India Industrial Air Compressors Market Size, Share, By Product (Reciprocating, Rotary, And Centrifugal), By Lubrication (Oil-Free And Oil-Filled), By Operation (ICE And Electric), And India Industrial Air Compressors Market Insights, Industry Trend, Forecasts to 2035.

Industry: Energy & PowerIndia Industrial Air Compressors Market Insights Forecasts to 2035

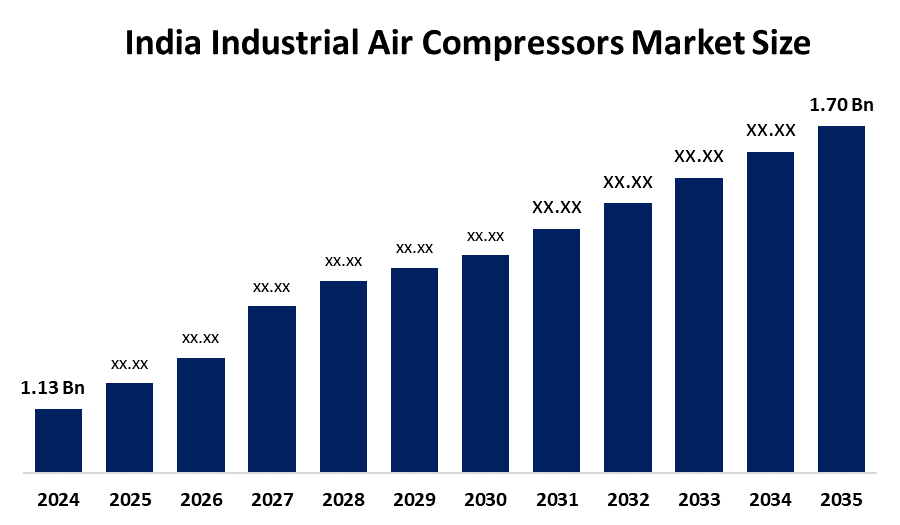

- India Industrial Air Compressors Market Size 2024: USD 1.13 Bn

- India Industrial Air Compressors Market Size 2035: USD 1.70 Bn

- India Industrial Air Compressors Market CAGR 2024: 3.78%

- India Industrial Air Compressors Market Segments: Product, Lubrication, and Operation

Get more details on this report -

The India industrial air compressor market includes the production, distribution, and use of air compressors used in different industries. Air compressors convert energy into compressed air through pressure increase and provide a supply source for pneumatic tools and various process operations, material handling, and automation. The increased demand for compressed air systems that enable more efficient and reliable operations for factories and automate their production processes contribute to the overall growth of the industry as a whole. In addition, the expansion of the various industrial sectors drives the continued need for industrial air compressors.

The industrial air compressor in India are backed by government support, including the Make in India initiative promoting domestic production, foreign direct investment (FDI), and technology development within India, contributing to the increased demand of industrial equipment like air compressors. Linked to this, India saw a large increase of over USD 33 billion in actual FDI investment in the manufacturing sector for FY2023-24, creating a rise in investor confidence and demonstrating an increase in industrial production capacity which ultimately creates a rise in demand for industrial air compressors.

As technology advances, India’s industrial air compressor providers are now using smart technologies and energy efficient technologies creates an unusual advantage for modern compressors having many common aspects like variable speed drives, oil-free designs for contamination-sensitive applications , remote monitoring, predictive maintenance, real-time monitoring of performance, reduced energy consumption, minimised downtime, support for Industry 4.0 development, compliance with energy efficiency regulations issued by various agencies and remote diagnostics and optimisation of compressed air systems to improve reliability, reduce operational expenses and increase overall efficiency.

Market Dynamics of the India Industrial Air Compressors Market:

The India industrial air compressors market is driven by the expanding industrial and manufacturing sector in India, demand for reliable compressed air infrastructure for automation, tools, and process applications, growth in manufacturing sectors, increased need for industrial air compressors, companies rising emphasis on energy efficiency and sustainability encourages the adoption air compressor technologies.

The India industrial air compressors market is restrained by the high initial capital cost of advanced industrial air compressors, upfront investment and associated maintenance costs, limited efficient systems, and slower adoption of newer technologies across price-conscious.

The future of India industrial air compressors market is bright and promising, with versatile opportunities emerging from the increasing demand for compressors that use less energy and are better for the environment in multiple industries. Additionally, the development of smart IoT-enabled air compressors is creating a significant market, allowing manufacturers to manage their equipment more effectively through remote monitoring capabilities and predictive maintenance, both of which align with the overall trend of digital transformation within the manufacturing sector.

