India Liquid Chlorine Market Size, Share, By Sales Channel (Direct/Institutional Sales, Retail Sales, and Other), By End-Use (Polyvinyl Chloride Resin (PVC), Water Treatment, Pharmaceuticals, Pulp and Paper, and Others), India Liquid Chlorine Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Liquid Chlorine Market Insights Forecasts to 2035

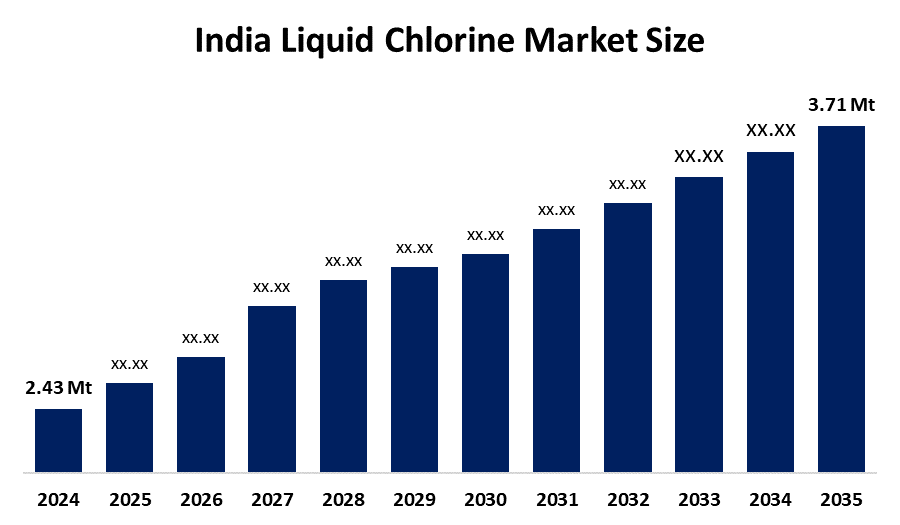

- India Liquid Chlorine Market Size 2024: 2.43 Million Tonnes

- India Liquid Chlorine Market Size 2035: 3.71 Million Tonnes

- India Liquid Chlorine Market CAGR 2024: 3.92%

- India Liquid Chlorine Market Segments: Sales Channel and End-Use

Get more details on this report -

The India Liquid Chlorine Market Size includes all activities related to producing liquid chlorine, which industrial and municipal facilities use to distribute and consume the chemical for water treatment, chemical manufacturing and pharmaceutical production, for paper manufacturing and sanitation operations.

Atul Products Ltd established its new caustic-chlorine production plant in Valsad during January 2024 after spending INR 1,035 Cr to build the facility. The development increases chlorine production capacity, which will serve chemical processing requirements and local market demands through its daily output of 300 TPD composed of 200 TPD caustic lye and 100 TPD flakes.

The Government of India has organized national symposiums and programs together with partners such as Evidence Action to implement in-line chlorination systems, which provide safe drinking water to communities throughout Andhra Pradesh and Madhya Pradesh. This initiative aims to develop uniform chlorination methods that public water systems will follow to enhance their service delivery.

India Liquid Chlorine Market Size will experience continuous growth because of increased investments in drinking water systems and wastewater treatment facilities, sanitation projects and the development of chemical and pharmaceutical production infrastructure.

India Liquid Chlorine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.43 Million Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.92% |

| 2035 Value Projection: | USD 3.71 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Sales Channel ,By End-Use |

| Companies covered:: | Grasim Industries Limited (Aditya Birla Group), Gujarat Alkalies and Chemicals Limited (GACL), DCM Shriram Limited, Chemplast Sanmar Limited, Reliance Industries Limited, Tata Chemicals Limited, Epigral Limited (formerly Meghmani Finechem), Nirma Limited, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Liquid Chlorine Market:

The India Liquid Chlorine Market Size is driven by the demand for safe drinking water, which has increased, together with municipal water and wastewater treatment projects that continue to expand and chemical and pharmaceutical manufacturing operations that keep growing and people who become more aware of sanitation practices and the government programs, which include Jal Jeevan Mission and AMRUT, that develop extensive chlorination systems.

The India Liquid Chlorine Market Size is restrained by the essential safety and environmental standards, together with the dangerous materials handling and transportation procedures, the expensive storage requirements, the fluctuations in raw material costs and the increasing use of different disinfection methods for some uses, describing the disinfection process.

The future of India Liquid Chlorine Market Size is bright and promising, with the nation experiences rising investments that develop its water infrastructure, while wastewater treatment facilities expand their capabilities and chemical and pharmaceutical industries grow, and the government establishes strong, safe drinking water and sanitation programs.

Market Segmentation

The India Liquid Chlorine Market share is classified into sales channel and end-use.

By Sales Channel:

The India Liquid Chlorine Market Size is divided by sales channel type into direct/institutional sales, retail sales, and other. Among these, the direct/institutional sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to bulk procurement by industrial users, long-term supply contracts, stable pricing, and strong direct relationships between manufacturers and large end-use customers.

By End-Use:

The India Liquid Chlorine Market Size is divided by end-use into polyvinyl chloride resin (PVC), water treatment, pharmaceuticals, pulp and paper, and others. Among these, the water treatment segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because of extensive municipal demand, mandatory disinfection norms, large-scale drinking water projects, and continuous consumption across urban and rural water and wastewater treatment systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Liquid Chlorine Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Liquid Chlorine Market:

- Grasim Industries Limited (Aditya Birla Group)

- Gujarat Alkalies and Chemicals Limited (GACL)

- DCM Shriram Limited

- Chemplast Sanmar Limited

- Reliance Industries Limited

- Tata Chemicals Limited

- Epigral Limited (formerly Meghmani Finechem)

- Nirma Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035.Spherical Insights has segmented the India Liquid Chlorine Market Size based on the below-mentioned segments:

India Liquid Chlorine Market, By Sales Channel

- Direct/Institutional Sales

- Retail Sales

- Other

India Liquid Chlorine Market, By End-Use

- Polyvinyl Chloride Resin (PVC)

- Water Treatment

- Pharmaceuticals

- Pulp and Paper

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India liquid chlorine market size?A: India Hydrogen Market is expected to grow from USD 2.43 million tonnes in 2024 to USD 3.71 million tonnes by 2035, growing at a CAGR of 3.92% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the demand for safe drinking water, which has increased, together with municipal water and wastewater treatment projects that continue to expand and chemical and pharmaceutical manufacturing operations that keep growing and people who become more aware of sanitation practices and the government programs, which include Jal Jeevan Mission and AMRUT, that develop extensive chlorination systems.

-

Q: What factors restrain the India liquid chlorine market?A: Constraints include the essential safety and environmental standards, together with the dangerous materials handling and transportation procedures, the expensive storage requirements, the fluctuations in raw material costs and the increasing use of different disinfection methods for some uses, describing the disinfection process.

-

Q: How is the market segmented by sales channel?A: The market is segmented into direct/institutional sales, retail sales, and other.

-

Q: Who are the key players in the India liquid chlorine market?A: Key companies include Grasim Industries Limited (Aditya Birla Group), Gujarat Alkalies and Chemicals Limited (GACL), DCM Shriram Limited, Chemplast Sanmar Limited, Reliance Industries Limited, Tata Chemicals Limited, Epigral Limited (formerly Meghmani Finechem), Nirma Limited and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?