India Hydrochloric Acid Market Size, Share, By Sales Channel (Direct Sales and Indirect Sales), By End-Use (Water Treatment, Steel Pickling, Oil and Gas Exploration, Food and Beverages, Chemicals and Petrochemicals, and Others), India Hydrochloric Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Hydrochloric Acid Market Insights Forecasts to 2035

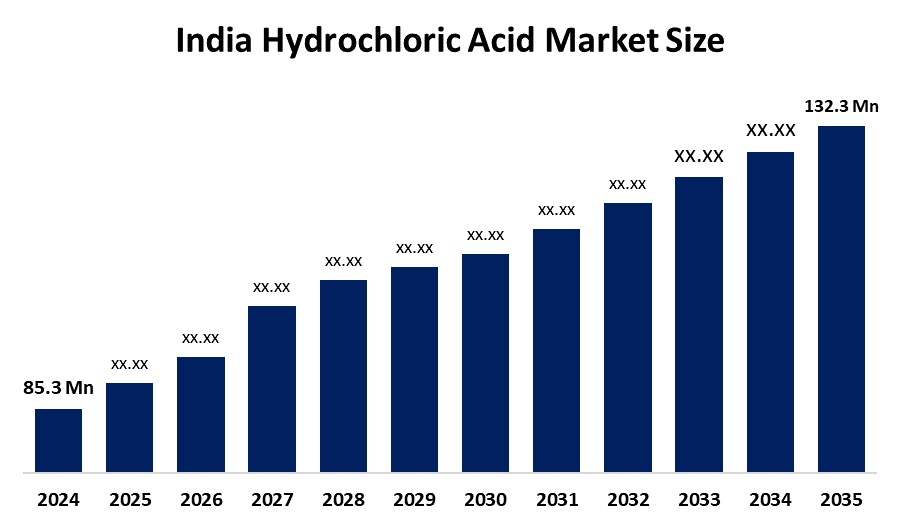

- India Hydrochloric Acid Market Size 2024: USD 85.3Million

- India Hydrochloric Acid Market Size 2035: USD 132.3Million

- India Hydrochloric Acid Market CAGR 2024: 4.07%

- India Hydrochloric Acid Market Segments: Sales Channel and End-Use

Get more details on this report -

The India Hydrochloric Acid Market Size tracks domestic production and distribution of HCl, which various sectors use for chemical manufacturing, steel pickling, pharmaceutical production, water treatment, and food processing.

John Cockerill and Baosteel launched a “2×20 m³/h Fluidized Bed Acid Regeneration” system to recycle spent hydrochloric acid and recover metal ions while producing reusable HCl, which leads to reduced environmental impact and increased resource efficiency.

The government uses PLI schemes to support domestic chemical production while attracting investments and decreasing import needs, which leads manufacturers to build new facilities while improving their market position.

The India Hydrochloric Acid Market Size presents strong future potential because of increasing steel pickling requirements and chemical manufacturing expansion, water treatment growth and rising demand for acid recovery and recycling solutions.

India Hydrochloric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 85.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.07% |

| 2035 Value Projection: | USD 132.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Sales Channel , By End-Use |

| Companies covered:: | Tata Chemicals Limited, Grasim Industries Limited, Gujarat Alkalies and Chemicals Limited (GACL), DCW Limited, Gujarat Fluorochemicals Ltd (GFL), Aarti Industries Limited, Lords Chloro Alkali Limited, Orient Micro Abrasives Limited (OMAL), Tamilnadu Petroproducts Ltd, SNDB Company, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Hydrochloric Acid Market:

The India Hydrochloric Acid Market Size is driven by the expanding steel pickling industry, together with increasing chemical and pharmaceutical manufacturing, rising water treatment requirements, infrastructure development and expanding downstream sectors, which include food processing and textiles, all of which experience growth because of industrialization and urbanization.

The India Hydrochloric Acid Market Size is restrained by the organization faces multiple challenges because of its strict environmental regulations and dangerous materials handling and storage requirements, problems with transporting goods, unstable raw material prices, and expensive safety and pollution control compliance measures.

The future of India Hydrochloric Acid Market Size is bright and promising, with the industrial sector maintaining its growth pattern while steel and chemical requirements escalate and water treatment initiatives expand, acid regeneration and recycling, and cleaner production technologies gain traction.

Market Segmentation

The India Hydrochloric Acid Market share is classified into sales channel and end-use.

By Sales Channel:

The India Hydrochloric Acid Market Size is divided by sales channel type into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because industrial customers require large quantities of products, which they purchase through permanent contracts that establish fixed prices, while manufacturers supply their products directly to major chemical, steel and water treatment companies.

By End-Use:

The India Hydrochloric Acid Market Size is divided by end-use into water treatment, steel pickling, oil and gas exploration, food and beverages, chemicals and petrochemicals, and others. Among these, the steel pickling segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because it serves as the primary method for steel pickling, which needs to remove both scale and rust from steel production facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Hydrochloric Acid Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Hydrochloric Acid Market:

- Tata Chemicals Limited

- Grasim Industries Limited

- Gujarat Alkalies and Chemicals Limited (GACL)

- DCW Limited

- Gujarat Fluorochemicals Ltd (GFL)

- Aarti Industries Limited

- Lords Chloro Alkali Limited

- Orient Micro Abrasives Limited (OMAL)

- Tamilnadu Petroproducts Ltd

- SNDB Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Hydrochloric Acid Market Size based on the below-mentioned segments:

ndia Hydrochloric Acid Market, By Phase Type

- Direct Sales

- Indirect Sales

India Hydrochloric Acid Market, By Service

- Water Treatment

- Steel Pickling

- Oil and Gas Exploration

- Food and Beverages

- Chemicals and Petrochemicals

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India hydrochloric acid market size?A: India hydrochloric acid market is expected to grow from USD 85.3 million in 2024 to USD 132.3 million by 2035, growing at a CAGR of 4.07% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the expanding steel pickling industry, together with increasing chemical and pharmaceutical manufacturing, rising water treatment requirements, infrastructure development and expanding downstream sectors, which include food processing and textiles, all of which experience growth because of industrialization and urbanization.

-

Q: What factors restrain the India hydrochloric acid market?A: Constraints include the organization faces multiple challenges because of its strict environmental regulations and dangerous materials handling and storage requirements, problems with transporting goods, unstable raw material prices, and expensive safety and pollution control compliance measures.

-

Q: How is the market segmented by sales channel?A: The market is segmented into direct sales and indirect sales.

-

Q: Who are the key players in the India hydrochloric acid market?A: Key companies include Tata Chemicals Limited, Grasim Industries Limited, Gujarat Alkalies and Chemicals Limited (GACL), DCW Limited, Gujarat Fluorochemicals Ltd (GFL), Aarti Industries Limited, Lords Chloro Alkali Limited, Orient Micro Abrasives Limited (OMAL), Tamilnadu Petroproducts Ltd, SNDB Company and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?