India Linear Low Density Polyethylene Market Size, Share, By Type Mono Layer & Multilayer Films, Extrusion Coating, Rotational Molding, And Others), By End Use (Agriculture, Electrical & Electronics, Packaging, Construction, And Others), And India Linear Low Density Polyethylene Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsIndia Linear Low Density Polyethylene Market Insights Forecasts to 2035

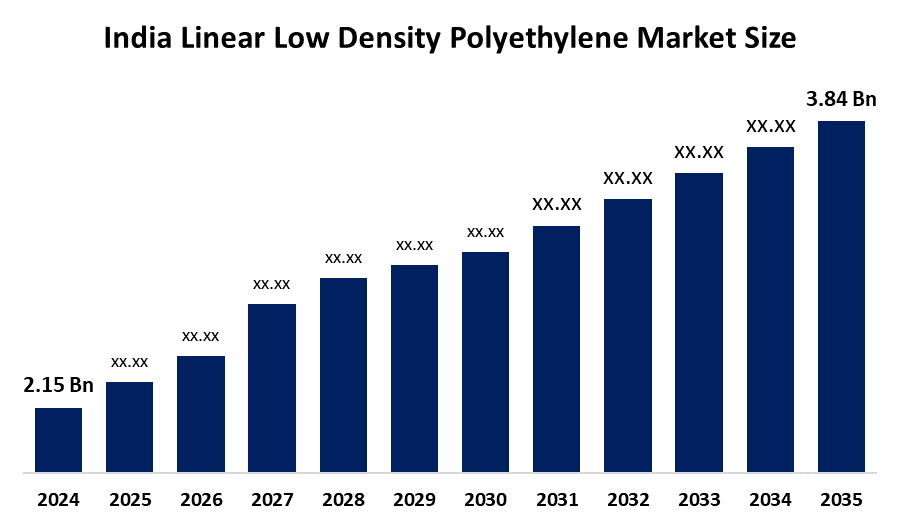

- India Linear Low Density Polyethylene Market Size 2024: USD 2.15 Billion

- India Linear Low Density Polyethylene Market Size 2035: USD 3.84 Billion

- India Linear Low Density Polyethylene Market CAGR 2024: 5.41%

- India Linear Low Density Polyethylene Market Segments: Type and End Use

Get more details on this report -

The India Linear Low Density Polyethylene (LLDPE) Market Size is a sector that produces, distributes, and consumes LLDPE, a type of linear polyethylene material, which has a much higher tensile strength than conventional LDPE. Therefore it is used in a wide range of applications including flexible packaging, agriculture, construction, automotive, and electric cable insulation. LLDPE is considered to be one of the fastest growing segments of the larger polyethylene market due to increasing demand for LLDPE in India and increasing performance benefits in newer industries as they continue to develop and expand.

The LLDPE in India is backed by government support, including the Production Linked Incentive (PLI) Scheme and broader policies under Make in India and Aatmanirbhar Bharat Abhiyan, which aim to promote domestic manufacturing, reduce import dependency, and foster investment in petrochemicals and polymers. India’s domestic plastic processing sector, made up of roughly 30,000 units across India that utilize polymers including LLDPE in molding, extrusion, and calendaring operations, with distribution varying regionally and Western India accounting for nearly half of the country’s plastic consumption.

As technology advances, Indian LLDPE providers are now using Industry 4.0 technology, polymerisation and processing that can improved by using automation and real-time monitoring systems along with advanced analytics methods to help achieve better quality control and lower production costs. The continued R&D activities within the polymer science community have led to the introduction of new grades of LLDPE that have improved mechanical properties. Innovations in catalyst systems and polymer architecture design have allowed for the development of new types of LLDPE resins that offer increased toughness, stiffness, and durability, all of which will allow Indian manufacturers to be competitive with their global counterparts and to satisfy the changing needs of their customers.

India Linear Low Density Polyethylene (LLDPE) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.15 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.41% |

| 2035 Value Projection: | USD 3.84 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By End Use ,By Type |

| Companies covered:: | Reliance Industries Limited, Indian Oil Corporation Limited, Haldia Petrochemicals Limited, GAIL (India) Limited, ONGC Petro additions Limited, Brahmaputra Cracker and Polymer Limited, SABIC, The Dow Chemical Company, ExxonMobil Chemical, LyondellBasell Industries, Chevron Phillips Chemical, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Linear Low Density Polyethylene Market:

The India Linear Low Density Polyethylene Market Size is driven by the strong demand from the flexible packaging industry, rapid expansion of e-commerce, retail, and FMCG sectors, cost-efficient characteristics make it a preferred material., growth in agriculture sector on irrigation and farm productivity, increased demand for LLDPE-based greenhouse films and irrigation solutions, infrastructure development, automotive industry expansion for lightweight polymer components, rising need for modern construction materials, expansion of domestic production capacity, and increasing investment by major petrochemical players also enhances supply reliability further propel the market growth.