India Industrial Air Compressors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.13 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 3.78% |

| 2035 Value Projection: | USD 1.70 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Atlas Copco, ELGi Equipments Ltd., Ingersoll Rand, Kirloskar Pneumatic Co. Ltd., Kaeser Kompressoren, Sullair, Hitachi, Ltd., BOGE Kompressoren, FS-Curtis Pvt. Ltd., Gardner Denver India, Indo-Air Compressors Pvt. Ltd., Anest Iwata Motherson Pvt. Ltd., BAC Compressors, Mitsubishi Heavy Industries, Ltd., Zen Air Tech Pvt. Ltd., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Industrial Air Compressors Market share is classified into product, lubrication, and operation.

By Product:

The India industrial air compressors market is divided by product into reciprocating, rotary, and centrifugal. Among these, the rotary segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Consistent, reliable air supply, high efficiency, compact size, broad use in key sectors, and meeting demands for continuous operations and powering pneumatic tools and automation all contribute to the rotary segment's largest share and higher spending on industrial air compressors when compared to other product.

By Lubrication:

The India industrial air compressors market is divided by lubrication into oil-free and oil-filled. Among these, the oil-filled segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The oil-filled segment dominates because of lower initial cost, simpler design, proven reliability for general industrial use, and India’s price-driven consumer base favours economical solutions providing reliability.

By Operation:

The India industrial air compressors market is divided by operation into ICE and electric. Among these, the electric segment held the largest market share in 2024 and is predicted to grow at a significant CAGR during the forecast period. Lower operating costs over the lifespan of the compressor, more energy efficient, stable electricity supply, and integration of modern industrial automation and smart manufacturing systems all contribute to the electric segment's largest share and higher spending on virtual events when compared to other operation.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India industrial air compressors market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Industrial Air Compressors Market:

- Atlas Copco

- ELGi Equipments Ltd.

- Ingersoll Rand

- Kirloskar Pneumatic Co. Ltd.

- Kaeser Kompressoren

- Sullair

- Hitachi, Ltd.

- BOGE Kompressoren

- FS-Curtis Pvt. Ltd.

- Gardner Denver India

- Indo-Air Compressors Pvt. Ltd.

- Anest Iwata Motherson Pvt. Ltd.

- BAC Compressors

- Mitsubishi Heavy Industries, Ltd.

- Zen Air Tech Pvt. Ltd.

- Others

Recent Developments in India Industrial Air Compressors Market:

In January 2026, Ingersoll Rand launched the LS Series Low-Pressure Oil-Free Screw Air Compressors in India, designed for applications like cement, power, food and beverage, pharmaceuticals, and petrochemicals requiring high air volumes at low pressure.

In November 2025, ELGi Equipments announced a planned investment of INR 600-650 crore for a new integrated facility near its foundry to consolidate manufacturing functions, increase capacity, and support its goal of being a top three global player.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insight has segmented the India industrial air compressors market based on the below-mentioned segments:

India Industrial Air Compressors Market, By Product

- Reciprocating

- Rotary

- Centrifugal

India Industrial Air Compressors Market, By Lubrication

- Oil-Free

- Oil-Filled

India Industrial Air Compressors Market, By Operation

- ICE

- Electric

Frequently Asked Questions (FAQ)

-

Q:What is the India industrial air compressors market size?A:India industrial air compressors market is expected to grow from USD 1.13 billion in 2024 to USD 1.70 billion by 2035, growing at a CAGR of 3.78% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by the expanding industrial and manufacturing sector in India, demand for reliable compressed air infrastructure for automation, tools, and process applications, growth in manufacturing sectors, increased need for industrial air compressors, companies rising emphasis on energy efficiency and sustainability encourages the adoption air compressor technologies.

-

Q:What factors restrain the India industrial air compressors market?A:Constraints include the high initial capital cost of advanced industrial air compressors, upfront investment and associated maintenance costs, limited efficient systems, and slower adoption of newer technologies across price-conscious.

-

Q:How is the market segmented by lubrication?A:The market is segmented into oil-free and oil-filled.

-

Q:Who are the key players in the India industrial air compressors market?A:Key companies include Atlas Copco, ELGi Equipments Ltd., Ingersoll Rand, Kirloskar Pneumatic Co. Ltd., Kaeser Kompressoren, Sullair, Hitachi, Ltd., BOGE Kompressoren, FS-Curtis Pvt. Ltd., Gardner Denver India, Indo-Air Compressors Pvt. Ltd., Anest Iwata Motherson Pvt. Ltd., BAC Compressors, Mitsubishi Heavy Industries, Ltd., Zen Air Tech Pvt. Ltd., and Others.

-

Q:Who are the target audiences for this market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?