India Linear Alpha Olefin Market Size, Share, By Type (Polyethylene, Polyalphaolefins, Oxo Alcohols, And Others), By Application (Polyethylene Co-monomers, Detergents & Surfactants, Synthetic Lubricants, OilField Chemicals, And Others), And India Linear Alpha Olefin Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Linear Alpha Olefin Market Insights Forecasts to 2035

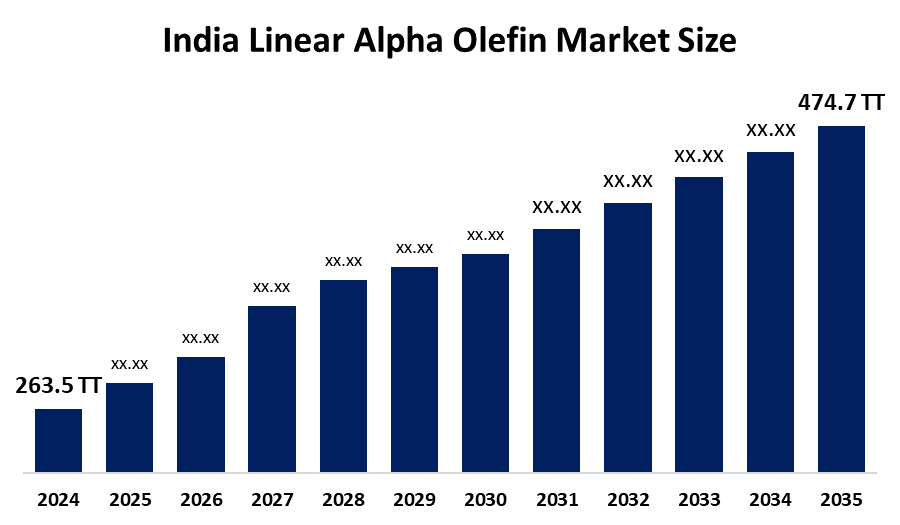

- India Linear Alpha Olefin Market Size 2024: 263.5 Thousand Tonnes

- India Linear Alpha Olefin Market Size 2035: 474.7 Thousand Tonnes

- India Linear Alpha Olefin Market CAGR 2024: 5.5%

- India Linear Alpha Olefin Market Segments: Type and Application

Get more details on this report -

The India linear alpha olefin (LAO) market encompasses industrial area that deals with the production, supply, and use of linear alpha olefins, which include straight chain terminal alkenes like 1-butene, 1-hexene, and 1-octene. These compounds are significant chemical intermediates that are used for making hundreds of different products, including polyethylene, lubricants, surfactants, and specialty chemicals. The linear alpha olefin is made through ethylene oligomerization to improve polymer characteristics and produce higher end use industrial products.

The linear alpha olefin in India are backed by government support, including the Production-Linked Incentive (PLI) schemes and infrastructure grants aimed at boosting domestic manufacturing capabilities, reducing import dependence, and encouraging research and development in related industries. India’s broader chemicals industry contributes significantly to the national economy as one of the world’s largest producers and ranking as sixth globally and third in Asia, contributing about 7% to GDP creating an environment of scale and investment that underpins demand for intermediates like LAOs.

As technology advances, India’s linear alpha olefin providers are now using combination of advanced catalyst system utilized in conjunction with automation-based control methods and optimized oligomerization processes, increased yield potential while decreasing energy input and producing a higher purity level of LAO that can be utilized in advanced applications, such as specialty polymers and high performance lubricant additive production. Furthermore, there is an increasing transition to sustainability by exploring green feedstock as well as energy-efficient manufacturing methods due to the increasing level of importance placed on compliance, stringent environmental regulations, and global objectives for sustainability, thus enhancing both competitive advantage and enhanced corporate environmental performance.

