India Home Ventilation System Market Size, Share, And COVID 19 Impact Analysis, By Product Type (Exhaust Ventilation Systems, Supply Ventilation Systems, Balanced Ventilation Systems), By Installation Type (New Construction, Retrofit), By Distribution Channel (Offline, Online Platforms), By Application (Apartments, Independent Houses) And India Home Ventilation System Market Insights, Industry Trend, Forecast To 2035

Industry: Machinery & EquipmentIndia Home Ventilation System Market Insights Forecasts to 2035

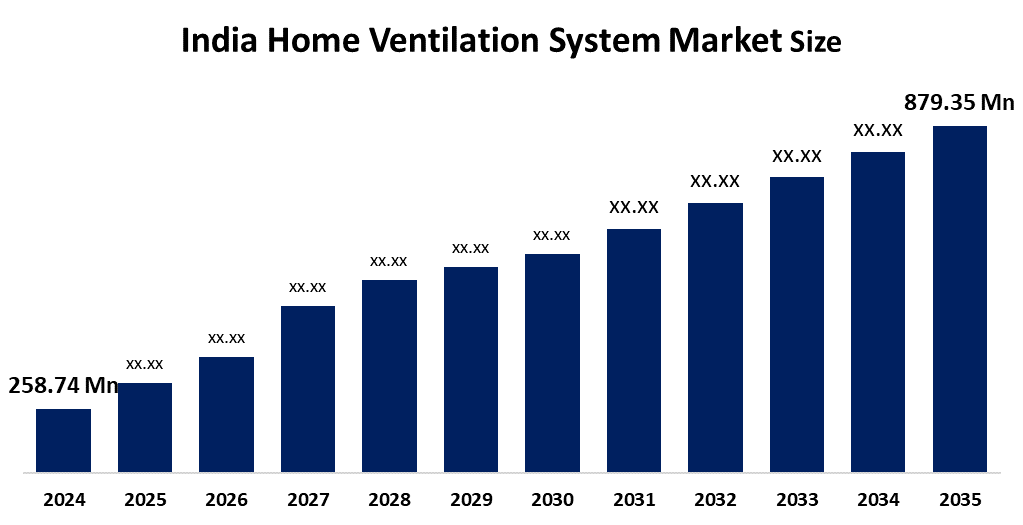

- India Home Ventilation System Market Size was Estimated at USD 258.74 Million in 2024

- The market size is expected to grow at a CAGR of around 11.76% from 2025 to 2035

- India Home Ventilation System Market Size was Estimated to reach USD 879.35 Million by 2035.

Get more details on this report -

Market Overview

Home ventilation systems are like machines that help keep the air moving in our homes. They get rid of the air inside and bring in fresh air from outside. We use these systems in lots of places like the kitchen, bathroom, living room and other areas where people hang out. This helps make the air inside our homes cleaner keeps it from getting humid and makes us feel more comfortable and healthier. Because more homes are being built people are learning more about how important it's to have good air inside and there are stricter rules about building homes people really want these systems now especially in cities and towns, in India. Home ventilation systems are really popular because they make our homes nicer to live in.

The government has started some plans like the Eco-Niwas Samhita. This plan is also known as the Residential Energy Conservation Building Code. It says that new homes need to have ventilation. This means that homes should have the right size windows that can be opened and closed. Homes should also have vents in the kitchen and bathroom. Nowadays we have technology that helps with ventilation. We have sensors that can feel the air and adjust the airflow. We also have ventilators that can save energy. We have quiet exhaust fans that do not make too much noise. All these new technologies are making ventilation systems better. More people are using them. The government plans like the Eco-Niwas Samhita and these new technologies are helping to improve the ventilation, in homes. Future opportunities lie in retrofitting existing homes with advanced systems, integrating ventilation with smart home platforms, and promoting sustainable, energy-efficient housing, as awareness of indoor air quality continues to rise across India.

Report Coverage

This research report categorizes the market for the India home ventilation system market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India home ventilation system market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India home ventilation system market.

India Home Ventilation System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 258.74 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.76% |

| 2035 Value Projection: | USD 879.35 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Product Type, By Installation Type, By Distribution Channel |

| Companies covered:: | Havells India Ltd., Crompton Greaves Consumer Electricals Ltd., Polycab India Ltd., Blue Star Ltd., Voltas Ltd., Panasonic Life Solutions India Pvt. Ltd., Systemair India Pvt. Ltd., Greenheck India Pvt. Ltd., Johnson Controls India Pvt. Ltd., Others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

India's increasing urbanization and compact living arrangements are driving an ever-greater need for effective control of internal airflow within homes. As a result, a growing awareness of indoor air quality and respiratory health is further increasing the demand for legitimate and effective home ventilation systems. Additionally, the availability of funds for energy efficiency programs through governmental building codes and initiatives such as Make in India have helped to increase the amount of home ventilation systems being utilized.