The India Linear Low Density Polyethylene Market Size is restrained by the increasing regulatory pressure related to plastic waste management, stringent environmental concerns, improving recycling infrastructure, and mitigating pollution constrains, pricing volatility tied to feedstock costs, import competition, and the need for consistent quality standards.

The future of India Linear Low Density Polyethylene Market Size is bright and promising, with versatile opportunities emerging from the increase in adoptability of bio-based and recyclable LLDPE materials that will allow for differentiation of product offerings. New application segments for industrial polymers including advanced automobile parts, high-performance engineering plastics, and specialty film also provide new avenues for innovative and higher-value products. Additionally, government initiatives related to infrastructure development, a growing middle class, and continued investments in agro-industrial polymer development will provide more opportunities for growth and help balance environmental goals with market expansion.

Market Segmentation

The India Linear Low Density Polyethylene Market share is classified into type and end use.

By Type:

The India Linear Low Density Polyethylene Market Size is divided by type in mono layer & multilayer films, extrusion coating, rotational molding, and others. Among these, the mono layer & multilayer films segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. High demand for flexible packaging in food and retail, widely used agricultural films for UV protection, and increasing industrial applications with superior puncture resistance, flexibility, and strength all contribute to the mono layer & multilayer films segment's largest share and higher spending on LLDPE when compared to other type.

By End Use:

The India Linear Low Density Polyethylene Market Size is divided by application into agriculture, electrical & electronics, packaging, construction, and others. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The packaging segment dominates because of rapid growth in e-commerce, expansion of food delivery services, increased demand for durable and lightweight flexible packaging, and provides high tensile strength with puncture resistance property for packaging.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Linear Low Density Polyethylene Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Linear Low Density Polyethylene Market:

- Reliance Industries Limited

- Indian Oil Corporation Limited

- Haldia Petrochemicals Limited

- GAIL (India) Limited

- ONGC Petro additions Limited

- Brahmaputra Cracker and Polymer Limited

- SABIC

- The Dow Chemical Company

- ExxonMobil Chemical

- LyondellBasell Industries

- Chevron Phillips Chemical

- Others

Recent Developments in India Linear Low Density Polyethylene Market:

In February 2026, Reliance Industries Limited announced a price increase of INR 2500/MT for LLDPE, indicating strong demand and tightening supply with continued investment done in upgrading its Jamnagar petrochemical complex with increasing capacity for higher grade polymers, including butene-grade LLDPE.

In June 2023, HMEL became a major player with its new integrated petrochemical complex in Punjab, enhancing domestic supply of LLDPE and butene-based grades.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Linear Low Density Polyethylene Market Size based on the below-mentioned segments:

India Linear Low Density Polyethylene Market, By Type

- Mono Layer & Multilayer Films

- Extrusion Coating

- Rotational Molding

- Others

India Linear Low Density Polyethylene Market, By End Use

- Agriculture

- Electrical & Electronics

- Packaging

- Construction

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India LLDPE market size?A: India LLDPE market is expected to grow from USD 2.15 billion in 2024 to USD 3.84 billion by 2035, growing at a CAGR of 5.41% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strong demand from the flexible packaging industry, rapid expansion of e-commerce, retail, and FMCG sectors, cost-efficient characteristics make it a preferred material., growth in agriculture sector on irrigation and farm productivity, increased demand for LLDPE-based greenhouse films and irrigation solutions, infrastructure development, automotive industry expansion for lightweight polymer components, rising need for modern construction materials, expansion of domestic production capacity, and increasing investment by major petrochemical players also enhances supply reliability further propel the market growth.

-

Q: What factors restrain the India LLDPE market?A: Constraints include the increasing regulatory pressure related to plastic waste management, stringent environmental concerns, improving recycling infrastructure, and mitigating pollution constrains, pricing volatility tied to feedstock costs, import competition, and the need for consistent quality standards.

-

Q: How is the market segmented by type?A: The market is segmented into mono layer & multilayer films, extrusion coating, rotational molding, and others.

-

Q: Who are the key players in the India LLDPE market?A: Key companies include Reliance Industries Limited, Indian Oil Corporation Limited, Haldia Petrochemicals Limited, GAIL (India) Limited, ONGC Petro additions Limited, Brahmaputra Cracker and Polymer Limited, SABIC, The Dow Chemical Company, ExxonMobil Chemical, LyondellBasell Industries, Chevron Phillips Chemical, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?