonate Pvt. Ltd.

- The Andhra Sugars Limited

- Others

Recent Developments in India Liquid Sulphur Dioxide Market:

In January 2026, Gujarat State Fertilizers & Chemicals Ltd. commenced commercial production at a new sulphuric acid plant. The plant, located at Fertilizernagar, Vadodara, has an installed capacity of 600 Metric Tonnes Per Day.

In October 2025, Paradeep Phosphates Limited scheduled to commission a new 2.0 million metric tonnes per annum sulphuric acid plant in Paradeep, Odisha to support fertilizer production and enhance captive energy generation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India liquid sulphur dioxide market based on the below-mentioned segments:

India Liquid Sulphur Dioxide Market, By Grade

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

India Liquid Sulphur Dioxide Market, By Application

- Food & Beverages

- Chemical Manufacturing

- Pulp & Paper

- Fertilizer

- Water Treatment

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India liquid sulphur dioxide market size?A: India liquid sulphur dioxide market is expected to grow from 32.02 thousand tonnes in 2024 to 59.51 thousand tonnes by 2035, growing at a CAGR of 5.8% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing demand from industrial applications, rising water treatment needs due to industrial effluent compliance requirements, expanding industrial base, strong government support, technological advancements, and growth in sectors like textiles, chemicals, and food processing further elevate the demand for liquid sulphur dioxide.

-

Q: What factors restrain the India liquid sulphur dioxide market?A: Constraints include the hazardous and toxic nature imposes high safety, complex handling, high storage costs on manufacturers and users, regulatory constraints on emissions, increase operational compliance costs, and fluctuating sulphur feedstock challenges.

-

Q: How is the market segmented by grade?A: The market is segmented into food grade, industrial grade, and pharmaceutical grade.

-

Q: Who are the key players in the India liquid sulphur dioxide market?A: Key companies include Hindalco Industries Ltd., Coromandel International Ltd., Aarti Industries Ltd., Paradeep Phosphates Ltd., Hindustan Zinc Limited, Atul Ltd., Indian Farmers Fertiliser Cooperative Ltd., Khaitan Chemicals & Fertilizers Ltd., Oriental Carbon & Chemicals Ltd., Kutch Chemical Industries Limited, Panoli Intermediates India Pvt. Ltd., Sai Sulphonate Pvt. Ltd., The Andhra Sugars Limited, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?