Restraining Factors

Low consumer awareness and high costs associated with home ventilation systems are impeding their adoption. The lack of trained technicians to install these systems, reliance on components manufactured overseas, as well as the numerous and varied types of residential structures all limit the potential for home ventilation systems to be as prevalent on a national scale.

Market Segmentation

The India home ventilation system market share is categorized by product type, installation type, distribution channel, and application.

- The exhaust ventilation systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India home ventilation system market is segmented by product type into exhaust ventilation systems, supply ventilation systems, and balanced ventilation systems. Among these, the exhaust ventilation systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This particular segment is bolstered by the widespread use of exhaust ventilation systems in bathrooms and kitchens for the removal of moisture and unwanted odors. Exhaust systems tend to have a simple design and are less expensive than supply systems. As a result, they are easier to install and are therefore becoming increasingly popular in both multi-family housing and the compact layout of Indian homes.

- The new construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India home ventilation system market is segmented by installation type into new construction and retrofit. Among these, the new construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of home ventilation systems is driven by the inclusion of ventilation systems during the design stage of buildings. Developers are now including ventilation systems as part of their building code compliance in order to improve the quality of life of their tenants, which makes it more economically feasible to install them than to retrofit them into existing properties.

- The offline segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India home ventilation system market is segmented by distribution channel into offline and online platforms. Among these, the offline segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The offline retail market remains the dominant sales channel for home ventilation systems due to the need to physically evaluate products and the ability to receive professional assistance and consultation when making purchasing decisions. In the residential home ventilation market, the majority of consumers make their purchasing decisions based on the input of electrical retailers, HVAC dealer networks, and builder partnerships.

- The apartments segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India home ventilation system market is segmented by application into apartments and independent houses. Among these, the apartments segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth in apartments is due to increased population density and a lack of natural airflow in buildings that are constructed above ground level. More and more people are moving into apartment buildings, which is leading to an increase in the need for mechanical ventilation to ensure that the indoor air quality and temperature are kept at acceptable levels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The India home ventilation system market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Havells India Ltd.

- Crompton Greaves Consumer Electricals Ltd.

- Polycab India Ltd.

- Blue Star Ltd.

- Voltas Ltd.

- Panasonic Life Solutions India Pvt. Ltd.

- Systemair India Pvt. Ltd.

- Greenheck India Pvt. Ltd.

- Johnson Controls India Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Home Ventilation System Market based on the below-mentioned segments:

India Home Ventilation System Market, By Product Type

- Exhaust Ventilation Systems

- Supply Ventilation Systems

- Balanced Ventilation Systems

India Home Ventilation System Market, By Installation Type

- New Construction

- Retrofit

India Home Ventilation System Market, By Distribution Channel

- Offline

- Online Platforms

India Home Ventilation System Market, By Application

- Apartments

- Independent Houses

Frequently Asked Questions (FAQ)

-

Q. What is the projected market size & growth rate of the India home ventilation system market?A. The India home ventilation system market was valued at USD 258.74 million in 2024 and is projected to reach USD 879.35 million by 2035, growing at a CAGR of 11.76% from 2025 to 2035.

-

Q. What are the key driving factors for the growth of the India home ventilation system market?A. Market growth is driven by rapid urbanization and compact housing, rising awareness of indoor air quality and respiratory health, government initiatives like ECBC and Make in India, and growing adoption of energy-efficient, smart, and technologically advanced ventilation systems.

-

Q. What factors restrain the India home ventilation system market?A. Constraints include low consumer awareness, high system costs, shortage of skilled installation and repair technicians, dependence on imported components, and challenges in adapting solutions to diverse residential building structures.

-

Q. How is the India home ventilation system market segmented?A. The market is segmented by product type (Exhaust Ventilation Systems, Supply Ventilation Systems, Balanced Ventilation Systems), installation type (New Construction, Retrofit), distribution channel (Offline, Online Platforms), and application (Apartments, Independent Houses).

-

Q. Who are the key players in the India home ventilation system market?A. Key companies include Havells India Ltd., Crompton Greaves Consumer Electricals Ltd., Polycab India Ltd., Blue Star Ltd., Voltas Ltd., Panasonic Life Solutions India Pvt. Ltd., Systemair India Pvt. Ltd., Greenheck India Pvt. Ltd., Johnson Controls India Pvt. Ltd., and others.

-

Q. Who are the target audiences for this market report?A. The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?