India Linear Alpha Olefin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | 263.5 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.5% |

| 2035 Value Projection: | 474.7 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Reliance Industries Limited, GAIL Limited, Indian Oil Corporation Limited, Godrej Industries Limited, Indus Petrochem Ltd., Shell Chemicals, Sasol Limited, Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the India Linear Alpha Olefin Market:

The India linear alpha olefin market is driven by the expanding petrochemical and plastics sectors, rapid urbanization, infrastructure development, growth in packaging, automotive, and consumer goods manufacturing, increasing demand for polyethylene and high-performance lubricants, enhanced domestic production capacities and strategic partnerships with global chemical firms, expansion of local supply chains and reducing dependence on imports, thereby further catalyzing market demand.

The India linear alpha olefin market is restrained by the high operational costs, volatility in raw material prices, fluctuating energy and petrochemical feedstock markets, uncertainty into production planning and profit margins, and stringent environmental regulations.

The future of India linear alpha olefin market is bright and promising, with versatile opportunities emerging from the demand from specialty chemicals, biodegradable surfactants, advanced polymeric formulation and global consumer products sectors, providing an opportunity for LAO suppliers are in both local and export markets. As investment in new petrochemical complexes is continuing, the company's human resources continue to innovate on technological advancements in their sustainable processes and products. The development of differentiated, higher value-added products has created more sustainable growth opportunities for linear alpha olefin as a result of ongoing industry changes.

Market Segmentation

The India Linear Alpha Olefin Market share is classified into type and application.

By Type:

The India linear alpha olefin market is divided by type into polyethylene, polyalphaolefins, oxo alcohols, and others. Among these, the polyethylene segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High demand for flexible packaging, automotive, and construction, primary raw material for manufacturing HDPE and LLDPE, and high demand for consumer goods all contribute to the polyethylene segment's largest share and higher spending on linear alpha olefin when compared to other type.

By Application:

The India linear alpha olefin market is divided by application into polyethylene co-monomers, detergents & surfactants, synthetic lubricants, oilfield chemicals, and others. Among these, the polyethylene co-monomers segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The polyethylene co-monomers segment dominates because of rapid expansion of India’s plastic packaging and infrastructure sectors, demand for HDPE pipes, rapid urbanization, increased disposable incomes and increased demand for long lasting construction materials in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India linear alpha olefin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Linear Alpha Olefin Market:

- Reliance Industries Limited

- GAIL Limited

- Indian Oil Corporation Limited

- Godrej Industries Limited

- Indus Petrochem Ltd.

- Shell Chemicals

- Sasol Limited

- Others

Recent Developments in India Linear Alpha Olefin Market:

In April 2025, HMEL crosses record 2 million tonnes polymer sales for FY25 and significant capacity additions at its petrochemical units. This expansion underpins feedstock production infrastructure, including LAO intermediated feeding polymer units.

In March 2024, HMEL won two major accolades, reflecting its technology implementation at the petrochemical complex linked to olefin and downstream polymer production and secured 20-year patent, reinforcing R&D and innovation efforts relevant to its integrated LAO/polymer operations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India linear alpha olefin market based on the below-mentioned segments:

India Linear Alpha Olefin Market, By Type

- Polyethylene

- Polyalphaolefins

- Oxo Alcohols

- Others

India Linear Alpha Olefin Market, By Application

- Polyethylene Co-monomers

- Detergents & Surfactants

- Synthetic Lubricants

- OilField Chemicals

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India linear alpha olefin market size?A: India linear alpha olefin market is expected to grow from 263.5 thousand tonnes in 2024 to 474.7 thousand tonnes by 2035, growing at a CAGR of 5.5% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the expanding petrochemical and plastics sectors, rapid urbanization, infrastructure development, growth in packaging, automotive, and consumer goods manufacturing, increasing demand for polyethylene and high-performance lubricants, enhanced domestic production capacities and strategic partnerships with global chemical firms, expansion of local supply chains and reducing dependence on imports, thereby further catalyzing market demand.

-

Q: What factors restrain the India linear alpha olefin market?A: Constraints include the high operational costs, volatility in raw material prices, fluctuating energy and petrochemical feedstock markets, uncertainty into production planning and profit margins, and stringent environmental regulations.

-

Q: How is the market segmented by type?A: The market is segmented into polyethylene, polyalphaolefins, oxo alcohols, and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?